Revealed: How World's Top Speculator banked $314 million through a rare gold investment:

http://www.angelnexus.com/o/web/29474

The ONLY way to trounce gold's gains without having to buy coins, ETFs, options, major gold mining stocks, or tiny exploration stocks...

In the summer of 2009, John Paulson — the billionaire investor who personally banked $2 billion shorting the housing market — made one of the simplest trades of his career.

It was an unassuming gold company that he isolated from hundreds of others by comparing two key variables.

When Mr. Paulson saw that this firm's numbers where exactly where he needed them to be, he went in strong. In fact, he was so sure of himself that he bought up close to 20% of the company...

He paid less than $2 per share.

About 15 months later, the stock soared to more than $8 — earning him a potential profit of $314 million.

Financial analysts and journalists around the world were astonished by the gains he'd made.

I was not one of them. It had been clear to me, even at the time Paulson made the purchase, the trade would be worth hundreds of millions...

While the financial community watched in awe, I was already searching for the next company to do the exact same thing.

It took hundreds of hours and required the intensive review of more companies than I care to list...

But just last week, that search ended. And after confirming and reconfirming at least a dozen times, I knew I wasn't just seeing things.

What I'd found was a gold company like no other.

Only it wasn't the location... or the size of the deposit... or corporate structure... or even cash reserves that set this company apart...

It had to do with a simple number — the most basic number, in fact, when it comes to how mining companies are evaluated:

Cost Per Ounce of Production

Ironically, the company I'd found didn't have the lowest cost of production for gold. In fact, their cost was so far from the lowest that the company wouldn't be able to break even if it decided to start mining at today's high gold prices.

In short, they were dead in the water — just like the company Paulson bought in 2009.

This apparent weakness, however, is actually a unique advantage.

It's what puts this breed of investment far above any major gold producer, which pumps out cheap gold by the truckload, or any ETF, which essentially just tracks the price of gold, or any junior gold exploration stock, which often times hasn't even found any gold at all...

You see, it's this precise cost of production that made Paulson's company a prime target for him back in 2009 — and the same reason the company I'm going to tell you about in the next few minutes is set to become a similar target right now.

This brings me to the second of the two variables I mentioned earlier.

It's not just about finding the right company with a project containing some specific grade of mineral deposit.

If that's all there were to it, any number of analysts or fund managers could have made the trade.

What makes Paulson's success so rare is in finding the right company just as gold is hitting a specific price.

In other words, you have to be at the right place at exactly the right time in the market.

One of the greatest investors I've ever met likened it to hitting a speeding bullet with a speeding bullet.

Only this is not going to be nearly that hard. For you, making the same $300-million-style trade that Paulson made is going might be one of the easiest things you've ever done...

Because by the time you finish reading this report, you'll have both the name of the company and the details on when this trade must be completed.

But first, let me show you how this works.

The Insiders' Secret: Compound Gold

There's an old joke in the industry that goes, "You can't mine gold for $500 an ounce, sell it for $300, and make up the difference in volume."

And that's precisely the problem with most companies that own property containing gold, silver, or anything else that's valuable.

Getting that valuable material out of the ground costs money — money that cuts into profits.

Cut enough of the profit and eventually, that land embedded with all those millions of ounces of gold and silver becomes worthless.

Just imagine... something worth billions of dollars — and nobody willing to shell out a dollar to own it.

Twenty-five years ago, when gold was trading at $350 and silver at $7, finding properties like this wasn't hard. More importantly, buying them was even easier.

Because no matter the size of the property — or how many million ounces of gold it held — anybody with an average-grade deposit who decided to start mining right then and there would be doomed to bankruptcy... making those properties worthless.

For those willing to bide their time, however, unimaginable fortune was around the corner.

Let's say you have a 3 million ounce gold deposit, an entry-level purchase for any major mining operation.

With cost of production at, for example, $400/ounce, that deposit would be functionally worthless when gold's market value is at $400/ounce. The owner would neither profit nor lose from the development of that property.

But if the market price rises by just a single dollar from that $400/ounce baseline...

That property suddenly becomes worth $3 million.

Historically, though, your gains would have been much, much bigger.

If you'd bought this 3 million ounce property back in February 1987, when gold was trading for $400/ounce, you'd have an asset with an overall value of zero dollars.

