A New Reserve Currency

China Calls for a "De-Americanized World"

By Daniella Nicole 2013-10-18

http://www.outsiderclub.com/a-new-reserve-currency/512

Economic downturn, sequester, tapering talk, standoff, and

shutdown. All of these things have impacted the country and the way the

world sees U.S. financial and political stability.

Though

the shutdown and standoff are over for now – no budget is in place and

funding is only through January – the sequester is ongoing, and we are

not nearly as far along in a recovery as some would have us believe,

ergo the rationale behind postponing tapering the stimulus program.

Though

the shutdown and standoff are over for now – no budget is in place and

funding is only through January – the sequester is ongoing, and we are

not nearly as far along in a recovery as some would have us believe,

ergo the rationale behind postponing tapering the stimulus program.

We're in trouble, and as the Fed continues to print more worthless

money to pay our bills, many are worried about how much longer the

dollar can survive.

Debt Ceiling, Default, and De-Americanizing the World

During the standoff in Congress, there was a lot of talk about the

United States defaulting on its debt. Money was still coming in to the

government, and the Constitution demands that the bills be paid, so the

likelihood of the interest on our debt not being paid – despite the

agenda-driven fear-mongering of some – was low. To choose to default

would be a malicious and impeachable offense.

However, the fear-mongering and speculation ran rampant, and the

world economy is deeply affected not just by what really happens, but by

what people fear will happen. With an out of control government running

the world's reserve currency, it is understandable some would begin

calling for that currency to be replaced. That is something that had

been whispered about before but is talked more loudly about now. The

world is creeping up to a downright unified shouted demand for it.

As the U.S. moved closer to the debt ceiling deadline, China

responded by openly stating a need to build “a de-Americanized world,”

according to the L.A. Times.

Though others are in agreement, for now, the world economy is too

deeply entrenched in the American dollar for a replacement currency to

be an easy or quick fix.

This buys the U.S. time to get its financial house in order, but that

time is only of benefit if those elected by the people to put and keep

the nation's financial house in order actually follow through with their

duties. Therein lies the rub.

The Senate has not passed a budget in years, thus the reason why we go through this piecemeal funding, default, and debt ceiling drama every few months. It serves no purpose other than to further political agendas.

With a budget, the whole world could breathe easier, and the dollar

could begin to stabilize. Without a budget, bullying, threats, and

political game-playing can ensue. Is there really any question as to who

it is our elected serve? It certainly isn't this county's best interest

or the best interest of her people.

A New World Order

Meanwhile, China has also called for “a new world order” in which all

nations would be on equal footing and even the smaller, poorer

countries would have a larger role in IMF and World Bank operations.

While China brings on the heat in its call for a replacement to the U.S.

dollar (which until recently has been considered to be the most stable

monetary unit in the world), it is also building up its own yuan,

clearly with the hope of it becoming the replacement currency for world

trade.

But there is a growing rumbling across the world, since about

“two-thirds of the world's foreign currency reserves are held in dollar

assets,” according to the Economic Times.

The paper goes on to call the U.S.'s policy making “erratic” and quotes

Charles Dallara, former Institute of International Finance head, as

well as a former Senior Treasury official (under Reagan and George H.W.

Bush), who asked:

“How can the United States preserve its financial and security

leadership role when it conducts itself with such ineptitude and such

disregard for the consequences for the world?”

Indeed.

You'll Never Be On The Inside!

So join Outsider Club

today for FREE. You'll learn how to take control of your finances,

manage your own investments, and beat "the system" on your own terms.

Become a member today, and get our latest free report: "The Only Unbiased Inflation Report."

American Privilege: the Beginning of the End?

The rumbling from the world includes that against “American privilege” in matters financial. As the New York Times notes:

“. . . no one gets a better deal than the United States. The United

States borrows in its own currency, and it borrows at extremely low

interest rates. It also borrows under its own laws, an often overlooked

advantage.”

Though some would claim the U.S. is doing just fine because it can print more money

if need be – and the New York Times actually goes on to make that claim

– doing so lessens the value of the dollar, and doing so is one of the

problems the rest of the world sees with our financial house. Putting on

blinders and buying the lie does nothing but further political agenda.

Though the risk of the United States acting so foolishly is one “the

lender accepts” when loaning us money, it does not have to. To say we

are okay because they have accepted our irresponsibility in the past is

ludicrous. Just because they have until now does not mean they will

continue to do so, nor does it mean that we should continue to be

reckless with our currency and its value.

There are consequences for actions, and if the U.S. continues on this

path – though the dollar may not be quickly or easily replaced – make

no mistake, there will be consequences. The world will not continue to

extend us so much “American privilege” nor be so willing to loan us

money without some way to recoup it.

If you liked this article, you may also enjoy:

Related Articles

The Problem With Fiat Currency

Fiat currency relies on the fact that citizens trust the government enough to not manipulate it. But what happens when that trust disappears?

The Dollar Dies in Nine Days

The impending U.S. default will decimate national and global economies, destroy the U.S. dollar, and return gold as the only global reserve currency.

Is This the End of Fiat Money?

The problem with fiat money is starting to rear its ugly head in nations like India...

How NOT to Launder a Billion Dollars

Just another day in the international criminal cartel we call the banking industry... As it turns out, liberty is reserved for the Insiders.

Fiat currency relies on the fact that citizens trust the government enough to not manipulate it. But what happens when that trust disappears?

The Dollar Dies in Nine Days

The impending U.S. default will decimate national and global economies, destroy the U.S. dollar, and return gold as the only global reserve currency.

Is This the End of Fiat Money?

The problem with fiat money is starting to rear its ugly head in nations like India...

How NOT to Launder a Billion Dollars

Just another day in the international criminal cartel we call the banking industry... As it turns out, liberty is reserved for the Insiders.

Is This the End of Fiat Money?

The Coming Currency Crisis

By Joseph Carducci 2013-09-16

http://www.outsiderclub.com/is-this-the-end-of-fiat-money/408

The other day, one of my best friends, Bob, gave me a call. He

wanted to talk about something that has been bothering him for a while

now: the whole idea and system of fiat money.

Bob had read an article I wrote a few months ago about this very topic. As you are no doubt aware, the idea behind a fiat monetary system

is that money is basically whatever the government of a country says it

is. And this is the thing that was really bothering Bob.

Bob had read an article I wrote a few months ago about this very topic. As you are no doubt aware, the idea behind a fiat monetary system

is that money is basically whatever the government of a country says it

is. And this is the thing that was really bothering Bob.

Bob is an investor, just like you and me. He has probably explored

just about every asset class there is, including precious metals and

currencies. But as he has been watching the recent events around the

world, he is now fully expecting that at some point in the future, the

fiat money system will come to a crashing end.

This may or may not lead to an actual currency crisis complete with

hyperinflation, but either way, investors in the U.S. must be prepared

for this and start to get ready.

Why Fiat Currency is Volatile

Have you ever wondered about those paper bills in your wallet? The

so-called Federal Reserve Notes? Why do they have any value at all...and

what determines this value? These are all good questions, and questions

that increasingly need to be asked and answered again in light of how

volatile “money” can actually be.

Since you asked, there are several reasons why fiat currency is

volatile. The first major reason for this volatility is the fact that

there is not anything “real” to actually back up the value of this

currency. You see, a government turns on its printing press and pops out

a million dollar bills or euros or rupees. This does not provide any

more intrinsic value; this currency is still just a mixture of paper and

ink.

