Exposing "The System"

Twisted Tales from the Financial Industry

By Nick Hodge 2013-03-05

http://www.outsiderclub.com/exposing-the-system

I Googled “financial scandal 2012.”

There were over 100,000,000 results.

That's a shame, because these are likely the institutions you rely on for your financial well-being.

You shouldn't be relying on them. You shouldn't be reliant on anyone. We'll help you get there.

But first...

Why were there so many scandals? What were they? And how are they affecting you?

A Short Story

It was 2008. The Dow had reached an all-time high above 14,000 in

2007. But it was quickly falling to 13,000... 10,000 — make that 8,000

by October (it would go below 7,000 in early 2009).

People wanted their money out. They wanted it in their hands. And who could blame them?

It was then we learned the banks were not prepared to give clients their money. They had leveraged up. When Bear Stearns was on the brink of collapse, it had 32 times more debt on its balance sheet than equity. Merrill Lynch and Lehman weren't far behind.

The U.S. Senate concluded the crisis was the result of “high risk,

complex financial products; undisclosed conflicts of interest; the

failure of regulators, the credit rating agencies, and the market itself

to rein in the excesses of Wall Street.”

That's the polite way of saying banks invented lending products that

allowed people to get loans they couldn't afford, and then invented

investment products based on those loans predicated on the fact that

home values would always rise — without oversight.

In other words, Wall Street had become the Wild West. And this almost

undeniably began with the repeal of the Glass-Steagall Act in 1999 that

removed the separation between investment banks and depository banks

(creating too-big-to-fail institutions) and the Commodity Futures

Modernization Act of 2000, which ensured the deregulation of financial

products known as over-the-counter derivatives.

The government — under then President Clinton — gave the banks

permission to do the things that led to the 2008 financial collapse. The

government — under then President Bush — condoned the activities and

bailed out banks with the Troubled Asset Relief Program (T.A.R.P.) when

those activities led to the worst financial crisis since the Great

Depression.

Both parties and the banks are to blame. As always, none of the three have your best interests in mind.

Five years later, banks are back to posting record profits while the

median net worth of American families is still down 40% from 2007, and a

search for “financial scandal 2012” will yield over 100 million

results.

Some things will never change...

“Scandal” or Criminal

Late last year, Forbes ran a story entitled “10 Biggest Banking Scandals of 2012.”

The name alone says a lot: These are just the “biggest,” implying there were many more.

But these aren't “scandals.” These are crimes. They're examples of fraud.

They're the epitome of why you need to drive a wedge between yourself and “the system.”

Here are what Forbes said were the “biggest” instances of that (parentheses mine):

-

JPMorgan lost $5.8 billion in a derivative (yep, they're still using them!) trade.

-

Dozens of banks found to be manipulating the London InterBank

Offered Rate (LIBOR). (This is the benchmark that determines the rates

of $300 trillion worth of loans, from mortgages to student loans. No

one's been jailed and U.S. Treasury Secretary Timothy Geithner has been

proven to have known about the manipulation for years.)

-

UBS paid $1.5 billion (3% of its market cap) to settle (not admit

guilt) LIBOR allegations. (I don't know how this is a scandal; it's a

scandal that no one was prosecuted.)

-

HSBC gets caught laundering money for Iranian terrorists and Mexican drug cartels. (They got to “settle,” too.)

-

Standard Chartered also laundered money on behalf of Iranian,

Sudanese, Libyan, and Burmese entities. (They “settled” as well: No

prosecution.)

-

UBS (man, they were naughty last year) loses $2 billion as a result

of a “rogue trader.” (The trader was prosecuted because he was an

individual and he screwed a bank. When banks screw individuals, there

is no prosecution.)

-

Peregrine Financial CEO Russell Wasendorf attempts suicide after

getting caught embezzling $215 million of client money. (His suicide

attempt failed and he was later prosecuted, I would argue, because

Peregrine wasn't a major financial institution.)

-

Knight Capital lost $440 million and sent major stocks (Goodyear,

China Cord Blood, CoreLogic) swinging more than 10%. (This was

attributed to a “technical glitch,” as opposed to something being

inherently wrong with the system.)

-

Rajat Gupta was fined $5 million and jailed for two years for

sharing information about, among other things, a $5 million investment

Warren Buffett would make in Goldman Sachs. (Again, we prosecute

individuals, not institutions.)

- Hedge fund trader Matthew Martoma was indicted on insider trading charges related to two pharmaceutical companies. (I have no comment. This goes on all the time.)

You should notice several patterns here...

