Turkey, Russia, Ukraine and Kazakhstan Further Diversify Into Gold

Posted by Wealth Wire - Tuesday, June 26th, 2012

Turkey raised its reported gold holdings by another 2% in the month of May. Turkey’s gold holding rose by 5.7 tonnes in May to total 245 tonnes, International Monetary Fund data showed, making it the latest in a string of countries to increase gold bullion reserves this year.

Russia expanded its gold reserves by 15.5 metric tons in May as Ukraine and Kazakhstan increased their holdings of the metal, International Monetary Fund data shows according to Bloomberg.

Russia’s bullion reserves climbed to 911.3 tons last month when gold averaged $1,587.68 an ounce, data on the IMF’s website showed. Ukraine’s climbed 2.1 tons to 32.7 tons and Kazakhstan boosted reserves by 1.8 tons to 100 tons, the data show.

Central banks are expanding reserves due to the Eurozone debt crisis and concerns about fiat currency debasement.

Central banks are on course to buy more bullion this year than the purchases of about 456 tons in 2011 as countries diversify their reserves.

Turkey has allowed banks to hold more of their reserves in gold to provide extra liquidity. The central bank this month raised the proportion of reserve requirements that can be held in foreign exchange to 50 percent from 45 percent, while the limit for gold was increased to 25 percent from 20 percent. The changes will add as much as $2.2 billion to gold reserves.

Gold accounts for about 9.1 percent of Russia’s total reserves, 5.1 percent of Ukraine’s and 15 percent of Kazakhstan’s, according to the World Gold Council. That compares with more than 70 percent for the U.S. and Germany, the biggest bullion holders, according to Bloomberg figures.

Kazakhstan plans to raise the amount of gold it holds as part of its reserves to 20 percent, Bisengaly Tadzhiyakov, deputy chairman of the country’s central bank, said earlier this month.

Central bank demand and Chinese demand alone should be enough to put a floor under prices near these levels and gold looks well positioned for another summer rally akin to the one seen last July and August (see chart above).

*Post courtesy of Mark O'Byrne at GoldCore. His daily ‘Market Updates’ are quoted and reported on in the international financial press on a daily basis.

Bernanke Decries Gold, Defends Fed's Make-It-Up System

By Nathan Lewis

“First they ignore you. Then they laugh at you. Then they fight you. Then you win.” –Mahatma Gandhi

Ben Bernanke did something odd this week – he made some meaningful comments about the gold standard system, which is the only sensible alternative to the Ben-Bernanke-makes-it-up system we have today.

He did this, I would say, because of increasing pressure, especially from the conservative grassroots in the U.S., which is translating into constant criticism of Bernanke’s super-easy-money actions at the Fed from U.S. conservative politicians.

I would say that we are well beyond the “ignore you” stage, and are in fact somewhere between the “laugh at you” and “fight you” stage.

Unfortunately, Bernanke’s comments launched a stream of the usual incomprehensible argle-bargle from gold standard advocates that has characterized their efforts for the past forty years. If you want to get beyond the “laugh at you” stage, you are going to have to do a little better than this.

Let’s see what Bernanke said, at his talk to college students at George Washington University (Transcript here):

Bernanke leads with a fairly good description of the original purpose of central banks – to provide short-term “elasticity” in the supply of base money, in response to short-term changes in demand. This “19th century central banking” is entirely compatible with the gold standard system, and indeed Bernanke traces this as far back as 1668 in Sweden. Considering that the world gold standard system existed in some form until 1971, we can see that central banks and the gold standard coexisted together for centuries.

Bernanke: “One of them was the effect of a gold standard on the money supply. Since the gold standard determines the money supply, there’s not much scope for the central bank to use monetary policy just to stabilize the economy. And in particular, under a gold standard, typically the money supply goes up and interest rates go down in periods of strong economic activity. So that’s the reverse of what a central bank would normally do today.”