The only reason you and I are able to use this to buy anything is

because the citizens of our country (and others) have confidence in the

government. The government says these notes are money.

Of course, in the old days, there was actually something backing up

this paper currency. This was most often gold, silver, or some other precious metal,

depending on the society and point in history. Even up until recent

times, it was a legal mandate that you could go to a bank and trade in

your dollar bills for gold.

But no longer—not since President Nixon took our country off the gold standard back in 1971, as Gold Seek reports, and the remainder of the world followed suit.

The other major reason why fiat currencies are volatile is because

they are traded—and possibly even manipulated—by major players on

currency and bullion exchanges. Certainly you have heard of the major

bullion trading exchanges like the LBMA and the COMEX.

The problem here is two-fold. First, what is actually being traded is

not the metal itself (which does have intrinsic value), but rather a

paper-based contract. Not only that, but there is never any requirement

for actual delivery like there is with real commodities (coffee or

wheat, for example).

The currency exchanges can also be manipulated very easily by big

traders tending to “concentrate” their orders in the times that are most

commonly used to determine prices.

Currency Manipulation Equals Economic Manipulation

There is a basic economic law at work in regards to how the

manipulation of a currency leads to other effects in an economy. You are

aware of the basic economic law of supply and demand. Now, consider

what would happen if the currency of a nation is manipulated—even for a

supposedly “good” cause.

Maybe it is decided that the money supply needs to be expanded, so

more physical bills are printed and put into circulation. You can

clearly see this will lead to a situation of more money chasing the same

amount of goods and services. As this continues, it will lead to higher

pries—or inflation.

If such a situation continues for very long, it is also possible that

the people will begin to lose confidence in their government. So far,

you have not seen this here in the U.S., although it is beginning to

occur in several other countries.

This could lead to people turning to “real” money, like gold and

silver. It could also lead to foreign investors deciding that this fiat

currency is no longer a good bet, causing them to sell their investments

and put their money to work someplace else. The world is so

economically interdependent today that you really need to think globally

when talking about issues related to currency and the system of fiat

money.

We should also be worried about counterfeiters. After all, what you

and I consider to be “money” in our pockets is really just paper—at

least from a physical standpoint. It has always been highly profitable

for criminals to attempt to create fake fiat currency. Even with

technological counter measures, there is still a huge amount of

counterfeit currency in circulation. This further degrades the money

supply and leads to more inflation.

You'll Never Be On The Inside!

So join Outsider Club

today for FREE. You'll learn how to take control of your finances,

manage your own investments, and beat "the system" on your own terms.

Become a member today, and get our latest free report: "The 5 Best Ways to Buy Gold."

Case in Point—the Indian Currency Crisis

If you have been watching economic news recently, the crisis in the

Indian rupee is likely something you have been following with increasing

interest. What led to this currency crisis?

As with most economic problems these days, it began with a loss of

confidence in the government due to their high level of corruption and

heavy-handed regulation. Foreigners began taking their money out of the

Indian rupee, primarily by selling their bonds and buying other

currencies with the proceeds, Market Oracle points out.

Indians themselves also have typically been trading their rupees for

physical gold. In fact, the entire culture of India is strongly inclined

towards holding wealth in physical assets, from gold to land and

cattle. This is also why India is one of the world's largest consumers

of gold, second only to China.

All of this has led to a record current account deficit in

India—almost 5 percent of the nation's GDP in fiscal 2012. So the

government has responded to this situation by actually targeting India's

second biggest import: gold.

At the beginning of 2013, import duties on gold were only 4 percent,

but they now have been raised to a whopping 10 percent in an effort to

discourage people from buying (and most likely continuing to increase

the current account deficit).

These policies have only served to create a boom in gold smuggling.

Even the World Gold Council recently reported that consumer demand for

gold in India has risen by 48 percent in just the first half of 2013.

The stock market has also been crashing, with $3.6 billion being sold

since early June.

All of this has led to the rupee, the Indian currency, plunging

against the dollar and other international currencies. In fact, you may

not be aware of the depth of this plunge. The rupee has declined 22

percent in less than four months. It is now at record lows against the

dollar.

This is leading to increased prices in India on everything from food

and grain to housing and services. Incidentally, this also pushes up the

price of gold in terms of rupees...and yet people are still buying!

The Return to a Gold Standard

The simple solution to currency crises and economic manipulation like

we are seeing today is a return to the gold standard. But governments

do not tend to like a gold standard. Why, you might ask? Because it

forces them to be accountable.

You see, under a true gold standard, a country or government should

not be able to print more money than they have gold to back up the value

of that money.

There are a number of different ways in which this could be

accomplished. It might be possible to have a “modified” gold standard,

where the government is allowed to print money in a specific multiple to

the amount of gold it holds. Each country may need to come up with some

variation of how to specifically apply a gold standard to its

situation.

Returning to a gold standard is definitely possible, although many

governments will not like this. It ultimately may not occur until more

of the major economies experience their own currency crises.

The problem is, once this occurs in the U.S. dollar, it will drag the

rest of the world down as well. In the meantime, we will likely see the

gold price continue rising, especially when priced in currencies that

are experiencing a crisis.

If you liked this article, you may also enjoy:

Related Articles

How to Save Money for Fall

With the start of fall comes a multitude of extra expenses. Here are some ways to tackle these without breaking the bank...

Are Major Banks Safe for Your Deposits?

Are FDIC-insured banks really as safe as they sound? What would happen to your savings if your bank failed?

With the start of fall comes a multitude of extra expenses. Here are some ways to tackle these without breaking the bank...

Are Major Banks Safe for Your Deposits?

Are FDIC-insured banks really as safe as they sound? What would happen to your savings if your bank failed?

Silver Rebound is Inevitable

Precious metal investors have another secret weapon, and it's more powerful than the Fed.

The Coming Bond Market Crash

The bond market is starting to get unsteady, and as rumors swell about the end of quantitative easing, investors are getting nervous...

Buy Gold for 2014

Gold is Going Up...

By Daniella Nicole 2013-10-21

http://www.outsiderclub.com/buy-gold-for-2014/517

With the congressional standoff now over and a debt ceiling raise agreed to, investors are keeping a close eye on the market.

Some investments did rise following the temporary end to the

congressional drama, and gold was one of them, closing at more than $40

an ounce higher. But with the congressional drama set to begin anew in

December through February, what do we have to look forward to with gold?

De-Americanizing the World

The deal Congress reached establishes a number of deadlines regarding

this country's financial state. These deadlines begin in December with

budget talks and run through February, when the debt limit suspension

will end. This gives Congress plenty of time to initiate more drama,

which will impact the markets and the global economy. This brings us to

the next point.

I wrote Friday about the call from China for a de-Americanized world. The nation referred to a need for a new reserve currency.

This is the cry heard round the world, as others are in agreement that

something must be done and are actively making moves to secure their own

financial houses from the ongoing American financial drama. Some

nations are investing more heavily in gold.

Though there is support for a move away from the American dollar, it

has also been pointed out that moving from the dollar to another

currency would not be easy or quick to do, even with all China is doing

to boost the yuan. This buys America time to get its financial house in

order, which benefits not only America but the entire global economy.

In the meantime, both Americans and investors 'round the world are

putting more faith in gold than in the U.S. dollar. This may benefit

those investing in gold, but in the long run, it may hurt the U.S.

economy as a whole. This, however, is only part of the equation for

gold's future.