Three months later — when gold hit $470/ounce — that formerly worthless property would now be valued at $210 million.

By December of that year, with gold up to $500, it would worth $300 million.

Or if you want to look at it in terms of percentages gained:

Start with the same cost of production: $400/ounce.

If the market price of gold exceeded this $400 threshold — even by as little as 1% — this modest property which was worthless the day before... would suddenly become a $12 million dollar asset.

If a week later the price of gold went up a mere $8.00 per ounce (just 2%, based on mid-80s prices), the price of that suddenly valuable asset would double...

A 10% jump in gold price and the value is now up 1000%.

But remember, the $400/ounce cost is just an example.

Every property — every mine — has its own specific break-even point. Some higher-grade deposits break even below $400/oz, sending their stock skywards earlier on, while lower-grade properties break even well above $400/oz, launching their stock later.

The only trick is knowing that point and buying the stock when the market price of gold is as close to that point as possible: when the cost of production to gold market price ratio is near or at 1.

Hit that "sweet spot," and any subsequent jump in market price immediately launches the stock into exponential growth.

So it's not just a gold investment, but a Compound Gold investment, as it compounds incremental changes in gold price to generate major profits from a specialized type of property.

It's so efficient at gaining ground and so reliable, in fact, that Compound Gold trades have outpaced the world's single most popular gold investment, the SPDR Gold Trust (GLD) — which itself has nearly doubled from $97 to $185 since November 2009 — by 458%.

And it doesn't just work for gold...

A company holding 85 million ounces of silver (not a large deposit by major industrial standards) that was worth zero dollars at $6/ounce... would be worth $17 million if the price of silver went up by just 20 cents.

If silver prices increase less than 10% — from $6 to $6.50 — our property would now be worth $43 million.

And if you'd bought this property in 1986... By the end of 1987, with silver at $10/ounce, this "worthless" property would have a net value of $340 million.

I know this comes off as amazing, but it's actually pretty simple; you just need the market to be heading in the right direction, and Compound Gold immediately picks up speed...

Here's what I mean:

When gold prices spiked back in the mid 1980s, millions of gold investors made 50%, 60%, as much as 80% on bullion.

A tiny handful of Compound Gold investors who had the skill and luck to find the right companies just as gold prices were reaching and exceeding their specific costs of production...

Made thousands of percent — hundreds of dollars returned for every dollar invested.

This sort of speed and reliability puts Compound Gold in a class of its own among gold investments..

It was so powerful that it gave rise to a whole new class of investors — and helped the precious metals mining industry explode into the sector it is today.

But here's the catch: There are times when this method simply won't work.

You see, back in the 80s, we were in the midst of one of modern history's greatest precious metals bull markets.

But just before the run started in 1985, a few people who knew what was coming went around deserted stretches of land in North and South America, buying up seemingly worthless tracts of land — land where there were proven gold deposits, but where the cost of production would bankrupt a company in short order.

And then the boom hit — and it was time to sit back and watch the profits collect.

Of course, nothing good lasts forever. When the precious metals bull market cooled off in the 1990s, anybody working this tactic would have to stop operations... and wait until the next one.

Today, that wait is over.

Only this isn't a repeat of the mid 80s bull market...

In fact it's far, far stronger than anything that's come before.

In the last two months alone, gold prices have risen by as much as 20%. And since February 2011, silver's doubled — going from $25/ounce to nearly $50 before settling at today's price of $43.

With each dollar, the price of gold or silver appreciates. Properties and companies that had never been profitable suddenly cross over into the black and transform overnight.

It's been happening gradually for several years...

But right now, we're reaching a critical moment.

The first variable I talked about — the 60-cent company with the perfect cost of production — I'm going to reveal shortly.

The second of those two magical variables — the market price needed to make this all work — is about to be delivered to your door, gift-wrapped.

This Bull Market is Just Getting Started...

You can't open a newspaper or click through a financial news site without seeing quotes like these:

5 Reasons Gold Will

Continue to Rise

1) Economy

The U.S. manufacturing base has been shipped overseas. The few jobs being created are in the service industry or government sector. The official unemployment rate hovers near 10%, and 1 out of every 8 Americans is on food stamps. The 2008 economic implosion destroyed the real estate market, sent foreclosures skyrocketing, and swallowed up a nearly $1 trillion bailout... and yet, most experts predict the worst is still to come.

