Fed to Devalue the Dollar by 33%

The Fed is joining forces with the big banks. After their most recent two-day meeting, the announcement has been made official and the message is clear; the dollar will be tanking in no time.

Over the next two decades, the Fed aims to devalue the dollar by at least 33% according toCharles Kadlec from Forbes:

The debauch of the dollar will be even greater if the Fed exceeds its goal of a 2 percent per year increase in the price level.

An increase in the price level of 2% in any one year is barely noticeable. Under a gold standard, such an increase was uncommon, but not unknown. The difference is that when the dollar was as good as gold, the years of modest inflation would be followed, in time, by declining prices. As a consequence, over longer periods of time, the price level was unchanged. A dollar 20 years hence was still worth a dollar.

At that rate of 2% per year for 20 years, we’d experience a 50% increase in the price level. What does that mean for consumers?

In 20 years, 2032, you would spend $150 to purchase the same items or services that would cost you $100 now in 2012.

That’ll be the basic impact of a dollar that is worth one-third of its present day value.

For some reason, the Fed believes this monetary manipulation will increase employment numbers. However, if that hasn’t worked for the past 40 years, why would it work now?

From November 2010 through June 2011, the Fed attempted to jumpstart economic growth by injecting $600 billion in Treasury securities into the banking system and keeping interest rates historically low. All that did was slow the annual rate of growth from 3.4% to a miserly 1% by the first half of 2011.

Once the Fed stopped interfering, economic growth climbed back up to a 2.3% annual rate by the second half of the year.

I hate to be the bearer of bad news, but there’s more…

Big banks are also contributing to fiscal woes by requiring the right to issue negative yield bonds. Yes, that means you would have the oh-so-luxurious fortune of paying the “too big to fail” banks money in turn for their gracious offer to hold onto your bond-money for you.

The picture is clear: the Fed simply doesn’t have the solutions the American people are looking for. Moreover, it’s evident that the dollar will never be as good as gold so long as the Fed’s in control…

Federal Reserve and Big Banks Are Going to Crush the

Dollar … and American Savers

Posted on February 13, 2012 by WashingtonsBlog

The Fed’s EXPLICIT Goal Is to Devalue the Dollar by 33% … and NEGATIVE Yield Bonds Are Coming

The Federal Reserve’s explicit goal is to devalue the dollar by 33%.

As Forbes’ Charles Kadlec notes:

The Federal Reserve Open Market Committee (FOMC) has made it official: After its latest two day meeting, it announced its goal to devalue the dollar by 33% over the next 20 years. The debauch of the dollar will be even greater if the Fed exceeds its goal of a 2 percent per year increase in the price level.

***

The Fed has announced a course of action that will steal — there is no better word for it — nearly 10 percent of the value of American’s hard earned savings over the next 4 years.

While that is stunning, it is actually par for the course for the Fed:

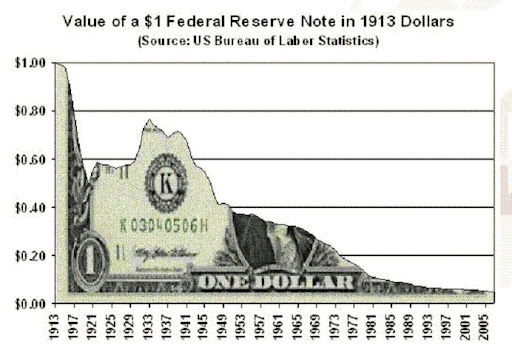

Here’s a chart of the trade weighted US Dollar from 1973-2009.

And here’s a bonus chart showing the decline in the dollar’s purchasing power from 1913 to 2005:

The giant banks – through their treasury borrowing committee headed by JP Morgan and Goldman Sachs – are also demanding the issuance of negative yield bonds.

In other words, the too big to fail banks want Americans to pay to have the luxury of holding their money in bonds.

American savers – and especially those living on fixed incomes and pensions – are going to get creamed.

Tidak ada komentar:

Posting Komentar