I have to admit that this is perhaps the first time I’ve heard this argument – that a gold standard system errs by providing too much money during boom times! That a gold standard produces interest rates that are too low! Of course, an expanding economy tends to be correlated with increasing money demand. Lower interest rates are typically an indicator of confidence in monetary policy and the main point is that a gold standard prevents a central bank from manipulating the economy via currency jiggering. This is one of the primary goals of a gold standard system – and it is this predictability which in turn leads to confidence in monetary and economic stability which forms the foundation of expanding economies and low interest rates. The Keynesians don’t see it that way, of course. They have forever been anxious to manipulate the economy by playing with the currency.

Bernanke: “Yet another issue with the gold standard has to do with speculative attack. Now normally, a central bank with a gold standard only keeps a fraction of the gold necessary to back the entire money supply. Indeed, the Bank of England was famous for keeping, as Keynes called it, a thin film of gold. The British Central Bank only kept a small amount of gold, and they relied on their credibility to stand by the gold standard under all circumstances to–so that nobody ever challenged them about that issue. But if for whatever reason, if markets lose confidence in your willingness and your commitment to maintaining that gold standard relationship, you can get a speculative attack.”

One of the main reasons that people “lose confidence” in your currency is that the currency managers start to talk about Keynesian notions of interest rate manipulation and currency devaluation – which is exactly what happened to the Bank of England in 1931. To deal with downward pressure on the pound, the Bank of England would have had to reduce the base money supply via open market operations. This would have likely led to a rise in short-term interest rates, which those at the helm were adverse to on Keynesian grounds. (The head of the Bank, Montagu Norman, was on vacation at the time, leaving matters in the hands of underlings with more “modern” views.) Thus, the Bank did nothing, with a devaluation the inevitable conclusion. The value of the pound plummeted, and the Bank of England had to respond with open market operations and higher interest rates just a few weeks later anyway, to keep the pound from collapsing into oblivion.

However, another problem is that central bankers like Bernanke don’t actually know how to manage a proper currency peg today. The reason that the U.S. dollar left the gold standard in 1971 was primarily that the Federal Reserve did not properly understand that the response to a weakening currency is to reduce the monetary base, through open market operations in either gold bullion or government debt. The Fed did exactly the opposite, expanding the monetary base in the late 1960s when they should have been contracting. We see the same problem today in the dozens of currency blowups throughout the world since 1970, all of which were avoidable if central bankers knew how to do their jobs correctly. Thus, this fear of “speculative attack” is a genuine one, but it stems from central banker incompetence, not anything inherent to the gold standard.

Bernanke: “And the reason is that in a gold standard, the amount of money in the economy varies according to things like gold strikes. So for example, if United States, if gold was discovered in California and the amount of gold in the economy goes up, that will cause an inflation, whereas if the economy is growing faster and there’s a shortage of gold, that will cause a deflation.”

This is baloney. The important thing is the value of gold, not how much of it is mined here or there. A gold standard is a value peg, as Bernanke describes correctly. Gold is the same value everywhere, and the ups and downs of mining production doesn’t change that value very much. Bernanke was just explaining that the Bank of England in fact didn’t hold much gold at all!

Bernanke: “But you can see that from 1930 to 1933, the economy contracted by very large amounts every year. So it was an enormous contraction of GDP close to the third overall, between 1929 and 1933. At the same time, the economy was experiencing deflation. Deflation is falling prices.”

The “deflation” that Bernanke talks about was really an economic collapse which had nothing to do with a failure of the gold standard system to do its job of maintaining a stable currency value. This is not just my opinion, but the consensus of people at the time as well. Even Keynes never blamed the gold standard for the Depression. He simply wanted to be able to manipulate interest rates and devalue the currency in response to the economic problems of the day. Bernanke doesn’t blame the gold standard for the Depression in this speech, but instead takes Keynes’ stance that the Fed should have been more proactive in responding to the problems with currency manipulation.

Student: “I have a question on the gold standard. Given everything that we know about monetary policy now and about the modern economy, why is there still an argument–some argument, for returning to the gold standard, and is it even possible?”

