Started in 1873 to provide monthly income to widows and orphans in Scotland...

"Title VI" Funds Are Now the

Preferred Investment Secret

of the Super-Rich!

Dear Fellow Investor,

http://www.angelnexus.com/o/web/56168?r=1

There's a type of fund — a fund that most Americans know very little

about — that's responsible for protecting and growing the wealth of the

world's greatest investors.

I call this kind of fund "Title VI," thanks to the clause given to it by the SEC.

Created in 1873, these unique funds were first designed to provide a

reliable and substantial source of income for Scotland's widows and

orphans... but they wound up paying so much, their fame rapidly spread.

In fact, they were so profitable that they soon became the preferred investment of the world's richest families...

- The Guggenheim family has been relying on Title VI for years. They now collect $159,000 every single month.

- Even large Ivy League endowments invest in them. According to Bloomberg, "Harvard University Endowment has a history of being one of the most-aggressive [Title VI] investors."

- Institutional Investor Magazine said that Title VI "have attracted savvy investors like Yale University endowment."

Most recently, the world's second richest man, Bill Gates, jumped on a Title VI opportunity...

According to a MarketWatch report from last October: "Bill

Gates has been taking advantage of a little-known investment on the

stock market... and it's open to anyone. He's been quietly building his

position in two of these [little-known] funds."

Gates now collects $140,000 from these funds every single month.

These funds have been such a reliable source of income — in good

times and bad — that it's baffling to hear fewer than 1% of Americans

even know they exist, or that anyone can take advantage of them...

That's why I'm going to reveal in this presentation how you too can

start collecting as many as 12 Title VI checks per month — beginning as

early as next week.

But before I do that, let me share with you a bit more about how

these unique funds got their start, and why the world's richest families

use them to protect and grow their wealth...

Massive, Reliable Income from the World's Poorest to the World's Wealthiest!

It all began with Scottish financier Robert Fleming...

Fleming started one of the very first Title VI funds in 1873. He

created it to provide steady income to Scotland's widows and orphans (a

pretty noble cause, if you ask me).

The investment Fleming created was unique in that it offered almost

absolute security while also paying a hefty dividend, between 5% and 8%.

That feat was accomplished because unlike any other funds, even those that exist today, the focus was on handing returns to the investor — not to board members or sales teams.

As you can imagine, it wasn't long before the world's investment elite started catching on... and 19 more funds were forced to be created just to handle investor demand.

But that was only the start...

Given their safety and high-profitability, this unique investment

design rapidly crossed the ocean and made its way to Wall Street, where

it still exists and flourishes today — helping the world's wealthiest

families safely grow and protect their fortunes.

The $265 Billion Cash Pot that's Paying Investors

as Much Money as They Wish!

That's right.

The Title VI cash hoard is worth roughly $265 billion.

That's $265 billion that the world's richest and smartest investors

have been quietly using to reliably protect and grow their wealth.

And it's getting larger every single day...

- According to the Investment Company Institute, an estimated 2.1

million wealthy investors are now taking advantage of these Title VI

funds.

- Guggenheim Capital owns 1.05+ million shares and pays 8.5 cents in

monthly dividends. That works out to roughly $86,000 a month (and that's

just from one single Title VI fund!).

- A survey of wealthy investors by Nuveen Investment shows holdings in

Title VI dividends have risen 30% in the last year — this as more and

more wealthy investors, Nuveen says, understand what they are.

After seeing so many of Wall Street's richest players investing in

these funds, using them to compound their wealth several times over,

I've decided to take matters into my own hands...

Today I'm going to share with you everything I've come to learn

about these funds, so that you too can use them to build your own

long-term retirement — no matter what your current financial situation

may be.

After all, why should the rich guys be the only ones taking advantage of these enormous income-generating opportunities?

Imagine yourself in the not-too-distant future making steady income

every month — or even every single week — without even thinking about

it...

Well, you can.

And all it takes is just five minutes, either online or on the phone with your broker, and you're set for life!

No more stressing over the Dow, oil, gold futures, or mutual fund performances...

No more sweating over risky options plays...

Five minutes could change your life forever.

It's really that easy.

