Having trouble viewing this issue? Click here.

https://mail.google.com/mail/u/0/?shva=1#inbox/138f1c12a07b33f0

|

Here is your Wealth Wire Weekend Editorial brought to you this week by

Wealth Daily...

It's a Ponzi Scheme...

By Nick Hodge | Saturday, August

4th, 2012

https://mail.google.com/mail/u/0/?shva=1#inbox/138f1c12a07b33f0

Is what we're all chasing even real?

Trades and investments we make today are largely done electronically.

You aren't trading gold-backed dollars for commodities or equity in

a company. You're trading a string of ones and zeros for another string of ones and zeros.

Think about it... When's the last time you took delivery of a commodity

or were sent a stock certificate after you bought shares?

Half the time, I'm in and out of trades faster than something could be

stamped and delivered.

So, how do we even know those commodities or shares are real?

JPMorgan, for example, is estimated to have sold between $1 billion

and $3 billion of silver that doesn't even exist. You or I would call that fraud.

On Wall Street it's called something like "naked short selling" or

a "derivative" or "leverage" or some other bogus term to pull the wool over our eyes.

It's like rebranding rapeseed as canola to make it more palatable...

Nobody wants to eat rapeseed just like nobody wants to invest in

nonexistent silver.

And that's just one way the banks and those who regulate them are

doing whatever they want to enrich themselves with total disregard f or people like us.

Advertisement

Merrill Lynch Predicts $2,000 Gold?!

It's the perfect storm for gold investments.

Investors are flocking to the precious metal as Europe's debt woes

and America's unemployment problems continue to plague the world economy...

Physical gold owners could see their holdings hit 25% gains by the end

of the year...

But there's another lesser-known — and much more profitable — way

to ride gold's next bull market.

(Central) Banking Elite

When we invest or disperse capital independently, we take on

the risk. If the trade goes sour, we lose money.

But these guys are trading billions of our dollars through pension,

retirement, mutual, and other funds... and reaping egregious commissions and bonuses.

Even if they leverage themselves into the ground with trades they

don't understand, not to worry — they'll land safely on their feet with a golden parachute deployed with still more dollars we worked hard to earn.

Obviously 2007 and 2008 taught us nothing, because the last

few months have revealed malicious fraud and cover-ups at the highest levels...

John Corzine and MF Global leveraged to the teeth in high-risk

off-the-balance sheet investments using CUSTOMER MONEY in an attempt to make enough money to hide its imminent insolvency.

The bets failed and the firm ended up stealing more than $1.6 billion from

its clients as it transferred money from the customers' accounts into the firm's to hide liquidity shortfalls. That money has not been repaid. It never will.

Meanwhile, Mr. Corzine walks around a free man.

If you were trading with MF Global, did any of those investments

ever really exist? Were they real?

A missing $1.6 billion indicates they weren't.

Or take the recent exposure of LIBOR to be an utter fraud,

conspiratorially manipulated by a small circle of elite bankers.

Many of the world's investments and interest rates are affected

in some way by LIBOR: bank lending rates, capital structures, mortgages, credit cards.

If the mother rate on which all that stuff was based was being

manipulated for years, are the millions of loans and credits cards based on that rate also fraudulent?

You'd think that would be illegal — that those bankers colluding to

defraud the entire financial system would be hauled in, their firms harshly penalized...

But that's hard to do when the agencies regulating them are in on

the scandal.

We know for a fact that the Fed was in on it.

One of the Barclays traders manipulating the rate told Fed official

Fabiola Ravazzolo in an April 2008 recorded phone call:

“We know that we're not posting, um, an

honest LIBOR.”

Yet the Fed continued to play along for years as the knowingly

manipulated LIBOR stole billions from the middle class.

It's the definition of conspiracy — perpetrated by the highest

levels of international banks, central bankers, and regulators.

And why would the Fed care? After all, they manipulate rates all

the time, just under the guise of “policy.”