Chairman Bernanke: “So the argument I think has two parts. One is the desire to maintain ‘the value of the dollar.’ I mean basically it’s a desire to have very long run price stability. So, the argument is that paper money is inherently inflationary, so we have a gold standard tool, you won’t have deflation. And as I said, that’s true to some extent over long periods of time. But from a year to year basis, it’s not true and so looking at history is helpful there.”

The Consumer Price Index was not created until 1940. Between 1913 and 1940, we have the Bureau of Labor Statistics Wholesale Price Index, which is something like a broad commodity index. Previous to 1913, people generally refer to the Warren-Pearson Index, which is a straight commodity price index, with about a 50% weighting in farm products and a 30% weighting in energy. A lot of this supposed “instability of prices” during the 19th century up to 1940 is due to the fact that people are looking at commodity price indices and assuming that they are comparable to today’s CPI. A 4% decline, in the course of a year, in today’s CPI would be indicative of a major economic event. A 4% decline in the CRB Continuous Commodities Index in the course of a week is just market noise.

Bernanke: ”The other reason, I think that gold standard advocates want to see return to gold, is that it removes discretion, it doesn’t allow the Central Bank to respond with monetary policy, for example to booms and busts, and the advocates of the gold standard say it’s better not to give that flexibility to a central bank. So those are basically the arguments.”

Bernanke: “I think though that the gold standard would not be feasible for both practical reasons and policy reasons. On the practical side, it is just a simple fact there is not enough gold to meet the needs of a global gold standard and achieving that much gold would be very expensive, cost a lot of resources. But more fundamentally than that is that the world was changed, so the reason the Bank of England could maintain the gold standard even though it had very small number, amount of gold reserves was that everybody knew that they were going to–their first, second, third and fourth priority was staying on gold and that they had no interest in any other policy objective. But once there was concern that Bank of England might–you know, might not be fully committed, then there was a speculative attack that drove him off gold.”

Here Bernanke manages to contradict himself in one paragraph. He says that “there is not enough gold” and then mentions that the Bank of England, the manager of the world’s premier gold-linked international currency, didn’t actually hold much gold. From 1860 to 1914, the Bank of England held an average of only about 1.5% of total aboveground gold. In 1910, the Bank of England held about 7 million ounces. Is 1.5% of the gold in the world “too much”? The U.S. still holds about 5% of aboveground gold today, or 262 million ounces, which is about thirty seven times more than the Bank of England in 1910.0.

Bernanke: “So in a modern world, the commitment to the gold standard would mean that we are swearing that under no circumstances, no matter how bad unemployment gets, are we going to do anything about it using monetary policy. And if investors had 1 percent doubt that we would follow that promise, then they will have varying incentive to bring their cash and take out gold in this and in fact it will be a self-fulfilling prophecy. And we’ve seen that problem with various kinds of fix exchange rates that have come under attack during financial crisis.”

Of course it is going to be problematic to maintain a peg if you constantly give hints that you would rather have a floating currency.

All in all, I thought Bernanke’s comments were quite even-handed, and certainly much easier to understand than the incomprehensible blah-blah that many gold standard advocates like to indulge in. He says some self-contradictory things, but that is just a repetition of the conventional wisdom he was taught, without having thought about it much.

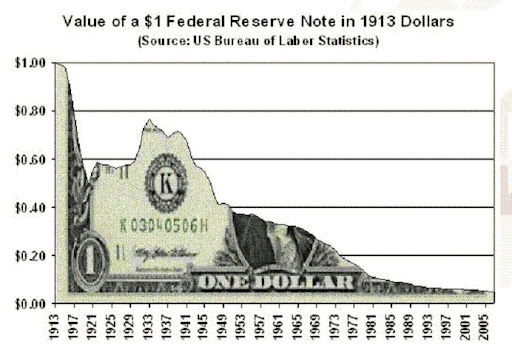

Bernanke’s views are clear: that a gold standard system prevents monetary jiggering, and that this is a bad thing. Funny how a guy in the money-jiggering business would say that. I say it is a good thing. Unemployment is still a problem which should be dealt with aggressively, but we should address it with real fundamental reforms and improvements, not currency twiddling. In the end, the Keynesian tricks don’t amount to anything more than currency devaluation.