The first is that these “scandals” generate billions in profit for

these institutions. The second is that the larger the institution and

the more egregious the crime, the lesser the penalty. The third is that

major corruption, rate-fixing, and money laundering isn't prosecuted;

it's always “settled” so it can remain “alleged.” And finally, even if

forced to pay a fine, these institutions often get to keep a portion of

their ill-gotten gains.

It's still the Wild West on Wall Street. And the sheriff's being paid off.

A Few Examples

What does all this mean for retail investors like me and you?

Well, some of the costs are immeasurable.

Because LIBOR is used to set trillions worth of loans, it's hard to

tell how much was lost because it was manipulated. One estimate says my

home city of Baltimore lost $6 million alone. The estimate for all

states and localities is up around $6 billion lost.

But what do the bankers care? They pay a fine and keep a portion of their massive profits.

Emails from the banks manipulating LIBOR reveal bankers aren't

worried about getting caught. This is LIBOR, responsible for $300

trillion in loans. If that's being manipulated, what do you think is going on with every other establishment bank deal?

Look at these quotes from the emails:

-

Broker to UBS derivatives trader: “Mate, you're getting bloody good

at this LIBOR game. Think of me when you're on your yacht in Monaco,

won't you?”

-

UBS Trader negotiating to fix LIBOR: “If you keep 6s (the sixth

month loan rate) unchanged today I will (CENSORED) do one humongous

deal with you. Like, a 50,000 buck deal, whatever. I need you to keep

it as low as possible. If you do that, I'll pay you, you know, $50,000,

$100,000 dollars — whatever you want. I'm a man of my word.”

-

Barclays trader's response: “Done... for you big boy.”

These guys were literally joking about enriching themselves at the

expense of the rest of the civilized world. And that's really what this

entire financial game has boiled down to...

How can banks and corporations continue to enrich themselves at the expense of the little man?

Check out the 2012 returns of the banks that committed the biggest atrocities compared to the S&P 500:

|

Company / Index |

2012 Return |

|

Barclays |

61% |

|

HSBC |

40% |

|

UBS |

35% |

|

JPMorgan |

34% |

|

S&P 500 |

14% |

The banks committing the most atrocious financial crimes outperformed the market last year by at least 2.5 times.

That's your current financial system.

Here's a more insightful look at it, and this should make your blood boil...

This is part of a February interview with Neil Barofsky, the man who

was chosen to oversee the Troubled Asset Relief Program (TARP) (emphasis mine):

I was a federal prosecutor for eight

years, and I got tapped to do this job. You know, life-long democrat

getting appointed by President George W. Bush, which was the craziest

thing ever. And I went down with my good friend Kevin Puvalowski, who

was also a prosecutor.

And we just went into this alien world of

Washington, where everything was sort of upside down. You know, we came

from a culture where doing the right thing — you know, putting bad

guys in jail is what you're supposed to do... but all of sudden we go

into a culture where everyone was more concerned with looking out for

themselves — the next newspaper report — rather than this giant

financial meltdown that we had walked into.

... that was Treasury department

inspector general Eric Thorson, and he and really a bunch of the

inspector generals all sort of gave me the same idea that the idea is to

have that perfect Goldilocks minimum. Like, don't be a lapdog, which

was, you know, playing golf on the weekend with Hank Paulson or

something like that; don't be too aggressive, being a junkyard dog,

because you don't want to make too many waves and get people too upset

with you...

You're just trying to go right in the

middle and be a watch dog, which means basically don't make too many

waves, but don't appear like you're too comfortable. What they were

really talking about is the best way to keep your head down, keep your

budget coming, and not rocking the boat too much, which is the best path

to getting an even higher, better job in Washington. And that's sort of

the way the town works.

When it came to the banks, anything and everything was on the table. Saving the banks was priority 1, 2, and 3.

But TARP was supposed to help homeowners. It doesn't get out of

Congress if not for that promise to help up to 4 million people stay in

their homes. But there was almost no effort, and the justification for

not doing the right thing: not reducing principal, not fulfilling that

promise, among them was, like, “oh well, we can't help an undeserving

homeowner. That would be terrible if we accidentally do that.”

Meanwhile, the financial institutions that drove this country into the

ditch — all the unemployment, the trillions of dollar in lost wealth...

Those guys? Let's not only get them their money, but let's make

sure they're still able to pay their billions of dollars in bonuses.

Let's not upset that, because that might upset the system.

The largest banks did and still do hold a gun to our head.

They hold us hostage. They can't be indicted because if you bring

criminal charges against them, you'll bring them down — and that'll

bring down the entire system. You can't be too tough with them for the

same reason. You can't break them up, because that'll tear down the system...

It's all preserving the status quo and keeping their power, their political power — which is so strong in Washington — intact.