But the ruse can only last so long... You can almost feel it coming

to a head.

Advertisement

There are 400 billion barrels of

“stranded” oil in the

United States...

Nearly 2 trillion barrels around the

world...

And this

company has just been tapped to extract nearly

every last drop of it.

Be Ready When It Does

Obviously, those who have been orchestrating this game know

it's almost up.

And they're going to try to keep what's yours when the house

collapses.

That's why the Fed recently gave new

“policy” instructions in

the form of a paper called, “The Minimum Balance at Risk: A Proposal to Mitigate the Systemic Risks Posed by Money Market Funds” (some more of those bogus terms to pull the wool over your eyes I noted earlier)...

What they're trying to mask with those big words and their

long report is a proposal that would deny your legal right to cash out your money market fund.

The official wording gives fund managers the option to

“suspend redemptions to allow for the orderly liquidation of fund assets.”

That means when the run on banks starts because

they are collapsing, the government is not going to allow you to take out your money.

It's criminal, of course. But they've been doing criminal things

for years — and there's nothing to stop them because the supposed regulators are part of the conspiracy.

Bankers and Fed officials move seamlessly between the public

and private sector, often finding cozy jobs on both sides in corner offices or in Congress or the White House.

Just ask Paulson or Geithner or Bernanke.

I'll be covering topics like these from here on out in Wealth Daily:

who's lying to you, why, where we're headed, how to prepare.

So before I get off on too long a rant today, let me leave you

with some words from Zero Hedge on this topic, and we'll reconvene next week.

(If you don't read Zero Hedge, start. It's a running

no-bull commentary on the Ponzi scheme that is our current financial system.)

Here's what it had to say about why the Fed wants to

limit your ability to withdraw your funds:

At this point it is

without doubt that even the government

understands that when things turn sour, and they will, the run on the bank will be unavoidable: their solution - prevent money from being dispensed, when that moment comes.

And all too often,

investors "discover" they were lied to, as the

emperor, in any fiat system, always has no clothes. Just like in September 2008, when the banks were forced to look at each-others' balance sheet and realize that there are no real assets on the left backing up the liabilities on the right, so the moment of enlightenment occurs at the most importune time.

What we know, is that now

i) the government is all too aware

that the market has become one huge Ponzi, and that all investment vehicles, even the safest ones, are subject to bank runs, and ii) that said bank runs, will occur. It is only a matter of time. And just as the president told everyone directly to buy the market on March 3, so the SEC, the Group of 30, and Barney Frank are telling us all, much less directly, to get the hell out of Dodge. Alternatively, the game of "last fool in", holding the burning hot potato, can continue indefinitely, until such time as the marginal utility of each and every dollar printed by Ben Bernanke is zero.

My personal goal is to get my entire financial house in order in case

that happens.

That means carrying zero debt, having physical wealth, property,

protection, a useful hands-on skill set, and more.

I'll be sharing how I'm doing that and why in these pages every

week so you can snap out of the financial Stockholm Syndrome that's been affecting the entire world for years.

Call it like you see it,

@nickchodge on Twitter @nickchodge on TwitterAll the details are right here in this free report. http://www.angelnexus.com/o/web/37898?r=1

This Rock Could Be Worth 127% for

You within the Next Few Months

The plain-looking rock you see in my hand is anythingbut ordinary:  from one of the largest new gold discoveries in North America.

And it's just one of millions

that are littering the ground in

this 7.5 million acre area.

The company that owns thisrock is already in the process of building a major multi-million-ounce gold resource, and is currently priced in the $3 to $4 range. In the next few months, results from exploration drilling could take this stock to the $8 to $10 range... or higher. What does this mean for investors? Simply put, this is the closest thing to a guaranteed winner I’ve witnessed in all my years as a precious metals investment analyst. This is why I traveled halfway across the continent to investigate these finds for myself. And I'm ready to share the good news with you: As you read this, Canada's Yukon Territory is in the early of stages of what could be the biggest exploration success for gold in decades. Just how big? Geologists estimate up to 100 million ounces lay under these few acres of land. At today's prices, that's over $160 billion worth of gold.