Bank Account Seizures and Black Markets

I have also written previously about the problem of deposits in major banks and

how safe they may be. Though it may seem unlikely here in the United

States that the government would “pull a Cyprus” and raid depositor

accounts, it is not only possible, but just the speculation that it can

happen drives investors to gold, silver, and other commodities. This

impacts the market and means prices will rise with demand, so long as

production remains low by comparison.

The other part of the equation is the black market for gold. In

China, it is against the law to export gold, so all of the nation's

stockpile remains in the country rather than entering into the global

market. China is also experiencing a bit of a gold rush right now,

buying up gold mines and physical gold like crazy, and this will

contribute to a jump in gold prices.

In India, there have been taxation increases on bullion imports,

which have caused a surge in smuggling. These laws also affect the

market and help stimulate a black market for gold trade.

How big of a problem is the black market for gold? The black market,

sometimes referred to as “System D,” is any “off-book” money-making

ventures, meaning transactions cannot be tracked or taxed. According to

a 2009 report from the Organization for Economic Co-operation and

Development, about half of the world's workers are involved in System D,

which means a staggering 1.8 billion people making a living “off-book,”

trading in a variety of "products” including gold.

According to a 2012 report from Business Insider,

though gold had not yet made it into the top ten of black market items,

other items commonly traded on the market, such as gas and oil, did. It

is reasonable to assume that gold could make the top ten now,

especially given the fears over the economy.

The black market can offer high-priced and hard-to-find items for a

lower price, which creates a problem in the legitimate market for those

items. Pirated DVDs is one example of this. Knock-off designer hand bags

is another. Though the lower price can be tempting, black market items

can be produced in unethical ways (such as with child or slave labor)

and can be less than what they are presented to be. Gold bars may really

be gold-plated lead bars, and those tempted to indulge can become

victims of fraud and scams.

What This Means for You

To track what may come next with gold, you need to pay attention to

what Congress does for the next few months as deadlines move closer.

What the world does in response, including how it treats commodities

such as gold, will all affect the market and your portfolio. The more

volatile America's financial house seems to the world, the more it will

move away from the dollar and into things such as gold.

Also keep tabs on reports regarding the black market and how gold is

being traded. Though some of it will be fake or not as pure as claimed,

real gold could also be traded on the black market, and that will affect

regulations countries initiate, as well as the legitimate market.

For now, gold is likely to remain high. Even if it dips between now

and February, it will likely rebound due to speculation about

congressional drama, as well as impending Fed tapering (or additional

stimulus programs). As long as the dollar is weak, commodities such as

gold will remain strong.

Related Articles

How Gold Storage is ProfitingGold storage facilities are in high demand. Is this a sign that the price will rebound?

Why Gold Prices will Jump

Gold prices are still low...so why are Chinese miners buying up gold mines?

Infinite Gold

What if I told you that your gold could be multiplied over and over... that a single bar of gold can be turned into a nearly endless hoard of the yellow metal?

The King of Silver and Gold Flees

J.P. Morgan has finally bowed to the masses and will abandon control of silver and gold.

The Great Gold Rally of 2014

By Jason Simpkins 2014-01-17

http://www.outsiderclub.com/gold-contrarian-play-of-2014-prices/742

Gold had a terrible year in 2013, and now it's everybody's favorite whipping boy.

Gold prices shed some 20% last year and, to hear the mainstream media tell it, they'll lose another 20% this year.

Well, these armchair prognosticators are wrong. Gold is going to rebound this year.

I'll give you four reasons why:

- Gold prices have already taken the market's hardest punch. If they haven't already bottomed, they're close.

- Fed tapering won't be as bad as everyone thinks.

- Trouble in the Eurozone and Asia will increase the risk profile of the global economy and prompt another round of stimulus.

- Demand is set to rise.

Don't believe me? See for yourself...

Don't Fear the Fed

Gold has been trending lower since it peaked above $1,900 an ounce in September 2011.

It fell nearly 40% to its June 2013 low of about $1,200. Since then,

it's recovered to where it currently sits, which is around $1,250 an

ounce.

Now, you may not believe gold has actually bottomed (and maybe it

hasn't quite yet), but at the very least, it's no longer in a free fall.

That's important, because the biggest threat to gold prices last year

was Fed tapering — that is, it wasn't until Federal Reserve Chairman

Ben Bernanke hinted at monetary tightening that gold really spilled.

But now tapering has arrived, and lo and behold, it's not as bad as everyone thought.

To begin with, the Fed has only reduced bond market purchases by $10

billion. It's still pumping $75 billion into the economy each month.

That's an awful lot of liquidity.

Even if the Fed continues at that pace, trimming $10 billion from its

purchases at each meeting, it will still take all of 2014 to bring its

purchases to a halt. And that's provided the economy stomachs the blow

during an election year — something I don't think is likely.

That means U.S. monetary expansion is going to continue through all

of 2014 and probably into 2015 as well. Furthermore, part of Bernanke's

plan to pacify the markets was promising interest rates wouldn't rise

until at least 2015. We'll just have to see about that.

Finally, as I mentioned last month, Fed tapering

will have a far bigger impact on the stock market, which we all know is

overvalued at this point. As investors flee equities, they'll once

again return to traditional safe havens like gold.

And that flight to safety will be exacerbated if there's trouble in the global economy, which there almost certainly will be.

Become an Outsider Today!

Looser Monetary Policy

To begin with, none of the problems we sought to fix during the last

crisis have truly been solved. Banks have effectively stymied regulatory

reform by lobbying Congress. Sovereign debt remains an albatross in

many countries around the world (including this one). And economic

growth hasn't accelerated.

Worse still, new problems are cropping up.

With its major economies losing steam, the Eurozone is edging perilously close to deflation.

Japan has been trying to inflate its way out of trouble, just as it has

been for the past 20 years. And the outrageous growth numbers we're

used to seeing out of China have dwindled.

Other emerging markets, like Brazil, Thailand, Indonesia, and Singapore, have all lost their footing as well.

So while the United States is ratcheting back stimulus, seemingly

every other country in the world is gearing up to go in the opposite

direction.

As 2014 unfolds, we're likely to see more central banks loosen

monetary policy to reignite growth, eroding the values of their

currencies in a race to the bottom. That could lead to a slowdown,

pause, or even reversal of Fed tapering...

And thus, higher demand for gold.

The Asian Contagion

In fact, demand is already on the rise, spurred by lower prices.

Chinese gold buying has noticeably picked up at the start of 2014, helped by the approach of Chinese New Year.

Indeed, gold is of serious cultural and psychological importance in

Asia — more so than in the West. And as I mentioned, China's economic

outlook isn't as rosy as it once was. There are very real concerns about

China's stability. A property market/real estate bubble, industrial

over-capacity, and domestic debt growth are serious red flags, and no

one knows that better than the Chinese themselves.

The state may run the media, but its citizens aren't blind. And

they've been scoffing up gold since private ownership restrictions were

lifted back in 2002.

Turnover on the Shanghai Gold Exchange has been around a six-month

high. Volumes for the exchange's two main gold contracts have averaged

more than 22 tons so far this year, compared with an average daily

turnover of 18 tons in December and 16 tons in November.

Furthermore, demand in Asia could be even greater if India would

relax its gold import restrictions. Remember, India raised duties on

gold imports several times last year. They currently stand at 10%. And a

minimum of 20% of all gold imported must be exported before further

imports can be made.

However, that may be about to change...

Analysts with HSBC said in a recent research note that Indian authorities are in discussions to relax the import restrictions.