And here's part of a February interview with Helaine Olen, author of Pound Foolish: Exposing the Dark Side of the Personal Finance Industry:

My conclusion is that we were sold all of

this as a way around income stagnation and income inequality. You know,

for 30 years our incomes have fallen. Net worth plunged 40% between

2007 and 2010. And this entire industry of everybody from Suzy Ormann to

CNBC built up saying, “Hey, we have the answer. We are going to help

you,” — often forgetting, by the way, to mention that they were selling

the products that going to help you, supposedly.

Jim Cramer, in fact, someone did a study

of his picks a few years ago. And they found the best thing you could

do, if you wanted to make money, would be to immediately short, or bet

against, anything he mentioned as a buy. Because people hear what he's

saying and the price goes up, and then, a couple of weeks later, it

comes back down.

We have 50% of the population saying

they're living paycheck to paycheck. And what has happened is there's

this whole industry of people saying, “Hey, you can't manage your money,

follow me...” instead of saying: “Gosh, 50% of the population can't get by, what's wrong with our society?”

This is an industry that earns hundreds

of billions of dollars per year from you. And they have hundreds of

billions of reasons to convince you as to why you need them. So we tell

people that you can invest your way out of this.

These empires of personal finance really

built up, in part, as a response to changes in the retirement system. It

used to be that we all got pensions — and we all know what happened to

those pensions... We now have 401(k)s, they don't do as well for people,

but they do really well for one segment, and that's the financial

services industry — which makes money win or lose.

That's your current “system,” a word used in both of those interviews.

It's a system where incomes have fallen for 30 years... where net

worth has fallen 40% since 2008... where half of the country is living

paycheck to paycheck...

And yet a system where bankers and politicians still only look out for themselves.

When will you stop playing their game?

Call it like you see it,

Nick Hodge

@nickchodge on Twitter

@nickchodge on Twitter

Nick is an editor of Energy & Capital and the Investment Director of the thousands-strong stock advisory, Early Advantage. Co-author of the best-selling book Investing in Renewable Energy: Making Money on Green Chip Stocks, his insights have been shared on news programs and in magazines and newspapers around the world. For more on Nick, take a look at his editor's page.

Plutocracy in America: Bowing Down to Corporate Masters

http://www.outsiderclub.com/plutocracy-in-america-bowing-down-to-corporate-masters

Not On Our Watch...

By Brittany Stepniak 2013-06-06

If America doesn't wake up to the most important issue facing our country right now, the consequences could be catastrophic.

The corruption between Washington and Wall Street has resulted in the largest inequality gap in history.

We mustn't simply place the bulk of the

blame on the market crash and financial meltdown of 2008, either. The

income inequality dilemma had its roots planted deeply into the

Establishment long before.

If you disagree, take a look at the share of household income from 1975-2005...

Or the share of net worth back in 2004:

Greed: Vice or Virtue?

Even after the most recent recession, the top 1% of earners took home 93% of all the income gains

in the first full year of the recovery. And economic research indicates

this will result in lower levels of economic growth and slower job

creation in years to come.

Our country's ever-widening gap between

the mega-rich and everyone else has expanded to the likes of which we

haven't seen since the Great Depression.

And it's a trend that has remained consistent over the past generation.

New technology has cut out many

blue-collar jobs, and routine white-collar work now gets outsourced

overseas as global competition heats up.

If the bigwigs don't shape up, history is

bound to repeat itself and we'll find ourselves in a state of

plutocracy with austere economic consequences...

But I wouldn't hold my breath waiting for change.

"Only patterns on top of patterns"

The last time our country experienced a

similar scenario was after the Civil War. Industries approached

monopolistic levels of market concentration and acquired serious

financial capital. Wealthy CEO-types began to use their power of

influence over industry, public opinion, and politics. According to

journalist Walter Weyl, money was “the mortar of this edifice.”

Economist Paul Krugman says the

plutocracy was able to emerge because the poorest of American

inhabitants were unable to vote (either non-naturalized immigrants or

African-Americans). The wealthy funded political campaigns in which vote

buying was quite popular and electoral fraud was rampant.

Although our country has made many

improvements since then — and the Internet now sheds a wider-cast light

on fraud and scandal — we're still combating many of these same

problematic issues.

It's a simple concept, really: A country

that prioritizes the accumulation of wealth (in order to maintain power

in the hands of just a few) over all other human interests is bound for

trouble.

Dismissing Inequality, Focusing on Overall Growth

The International Monetary Fund has

warned, “Some dismiss inequality and focus instead on overall growth —

arguing, in effect, that a rising tide lifts all boats... When a handful

of yachts become ocean liners while the rest remain lowly canoes,

something is seriously amiss.”