You still can’t devalue yourself to prosperity. For 182 years, until 1971, the United States adhered to the principle of a gold standard, and became the wealthiest, most powerful, most innovative, and most advanced country the world has ever seen. Since 1971, even by the government’s own unnaturally-rosy statistics, the average worker is making less than in 1970, after adjusting for currency devaluation. The reality is that we are poorer than forty years ago. The United States is in a slow decline, and will likely remain in one until we return to the principle that made us great: the gold standard system.

Fed to Devalue the Dollar by 33%

Posted by Brittany Stepniak - Thursday, February 16th, 2012

The Fed is joining forces with the big banks. After their most recent two-day meeting, the announcement has been made official and the message is clear; the dollar will be tanking in no time.

Over the next two decades, the Fed aims to devalue the dollar by at least 33% according toCharles Kadlec from Forbes:

The debauch of the dollar will be even greater if the Fed exceeds its goal of a 2 percent per year increase in the price level.

An increase in the price level of 2% in any one year is barely noticeable. Under a gold standard, such an increase was uncommon, but not unknown. The difference is that when the dollar was as good as gold, the years of modest inflation would be followed, in time, by declining prices. As a consequence, over longer periods of time, the price level was unchanged. A dollar 20 years hence was still worth a dollar.

At that rate of 2% per year for 20 years, we’d experience a 50% increase in the price level. What does that mean for consumers?

In 20 years, 2032, you would spend $150 to purchase the same items or services that would cost you $100 now in 2012.

That’ll be the basic impact of a dollar that is worth one-third of its present day value.

For some reason, the Fed believes this monetary manipulation will increase employment numbers. However, if that hasn’t worked for the past 40 years, why would it work now?

From November 2010 through June 2011, the Fed attempted to jumpstart economic growth by injecting $600 billion in Treasury securities into the banking system and keeping interest rates historically low. All that did was slow the annual rate of growth from 3.4% to a miserly 1% by the first half of 2011.

Once the Fed stopped interfering, economic growth climbed back up to a 2.3% annual rate by the second half of the year.

I hate to be the bearer of bad news, but there’s more…

Big banks are also contributing to fiscal woes by requiring the right to issue negative yield bonds. Yes, that means you would have the oh-so-luxurious fortune of paying the “too big to fail” banks money in turn for their gracious offer to hold onto your bond-money for you.

The picture is clear: the Fed simply doesn’t have the solutions the American people are looking for. Moreover, it’s evident that the dollar will never be as good as gold so long as the Fed’s in control

10 Reasons Why the Reign of the Dollar as the World Reserve Currency is About to Come to an End

Posted by Wealth Wire - Wednesday, March 28th, 2012

The U.S. dollar has probably been the closest thing to a true global currency that the world has ever seen. For decades, the use of the U.S. dollar has been absolutely dominant in international trade. This has had tremendous benefits for the U.S. financial system and for U.S. consumers, and it has given the U.S. government tremendous power and influence around the globe.

Today, more than 60 percent of all foreign currency reserves in the world are in U.S. dollars. But there are big changes on the horizon...

The mainstream media in the United States has been strangely silent about this, but some of the biggest economies on earth have been making agreements with each other to move away from using the U.S. dollar in international trade. There are also some oil producing nations which have begun selling oil in currencies other than the U.S. dollar, which is a major threat to the petrodollar system which has been in place for nearly four decades. And big international institutions such as the UN and the IMF have even been issuing official reports about the need to move away form the U.S. dollar and toward a new global reserve currency. So the reign of the U.S. dollar as the world reserve currency is definitely being threatened, and the coming shift in international trade is going to have massive implications for the U.S. economy.