As it stands right now, the supply is just enough to feed the Chinese

market. If the Indian market were opened back up, there would actually

be a shortage of supply.

To sum it all up: Monetary policy in 2014 is likely to be looser

— not more restrictive — than most observers think. And we may even see

outright defaults in the Eurozone. That will trigger a flight out of

fiat currencies — including the dollar — and back into gold. Meanwhile,

prices are already in the process of bottoming, and demand is coming

back to life.

Ultimately, gold prices will probably revisit $1,400 an ounce this

year — despite what the critics tell you — and may even shoot higher.

Get paid,

Jason Simpkins

Jason Simpkins is a seven-year veteran of the financial publishing

industry, where he's served as a reporter, analyst, investment

strategist and prognosticator. He's written more than 1,000 articles

pertaining to personal finance and macroeconomics. Simpkins also served

as the chief investment analyst for a trading service that focused

exclusively on high-flying energy stocks. For more on Jason, check out

his editor's page.

Related Articles

Betting on a Gold Price Rally

As gold begins to show a bit of a spike back up, some analysts are calling for it to go all the way...

Buy Gold for 2014

Demand from China and continued congressional disagreements will give gold a boost into the new year...

Gold: Time to Buy

Gold and silver have been flat for a month now. A bottom is seemingly being carved out. This is presenting us with deep value to initiate or accumulate positions.

As gold begins to show a bit of a spike back up, some analysts are calling for it to go all the way...

Buy Gold for 2014

Demand from China and continued congressional disagreements will give gold a boost into the new year...

Gold: Time to Buy

Gold and silver have been flat for a month now. A bottom is seemingly being carved out. This is presenting us with deep value to initiate or accumulate positions.

How NOT to Launder a Billion Dollars

Government Cracks Down on Digital Currencies

By Jimmy Mengel 2013-05-31

In this country, there are two ways to operate a criminal enterprise: totally underground or hiding in plain sight.

Liberty Reserve has learned the hard way that if you want to launder

billions of dollars for criminals, you had better choose the latter.

The currency company just got nailed for washing $6 billion worth of criminal funds through their secretive online currency.

In case you're wondering, theirs was a relatively simple scheme...

Here's how it worked: You opened an account with Liberty Reserve

using a fake name and email address. You sent your U.S. dollars to an

unregulated currency exchange in Russia, Nigeria, or Vietnam, where the

unscrupulous currency exchanger coverts your dollars to LRs, Liberty Reserve's online currency.

Those LRs were then transferred to another Liberty Reserve

member in return for drugs, stolen credit card numbers, or any other

type of illegal item or service. The recipient was then sending their ill-gotten gains to the unregulated currency exchange, who converted the LRs back into dollars.

Liberty Reserve made its money by charging users 1% transaction fees

and $0.75 "privacy fees" to facilitate the exchanges. This scheme

allowed “the bank of choice for the underworld” to conduct 55 million

transactions for its one million users before getting busted.

This is one of the biggest money-laundering schemes ever hatched —

and the founders of Liberty Reserve, Arthur Budovsky and Vladimir Kats,

now find themselves facing what could be decades in prison.

Some of the their more clownish clients actually opened up accounts

with names like “Russian Hackers” and “Hacker Account.” Cute.

Here's the type of criminals that were using Liberty Reserve:

-

Traffickers of stolen credit card data and personal identity information

-

Peddlers of various types of online Ponzi schemes

-

Computer hackers for hire

-

Unregulated gambling enterprises

-

Underground drug-dealing websites

-

Child pornographers

Not necessarily the most endearing of folks, to be sure...

However, these thugs don't look so bad when compared to the actions of “legitimate” superbanks like HSBC.

Too Big to Jail

Here's a rundown of HSBC's crimes:

-

Illegally conducted transactions on behalf of Mexican drug lords and terrorists

-

Moved tainted money for Saudi banks tied to terrorist groups

-

Illegally catered to customers in Cuba, Iran, Libya, Sudan, and Burma — countries that are all blacklisted by U.S. sanctions

And these mega-laundering schemes weren't the work of some renegade HSBC employee...

Investigations all pointed to senior bank officials complicity

in the activities. Hell, one HSBC exec actually argued that they should

continue working with the Saudi Al Rajhi Bank, which has knowingly

supported Al Qaeda!

Now I don't want to split hairs here, but doesn't the whole funding

terrorism thing AUTOMATICALLY require a jail sentence for somebody?

If you or I so much as donate money to a charity that is found to

have ties to terrorism, we'd be stretched over the rack quicker than you

can say "Patriot Act"...

"Given that over 35,000 people were brutally slain in Mexico at the

hands of drug traffickers while HSBC laundered at least $880m of their

money, it's shocking that the current system of sanctions does not

include senior executives being held personally responsible for the

actions of their institutions,” Stuart McWilliam of Global Witness told

the Guardian.

“Is HSBC too big to jail?" McWilliam asks. It certainly seems that

way. HSBC has around 7,200 offices in 85 countries around the world.

They cater to roughly 89 million customers and claims assets of $2.69 trillion.

As of last year, it was the world's sixth-largest public company and the single largest bank in terms of assets, according to Forbes. These guys make Liberty Reserve look like a child's piggy bank.

And yet not one person involved went to jail.

In fact the Justice Department came out and straight up admitted that their hands were tied.

U.S. Attorney General Eric Holder made this maddening confession to the Senate Judiciary Committee:

I am concerned that the size of some of these institutions becomes so large that it does become difficult for us to prosecute them when we are hit with indications that if you do prosecute, if you do bring a criminal charge, it will have a negative impact on the national economy, perhaps even the world economy. And I think that is a function of the fact that some of these institutions have become too large.

In a delicious bit of irony, the Wall Street Journal, while

describing the Liberty Reserve case, contended: “Law enforcement

officials are concerned about criminals ability to move around money outside of the regulated world of banks.”

What they really mean is if you want to launder money, you had better

give the big banks a large enough cut in order to protect your

identity.

Paying for protection: an old school racket if I ever saw one.

The Italian mafioso called it pizzo... We call it international finance.

Bitcoin, We're Coming for You

My first thought when I heard about the Liberty Reserve case?

Bitcoin, you'd better watch out.

“I think is just another giant, flashing warning light to bitcoin exchanges: If you are not compliant,

there are some serious risks, both at the federal and state levels,”

said Patrick Murck, legal counsel for the Bitcoin Foundation.

The government actually tapped the

Patriot Act for the first time in such a case in order to take Liberty

Reserve down. It may allow them to set up a precedent for eventually

taking down Bitcoin.

But Bitcoin does have some crucial differences working in its favor...

For one, it is a decentralized

organization — so while the Feds could easily target Liberty Reserve

founder Arthur Budovsky, there's no head to chop off at Bitcoin.

From Timothy Lee at the Washington Post:

There’s also at least one important difference between Bitcoin and Liberty Reserve: If the authorities concluded that Bitcoin were a money laundering scheme, it’s not clear whom they’d prosecute. There’s no Budovsky for Bitcoin. Rather, the online currency was created by “Satoshi Nakamoto,” widely regarded as a pseudonym. Bitcoin transactions are processed in a distributed fashion by thousands of “miners” around the world. It would be difficult for the United States to indict all of them, and doing so would likely drive Bitcoin mining underground — which could make it even more attractive to criminals.

That sprawling, decentralized network would create a dilemma for federal regulators if former Liberty Reserve users switched to Bitcoin. The crypto currency doesn’t fit well into existing money-laundering laws, and there’s no one who can be required to reform the network to bring it into compliance. Trying to shut down Bitcoin could prove futile — the feds can make life hard for individual Bitcoin users but likely could not destroy the network altogether.