In 1913 the U.S. instituted the income

tax among various other forms of progressive taxation. But in the 1970s,

elites began using their political influence to lower their taxes, and

many still remain entitled to what political scientist Jeffrey Winters

calls “the income defense industry,” which keeps their taxes

exceptionally low.

This is an on-going pattern...

Earlier this week, at least 18 companies

including Apple, Nike, and Microsoft were in the doghouse for stashing

profits in offshore tax havens to skirt $92 billion in U.S. taxes.

Chrystia Freeland, author of Plutocrats: The Rise of the New Global Super-Rich and the Fall of Everyone Else, stated in an interview:

You don't do this in a kind of chortling, smoking your cigar, conspiratorial thinking way. You do it by persuading yourself that what is in your own personal self-interest is in the interests of everybody else. So you persuade yourself that, actually, government services, things like spending on education, which is what created that social mobility in the first place, need to be cut so that the deficit will shrink, so that your tax bill doesn't go up.

And what I really worry about is, there is so much money and so much power at the very top, and the gap between those people at the very top and everybody else is so great, that we are going to see social mobility choked off and society transformed.

On the other hand,

the global elite at the top are already tapping into the bulk of our

gold reserves as fiat insurance and the big banks are complying by

manipulating prices, hoping everyday investors like you and me will shy

away in fear.

They know there's more chaos yet to come, and they're making sure they're prepared.

Cognitive Capture

If these trends

continue, Freeland believes the elite at the very top of the food chain

will capture the entire political system.

Chief economist at

Citigroup, Willem Buiter, has referred to it as “cognitive capture.”

Freeland responded to this in an interview with Bill Moyers:

His argument was

that part of the reason the financial crisis happened is the entire

intellectual establishment, not just people inside investment banks, but

regulators, academic economists, financial journalists, had all been

captured by the financial sector's vision of how the economy should

work.

This cognitive

capturing will have profound impacts on the burgeoning wealth inequality

gap. Elites will tell themselves they're acting in the “collective

interest” by spending big money in powerful sectors...

As a result, less

money will go to truly beneficial social programs, small businesses, and

other things necessary to keep the middle class thriving and the poor

above the poverty line.

Cutting people off

from economic opportunity is the antithesis of capitalism. But

plutocrats aren't interested in creating an environment where Outsiders

can accumulate a comfortable wealth and achieve the American Dream —

rather, they're interested in expanding their own bank accounts and

sometimes giving a little extra support to the hand that feeds them.

It's a vicious cycle.

The global elite

consists of a small group with a big revolving door. While the

politicians in Washington banter back and forth about how to restore the

middle class via taxes and government transfer programs, the income

inequality continues to grow.

The truth is you and I are ultimately on our own in this recovery phase.

That's why our sole goal here at the Outsider Club

is to provide you with the insight and foresight you'll need to succeed

independently. You can forget mainstream media — it too is controlled

by the plutocrats.

To get you on the right track, make sure you subsribe to our mailing list to receive the most lucrative investment opportunities other financial newsletters haven't leaked yet.

Just because you're not an Insider doesn't mean you can't prepare, plan, and profit like one.

Farewell for now,

Related Articles

The Revolting Change to the Revolving Door

Cronyism is now being fed with tons of cash as Obama promotes an insider.

Ron Paul & Jim Rogers on the Gov't: "A Lot More Chaos Yet to Come"

MUST SEE VIDEO. Rogers says the government won't take our bank accounts, but they will take our retirement. Paul says they'll use force, they'll use intimidation, and they'll use guns.

Too Big to Fail, Too Big to Jail

What's better than "too big to fail"?

Cronyism is now being fed with tons of cash as Obama promotes an insider.

Ron Paul & Jim Rogers on the Gov't: "A Lot More Chaos Yet to Come"

MUST SEE VIDEO. Rogers says the government won't take our bank accounts, but they will take our retirement. Paul says they'll use force, they'll use intimidation, and they'll use guns.

Too Big to Fail, Too Big to Jail

What's better than "too big to fail"?

Who REALLY Controls the World?

Science Confirms Big Bank Domination

By Jimmy Mengel 2013-08-16

http://www.outsiderclub.com/who-really-controls-the-world

It's the question that conspiracy theorists dedicate their life to answering...

Who REALLY controls the world?

Who is pulling the strings?

Who is hiding behind the curtain?

These questions have long been subject to speculation, scapegoating, and paranoid ravings — some more well-founded than others.

Now, thanks to the science of complex system theory, the answer may actually be right in front of our faces.

This scientific process sheds light on the dark corners of bank

control and international finance and pulls some of the major players

out from the shadows.