A lot of this is being fueled by China. China has the second largest economy on the face of the earth, and the size of the Chinese economy is projected to pass the size of the U.S. economy by 2016. In fact, one economist is even projecting that the Chinese economy will be three times larger than the U.S. economy by the year 2040.

So China is sitting there and wondering why the U.S. dollar should continue to be so preeminent if the Chinese economy is about to become the number one economy on the planet.

Over the past few years, China and other emerging powers such as Russia have been been quietly making agreements to move away from the U.S. dollar in international trade. The supremacy of the U.S. dollar is not nearly as solid as most Americans believe that it is.

As the U.S. economy continues to fade, it is going to be really hard to argue that the U.S. dollar should continue to function as the primary reserve currency of the world. Things are rapidly changing, and most Americans have no idea where these trends are taking us.

The following are 10 reasons why the reign of the dollar as the world reserve currency is about to come to an end....

#1 China And Japan Are Dumping the U.S. Dollar In Bilateral Trade

A few months ago, the second largest economy on earth (China) and the third largest economy on earth (Japan) struck a deal which will promote the use of their own currencies (rather than the U.S. dollar) when trading with each other. This was an incredibly important agreement that was virtually totally ignored by the U.S. media. The following is from a BBC report about that agreement....

China and Japan have unveiled plans to promote direct exchange of their currencies in a bid to cut costs for companies and boost bilateral trade.The deal will allow firms to convert the Chinese and Japanese currencies directly into each other.Currently businesses in both countries need to buy US dollars before converting them into the desired currency, adding extra costs.

#2 The BRICS (Brazil, Russia, India, China, South Africa) Plan To Start Using Their Own Currencies When Trading With Each Other

The BRICS continue to flex their muscles. A new agreement will promote the use of their own national currencies when trading with each other rather than the U.S. dollar. The following is from a news source in India....

The five major emerging economies of BRICS -- Brazil, Russia, India, China and South Africa -- are set to inject greater economic momentum into their grouping by signing two pacts for promoting intra-BRICS trade at the fourth summit of their leaders here Thursday.The two agreements that will enable credit facility in local currency for businesses of BRICS countries will be signed in the presence of the leaders of the five countries, Sudhir Vyas, secretary (economic relations) in the external affairs ministry, told reporters here.The pacts are expected to scale up intra-BRICS trade which has been growing at the rate of 28 percent over the last few years, but at $230 billion, remains much below the potential of the five economic powerhouses.

#3 The Russia/China Currency Agreement

Russia and China have been using their own national currencies when trading with each other for more than a year now. Leaders from both Russia and China have been strongly advocating for a new global reserve currency for several years, and both nations seem determined to break the power that the U.S. dollar has over international trade.

#4 The Growing Use Of Chinese Currency In Africa

Who do you think is Africa's biggest trading partner?

It isn't the United States.

In 2009, China became Africa's biggest trading partner, and China is now aggressively seeking to expand the use of Chinese currency on that continent.

A report from Africa’s largest bank, Standard Bank, recently stated the following....

“We expect at least $100 billion (about R768 billion) in Sino-African trade – more than the total bilateral trade between China and Africa in 2010 – to be settled in the renminbi by 2015.”

China seems absolutely determined to change the way that international trade is done. At this point, approximately 70,000 Chinese companies are using Chinese currency in cross-border transactions.

#5 The China/United Arab Emirates Deal

China and the United Arab Emirates have agreed to ditch the U.S. dollar and use their own currencies in oil transactions with each other.

The UAE is a fairly small player, but this is definitely a threat to the petrodollar system. What will happen to the petrodollar if other oil producing countries in the Middle East follow suit?

#6 Iran

Iran has been one of the most aggressive nations when it comes to moving away from the U.S. dollar in international trade. For example, it has been reported that India will begin to use gold to buy oil from Iran.

Tensions between the U.S. and Iran are not likely to go away any time soon, and Iran is likely to continue to do what it can to inflict pain on the United States in the financial world.