2) Fear

The sovereign debt crisis threatens to spread across the globe. Fearful investors are shifting assets from the euro and other weakening currencies into gold. The stock market rebounded from its 2008-09 depths, but some analysts say it's overbought and due for painful correction. Meanwhile, turmoil across the Middle East, Asia, and elsewhere is exacting huge costs in American blood and treasure.

3) Demand

The Federal Reserve has kept U.S. interest rates at virtually zero with no sign of a hike on the horizon, thereby lowering the opportunity cost of buying gold. And investors have responded with astonishing eagerness — even forcing the U.S. Mint to ration popular bullion products in order to meet overwhelming demand. Expect central banks in China, India, and Russia to fuel demand for gold.

4) Reflation

Of the major assets, only Treasuries and gold have escaped the selling panic that has gripped the markets. Rushes on gold have caused mints around the world to run out of popular gold coins. Because of the inflationary impact of government bailouts, $2,000 could be the floor, not the ceiling.

5) The Dollar

Dollar weakness, plentiful liquidity, and policy reflation will be persistent themes in the future. Massive fiscal and monetary stimulus have weakened the dollar, whose current resurgence stems mainly from the European debt crisis. Once that crisis reaches the debt-burdened United States, the dollar's weakness as a currency will be evident to all — and its role as the world's reserve currency will be in jeopardy. As always, gold will be the first and most universal remedy.

But with today's gold price at $1,900 an ounce and silver hovering around $45, finding companies with the perfect cost of production levels isn't as easy as it used to be.

Companies with production costs at or near today's Compound Gold sweet spot are few and far between.

However, with gold gaining as much as 20% (close to $400) in less than two months' time...

The profit potential for this highly-specialized breed of companies is simply staggering — far in excess of anything Compound Gold investors could have hoped for when the method was first put into practice back in the 1980s.

Remember, for gold to just rise a few dollars is enough for these stocks to start doubling or tripling. So if gold itself doubles, you could be looking at 100, 500, even 1,000 times your initial investment back...

Just imagine investing $1,000 today... and in two years, cashing out a cool million.

All that matters is finding the right company — with the right cost of production levels — and waiting for that sweet spot.

I know what you're going to say: All these theories and stories are great. But you want to see a live example of what happens when a company hits the Compound Gold sweet spot...

Instantly in the Black: South American Silver Corp

In October of 2009, South American Silver Corp. (SAC) was a tiny $13 million company trading at 13 cents a share.

Investors looking at just the stock value would have been misled, because within SAC's property in Bolivia was an estimated 322 million ounces of silver. Even at 2009 prices, this deposit had a theoretical value of over $5.1 billion.

But here's where this system comes in...

Because the low-grade ore found in great abundance on this property would cost about $20/ton to process into raw silver, the owners of this property would have been losing $2/ton on their investment (at late 2009 silver prices).

Their $5.1 billion asset wasn't an asset at all. It was a liability...

But over the next 20 months, the price of silver did something spectacular:

In a rally to rival all rallies, silver jumped from $18.50 an ounce to over $50!

That's a gain of over 170%. Not bad, right?

You could have invested $10,000, and by the summer of 2011, cashed out with $27,000.

But remember this: At $18/ounce, SAC was virtually worthless...

At $50/ounce, less than two years later, this company was profiting $32/ounce!

At that price, the entire property had a total resource value of $16.1 billion — with $10.3 billion of that being pure profit.

In case you can't imagine what that does to a company's stock price, here's what South American Silver Corp looked like as it passed its sweet spot last year:

Between September 2009 and April 2011, South American Silver went from 13 cents to over $3.00 for a gain of 2,307%.

So if instead of putting that $10k into raw silver, you bought SAC just as its cost of production hit that sweet spot...

You'd have made a pre-tax profit of $230,000.

It's not a trick, it's not a fluke, and it's not especially complicated. With a single trade, anybody who knew the cost of silver production for this one Bolivian property would have made millions in less than two years' time.

Want another example?

Here's Copper Mountain Mining Corporation (CUM). It hit its break-even price back at the end of 2008, when gold prices were at $800/ounce.

In the two years since, as the sweet spot came and went, the stock looked like this:

So while gold doubled to $1,830 an ounce in the 26 months following that magical sweet spot...

This company went from 40 cents to $8.00 — a self-sustained gain of 2,000%.