And it goes back to the old credo: Just follow the money...

Systems theorist James B. Glattfelder did just that.

From a massive database of 37 million companies, Glattfelder pulled

out the 43,060 transnational corporations (companies that operate in

more than one country) that are all connected by their shareholders.

Digging further, he constructed a model that actually displays just

how connected these companies are to one another through ownership of

shares and their corresponding operating revenues.

The 1318 transnational corporations that form the core of the economy.

The 1318 transnational corporations that form the core of the economy.

Superconnected companies are red, very connected companies are yellow. The size of the dot represents revenue.

I'll openly admit that this graphic almost scared me off. Complex

scientific theories are not my forte, and this looks like some sort of

intergalactic snow globe.

But Glattfelder has done a remarkable job of boiling these

connections down to the main actors — as well as pinpointing how much

power they have over the global market. These "ownership networks" can

reveal who the key players are, how they are organized, and exactly how

interconnected these powers are.

From New Scientist:

Each of the 1318 had ties to two or more

other companies, and on average they were connected to 20. What's more,

although they represented 20 per cent of global operating revenues, the

1318 appeared to collectively own through their shares the majority of

the world's large blue chip and manufacturing firms - the "real" economy

- representing a further 60 per cent of global revenues.

When the team further untangled the web

of ownership, it found much of it tracked back to a "super-entity" of

147 even more tightly knit companies - all of their ownership was held

by other members of the super-entity - that controlled 40 per cent of

the total wealth in the network.

According to his data, Glattfelder found that the top 730

shareholders control a whopping 80% of the entire revenue of

transnational corporations.

And — surprise, surprise! — they are mostly financial institutions in the United States and the United Kingdom.

That is a huge amount of concentrated control in a small number of hands...

Here are the top ten transnational

companies that hold the most control over the global economy (and if you

are one of the millions that are convinced Big Banks run the world, you

should get a creeping sense of validation from this list):

1) Barclays plc

2) Capital Group Companies Inc.

3) FMR Corporation

4) AXA

5) State Street Corporation

6) JPMorgan Chase & Co.

7) Legal & General Group plc

8) Vanguard Group Inc.

9) UBS AG

10) Merrill Lynch & Co Inc.

Some of the other usual suspects round out the top 25, including JP Morgan, UBS, Credit Suisse, and Goldman Sachs.

What you won't find are ExxonMobil, Microsoft, or General

Electric, which I found shocking. In fact, you have to scroll all the

way down to China Petrochemical Group Company at number 50 to find a company that actually creates something.

The top 49 corporations are financial institutions, banks, and

insurance companies — with the exception of Wal-Mart, which ranks at

number 15...

The rest essentially just push money around to one another.

Here's the interconnectedness of the top players in this international scheme:

Here's a fun fact about the number one player, Barclays:

Barclays was a main player in the LIBOR manipualtion scandal, and

were found to have commited fraud and collusion with other

interconnected big banks. They were fined $200 million by the Commodity

Futures Trading Commission, $160 million by the United States Department

of Justice and £59.5 million by the Financial Services Authority for

"attempted manipulation" of the Libor and Euribor rates.

Despite their crimes, Barclays still paid $61,781,950 in bonuses earlier this year, including a whopping $27,371,750 to investment banking head Rich Ricci. And yes, that's actually his real name...

These are the guys that run the world.

It's essentially the "too big to fail"

argument laid out in scientific setting — only instead of just the U.S.

banks, we're talking about an international cabal of banks and

financial institutions so intertwined that they pose a serious threat to

global economics.

And instead of "too big to fail," we're looking at "too connected to fail"...

Glattfelder contends that "a high degree of interconnectivity

can be bad for stability, because stress can spread through the system

like an epidemic."

Industrialist Henry Ford once quipped, "It is well enough

that people of the nation do not understand our banking and money

system, for if they did, I believe there would be a revolution before

tomorrow morning."

It's one thing to have suspicions that someone is working

behind the scenes to control the world's money supply. It's quite

another to have scientific evidence that clearly supports it...

Just another reason to stay on the Outside.

Godspeed,

Jimmy Mengel

@mengeled on Twitter

Jimmy is a managing editor for Outsider Club and the Investment Director of the personal finance advisory The Crow's Nest. You may also know him as the architect behind the wildly popular finance and investing website Wealth Wire, where he's brought readers the stories behind the mainstream financial news each and every day. For more on Jimmy, check out his editor's page.

Related Articles

Exposing "The System"The banks committing the most atrocious financial crimes outperformed the market last year by at least 2.5 times. That's your current financial system.