This discovery is so big, one company I found has had a 100%

success rate in their drill tests.

I'm serious. Every single drill hole they've sampled (and they've done 72 so far) has come up with gold in it. Now the Securities and Exchange Commission forbids me from telling you that triple-digit gains from this company are guaranteed... but I can say this... With so much overwhelming evidence for their massive discovery, I'm putting my own money on the line. I'm convinced I'll walk away with at least double my money in less than a year. This particular company has already established themselves early in the game, so I'm talking an easy 127%+ return within the next year. And I should know. In my thirteen-year career as a bullion dealer and gold investor, I've seen similar companies net my readers hundreds to thousands of percent gains. Just take a look for yourself:  Capital Gold — 1,235% gain Capital Gold — 1,235% gain Pediment Exploration — 254% gain Pediment Exploration — 254% gain Atna Resources — 106% gain Atna Resources — 106% gain Allied Nevada — 894% gain Allied Nevada — 894% gain Duluth Metals — 346% gain Duluth Metals — 346% gain Jinshan Gold Mines — 186% gain Jinshan Gold Mines — 186% gain Silvercorp — 610% gain Silvercorp — 610% gainand the easiest way you can profit from it. You see, it all starts with a man a lot like you and me... Someone whose wealth came from his own ideas, determination, and years of backbreaking work. Meet Shawn Ryan. nothing but praise and excitement. Shawn is, by far, the individual most responsible for uncovering this record-shattering Yukon Gold Rush…

“[The discovery] also resulted in Mr. Ryan

being named Prospector of the Year by

the British Columbia

mineral exploration industry.

'Shawn is the most talented prospector

I’ve met in

my career,' Mr. McLeod [CEO of Underworld

Resources] said.” — The Globe and Mail

You see, Shawn Ryan worked the Yukon for two decades.As he watched countless amateur prospectors throw away their life savings trying to find one of the fabled “source rocks,” Ryan knew there had to be a better way to go about it. He knew all the evidence was there. He had seen it for himself. Gold was still washing up on the shores of the local rivers, and it had to be coming from somewhere... This eroded gold in the Yukon and Alaska — or “placer gold,” as it’s called — is the largest known occurrence of this type of gold anywhere in the world. Geologists will tell you the source of placer gold is typically ten times larger than the total number of ounces taken out of a placer mining camp. But Shawn is not the sort of guy who's content with abstract numbers... He spent years and hundreds of thousands of dollars collecting enormous amounts of soil samples from across the White Gold area. Where a typical exploration company might do 2,000 to 5,000 soil samples on a project, Shawn was doing tens of thousands, year after year, trying to locate the source of all this placer gold in the Klondike. It took him 10 years of tedious sample collection... But in the end, it all paid off. Shawn Ryan found 10 square miles of one of the richest gold sources in the world. This particular piece of land proved Shawn’s theory — and sent the naysayers packing. It would go on to become the first of many Shawn Ryan properties that were vended into other companies. The first piece of ground vended to a major was soon bought by Kinross Gold for a whopping $138 million. Shawn has hit the big-time with his major discoveries, and is the primary reason the second Yukon Gold Rush is on. What is interesting is that Shawn Ryan controls the biggest part of the White Gold camp on land he staked long ago, before the new Yukon Gold Rush started. Any company with Shawn Ryan ground is highly sought-after by investors. The two companies I'm about to reveal to you got their ground from Shawn Ryan. As a matter of fact, they got some of the best ground he had, according to Shawn's own words...