#7 The China/Saudi Arabia Relationship

Who imports the most oil from Saudi Arabia?

It is not the United States.

Rather, it is China.

As I wrote about the other day, China imported 1.39 million barrels of oil per day from Saudi Arabia in February, which was a 39 percent increase from one year earlier.

Saudi Arabia and China have teamed up to construct a massive new oil refinery in Saudi Arabia, and leaders from both nations have been working to aggressively expand trade between the two nations.

So how long is Saudi Arabia going to stick with the petrodollar if China is their most important customer?

That is a very important question.

#8 The United Nations Has Been Pushing For A New World Reserve Currency

The United Nations has been issuing reports that openly call for an alternative to the U.S. dollar as the reserve currency of the world.

In particular, one UN report envisions "a new global reserve system" in which the U.S. no longer has dominance....

"A new global reserve system could be created, one that no longer relies on the United States dollar as the single major reserve currency."

#9 The IMF Has Been Pushing For A New World Reserve Currency

The International Monetary Fund has also published a series of reports calling for the U.S. dollar to be replaced as the reserve currency of the world.

In particular, one IMF paper entitled "Reserve Accumulation and International Monetary Stability" that was published a while back actually proposed that a future global currency be named the "Bancor" and that a future global central bank could be put in charge of issuing it....

"A global currency, bancor, issued by a global central bank (see Supplement 1, section V) would be designed as a stable store of value that is not tied exclusively to the conditions of any particular economy. As trade and finance continue to grow rapidly and global integration increases, the importance of this broader perspective is expected to continue growing."

#10 Most Of The Rest Of The World Hates The United States

Global sentiment toward the United States has dramatically shifted, and this should not be underestimated.

Decades ago, we were one of the most loved nations on earth.

Now we are one of the most hated.

If you doubt this, just do some international traveling.

Even in Europe (where we are supposed to have friends), Americans are treated like dirt. Many American travelers have resorted to wearing Canadian pins so that they will not be treated like garbage while traveling over there.

If the rest of the world still loved us, they would probably be glad to continue using the U.S. dollar. But because we are now so unpopular, that gives other nations even more incentive to dump the dollar in international trade.

So what will happen if the reign of the U.S. dollar as the world reserve currency comes to an end?

Well, some of the potential effects were described in a recent article by Michael Payne....

"The demise of the dollar will also bring radical changes to the American lifestyle. When this economic tsunami hits America, it will make the 2008 recession and its aftermath look like no more than a slight bump in the road. It will bring very undesirable changes to the American lifestyle through massive inflation, high interest rates on mortgages and cars, and substantial increases in the cost of food, clothing and gasoline; it will have a detrimental effect on every aspect of our lives."

Most Americans don't realize how low the price of gasoline in the United States is compared to much of the rest of the world.

There are areas in Europe where they pay about twice what we do for gasoline. Yes, taxes have a lot to do with that, but the fact that the U.S. dollar is used for almost all oil transactions also plays a significant role.

Today, America consumes nearly a quarter of the world's oil. Our entire economy is based upon our ability to cheaply transport goods and services over vast distances.

So what happens if the price of gasoline doubles or triples from where it is at now?

In addition, if the reign of the U.S. dollar as global reserve currency ends, the U.S. government is going to have a much harder time financing its debt.

Right now, there is a huge demand for U.S. dollars and for U.S. government debt since countries around the world have to keep huge reserves of U.S. currency lying around for the sake of international trade.

But what if that all changed?

What if the appetite for U.S. dollars and U.S. debt dried up dramatically?

That is something to think about.

At the moment, the global financial system is centered on the United States.

But that will not always be the case.

The things talked about in this article will not happen overnight, but it is important to note that these changes are picking up steam.

Under the right conditions, a shift in momentum can become a landslide or an avalanche.

Clearly, the conditions are right for a significant move away from the U.S. dollar in international trade.

So when will this major shift occur?

Only time will tell.

Tidak ada komentar:

Posting Komentar