The gains took the company up from a tiny $30 million exploration outfit to an exploding $600 million gold mining powerhouse... and would have turned a $10k investment into $200,000.

Here's a third example: Agnico-Eagle Mines Ltd. (AEM).

This one goes back more than a decade, and illustrates the point that every property has its own specific break-even point, which can be exploited.

As the gold market picked up after going through a dry patch in the 90s, the profits on paper suddenly materialized and the value of this company's property shot up exponentially.

It took a little while longer than usual, but in the end it was a monster success story — gaining 2,600% as it climbed from $3 to $80.

Not convinced?

Here's another example, from very recent history...

This company, Gabriel Resources (GBU), hit its sweet spot back in 2009. By mid 2011, it had grown by over 800% into a $2.5 billion giant.

In that same time, gold only rose by 60%.

This wasn't that small of a company to begin with, but an established firm worth hundreds of millions.

Regardless, its rise was so easy to predict — and so reliable — that billionaire investor and hedge fund superstar John Paulson bought a full 18% of the company.

The purchase was just one of the many gold investments he made that year...

Paulson also invested heavily in physical gold, as well as a number of larger North American producers. But this play was by far the strongest-gainer of the bunch, helping to make 2010 the biggest year of his already legendary career.

"Mr. Paulson, a hedge fund manager who sprang to fame when the housing market collapsed, personally made about $5 billion in 2010, according to two investors in his company." — NY Times

If the several examples above don't convince you, here are a few more:

1.) International Tower Hill Mines Limited (THM): December 2008: 98 cents — January 2011: $10.00 (1020% GAIN)

2.) Northern Dynasty Minerals (NAK): November 2008: $1.80 — February 2011: $21.90 (1216% GAIN)

3.) Teck Resources Limited (TCK): March 2009: $3.30 — January 2011: $61.00 (1848% GAIN)

4.) New Gold Inc. (NGD): December 2008: $1.70 — August 2011: $13.07 (768% GAIN)

5.) Osisko Mining Corporation (OSK.TO): December 2008: 75 cents — December 2010 $16.00 (2133% GAIN)

And that's just a small sampling...

Which illustrates my final point: Professional investors and industry insiders have been banking billions off this method for years.

So using this basic principal isn't a new or novel idea.

In fact, many of the professional commodities investors refuse to make any trades in which this algorithm hasn't predicted success.

Unfortunately, this simple yet essential system of investment is almost completely overlooked by do-it-yourself investors. This baffles me, but it's just a fact of life in today's financial world...

A vast majority of today's investors have simply never heard of Compound Gold, nor do they understand the basic principal behind its pattern of success.

So you can already consider yourself a member of the elite. After all, you already know how and why this system works and the basic principal behind putting it into action to make yourself tens, even hundreds of times your money back in short order.

But picking the right company can still be tricky...

There are so many to choose from, and digging through quarterly financial statements to come up with that perfect cost-of-production isn't exactly a weekend activity for everyone.

To me, finding it was an obsession...

And I'm about to let a precious few in on what I discovered.

I Don't Specialize in an Industry; I Specialize in Making Money

My name is Andrew Mickey. I am the Investment Director and founder of Angel Publishing's newest financial advisory, Freedom and Capital.

Before I get into what makes Freedom and Capital the most unique, most forward-thinking, and most versatile investment newsletter of its kind, let me give you a little background...

The last few years have been a bit of a whirlwind for me.

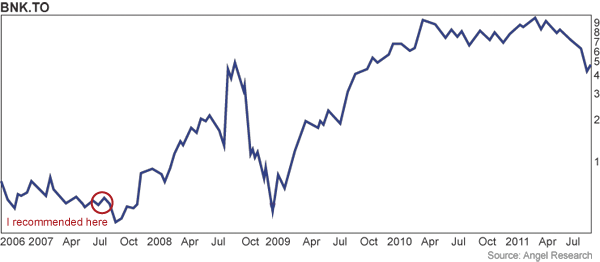

In 2007, after a trip to Albania to meet with the CEO of an almost unknown oil company, I recommended my readers buy Bankers Petroleum (BNK), then trading at 50 cents.

Less than three years later, the stock hit a high of $9.92 — up 1,884%.

In February 2009, I also recommended they buy Ventana gold (VEN), then trading at $1.05.