As Close to Insider Info as It Gets

I've known Shawn for several years now, and I can tell youthis kind of success couldn't have happened to a more deserving guy. He worked hard in the face of great opposition — and is now enjoying major success, almost like a rock star. So when I found out that he had sold another one of his monster claims to a little-known mining company, I took the first flight to Dawson City I could find to see what he could tell me about it... Because this marks the point where individual investors can buy in. And you can be among the first. After several flights, I met up with Shawn at the local hot spot in Dawson City for breakfast. What he showed me there gave me goose bumps...  These are the drill samples from four of those initial 72 drill holes I told you about earlier... And all those light rust-colored areas in the rock contain gold mineralization. I could barely contain by excitement. But it was only when I began crunching numbers that I started to realize just how big this kind of discovery could be... You see, those 72 drill holes represent less than 10% of the total land area of this particular gold mining claim. Conservative estimates suggest four to six million ounces of gold in the combination of the first 72 drill holes and the soon-to-be-released 00 new holes from this past summer’s exploration work. Now, imagine that much gold spread out over 720 drill holes... That's upwards of 60 million ounces of gold. And the company that now owns it has a market cap of just $208 million. That's a disconnect that could make you very wealthy. It's a resource worth over $108 billion dollars at today's gold prices. Early investors could walk away multi-millionaires. The thing is, this is just the beginning of what will be one of the largest gold rushes the world has ever seen — with the potential to bring you an easy 127% gains...

Let Me Show You What I Mean

You see, one of the reasons this Yukon find is so hugehas to do with the unique geology of the area. These massive gold deposits lie in one of the few areas of the Yukon that was not covered with glaciers during one of the many prehistoric ice ages:  As the glaciers slowly rolled over the numerous gold-rich areas in Canada and Alaska, they destroyed the large gold deposits lying in their path and dispersed them over hundreds of miles. But because our particular area in the Yukon was not covered in glaciers, the large gold “source” deposits were left virtually untouched — until now... Geologists believe the placer gold that sparked the 1898 Yukon Gold Rush was gold that eroded off the source deposits and found its way into the streams and rivers that lead to Dawson City, the heart of the first Klondike Gold Rush. But Shawn Ryan’s hard work has now opened up the possibility of discovering the source of all that Klondike placer gold... And the earliest successes in the White Gold camp have now garnered the attention of an increasing number of smart investors and mining companies the world over.

Follow the Leader, Find the Profits

Ryan currently owns more than 60% of the claims in theWhite Gold area — most of them places previous prospectors never thought to look. So when he sells a claim to a mining company, investors like you can act. The most famous of these has been Underworld Resources. Most people have never heard of Underworld before, but they were the first company to option one of Ryan's claims. They bought the first package from his total mining claims back in 2008... And within just one year, the amount of gold they found was nothing short of spectacular:

“The

holes Underworld was drilling on the White

showed a thick, concentrated

deposit: a million

and a half ounces in one small zone. This was

not a

long quartz vein, as in the California

gold fields, but a well-defined

pocket, a bubble

of gold.” — New York Times

Underworld continued to produce record-breaking gold samples,and its stock shot up 970% in just one year. By the time mining giant Kinross Gold bought them for $138 million, many of Underworld's early investors walked away millionaires. (The same deal netted Shawn and his wife a cool $6 million). Underworld is gone, but the company I'm recommending has property right next to and near Underworld... And the resource calculation of their claim is looking to be more than twice as large.  Their drilling results make Underworld's initial samples look like peanuts. You see, the basic order of the exploration program in the White Gold camp goes like this: soil sampling, trenching, grid test, then drilling. When the soil samples come back with high gold values, those areas are then trenched and measured, and then assayed for gold values. Here's a picture of me with a recently trenched sample in my hand... The high-value areas from the trenching program are then laid out with a grid pattern — much like casting a net on the ground — and tested further in order to pinpoint high-value targets and prepare for a drilling program. With the drilling program, you get a better idea of how deep the gold mineralization can run... and exactly where the high-grade mining areas are located. This is where our little-known company sits. They already have the results from soil samples, trenching and drilling (now over 175 holes), and their new 43-101 resource calculation is going to a be a whopper! What we want is high-grade soils and trenching numbers along a big structure. This company has all of that — and more.