Now, before we get started, let me show you one example...

"They'll make at least an easy $159,540 per month"

Seeking a better life for himself, 19-year-old Meyer Guggenheim left

the Jewish ghettos of his native town of Lengnau, Switzerland, to see

what hard work and ingenuity could bring him.

The Guggenheim family arrived in Philadelphia in 1847 extremely poor.

But that didn't stop Meyer from working hard to provide his family with

a roof over their heads and fresh meat for the table...

His first job was selling household goods to coal mining families in

northern Pennsylvania. Meyer soon moved up to manufacturing stove

polish, and then set up his own business importing Swiss embroidery

products.

By the 1870s, Meyer had made his family a modest fortune through his

import business — enough to have his two sons open two embroidery

factories back in Switzerland.

It wasn't until 1881 that the Guggenheims' fortune really took off...

An acquaintance offered Meyer half interest in two Colorado silver

mines, which started his claims of the world's mining and smelting

business that would soon spread over half the globe.

The Guggenheims have since reinvested their precious metals fortune many times over.

Today they hold a whopping $150 billion in collective investments.

But right now, they aren't thinking of making a buck today, or two tomorrow... They want millions, today, tomorrow, and 50 years from now.

Should another economic crash happen, they won't even break a sweat.

Because they're not letting Meyer's years of hard work and smart

investing go down the drain because of some financial crisis.

With Title VI, the Guggenheims continue to make sure they have a

secure paycheck, no matter what the market is doing. And they'll make at least an easy $159,540 per month.

But as I already mentioned, you don't need to have a billion-dollar fortune to secure your own monthly income check...

Thousands of Everyday Investors are Discovering

Just How Powerful "Title VI Income" Can Be!

What's really amazing about these investments — on top of their

safety — is that you can make as much money per month as you want, from a

few extra dollars to a few thousand dollars... in your bank account... Every. Single. Month.

- Salvatore Zizza knows it: Every month, he's finding an extra $923 in his account without lifting a finger.

- James Keenan recently joined the Title VI party... and his monthly checks are now more than $1,420!

- Family man Walter Row decided to bank an extra $471 in income.

- Richard Duncan just received the first of many monthly checks for $405.

- And Mario Gabelli is safely collecting $988 — every single month!

The best part is these Title VI investors are safely collecting these payments from every corner of the market — no matter how volatile.

Mario, for example, is collecting his $988 a month from a gold-backed Title VI fund.

That's right. Even while physical prices and mining stocks tank,

thanks to using a Title VI investment and not direct stocks, he's still

getting a handsome monthly payment!

By now, you may be wondering: What's the catch?

Like any investment, Title VI dividend returns depend on how much you invest.

And with Mario's investment, for example, there's one very important caveat...

Title VI Funds are Generally Much Safer than

Anything You'll Find Trading in the Open Stock Market

As a long-term investor, you'll find Title VI funds' inherent safety

is much easier to stomach than throwing your money into the index fund.

The fact is the 2008 financial crisis has made it increasingly harder to find a safe and profitable investment that can outpace our growing inflation rate.

You will be hard-pressed to find advice geared toward the long-term

investment in today's environment. Too many people out there are still

looking for the quick buck.

If you're looking for a secure and easy way to make your

retirement savings work for you, then Title VI dividends will be the

perfect way to do so.

There's no need to open up any special accounts or fill out any special paperwork...

As I already mentioned, it's as simple as a phone call or email to your broker.

And now, due to my research and a recently published report, you no longer have to be a member of the world's richest families to become familiar with Title VI Incomes.

I'm talking about monthly, even weekly, checks of tens, hundreds, or thousands of dollars — sent straight to your mailbox...

You could retire early and have more time to spend with your

grandkids... donate to your favorite charity... set money aside to

refurbish a '69 Pontiac GTO... or take that long awaited trip to Italy's

wine country.

The report is called,

"Top Title VI Dividends: How to Earn a Paycheck Every Week.

"

And it details how you can gain access to the best investments in the world.

Title VI Income: The Income Secret of the Super-Rich

Income from Title VI dividends is a rare but safe, high-income investment that has been used by the world's richest for years.