So keep your eyes peeled, bitcoin holders. It looks as though you'll

be the ones taking the brunt in the face of another government

crackdown.

Dirty Laundry

The moral of this story is if you want to launder money, for whatever

purpose, you had better do so with a too-big-to-jail bank. Otherwise,

the long arm of the law will come down swiftly.

While Liberty Reserve's owners and operators will most certainly meet

the business end of a judge's gavel in the coming months, HSBC's

higher-ups are made in the shade...

HSBC's investors just reelected chief executive Stuart Gullivar as a

director by a 99.7% margin. Gulliver also raked in $3 million in annual

bonuses while nailing down a sweet incentive plan that would net him

another $4.5 million over the long term.

Sure beats a concrete prison cell.

Alas, it's just another day in the international criminal cartel we call the banking industry.

As it turns out, liberty is reserved for the Insiders.

Godspeed,

Jimmy Mengel for Outsider Club

Related Articles

Am I Being Paranoid?

American neighborhoods are increasingly being policed by cops armed with the weapons and tactics of war...

You Are a Victim of the Modern Age

"Nothing was your own except the few cubic centimeters inside your skull." - George Orwell, 1984

Bitcoin: Safe or in Danger?

The Department of Justice just recently shut down digital payment service Liberty Reserve. Is the bitcoin in for a similar fate?

American neighborhoods are increasingly being policed by cops armed with the weapons and tactics of war...

You Are a Victim of the Modern Age

"Nothing was your own except the few cubic centimeters inside your skull." - George Orwell, 1984

Bitcoin: Safe or in Danger?

The Department of Justice just recently shut down digital payment service Liberty Reserve. Is the bitcoin in for a similar fate?

Dear Reader,

http://www.markskousen.com/offer/fma-windows?source=FMA018

Roger Michalski here with Eagle Financial Publications.

I’ve just finished a special project with my colleague Dr. Mark Skousen.

If you’ve followed Dr. Skousen’s work over the years, you know that he’s generally pretty conservative.

He believes in sound money and sound companies. His expertise as a

PhD in Economics helps him uncover ways to increase your wealth in all

markets… And no matter what’s going on in government.

And today he’s asked me to share with you something completely different than anything you’ve likely read about or seen before.

He’s been working on this privately for the last five years.

And we’re now finally ready to go public.

Here’s what’s going on…

Essentially we’ve found a really fascinating… And extremely profitable… trading pattern in certain stocks.

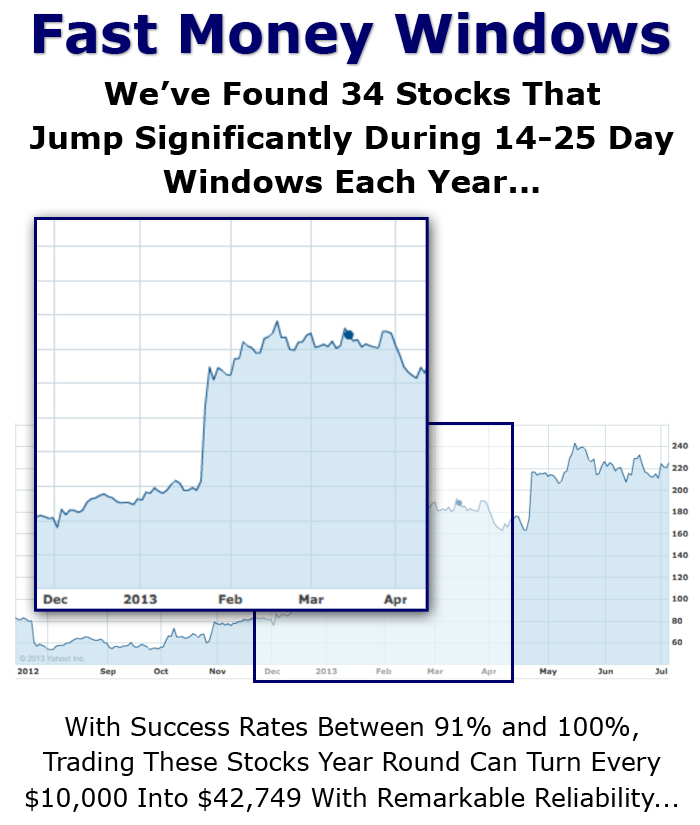

In short, during specific 14-25 day periods each year that don’t change — what I call fast money windows — certain stocks have proven to make very sudden leaps in share price.

And it’s not just for the last year or two either.

Almost every one of the 34 opportunities we’ve found worked nearly

every single year for the last decade or more. We’re looking at a 91% to 100% effectiveness rate.

That kind of predictability is unheard of. But when you see what

causes these fast money windows to appear, you’ll quickly understand why

it happens.

It simply makes sense.

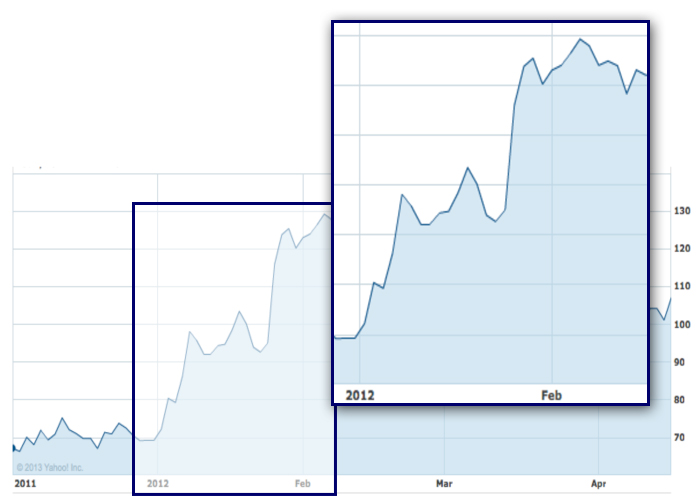

For example, there’s a famous tech company with a “fast money window” that starts in January.

Between January 20 and February 3 — a 14-day window — this stock has leapt higher every year for the past decade.

It’s 10-0.

Here’s a chart from 2013. As you can see, during its predictable fast money window, the stock jumped 78.7% in 14 days.

|

In 2012, the stock burst 26% higher.

|

In 2011, it surged 14% in 14 days.

In 2010, another 21%.

|

If you look at the charts for this company, year after year they all look virtually identical to the ones I’ve just shown you.

Between January 20 and February 3, there’s always a “pop.”

Ten years in a row, the stock jumped significantly during this 14-day

window… Averaging a 22% gain each year over that 10-year period.

That’s enough to turn every $10,000 into $73,046.

Tracking this trend, and investing in the company every year during its “fast money window” can hand you extraordinary results.

But here’s what’s really interesting…

We’ve found 34 opportunities throughout the year that behave exactly like the one I just showed you.

Every one exhibits a 91% to 100% success rate.

Play them from one to another and you could end up turning very small sums of money into quick fortunes.

In fact, if you follow the scheduled plan I’ll outline, you could

safely and reliably turn every $10,000 into $42,749… This year alone.

The bottom line is…

When you know the company… And you know the exact dates that make up

each fast money window… You can collect again and again all year long.

It’s one of the most simple, but effective ways to make money I’ve seen.

And over the next few minutes I’m going to show you dozens of

opportunities that behave exactly like the stock I just showed you.