Plutocracy in America: Bowing Down to Corporate Masters

Plutocrats: too big to jail, too big to tax, too big to stop. The growing gap between the haves and the have-nots is spiralling out of control.

The King of Silver and Gold Flees

J.P. Morgan has finally bowed to the masses and will abandon control of silver and gold.

American Pie

Wealth and Income Inequality in America

Wealth and Income Inequality in America

http://www.currydemocrats.org/american_pie.html

No matter how you slice it, when it comes to income and

wealth in America the rich get most of the pie and

the rest get the leftovers. The numbers are shocking. Today the

top 1 percent of Americans control 43 percent of the financial

wealth (see the pie chart below) while the bottom 80 percent control

only 7 percent of the wealth. Incredibly, the wealthiest 400

Americans have

the same combined wealth as the poorest half of Americans --

over 150 million people.

According to the Center for Budget and Policy Priorities:

In 2007, the share of after-tax income going to the top 1

percent hit its highest level (17.1 percent) since 1979, while

the share going to the middle one-fifth of Americans shrank to

its lowest level during this period (14.1 percent).

Between 1979 and 2007, average after-tax incomes for the top 1 percent rose by 281 percent after adjusting for inflation — an increase in income of $973,100 per household — compared to increases of 25 percent ($11,200 per household) for the middle fifth of households and 16 percent ($2,400 per household) for the bottom fifth.

If all groups’ after-tax incomes had grown at the same percentage rate over the 1979-2007 period, middle-income households would have received an additional $13,042 in 2007 and families in the bottom fifth would have received an additional $6,010.

In 2007, the average household in the top 1 percent had an income of $1.3 million, up $88,800 just from the prior year; this $88,800 gain is well above the total 2007 income of the average middle-income household ($55,300).

Between 1979 and 2007, average after-tax incomes for the top 1 percent rose by 281 percent after adjusting for inflation — an increase in income of $973,100 per household — compared to increases of 25 percent ($11,200 per household) for the middle fifth of households and 16 percent ($2,400 per household) for the bottom fifth.

If all groups’ after-tax incomes had grown at the same percentage rate over the 1979-2007 period, middle-income households would have received an additional $13,042 in 2007 and families in the bottom fifth would have received an additional $6,010.

In 2007, the average household in the top 1 percent had an income of $1.3 million, up $88,800 just from the prior year; this $88,800 gain is well above the total 2007 income of the average middle-income household ($55,300).

Slate.com collects more data in an article titled "The

Great Divergence In Pictures: A Visual Guide to Income

Inequality.":

Income for the top 20 percent has increased since the

1970s while income for the bottom 80 percent declined. In the

1970s the top 1 percent received 8 percent of total income while

today they receive 18 percent. During the same period income for

the bottom 20 percent had decreased 30 percent.

In the 1970s the top 0.1 percent of Americans received 2 percent of total

income. Today they get 8 percent.

In 1980 the average CEO made 50 time more money than the average

worker while today the average CEO makes almost 300 time more

than the average worker.

Over the past 30 years the rich

in America have become a lot richer, while many

millions of Americans have seen their income stagnate or

decline. As Warren Buffett, the

second richest man in America, famously said, “There’s class warfare, all right, but it’s

my class, the rich class, that’s making war, and we’re winning.”

Wealth and income inequality today is by far the worst in the industrialized world and

has fallen in line with

many Third World countries. Nobel Prize winning economist Joseph E. Stiglitz explains why this is bad news:

Some people look at income inequality and shrug their shoulders.

So what if this person gains and that person loses? What

matters, they argue, is not how the pie is divided but the size

of the pie. That argument is fundamentally wrong. An economy in

which most citizens are doing worse year after year—an economy

like America’s—is not likely to do well over the long haul.

...

The top 1 percent have the best houses, the best educations, the best doctors, and the best lifestyles, but there is one thing that money doesn’t seem to have bought: an understanding that their fate is bound up with how the other 99 percent live. Throughout history, this is something that the top 1 percent eventually do learn. Too late.

...

The top 1 percent have the best houses, the best educations, the best doctors, and the best lifestyles, but there is one thing that money doesn’t seem to have bought: an understanding that their fate is bound up with how the other 99 percent live. Throughout history, this is something that the top 1 percent eventually do learn. Too late.

Where Has All the Money Gone?

This may be the one of the most important graphs you will ever see. It show the reason

for the

decline of the American middle class -- how the

rich have become so much richer in the last 30 years and why the

rest of us have been left behind:

In the post World War II period through the mid 1970s the

productivity of the American worker increased at a steady rate.

During this period workers were rewarded for their increased

productivity with a commensurate

increase in wages. Then something happened. Productivity

continued to increase, but workers' wages stagnated.