Now, I should warn you...

You'll have a heck of a time finding any kind of money manager who knows anything about it.

If you ask your average broker the safest place to store your wealth

in times like these, they'll give you the same poorly thought out

answer — a wishy-washy "diversify" recommendation, or what Warren

Buffett recently bought, or whatever stock was featured in the latest

analyst report he read.

The simple fact is that they're either completely oblivious — or extremely greedy.

Money managers make their commission by constantly either buying and

selling stocks, or rolling over investments from fund to fund for their

customers — regardless of performance.

They can't make any money off you if you're putting your money into secure long-term income investments — regardless of how lucrative and safe they may be.

So what do the world's richest investors do in times like these to secure their own financial independence?

They certainly don't leave their future up to the groupthink of marginally informed brokers, financial advisors, salesmen, sit-in bank certificate deposits, or in the hands of inept "where's my bonus" mutual fund managers.

After all, they're rich. And they've maintained and grown their wealth for decades — and in some cases, centuries.

They have access to investments that no one else does.

That is, until now...

And access to them couldn't have come at a better time for you.

The simple truth is if our recent recession hasn't already crushed

your 401(k) or IRA, the European Debt crisis and our current

government's economic betrayal almost certainly will.

Stashing your money in a savings account isn't any better... The

returns on CDs, Treasury bonds, and savings accounts are barely enough

to keep ahead of government-sponsored inflation.

It can be hard to trust anyone but yourself with your financial future these days.

The market crash proved all too well that sometimes you're just safer doing these things yourself.

That's the beauty of Title VI Income.

You might have heard about the safety of dividends before — but I

assure you that this particular income stream is unlike any you've ever

heard of before...

The Safest, Highest-Paying Investment You Can Make

And in a moment, I'll tell you exactly how to secure your own access

to these virtually recession-proof Title VI secrets of the extremely

wealthy.

First, I'm going to show you why Title VI dividends are practically one of the safest investments you can make these days...

Title VIs were originally designed to require minimal effort on your

part — which is what makes them such an appealing income investment for

folks like you, folks who are worried about their retirement.

If they're good enough for the Guggenheims, the Gates, and the Rockefellers, they're good enough for you and me.

The truth is you can get the exact same kind of yields as these folks, too — without being a multi-billionaire.

Safe Enough for Widows and Orphans...

Massive Upside Potential for Aggressive Investors

You see, Title VI Income hasn't always been the preferred investment of billionaires...

As I mentioned earlier, these were originally meant to give a savings

plan to those who were unable to create one of their own. At the time

of their creation, this was primarily widows and orphans...

With little work and money available without a male breadwinner in

the family, these two classes of people were often left to fend for

themselves. And the little work that they were able to take up didn't

pay enough for any kind of savings for their future.

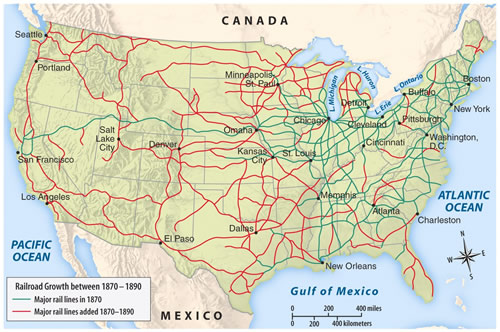

Now, initial securities used to back up funds were some of the safest

growth-oriented stocks of the day: U.S. railroad construction.

You can see from the map that this was during one of the greatest

expansion periods in U.S. history, which proved to be gangbusters for

the first holders of Title VI funds streams...

"The Scottish American Investment

Company is estimated to have yielded between 5.5 and 7.5 per cent

annually, even during years of crisis up to 1929." — Baillie Gifford Investment Trust Magazine

You can bet it didn't take long for the rest of the investment world to take notice of these once little-known profit sources.

But as safe investments fell to the wayside with speculative boom and bust bubbles, Title VIs soon joined them.

Fortunately, due to the recent publication of "Top Title VI Dividends: How to Earn a Paycheck Every Week," many investors are once again finding safety and ease in utilizing this type of income investment.