Twenty-five months later, in March 2011, I alerted my readers to sell at $13.05.

I took Wildcat Silver(WS) from 32 cents to $3.16...

And I rode Canoco Resources from 55 cents to $6.45 in less than twelve months...

I've appeared on multiple cable and network television financial news shows, logged hundreds of thousands of miles in air travel, and have come to be on a first-name basis with some of the richest and most influential corporate executives operating in New York, Washington, D.C., Vancouver, and London...

And I've done all of this before my 30th birthday.

As I said, it's been a wild ride. But something was still missing...

Don't Let Them Feed You Only What You Want to Hear

In my years in the financial research industry, every publication I've worked for, contributed to, or run has had some sort of pre-determined investment philosophy.

Whether it was energy, technology, minerals or metals, every publication was aimed at investors looking to invest in something specific.

I saw the inherent flaw in this, and became determined to change it.

Real Solutions, Custom-Made for the Changing Market

So when I got the chance to launch Freedom and Capital, I decided to take a completely different approach.

You see, my aim here isn't just feeding you information on commodities or industries you want to hear about; my aim is help you achieve the goal of protecting and building your wealth — no matter what sort of troubles our nation and world may be going through.

In short: to create, preserve, and improve the financial freedoms you've worked hard to build.

The answer could be gold, it could be oil, it could be timber, or it could be some biotech small cap about to revolutionize medicine...

Anything is on the table, as long as it achieves my one singular goal:

To give my readers financial security, and profits, even in the worst possible economic conditions.

And it's no accident that I'm doing this right now.

Because in times like these, Freedom and Capital is exactly what my readers are looking for.

Recession? Credit Crisis? Housing Market Collapse?

Inflation? End of Social Security?

Inflation? End of Social Security?

I've studied all the issues. I understand the mechanics behind every problem. And while I don't have the answer that will halt the next stock market plunge or balance our national budget...

I do know how you can walk away from any economic hardship stronger and richer than you were when you walked in.

Freedom and Capital isn't here to sell you a stock or to promote some industry or political ideal...

It's here for one reason: to show you how to become rich no matter what the market does.

Inside: Time-Sensitive Material

As a new subscriber to Freedom and Capital, you'll gain immediate access to a brand-new, dedicated portfolio.

As with all my past services, Freedom and Capital will bring you original, unique investment ideas on a regular schedule.

In case the past examples I listed above aren't enough, here's a list of several more recent winners my readers have used to build and solidify their wealth...

- 383% on Generex

- 270% on Williams Companies

- 142% on Alliance Fiber

- 171% on Mikohn Gaming

- 96% on DG FastChannel

- 88% on ICN Pharmaceuticals

- 123% on E*Trade

- 68% on Mesa

- 110% on KVH Industries

- 164% on Orbital

- 100% on Crown Cork & Seal

And that's still just a fraction... I could go on for pages, but showing you past successes doesn't really make either of us any richer.

So here's the deal:

The moment you agree to take Freedom and Capital for a risk-free test-drive, you'll gain access to my brand-new portfolio containing the latest stocks with the biggest profit potential yet.

Along with these fresh recommendations, I'll also throw in my archival portfolio containing eight previous stocks that are still bringing in major profits for my existing readers.

As a Freedom and Capital subscriber, you'll get the inside scoop on every one of these companies before the deals are made, before the drill results are published — before the stocks move.

So, whether you're interested in taking a new stock from modest beginnings to triple- and quadruple-digit percent gains, or you just want to take some quick profits on a proven winner...

Freedom and Capital will tell you how to do it and when.

PLUS: You Get TWO Special Bonus Reports — FREE!

In addition to my inaugural report, "Compound Gold: Ride the Gold Bull to Exponential Gains" you'll also receive two bonus reports — either of which are virtually guaranteed to make you quick double-digit profits — if you agree to give Freedom and Capital a risk-free try today.

Here's what you'll get:

- "F&C Crash Course in Financial Freedom" – Times are changing. The market isn't what it used to be, and you need to know how to prepare for what's coming next. Can you spare 17 minutes to change to your financial well-being forever?

- "Retirement Rescue" – Don't let millionaire money managers take another penny from you! Earn greater profits with less risk with this essential instruction manual for preserving and growing your capital reserves.

Remember, as a Freedom and Capital subscriber, you'll be getting cutting-edge, time-sensitive information that will put you head and shoulders above 99.99% of the investors on the planet.