Trickle Up Economics

As Nobel Prize winning economist Paul Krugman points out, since 1973 national Gross Domestic Product (GDP)

per household has increased 46 percent in real terms, but median income per household has

only increased 15 percent. Where did the other 31 percent go? It

went to the wealthy.

... the gap between economic growth and median incomes has a lot

to do with rising inequality.

... it remains striking how little of growth has trickled down to the typical family.

... it remains striking how little of growth has trickled down to the typical family.

Supply Side economics is the cornerstone of Republican economic

theory and has driven U.S. economic policy since the Ronald

Reagan presidency. This is how Investorpedia describes it:

Supply-side economics is better known to some as "Reaganomics",

or the "trickle-down" policy espoused by former U.S. president

Ronald Reagan. He popularized the controversial idea that

greater tax cuts for investors and entrepreneurs provide

incentives to save and invest and produce economic benefits that trickle down into

the overall economy.

In other words, if government economic policy focuses on making

the rich richer, the benefits will "trickle down" to everyone

else. As supply-siders are

fond of saying, "A rising tide lifts all boats." Since

Supply Side economics came to dominate American economic policy

during the Reagan administration, the rising economic tide has

certainly lifted a lot of yachts, but at the same time it has

left most of the row boats stuck in the mud.

The past quarter century of Republican economics has proven that the trickle down theory is just a convenient excuse to justify an economic policy favoring the rich, with the benefits trickling up to make the very wealthy even wealthier.

The past quarter century of Republican economics has proven that the trickle down theory is just a convenient excuse to justify an economic policy favoring the rich, with the benefits trickling up to make the very wealthy even wealthier.

Must-See Videos on Wealth Inequality in America

Shocking Wealth Inequality

Nick Hanauer's "Banned" TED Talk

The U.S. Has The Worst Income Inequality In The Developed World, Thanks To Wall Street: Study

Huffington Post, Mark Gongloff

Huffington Post, Mark Gongloff

Hey, who says America is in decline? The U.S. is still

more awesome than the rest of the world at making at least one thing.

And that thing is income inequality.

A new paper by economists Facundo Alvaredo, Anthony B.

Atkinson, Thomas Piketty, and Emmanuel Saez lays out just how much

better at making inequality the U.S. is than everybody else and tries to

explain how it got that way.

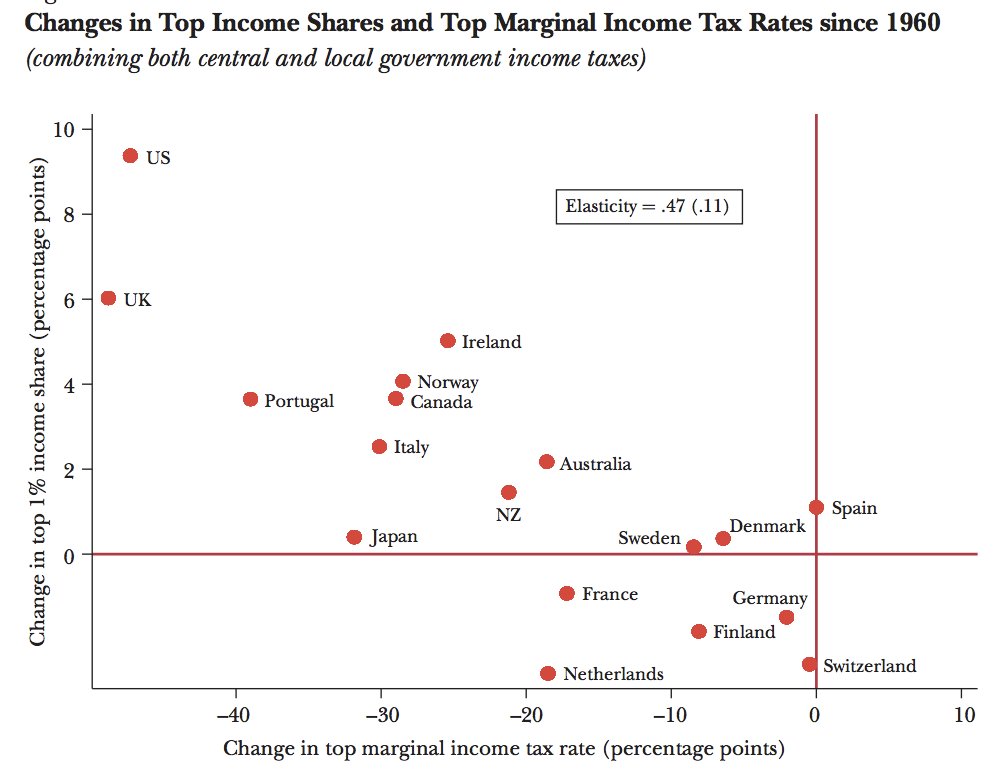

Since the 1970s, the top 1 percent of earners in the

U.S. has roughly doubled its share of the total American income pie to

nearly 20 percent from about 10 percent, according to the paper. This

gain is easily the biggest among other developed countries, the

researchers note. You can see this in the chart below, taken from the

paper, which maps the income gains of the top 1 percent in several

countries against the massive tax breaks most of them have gotten in the

past several decades. (Story continues after chart.)