And I'm not talking about limiting this to the privileged few, either.

This report is meant to put a monthly, even weekly, income check into your pockets — for as little or as much as you like.

Want to easily supplement your Social Security checks?

Perhaps you just want to retire early?

Maybe you want to upgrade your retirement home to a condo in Boca Raton...

Or you simply want a better way for your investments to work for you?

"[These little known dividends are] invading the income securities world," says Forbes.

"[Title VIs remain] terrific opportunities for the shrewd," writes the Wall Street Journal.

In 1940, the SEC developed the following little-known provision,

which has made Title VI Income streams the go-to retirement vehicle of

the richest families in the world:

SEC.

23. No registered [Title VI] company shall issue any of its securities

(1) for services; or (2) for property other than cash or securities

(including securities of which such registered company is the issuer),

except as a dividend or distribution to its security holders or in

connection with a reorganization.

What's that mean for you? Simply put, the law requires Title VIs to provide regular payments via dividends or distributions.

This is a "set it and forget it" investment that is far better suited to protect your own retirement funds than any cash-hungry money manager.

Title VI Payments are like Dividends... On Steroids

Without revealing the whole secret, I can tell you that this secret income is — as you may have guessed — a type of dividend.

But it's not your normal dividend investment...

As you'll see, these Title VI Incomes are much more reliable than the dividends you've heard about before.

Most dividends are distributed when you purchase stock from a

dividend-paying company; but these dividend payments can fluctuate

widely on the price of the stock.

You don't need to be a financial expert to see that the stock market is anything but stable since 2008.

Not only are regular dividend payments extremely volatile, but you

stand to lose a lot of money on the stock itself, should the market

decide to drop. And the majority of dividends from big-name corporations

pay out a measly 2%-3% per-share return on any shares you buy.

Title VIs are like dividends — but with much higher yields and a lot safer returns.

What's more, they're more of a bargain...

"[Title VI funds] have long had a

cost advantage over open-ended funds, with no upfront charges other

than stamp duty on purchases, and annual management charges that tend to

be lower than the industry-standard 1.5% AMC on actively managed

open-ended funds." — IFAonline

Unlike regular dividends, there's only a limited amount of Title VIs

available to be purchased, which makes them practically invulnerable to

wild market swings caused by uncontrolled speculation.

Their limited availability also makes finding the reasonably priced

ones an extremely difficult task — that is, unless you know exactly

where to look.

In a moment, I'll show you 11 Title VI funds that you can find in my latest report, "Top Title VI Dividends: How to Earn a Paycheck Every Week."

Now I'd like to tell you why Title VI Incomes make the perfect vehicle for your retirement — no matter what the market is doing.

Bull Market Profits in Bear Market Times

Remember the "feel-good years" of the dot-com boom, when picking a winning investment was so easy even your kids could do it?

Those years saw massive growth in the general stock market.

But it all came barreling down once the bubble burst... and the 2001

terrorist attacks saw the stock market hit record-low levels.

Amateur investors pumped their life savings into the dot-com speculations. They lost thousands.

At the same time, the much safer Title VIs went practically ignored...

Title VI dividends took off during the stagnant growth of the early Bush years — to the tune of $104 billion!

And for good reason: Title VI Incomes are the type of investment that

cautious investors buy in troubled times. Their limited exposure to

speculation, management transparency, and positive returns are the

ultimate retirement investments for in-the-know investors looking to

avoid heavy recession losses.

And they won't just secure you a steady income in a bear market...

Take a look at this piece from financial news site IFAonline:

"Recent research by broker

Winterflood showed that over 10 years, closed-ended funds outperformed

open-ended funds in seven out of eight major sectors [...], covering

both developed and emerging markets and larger and smaller companies."

That's a decade of gains during the end of the dot-com market

decline, the "Bagdad bounce" of 2003, and the crash and following

recovery of 2008/2009.

The economic stability of Title VIs in both bull and bear markets

means there's no need to panic and sell, no need to worry about selling

your losses, and no need to keep a constant eye on stock charts.

I've Never Seen a Better Title VI Buying Opportunity

Title VI dividends aren't a "get rich quick" scheme or pump-and-dump penny stocks...