For investors, this company is exactly where you want a gold

investment opportunity to be.

The biggest gains we see in the junior mining space come whena major discovery is bought out by one of the big boys, or a company makes the initial new discovery that has the right numbers. How do I know? It's simple, really. It all boils down to more than a decade of experience... thirteen years, to be exact. My name is Greg McCoach. I've been dealing in precious metals since 1998, when I founded Amerigold.com, a gold and silver bullion dealership located in Denver, Colorado. In 2000, after coming out of the dot-com bubble, I knew gold prices were bottoming — and that a new precious metals bull market was taking hold. That’s when I launched my investment newsletter, Greg McCoach’s Mining Speculator. Since then, I've traveled across the globe — from Canada to Argentina, from China to Indonesia — in search of the biggest upcoming gold and precious metal stocks that have netted my readers thousands of percent gains...  I've been interviewed by major media outlets like Fox and CNBC. I was calling for $1,000 gold long before anyone believed it could happen — and $1,500 gold two years before we reached that benchmark... I've made my readers thousands of dollars off homerun investments that move. Take a look for yourself:  When it comes to the gold bull market, I've been ahead of the mainstream media every step of the way. For years, I've been warning readers like you about the financial mess our government has been getting us into, and telling you the best way to prepare for it is to buy gold and buy gold stocks. Many talking head pundits disagreed with me at the time... But that didn't stop Mining Speculator readers from making profits hand over fist as the dollar sunk further and our government piled on more and more debt. Like Shawn Ryan, I know that hard work and field research are the things that really pay off when it comes to playing the gold market for maximum gains. And it's why I was so excited when Shawn told me about the work he was doing in the gold-rich Yukon region. What I learned about the Yukon on my trips there confirmed that we are looking at a ground-floor opportunity that is going to be a major story for the next ten or twenty years. In my opinion, the potential for major new gold discoveries in the Yukon exceeds any other place I have ever been to. But you don't have to travel all the way to the Yukon to see how big the two companies I've been telling you about will be... All the evidence overwhelmingly shows that these companies have what it takes to be the next Underworld Resources, and potentially much bigger than that!

Gold History is about to Repeat Itself

Take a look at this map of the Yukon claims currently sprawlingacross the White Gold camp:  The bright orange section is the original Underworld claim, now owned by Kinross. The red company is the company I'm recommending today. It lies smack-dab next to Underworld's gold-rich property. Just like Underworld, the gold soil samples here were taken by Shawn Ryan, using the same techniques that showed a potential 2-3 million ounces in Kinross's small property. Yet this company owns almost twice as much gold-bearing land: over 150,000 acres. Even better than Underworld, they've been pulling up gold since their very first drill, leading to their unusually high success rate with exploration drilling. And as far as Yukon gold miners go, there is another reason they're #1 on my radar for triple-digit gains... Simply put, they are the most advanced junior exploration company in the region. As mining insider Jim Mustard, VP of PI Financial, put it in an interview with the Gold Report:

The

company did a lot of soil sampling,

prospecting and drilling last year.

It is

following up this year [2011]. So

that's one property that is

going to

see a lot of drilling and is probably

going to lead the pack in

that area.

In

the White Gold area, they are the

go-to company at the moment because

they've got the largest budget

and the most well-developed targets.