So let’s get started…

Dozens of Windows All Year Long…

Dr. Skousen first started noticing these opportunities about five years ago.

As you probably know, he speaks at investment conferences all over the world.

At one of these conferences, he met a gentleman who showed him something a bit strange.

It was a trading pattern much like the one I just showed you.

During one specific period each year, a stock he was looking at always seemed to jump.

After he brought it to Dr. Skousen’s attention, we decided to put our considerable resources at Eagle to work.

We dug in. Explored that stock. Tried to figure out why it acted in this strange way.

Very soon we uncovered the reason.

It was simple, but very powerful. And it applied to other stocks as well.

As we looked around we started uncovering this trading pattern in dozens of stocks across a variety of industries.

I knew we were on to something big.

It meant we could reliably count on certain stock jumping like clockwork at specific times each year.

For someone running a financial publishing company, that’s like manna from heaven.

But we weren’t ready to take it live just yet.

We decided to keep digging and essentially build a “plan.”

The “Fast Money Window” Plan Comes Together

One of the first things we noticed was that each stock had a different “fast money window.”

For example, the one I mentioned earlier occurs every January 20 to February 3.

But Dr. Skousen found another that started March 3 and went through April 1. It has a 100% success rate over the last 11 years.

He uncovered a window that goes from April 13 to 27. And another that goes from May 22 to June 8.

In short, he started putting together a plan… One that would allow

our readers to roll one gain into the next, collecting on these “fast

money windows” all year long.

Very soon he had 34 stocks that were between 91% and 100% effective each year.

The windows last about 14-25 days each. And the gains could be anywhere between a minimum of 5% and a maximum of 120%.

And while 5% certainly doesn’t sound like much, small gains like that

can actually be quite powerful when they only take a couple of days.

Here’s what I mean…

Imagine for a second that you used just one fast money window each month… 12 in all for the year.

Now let’s go with the low estimate of what you can expect to make, 5% per window.

If you got just 5% per month for the year, your overall return

January to December would be 61%, nearly 10 times the average return of

the S&P.

That’s better than virtually every major money manager in America.

And remember, that’s a worst-case scenario.

From what we’ve found, you should probably average at least 12.87% per fast money window.

Many times you’ll do even better.

For example, the very first live recommendation Dr. Skousen made

using this system jumped 40% in less than a month. He also locked in a

957% gain on a call option on that play.

So 12.87% may even be a low estimate.

Regardless, I’ll show you why we’re confident in that number in a moment.

But for now consider… If you get that easy 12.87% gain once a month

for the year, it would turn $10,000 into $42,749 — A return of 327.5%.

Do it twice a month for a year, and you’d turn $10,000 into $182,761!

See how quickly these types of gains add up?

I don’t think I’ve ever seen a safer (And more reliable) way to quickly turn small sums of money into big paydays.

In fact, some of the most profitable “fast money windows” even work during the most uncertain and difficult markets.

Let me give you a couple examples from the middle of the financial crisis in 2008…

How $5,000 Could Have Turned into $18,121 on

Just Four Fast Money Windows Even in 2008

As I mentioned earlier, “fast money windows” have an incredible track record of working year after year.

The moves Dr. Skousen uncovered have proven to be 91% to 100% effective.

That means that if you were to make 100 of these trades, history says you’re likely to win between 91 and 100 times.

That’s what I like about this system. It’s reliable.

You can play the small ones or the big ones reliably all year long.

But of course, it’s easy to say that when the stock market is roaring.

It’s always easier to pick winning stocks when they all are going up.

That’s why I want to show you how a few of these performed even during the worst of the financial crisis in 2008.

Let me walk you through how just a few fast money windows could have handed you a ton of money in 2008.

Let’s say you started with $5,000 in July when the crisis really started to heat up.

On July 14th, the government initiated the takeover of Fannie and Freddie’s $5 trillion loan portfolio.

And the markets panicked.

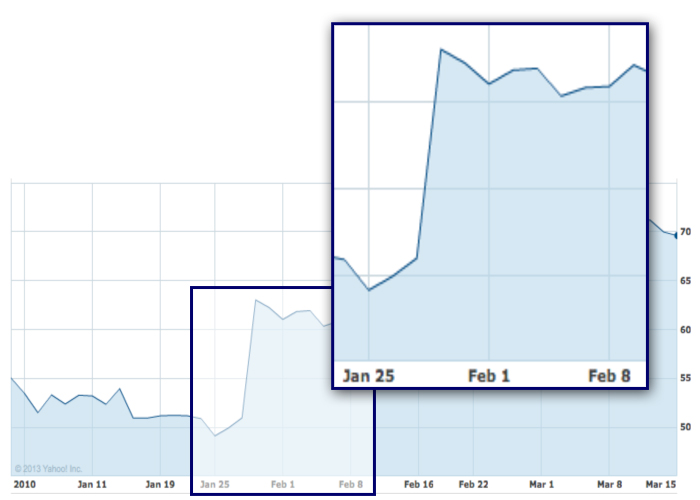

But there’s a fast money window that starts every July 15 and ends on July 29.

It’s gone up 10 out of the last 11 years…That’s a win-rate of 91%.

So on July 15th, despite the market turmoil, lets say you put in $5,000.

Here’s what the stock did next…

|

By July 29th, the stock was up 49%… Turning your $5,000 into $7,450.

49% in 14 days during the height of the financial crisis was unheard

of. But you would have known about it if you knew the name of the stock

and the days that made up its fast money window.

And it didn’t stop there.

There was another fast money window in a women’s fitness clothing

business that occurs every September 3rd thru the 18th. It has a 100%

win-rate.

In September of 2008, all hell was breaking loose. England

experienced its first run on a bank in a century. And Lehman Brothers

filed for bankruptcy.

Yet, in the midst of that, here’s what the women’s clothing stock did:

|

It went from $9 to over $12 in a matter of 15 days… A gain of 26%.

In the meantime, the Dow dropped 500 points.

And if you moved your $7,450 from the previous fast money window, you’d be sitting on $9,387.

In other words, you’ve nearly doubled your money on two moves during

the worst of the financial crisis simply by using fast money windows.

And it keeps getting better.

On Oct. 22, another fast money window hits in a mining stock. It lasts until November 6.

This one leapt 43% in another 15 days.

Your $9,387 would have grown to $13,423.

Then there’s another fast money window in an equipment manufacturer every year between November 19th and December 7th.

In 2008, it jumped 35%.

All told, with these four plays, you could have turned $5,000 into

$18,121 in a little under six months… Despite the worst financial crisis

we’ve seen since the Great Depression.

Your total gain would be 262%. By comparison, the Dow dropped 20% from 11,000 to 9,000 over the same period.

That’s the power of fast money windows.

Because these periods have proven to be winners for certain stocks

year after year, you can play them even during the worst markets with

great results.

So how is this possible?

Why do fast money windows work?

There’s a very simple, but powerful explanation.

Why Fast Money Windows Work

Ok so I’ve shown you that certain stocks jump nearly every year during predictable 14-25 day periods.

But no doubt you have one question you’re dying to ask…

Why?

There’s got to be some catalyst that makes this happen right?

Well, yes, there is.

It has to do with the release of earnings reports.

You see… Many people don’t realize this but almost every company on Wall Street follows certain earnings patterns.

Some of them are obvious…

Like retail stocks having their best quarters at the end of the year during holiday season.

But others are lesser known… And create rare “pops” in certain stocks year after year.