With yields nine times higher than Treasury bonds, 10 times higher

than CDs, and 25% higher than even the best retirement income vehicles,

this investment provides one of the healthiest returns you'll see in the

market today.

The world's wealthiest families are continuing to make Title VI dividends a healthy part of their portfolios:

- Rockefeller Financial, the investment arm of the Rockefeller family, holds $91.96 million in Title VI funds.

- The Du Pont family — head of America's second largest chemical firm, which also owns Dupont Capital Management — has $356,281,000 in Title VI funds.

- RIT Capital Partners, a 51-year-old investment trust owned by the Rothschild family, is a Title VI fund valued at a whopping $3.08 billion.

But again, with the information I'm about to give you, you don't have

to be famous or come from old money millions to make as much money as

these folks on a percentage basis...

In fact, I'll now show you a few of the Title VI funds that you can get in on today, with as little as a few hundred dollars.

You could be earning your first weekly paycheck in less than a week.

Title VI Income #1:

Cash In on the $759 Million Income-Generating Powerhouse!

Trying to invest in the stability of large-cap American companies can be tough on the wallet...

Shares for Exxon ($88), Google ($589), and Wal-Mart ($61) are a bit pricey for everyday investors.

You could try to get a part of them by paying outrageous manager fees

for a mutual fund that probably won't beat the market average... or by

buying the stocks individually (but then you risk losing money if the

share prices fall).

Why bother with the risk and weak returns when you could take part in Title VI Income #1?

This is a diversified, large-cap portfolio with companies like Exxon, Apple, and Pfizer right at your fingertips.

No need to invest hundreds of thousands of dollars making just one of these stocks pay for you...

Now you can get the same stability and income payouts at a fraction of the price.

Title VI Income #2:

Every Month, an Astounding 14% "Payment"— Straight to Your Wallet!

Use this Title VI fund, and reap a stable source of income worth more than 14% annually.

That's right... 14%.

More amazing, this Title VI fund focuses primarily on gold and natural resources, paying you even when prices tank.

Let's face it; if you own physical gold, you can't really do much with it...

If its value rises, great. Your gold is worth more (if you ever even

sell it). If prices crash, you're stuck with a yellow rock in your safe.

In other words, physical gold will never again be the same as cash. And neither will risky stocks in a market as hectic as this.

That's where this unique Title VI fund comes into play...

Simply put, there's no safer way to make a fortune in gold, silver,

or any other precious metals. Whether prices go up or down, this Title

VI fund won't leave you — or your investment — hanging.

No matter what happens to spot prices on Wall Street or the

performance of mining companies, you can rest assured that this special

fund continues to pay you every single month.

Title VI Income #3:

Make 13% Annually from Industries that Never Lose Demand

Energy. Water. Waste. Electricity. Roads. Utilities.

For some people, the prospect of investing in basic goods might seem "boring"...

The people who pass up this Title VI jackpot are suckers.

Understandably, most of the utility stocks available are downright

weak. On average, a "good" one will hand you a dividend of about 4% —

nothing to get excited about.

But what if you could supercharge your utility investments and have them start handing you real money, month after month?

That's exactly what this Title VI fund is designed to do!

Managed by some of the brightest minds in the financial world, it

manages to hand the risk-averse investor safe, sizable checks, month

after month —

275% larger payments than buying regular utility companies!

Title VI Income #4:

$1.62 Billion Fund that Mastered the Art of Stable Value Investing

Many of the richest investors in the world — including the infamous

Rothschild family — made their initial fortune by following one simple

mantra: "Buy low, and sell high."

When things look grim, you play it safe. When they look up, you swing for the fences.

Unlike other Title VI funds, this one's unique approach and freedom

to rearrange assets on a moment's notice truly sets it apart from

anything else the markets have to offer.

That goes for other Title VI funds as well.

Its primary objective is stability; but as its team of global

tacticians will tell you, when they get a hunch certain investments are

going to skyrocket (and they're hardly wrong), they become as aggressive

as a wolf.

Title VI Income #5:

Meet the $2.9 Billion Powerhouse that Dishes Out Cash

from the World's Best-Performing Companies!