Of course, I know you're probably wondering what all this costs...

Well, that's the best part of all.

As you're probably aware, investment advisories often cost $2,000 or more per year. I personally know a number of people shelling out more than $5,000 per year just to get a fraction of the information you'll receive as a member of Freedom and Capital.

A year's subscription would normally cost $199.

But because this is my debut special report, I'm offering you a one-time 75% discounted price of just $49/year — or an unbeatable $89 for two full years.

For just 12 cents a day, you'll receive cutting-edge investment information that you wouldn't get with a $5,000/year "premium" investment advisory.

It's one of the best bargains you're going to see — not just in this industry, but in any industry.

There is one catch: If you want to become a Freedom and Capital investor, you must be able to meet the three qualifications outlined below.

Do you have what it takes to join us? Let's find out...

Do You Qualify for This Opportunity?

Requirement #1: You must be comfortable with small cap stocks.

Some of the stocks we trade are valued at less than one dollar. In some cases, they may be very volatile. So while the stocks have the potential to soar by 1,000% or more, they can also exhibit rapid price declines.

Freedom and Capital is only for people who are prepared to invest small sums of money into a potentially huge winner. Just ask yourself this: Would you risk $500 to make $5,000?

If your answer is yes, I believe you belong with Freedom and Capital.

Requirement #2: You will treat everything you read as confidential. Sharing the information you get with people who are not members of our service is strictly prohibited.

Why? Because it puts our profits at risk. We keep our numbers low because too many extra traders riding our coattails will eat into our own earnings. I design these trades for my readers and my readers only — and I intentionally keep the recommendation limited to an exclusive group.

All I ask is that you keep any information you get from me to yourself for 48 hours...

Give us enough time to make take our profits, and then you can go brag to your friends all you want.

Requirement #3: You're ready to be decisive and act now.

If you act immediately, you can ensure your shot at a ten-fold return by the end of 2011. But for every hour you hesitate, big chunks of those profits will simply disappear...

Please take a moment now and subscribe to Freedom and Capital.

The moment I hear from you, you'll receive immediate access to the "Compound Gold: Ride the Gold Bull to Exponential Gains" report revealing stocks that could triple, even quadruple in value in just days or weeks...

And because I want to make this a seal of my commitment to you, I'm going to go one step further and make sure you're absolutely comfortable trying out Freedom and Capital...

Here's my personal pledge to you:

You'll Make Triple-Digit Gains — OR IT'S FREE!

I'm absolutely certain my Compound Gold stock will go up by 100% before December 2011. I'm so sure of it that if it doesn't work — for whatever reason — I'll refund every penny of your subscription.

Bottom line: Either you double your money in the next year, or you pay nothing.

No small print, no exceptions, no excuses... Make 100% or get your money back. Period.

And listen, if at any point during your first year with me you're unhappy for any reason at all, just say the word and I'll send you a check in the amount of your subscription fee.

12 full months. Any reason at all. No questions asked.

No matter what you decide, however, you get to keep your copy of "Compound Gold: Ride the Gold Bull to Exponential Gains" — plus the special bonus reports.

You have absolutely nothing to lose.

The upside here is staggering.

I'm not exaggerating in the slightest when I say that this opportunity can potentially alter your life forever.

But you must move quickly...

The way things are progressing in the gold market, I wouldn't be surprised to see my new recommendations double or even triple in the coming weeks.

Things are only going to move faster, and you need to position yourself now to ensure full profit potential.

So please, take just a moment to reserve your space. Click here.

However you choose to order, please do it now... This opportunity won't wait.

Good Investing,

Andrew Mickey

Investment Director, Freedom and Capital

Investment Director, Freedom and Capital

P.S. This trade must be executed in the next 7 days. With the recent fluctuations in gold prices, I've expanded my Compound Gold play from one to three stocks — each precisely selected from a pool of thousands to take advantage of day-to-day changes above and below $1900/ounce.

But be warned: Market instability has guaranteed that today's prices won't last for more than a few days, a week at the most. A 10% shift in spot price, like we saw just two weeks ago, could completely throw off buy-in levels...

Get in on these two bonus trades today — or watch the profits run away.

Get in on these two bonus trades today — or watch the profits run away.

Tidak ada komentar:

Posting Komentar