So far, the company has made eight different discoverieson their property. But with only 10% of their land sampled so far, we could see this number sky rocket... Heck, in the past two years alone, their share prices have already managed to shoot up over 870%! Let me show you what I mean:

This company is in the same place Underworld was before its stock ran 970%. You've got a small window of opportunity to buy at these low prices. And for that, we thank Mother Nature... You see, due to the sub-zero temperatures and several feet of snow that tends to cover an area so close to the Arctic Circle, the Yukon drilling and exploration season is limited to just a few warm months in the summer. The temperature is simply too cold to drill in most areas, even with the most sophisticated high-tech equipment. Despite what the stuffed shirts in Wall Street may tell you, this is actually great news for new gold investors. Because every winter, there is a predictable sell-off of Yukon mining stocks as shareholders sell shares before the cold weather halts operations. This means stocks drop to extremely undervalued prices — especially considering the high prices of gold that we're seeing at the moment. But — and this is a big "but" — our tiny mining company will continue its drilling during the winter! They’re not letting Mother Nature slow them down because they know they’re sitting on something big. Which is why a 107% gain with this company isn't just expected... it’s highly likely.  Just take a look Just take a lookat this company's stock chart: There are two things I want to point out to you:

discovered. But winter weather and poor market conditions have already dropped share prices to about $3/share... What most of the investing public doesn’t know is the company’s plan to continue operations throughout the winter — and the upcoming assays from the 100 holes that will soon be released. So we have an excellent opportunity to buy at these low levels. Remember, these share prices reflect just a few major discoveries of gold on just 10% of their land. The more gold they continue to find, the more likely the share prices will jump even higher than $7... We're talking along the lines of up to $30 if the rest of their drilling pulls up the same amount of gold as the 10%! That's a potential 1,000% gains — and they're not the only company who is going to make it big up there...

Here's Your Yukon Boomer #2!

This particular company might not be for you...

They're a little bit newer to the area than the one I've been

describing, and a bit more speculative.

But the potential for a massive upside is much, much greater.

This second firm owns property nearby the

127% gainer, and is

on the same trend and geological structure — and

it's also

on gold bearing land discovered by Shawn Ryan.

Their samples appear to be an exact

look-a-likes to the rock

at the beginning of our story, which has been

the leading indicator

for hugely successful drilling.

This company is much smaller than our first company, and is

currently trading in the $0.50 to $0.80 range...

And they represent as good a chance at exploration success as

I’ve seen in a long time.

They recently announced high-grade soils and high-grade trenchingsamples and has completed their grid work. The firm is ready to drill, but will have to wait till next spring to begin their work... Which translates to the most perfect buying opportunity you'll see all year. Both of these companies represent the best I can offer to early investors looking to take advantage of these very promising situations: one as a likely buyout candidate, and the second as the next big discovery of gold in the Yukon. Both are poised to take investors on a great ride...

Your Time to Act is Now

The kind of discoveries that we're witnessing up in the Yukon arevery rare occurrences in the gold exploration field. Most investors will miss out on it. By the time they realize what has happened up there, the stock prices will be too far out of reach to realize the kinds of gains early investors will witness. Those who are lucky enough to get in may make a couple double-digit gains... But the big bucks are in the well-established companies with high-yield drill results. Buying now while prices are low — before the spring blooms — should be the easiest investment decision you'll make all year. It's why, as soon as it was legal for me to start talking with Shawn, I took a tour of this company for myself. It's why I put together an entire research report about its extremely rare gold-finding success... It's called, "The Yukon's Best: The Easiest Gold Gains You'll Ever Make." This unique report documents all the details you need to get in on our two Yukon companies, both highly likely to give you exceptional gains... And in a moment, I'll show you how you can get it this report absolutely free. But with so much going on in the Yukon, I couldn't keep the research to just one report. There are a number of long-term plays that will end up paying off big gains as the Yukon Gold Rush starts to gain traction with more and more investors... That's why I put together another report documenting the major Yukon discoveries these past couple years, and the details of how you can use this information to continue to make profitable Yukon gold investment decisions until this boom plays out. It's called, "Yukon Gold's Biggest Boomers: Understanding the Undervalued," and it too can be yours at no additional cost. Both of these reports will be among the first things you'll receive when you become a trial member to my precious metals research advisory, The Mining Speculator. Now, I'll tell you up front that this kind of gold and silver investment advice may not be for you... So, before you sign up for your two free reports, I'm going to give you all the information you need to make an effective decision for yourself. You see, the Mining Speculator isn't your typical investment newsletter. It was created to bring investors the quickest and easiest precious metals profits from around the world. I'll hold a stock for as little as one month to a few years — but with great overall performance over a long period of time. As reader John N. points out:

I know that you don't like to 'toot your own horn,

' but the two things that really set Mining Speculator

apart from the other mining stock recommendation

services are:

1) You

do the legwork and go to visit the mines and

the management, so if you

recommend something,

I have great confidence about it; and

2) You

do not do a 'pump and dump' like many

other people out there... You

also have been

covering the junior miners for many years,

and know many

of the companies and individuals

in this industry, which is invaluable.

I don't take picking my recommendations lightly.I spend as much time on the ground, on the phone, and behind my computer screen as necessary, until I am 100% convinced that investing in these companies represents the best chances of success I can find. I bring my subscribers real-deal companies that are trying to do the right things for the right reasons. And the first highly-successful company in the Yukon I've been describing to you today is no different. When you boil it down to the bare facts, this outfit has everything you need to become filthy rich off a gold mining investment:

for investors to maximize their gains with Yukon gold plays. With prices so low as the lull in drilling sets in, we're finding Yukon gold stocks at dirt-cheap prices. But I can guarantee they won't stay this cheap for long... Which is why it's important that you get started on these Yukon gold plays as soon as possible. Sign up today and you'll immediately receive your two free Yukon reports — and a 30% discount off the regular membership price of the Mining Speculator. That's right. If you sign up right now, not only will you get your free tickets to the Yukon gold boom — and your practically guaranteed 100% gains — but you'll have a year's access to The Mining Speculator for the special low price of just $69. For just $69, you’ll receive:

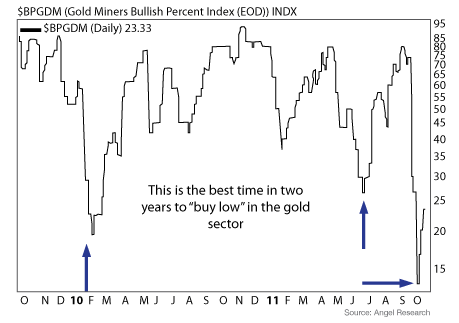

gains the Mining Speculator will bring you... But I don't want you to just enjoy your membership; I want you to be completely happy with it. That's why I'm throwing in an ironclad six-month refund policy with this offer: If you're not 100% satisfied with your membership within the first six months, you can get a full refund of your money — no questions asked. Before you get started with your Mining Speculator membership, you should be aware of one more issue that makes receiving your "The Yukon's Best: The Easiest Gold Gains You'll Ever Make" and "Yukon Gold's Biggest Boomers: Understanding the Undervalued" reports even more urgent... Take a look:  That chart is the Gold Miners Bullish Percent Index, an indicator of gold investor sentiment for mining stocks. If you've been paying attention to gold news these past few months, you've seen gold soar to $1,900/ounce... But gold mining stocks have failed to respond in kind. Why? Simply put, it's an economic anomaly. The reaction to the financial crisis in the United States and Europe caused physical gold to be overbought, while gold mining stocks have been oversold. Lucky for you, this anomaly is only just beginning to correct itself... What you're seeing is a rare low in the gold market that's perfect for getting in at dirt-cheap prices. And this makes our Yukon stocks even more valuable, as we will most likely never see them this cheap again — even with winter prices in effect. Once the market corrects itself and drilling resumes in the spring, you'll be riding a wave of easy gains well into the next few years... Don't be fooled by every Yukon stock you see. There are a lot of shell companies out there, and I'd hate to see you lose money on a bad gamble... Stick with experience and dedication. Sign up for your trial membership to the Mining Speculator today. Sincerely, Greg McCoach Gold and Precious Metals Analyst, Mining Speculator |

Tidak ada komentar:

Posting Komentar