America doesn't hold the monopoly on safe long-term investments — and

as a way to diversify your income portfolio, you should consider Title

VI Income #5.

It's a top rated income fund with holdings in such large-cap companies as:

- Korean electronics giant Samsung

- Multinational oil king Chevron

All of these companies have excellent long-term growth potential...

And Title VI Income #5 is the best way to grow your income from these international players.

The complete report on these Title VI Incomes — plus six more I haven't even mentioned yet! — can be found in your free copy of "Top Title VI Dividends: How to Earn a Paycheck Every Week."

I'll show you exactly how to have your own copy — detailing all 11 Title VI opportunities — in just one minute.

But first, let me show you how to...

Free Yourself from Your 401(k)

My name is Brian Hicks, and I'm the publisher of The Wealth Advisory.

The goal of The Wealth Advisory is simple: to provide you with the instruments necessary for you to take control of your own financial destiny.

And I don't mean instruments that cost thousands of dollars, or require you to be a multi-millionaire.

I'm living proof that you can take successful control of your finances with as little as $1,000...

In 1996 — with hours of scanning financial statements and finding

expert opinions — I invested $1,000 of my teacher's salary into the

newly public Closure Medical Corporation. Closure Medical Corporation is

the manufacturer of Dermabond, a liquid bandage that now sells over the

counter.

I'd noticed the medical potential of Dermabond as it was nearing the

end of its clinical trials — but more importantly, my research indicated

buyout potential from larger pharmaceutical companies.

Later that year, Dermabond was bought out by Johnson & Johnson (NYSE: JNJ), quadrupling the price of Closure's stock... and netting me $4,000 — all on my very first investment!

After that, I knew I could make a living out of investing if I took

the time and due diligence to research my investment theories as

thoroughly as possible.

A year later, I followed up my first investment experience by

studying stock market technical analysis with the Market Technicians

Association... This led me to develop the Volume Spike Indicator,

which has led me to predict numerous financial trends, including the

decline in worldwide oil production and the rise in American natural gas

usage.

What's this mean for you?

Well, if you're one of my readers, it means you get to take advantage

of some of the most reliable and consistent gains the market has to

offer.

Using trend analysis to create safe investment havens for my readers is the backbone of

The Wealth Advisory — and the reason I've been invited to speak on CNBC, CNN, Fox News, and Bloomberg TV.

I'm writing you today because you're one of the many

Americans fed up with the corporate greed and inexperience rampant in

today's money managers and financial planners.

But you're also willing and intelligent enough to take

back control of your finances from the suits on Wall Street — and

guarantee yourself some better returns in the process.

In my 19 years of investment advising, I have to tell you that right

now, Title VI funds represent one of the best opportunities for reliable

long-term investment income that I have seen for quite some time.

But you don't have to take my word for it...

I've spent the past year putting together a small library of the best

Title VI opportunities I could find, and I've compiled them all in the

"Top Title VI Dividends: How to Earn a Paycheck Every Week" report.

I'd like to send it to you, right now — so you can start collecting your next paycheck within the next few days.

As a bonus, I'll also sign you up for a trial membership to my flagship investment service, The Wealth Advisory.

Once you read your first issue, I guarantee you'll be hooked. That's because The Wealth Advisory is unlike any other investment advisory service you've heard of before...

With so many publications fixed on speculative penny stocks and volatile commodity plays, The Wealth Advisory focuses on bringing you safe and reliable investment recommendations resulting in consistent returns on your investment.

Take a look at the following high-yield, highly reliable investment ideas that you'll have access to with a membership to The Wealth Advisory (in addition to your Title VI dividend report, of course)...

Outstanding Income from the North American Oil and Gas Boom

Do "master limited partnerships" (MLPs) or "oil and gas trusts" ring a bell?

Don't worry if they don't...

Like Title VI dividends, they're another tool that only a handful of experienced investors are aware of.

MLPs and trusts are basically a way to utilize the safe growth of certain stocks with the tax benefits of a limited partnership.

In order to qualify to become a MLP, a company has to operate in a

certain financial sector and is usually contractually obligated to pay

its investors quarterly dividend payments. Because of the way they're

structured, MLPs usually have more incentive to create higher dividend

returns than most other types of investments.