For example, there’s a tech stock that always seems to report its best earnings in late January each year.

The rest of the year is nothing great, but the January results are always killer.

This creates an unusual situation.

It means that only during this one short span does the mainstream investing crowd get excited about the stock.

It creates a predictable and sizeable short term pop that any investor can take advantage of.

It’s happened each year for 10 straight years now. And every single time the stock went up significantly.

In 2013, for example, those earnings came in on January 23. If you

got in just before on January 20 and held for just two weeks, you’d have

made 78%.

It seems too easy I know, but it works really, really well in about 34 lesser-known stocks that Dr. Skousen uncovered.

And he’s put together an entire plan telling you exactly when to get in the best ones.

Let me show you how you can begin profiting from it right away…

Five Years of Hard Work Pay Off…

In 2014, for the first time ever, Dr. Skousen plans on bringing a few

people in on his plan to profit from these special situations in the

markets.

He’s created a brand new service to let people known exactly when each window begins and when to get out.

It’s called The Fast Money Alert.

Here’s how it will work.

As a new member, you’ll receive alerts each week detailing what stocks are about to enter their fast money windows.

You’ll get it in plenty of time to put in an order so you’re prepared for the moment the window opens.

Then, watch the stock as it goes up… And Dr. Skousen will let you know when you’re ready to exit.

Just collect the profit. And move to the next trade.

It’s incredibly simple.

But with the track record of the windows he’s found, we’re expecting big-time results.

2014 could be a life-changing year for those who get in on this now…

2014 is Loaded With Opportunities to Profit

Our goal for The Fast Money Alert is to give you a plan throughout 2014 to profit from fast money windows.

If you know the names of the companies… And the dates to trade… You can collect these gains one after another all year long.

There are 34 opportunities we’ve found that work really well and have

extremely high win-rates. And below I’ve given you a basic outline of

what your experience could play out like.

I should emphasize… Our number one goal with this is safety. And reliability.

Dr. Skousen chose opportunities that almost all have 100% win-rates.

And even though some have expected gains in the single digits, it’s

important to remember that 8% or 9% in two to three weeks is actually

quite good… And taken together, they can help you make a lot of money.

Here’s what a yearlong plan could look like for you, including estimates if you started with $10,000.

Play 1) January 20 — February 3. 100% win-rate. Expected Gain: 22%

New value of your $10,000: $12,200

|

Play 2) March 7 — March 25. 100% win-rate. Expected Gain: 13% in 18 days.

New value of your $12,200: $13,786

|

Play 3) March 25 — April 8. 100% win-rate. Expected Gain: 14% in 14 days.

New value of your $13,786: $15,716

|

Play 4) April 13 — April 28. 92% win-rate. Expected Gain: 8% in 15 days.

New value of your $15,716: $16,973

|

Play 5) April 28 — May 19. 100% win-rate. Expected gain: 14% in 21 days.

New value of your $16,973: $19,349

|

Play 6) May 22 — June 8. 100% win-rate. Expected gain: 10% in 17 days.

New value of your $19,349: $21,284

|

Ok so with just six money windows under this plan… one each month…

You could easily double your money in the first six months alone.

Best of all you don’t have to do anything spectacular. All you have to do is capture the historical average of each play. For these six plays, that’s between 8% and 22% on each.

Very doable.

It’s important to note, these aren’t going to all hit their averages

exactly. Some will undoubtedly come in higher and some lower.

But remember, these plays have been working for a decade straight.

As you can see, all but one have a 100% win-rate during this time period.

Plus, even with the conservative estimates we’re using, you’ve turned $10,000 into $21,284.

And keep in mind; this is just in the first six months.

As I’ll show you, if you continue with a plan like this for the whole year, you can do much better.

Play 7) June 22 — July 7. 100% win-rate. Expected Gain: 19.5% in 15 days.

New value of your $21,284: $25,434

|

Play 8) July 11 — July 25. 100% win-rate. Expected Gain: 15% in 14 days.

New value of your $25,434: $29,250

|

Play 9) Aug. 28 — Sep. 17. 92% win-rate. Expected Gain: 10% in 21 days.

New value of your $29,250: $32,175

|

Play 10) Sep. 30 — Oct. 14. 100% win-rate. Expected Gain: 5% in 14 days.

New value of your $32,175: $33,784

|

Play 11) Oct. 23 — Nov. 6. 100% win-rate. Expected Gain: 14% in 14 days.

New value of your $33,784: $38,513

|

Play 12) Nov. 19 — Dec. 7. 100% win-rate. Expected Gain: 11% in 18 days.

New value of your $38,513: $42,749

|

In total then, on these 12 fast money windows, you’ve turned $10,000

into $42,749. That’s on an average return of just 12.87% per play… But

it gives you a total return of 327.5% for the year.

I think that’s pretty darn good…

It shows that reliable, safe gains can transform your portfolio in a quick and realistic way.

But if you are more of the speculative type, we have something for

you as well. Along with most regular fast money windows, Dr. Skousen

will also include an option play that can supercharge your returns on

every play.

Since these gains are so consistent, options plays can be much more effective than with traditional stock picks.

For example, Dr. Skousen’s first fast money window in real time was a

40% gain. But the option he recommended with it went up 957%.

Whatever your approach, whether conservative or aggressive, there’s

no question that fast money windows can help you make significant

amounts in the markets.

That’s what we’re looking at with fast money windows.

We’ve spent five years researching these little anomalies in the market. And I now feel very confident that we’re going to have a big year collecting on them.

That’s why we’re launching The Fast Money Alert based around this very unique approach to stock selection.

Five Years of Carefully Laid Plans

Finally Paying Off…

With this service, Dr. Skousen wanted to create something different. We wanted a system people could trust to play EVERY recommendation… Not a total hit or miss guessing game.

Dr. Skousen will arrange each play you should make throughout the year.

All you have to do is follow his alerts… Hit each fast money window

as it comes along… And skip all the anxiety of usual stock trading.

One of the aspects of this system I like best is that you already

know when to get in and out of each stock. You don’t have to worry about

whether it’s the right time to buy or sell.

This strategy combines Dr. Skousen’s 30 years of market experience,

training as a PhD Economist, and his proprietary new system to create a

strategy that:

| ✓ | Requires each play to carry a 91% to 100% win-rate |

| ✓ | Ensures each stock is financially strong and stable |

| ✓ | Uses no penny stocks or micro-caps |

| ✓ | Provides expected gains between 5% and 120% in less than a month on every play |

| ✓ | Monitors new stocks as they begin generating new fast money windows |

| ✓ | Gives speculators the chance at supercharged gains with option plays |

To put it simply, we do the legwork, so you don’t have to worry. Our

goal here was to create the most low risk stock alert service in the

business.

We don’t want you to guess what the markets will do. We want you to know what the markets will do.

You’ll feel the difference very soon if you join Dr. Skousen’s Fast Money Alert.

It couldn’t be any easier. Here’s why…

Three Reasons Fast Money Windows Are the

Safest Ways to Multiply Your Investment Account Several Fold Each Year

If you’re like me, you don’t really like distressing over your investment choices.

You want something easy. You want something simple. And you want something that works.

I believe Fast Money Alert can do that for you for three reasons:

REASON #1: You Already Know When to Buy and Sell

Most investors are constantly worrying about two things.

Did I buy in at the right time? When should I sell?

With this system, you don’t worry about that at all.

Remember, these windows have worked every year for a decade straight. You already know the buy in date. And sell date.

We give that to you. And you collect the profits.