...

One nifty benefit to having nine metric craptons of money

is that you can use it to buy politicians to help you craft the laws you

like, particularly those that will help you end up with 10 metric

craptons of money. The poor and middle class, meanwhile, just get ever

more discouraged about the political system and stop bothering to fight

it, increasingly turning the whole process over to the wealthy and the

politicians they own, according to a recent paper by Frederick Solt at

Southern Illinois University. Sound familiar?

The U.S. Has The Worst Income Inequality In The Developed World, Thanks To Wall Street: Study

The Huffington Post

|

By Mark Gongloff

Posted: 08/15/2013 3:52 pm EDT | Updated: 08/16/2013 12:08 pm EDT

Hey, who says America is in decline? The U.S. is still more

awesome than the rest of the world at making at least one thing. And

that thing is income inequality.

A new paper by economists

Facundo Alvaredo, Anthony B. Atkinson, Thomas Piketty, and Emmanuel

Saez lays out just how much better at making inequality the U.S. is than

everybody else and tries to explain how it got that way.

Since the 1970s, the top 1 percent of earners in the U.S. has roughly

doubled its share of the total American income pie to nearly 20 percent

from about 10 percent, according to the paper. This gain is easily the

biggest among other developed countries, the researchers note. You can

see this in the chart below, taken from the paper, which maps the income

gains of the top 1 percent in several countries against the massive tax

breaks most of them have gotten in the past several decades. (Story

continues after chart.)

The higher the dot, the more income inequality has grown in that

country. See the red dot waaaay up in the left-hand corner, far away

from everybody else? That is the United States, where the top earners

have made more while getting their taxes slashed by over 40 percent.

This echoes an OECD study from earlier this year that found the U.S. had the highest income inequality in the developed world. It followed only Chile, Mexico and Turkey among all nations.

So how did America get so darn great at ratcheting open the chasm

between the haves and have-nots? Thank the dynamic duo of Wall Street

and Washington, which have been working so well together

for the past few decades to make laws that favor banks. Turns out this

Axis Of Making It Rain has also been making laws that favor the

exorbitantly wealthy. Win-win. Unless you are poor, in which case:

Sorry, be born to richer parents next time, maybe?

One thing you'll notice in this chart is that, typically, the bigger

the tax cuts given to the 1 percent (the horizontal scale on the

chart), the bigger the income inequality. This is consistent with other

studies that have shown the tax code has a big effect on income distribution.

That's one way Washington has boosted inequality: By slashing taxes on

the rich, for freedom and growth and trickling down on the poor.

Unfortunately, the paper points out, contrary to what you will hear from

conservatives, lower tax rates on the wealthy offer no obvious benefits

to growth, or to the poor.

One other thing you'll notice from the chart is that the United

Kingdom has slashed taxes on the top 1 percent almost as aggressively

the U.S. has, and yet the share of income going to the top 1 percent is

not nearly as big. So there's something else going on here besides just

tax breaks.

That something is Wall Street, more or less, as Matthew O'Brien of The Atlantic

points out. The same politicians that have busily been slashing taxes

on the wealthy have also been loosening fetters on banking, allowing the

financial sector to swell to bloated size and mop up ever-more income

while contributing ever-less back to the economy. Again, this is

consistent with other studies that have attributed much of the rise in

in inequality to the pay being sucked up by bankers and overpaid CEOs.

At the same time, U.S. lawmakers have also made it easier and more

tax-friendly for the wealthy to pile up more capital gains on their

investments. As O'Brien puts it, "The top 1 percent leveraged itself to

the market, and haven't looked back."

One nifty benefit to having nine metric craptons of money is that you

can use it to buy politicians to help you craft the laws you like,

particularly those that will help you end up with 10 metric craptons of

money. The poor and middle class, meanwhile, just get ever more

discouraged about the political system and stop bothering to fight it,

increasingly turning the whole process over to the wealthy and the

politicians they own, according to a recent paper by Frederick Solt at Southern Illinois University. Sound familiar?