But while you can plunk your money in any MLP and maybe watch your investment slowly grow, I've recently discovered four MLPs that are currently skyrocketing at a record rate.

They're in American shale oil and natural gas.

Recent discoveries across North America have led to enormous support

from the likes of George Soros, Warren Buffett, Big Oil, and politicians

on both sides of the aisle.

I've been bullish on natural gas for quite some time. I even

published a book about profiting from easy-to-get oil production across

the United States.

The fact is the United States is poised to be the largest natural gas

producer in the world, soon outpacing Russia. And with enough oil to

wean us from foreign producers, long-term investors in American energy

MLPs could see larger and larger dividend payouts as America reclaims

its spot as a global energy supplier.

I've discovered four

American oil and natural gas MLPs that are paying huge dividends right

now — yielding anywhere from 7.3% to 9.0% per share!

The investment details of all four MLPs are located in another report you'll have access to through The Wealth Advisory website — free of charge.

This report is called, "Outstanding Income from the North American Oil and Gas Boom" — and it's yours free as part of your trial membership to The Wealth Advisory.

Is The Wealth Advisory right for you?

As I've mentioned before, The Wealth Advisory is not your typical research letter...

We're not focused on quick gains, short selling, or day trading.

Our goal is to provide you with the information necessary so you can

control your own long-term portfolio. We're talking about the

highest-yielding incomes and continuous growth stocks that won't stumble

when the market does.

That's why I'm so excited about these 11 amazing Title VI investments.

What's more, The Wealth Advisory aims to provide you with

the advice necessary to build long-term capital in a volatile world —

whether it be for an early or comfortable retirement, saving for your

dream car or a trip around the world, or providing your grandchildren

with the gift of college tuition payments...

As you'll see during your free trial, a Wealth Advisory membership gives you everything you need to create a successful, self-controlled retirement portfolio, including:

- 12 issues of The Wealth Advisory letter, delivered monthly to your email inbox.

On

the third Friday of each month, you'll receive an issue containing

recent market trends, insights into the general market, investment tips,

and economic news you should look out for. This includes access to The Wealth Advisory archives and our open income stocks portfolio.

- Special Report: "Top Title VI Dividends: How to Earn a Paycheck Every Week"

Utilize

one of the preferred investment vehicles of the world's richest

families — the Guggenheims, the Gates, and the Rockefellers — to secure

your own retirement. The amount you receive depends on how much you

invest, but total yearly income yields of 95.7% are realistic. Remember,

as part of SEC regulations, these companies are required to hand you

regular dividend payments. Getting paid to invest has never been easier!

- Bonus Report: "Outstanding Income from the North American Oil and Gas Boom"

Like

it or not, America's shale oil and natural gas boom is upon us. Due to

their belief in Big Oil, many investors will refuse to take advantage of

this lifetime opportunity... and they will pass up thousands of dollars

in the process. You don't have to take any chances with this special

oil and gas MLP report, which details for you four of the biggest

players — with some of the highest income yields — in the industry.

- Complimentary subscription to our flagship newsletter, Wealth Daily

Whether

it's stocks, bonds, energy, commodities, or real estate, my editors and

I work every day to provide investors with the kind of independent

analysis they just can't find by following the mainstream media. Wealth Daily

offers our readers access to free moneymaking insights and opinions

that cover the broad scope of the entire market. From real estate to oil

and everything in between, you'll have a front-row seat to the world's

market trends.

I am so confident that you will find what you're looking for in The Wealth Advisory that I'm sure after your free three-month preview ends, you'll be more than happy to sign on for a full year...

Here's the Deal

The report "Top Title VI Dividends: How to Earn a Paycheck Every Week" — which I spent months researching, scrutinizing, and drafting — is yours to print, share, and keep for joining The Wealth Advisory for the low price of just $49.

That's right...

For less than $50 a year... you'll have access to the sort of

market analysis, research, and retirement-building tools that brokers,

money managers, and financial advisors charge thousands of dollars for!