REASON #2: We’ve Minimized the Risk to the Bone

We didn’t choose investments that work 50% of the time… Or even 60% or 70%.

We’re only targeting stocks that have proven to increase between 91% and 100% of the time during their particular windows.

Most are 10-0 over the last decade. Some go back 14 years or even more.

We don’t like guessing with our investment picks. We’ve only selected the very best.

REASON #3: At Least Double-Digit Returns Each Month

Safety is my number one priority. But these aren’t U.S. Treasuries or AAA rated bonds that pay 1% or 2% per year.

Most of these fast money windows average at least 10% in 14 to 25 days.

That means you can expect at least one double-digit gain every month.

And while that may not sound huge, it’s important to remember…

Getting a 12.87% gain each month compounded for the entire year will turn $10,000 into $42,749.

Do it twice a month for the year and your $10,000 will turn into $182,761.

That’s a total return of 1,727%.

It’s nearly impossible to find a stock that goes up that much in a

year. And you’ll probably end up buying into a lot of losers trying to

find one.

But getting 12.87% once or even twice a month is completely doable.

Just follow the moves and you’ll do fine.

It’s straightforward. It’s quick. It’s profitable.

And it requires NO GUESSWORK.

No Matter What Time of Year,

We’re Ready to Get You Started

I should mention to you that this is a brand new service.

Dr. Skousen has been working on it for five years and he’s just now launching it .

But that isn’t to say he hasn’t profited from it in real-time. In

fact, he’s been using these windows to collect handsomely in some of his

other services already.

For example, I mentioned earlier his first ever trade on one of these

fast money windows. It was on Icahn Enterprises in October. Icahn’s

money window begins in October and goes into early November.

Yet, in that time the stock screamed upward for a quick 40% gain. And the option gain shot up nearly 10-fold.

Not bad for his first live recommendation using this system.

It’s one of the reasons I’m so anxious to get you on board and ready to profit in 2014.

Once you get started, you’ll be shocked at how quickly these

opportunities start lining your inbox. And they happen all year long.

In January you can collect 22% in 14 days on a tech stock. There’s an

internet stock that jumps19.5% in 15 days during June. 18% in 15 days

during September on a retailer.

And remember, these expected gains are based on decades long track records of jumping this much every year.

We’re looking at 34 of these plays throughout the year that are

absolutely reliable. So whenever you’re getting in… You’ll easily be on

track to start locking in a minimum of 12.87% each month.

Again, I should emphasize. We’re being realistic here.

Sure, I could promise you 150% every month, but that’s just not reality. I like to keep it simple, easy, and REAL.

And that doesn’t make it any less profitable.

12.87% per month for three straight years would turn $10,000 into $781,316!

That’s nothing to sniff at. But it requires patience, diligence, and smarts.

The key is that you join The Fast Money Alert now to make sure you don’t miss out.

As one of our charter members, you’ll get all Dr. Skousen’s Fast Money Alerts

to keep you on a scheduled plan for the year. Armed with every buy

date, you’ll be investing in a totally different way than anything

you’ve likely tried before.

That’s an edge not many people can claim to have.

And this is the only place you can find a system like this. We’ve never shown this to any outside group… And we never will.

We’ll only share it with members of The Fast Money Alert.

So how do you begin receiving the first one right now?

The Only Place You Can Access These

Fast Money Windows

This is the first and only time anyone I know of has created a service like this.

In fact, up until this time, I doubt anyone even knew these sorts of fast money windows actually existed.

This is an opportunity to make more each month than most investors do every year.

Most people would pay top dollar for that kind of thing.

I’ll remind you, 12.87% every month for two years would turn $10,000 into $182,761.

So you can understand why we originally felt an annual price of $1,995 would be more than fair.

There’s no doubt in my mind, you could end up collecting at least 10 times that amount in the first six months alone.

However, as the publisher, I also have a specific goal for this service.

I want everyone to be on board right from the start so they can benefit from the plan Dr. Skousen is preparing.

That’s why I’ve created a special situation for charter members…

Special Offer for Charter Members Only…

As a charter member, I’m offering you a full year of Fast Money Alert at a special rate.

Join right now and I’ll give you an additional 50% off the $1,995 price.

As a charter member you’ll get a full year of Dr. Skousen’s Fast Money Alert for just $995.

Better yet, I can guarantee that as a charter member, you’ll never have to pay a higher price for this service.

Even if you like it so much that you continue as a member for five years, you’ll do so at the same discounted rate.

But I should warn you.

This offer is not going to last long.

I want you on board for the next alert.

With the response I expect, we could easily fill up all spots and shut enrollment down very soon.

That’s why I suggest you go ahead and sign up as a charter member right now.

But if you have any final concerns, let me make this as easy as possible for you.

Let Me Make This as Low Risk as Possible For You With Our 100% Satisfaction Guarantee

With The Fast Money Alert, capturing

reliable double-digit gains each month is no longer a “dream scenario.”

You could turn every $10,000 into $42k on just 12 moves. And $182k on 24

moves!

That’s life-changing money.

And with a 91% to 100% effective rate on those trades, it’s

unquestionably one of the best opportunities I’ve ever seen in the

markets.

In short, I don’t want you to miss out.

Here’s what I suggest you do…

Click on the button below to review everything Fast Money Alert

has to offer. Then, go ahead and sign up as a charter member. In a few

minutes, you’ll receive our welcome package with all the details on your

membership.

From there, you’ll receive the first few opportunities right away.

Each one will include a write-up on the opportunity. The buy date…

Plus Dr. Skousen’s financial analysis and the additional option play for

those that want to supercharge their results.

Go ahead and begin using them if you like. Or if you’d rather paper trade them at first, that’s fine to.

Consider this a “test drive.” Take up to 60 days to see what you

think. That’s two months loaded with chances to profit… Plenty of time

to see just how effective this strategy truly is.

And if at any time during that first 60 days you’re unsatisfied with

the service, one quick phone call is all it takes to cancel it. And

we’ll immediately refund your subscription charge.

I don’t think I can make this any easier to find out firsthand how profitable this system can be.

It’s one of the most exciting new services I’ve ever had the pleasure of launching.

Unfortunately, there is one drawback you should know about.

Because we want to make sure the mainstream crowd doesn’t discover

this anomaly, we’re strictly limiting the total number of people allowed

on board.

So, everyone who wants to become a charter member must get in during this very short launch period.

If you’re not in at the beginning, you may not have the chance to join again for the rest of the year.

To ensure you get our best deal and a full 60-day trial period to try it, just click the button at the bottom of this page.

You’ll be able to review everything before making a final decision.

Or call our staff at 800-211-7661. They’ll answer any questions you may have and sign you up right away.

I look forward to hearing from you today.

Sincerely,

Roger Michalski,

Publisher,

Eagle Financial Publications

P.S. We’ve discovered 34 opportunities proven to jump during 14-25

day windows every year. They are successful between 91% and 100% over

the past decade with most averaging double-digit returns every two

weeks. Go here to get on board Dr. Skousen’s plan to capture one to two

of these every month in 2014.

P.P.S. Dr. Skousen will be recommending supercharged options plays as an added benefit to The Fast Money Alert.

The first one turned a 40% gain into 957%. But some people

understandably feel that options are too complex or risky. That’s why I

want to send you a free report showing you the best ways to trade them.

It’s called The Little Black Book of Option Secrets. Click the button below to receive it and everything else I’ve promised today.

Tidak ada komentar:

Posting Komentar