And to make things as painless as possible, you have a full six months to try out the service. If you don't agree how valuable The Wealth Advisory is, just give us a call and we'll give you a full refund... no questions asked.

To be honest, I'm not worried you'll cancel — especially when you see how valuable our service is...

With The Wealth Advisory, you don't have to spend hours

looking at stock charts or flipping through corporate financial

statements; you don't have to waste your own precious time or money

meeting up with company CEOs...

I do all that for you, while you sit back and watch your income checks come in, week after week.

Before I give you the rest of the details of how to receive your

report and your trial, there's one more important thing I'd like to tell

you...

Your First Title VI Paycheck Could Come as Soon as Next Week!

My goal with these reports is to maximize the benefits you receive from any opportunity we send your way.

That said, I've structured your Title VI and oil and gas payouts in a

way that, should you decide to invest in every one, they should provide

you with a weekly income reflective of how much you invest.

You'll receive your weekly paycheck, and you still have all the free

time to do the things you love while living a comfortable lifestyle —

whether it's working in the garden or on your car, spending time with

loved ones, or finally getting around to learning to golf or another

language...

No need to wait years to start making your retirement savings work for you.

But the longer you wait, the more paychecks you'll miss out on...

Simply click the button below to gain immediate access to your first Title VI paycheck.

Good Investing,

Brian Hicks

Publisher,

The Wealth Advisory

Tiny Biotech Owns World's

Only Source Of

Rare Cancer-Curing Chemical

Early investors are looking to bank 300 times their money

This urgent video has live footage of the company in action...

| [This Material] Could Cure Cancer. — Popular Science |

Dear Reader,

http://www.angelnexus.com/o/web/56163?r=1

This is urgent. And every minute counts.

As you read this report, investors are getting rich from a tiny

biotech start-up that is lighting the fuse under modern-day medicine.

At the center of it all is its main product, which is on a worldwide lockdown:

"Blue Blood."

Highly rich Blue Blood Protein — which really is blue — is extracted from one of the rarest and most endangered animals on the face of this planet... a sea snail called a Limpet.

What makes this blood so unique and life-changing?

Well, it's a major component of over 100 vaccines and drugs currently

going through clinical trials with the FDA. In other words, these drugs

simply cannot work without Blue Blood... and there is nothing in the world that can replace it.

And here's the mind-blowing peculiarity in all of this...

Blue Blood is so vital to breakthrough vaccines and drugs today... one gram of it can sell for up to $900,000.

Talk about top dollar!

The biggest pharmaceutical companies around the world don't mind paying a fortune for it.

Why?

Well, because right now, "Several companies and institutions are developing Blue Blood based therapies for a wide variety of cancers," according to the National Cancer Institute.

If you're thinking of American giants like Pfizer, Merck, Amgen, and Biogen Idec... you wouldn't be off the mark.

England's GlaxoSmithKline, Germany's Bayer, Switzerland's Novartis, and Denmark's Novo Nordisk all need this Blue Blood too...

And the most exciting part of this opportunity for you is that they can only get this Blue Blood Protein from one little biotech company, which I'd like to tell you about today.

It owns exclusive rights and patents to extract and supply Blue Blood

Protein to over a dozen big pharma companies... which gives this little

gem a virtual monopoly in the biotech arena.

Over the last seven months, I've been shouting about and making the

call on this little company — and it's up more than 300% since then.

Now, I'm predicting the stock could surge another 300% over the next

12 months based on events already shaping up. A deal with a company

developing a breast cancer vaccine has already been signed.

I'd suggest you get in now to avoid missing out again on this life-changing opportunity.

Remember, it's trading below $3 right now. So there isn't much time

to waste. You need to get in now to reap the biggest possible gains.

When you understand the operations of this tiny company... how it

secures worldwide supplies of Blue Blood from a sea snail, not to

mention its global influence... you'll realize why it's set to become

the most important and innovative company this century.

That's the impression I got when one of my valuable inside sources

alerted me about this tiny company a few months ago. And the company has

been proving it every day since with its rising share price.

I can't reveal his name or identity here. All I can say is he's a major shareholder and close to this tiny company.

To vet every detail, I quickly hopped on a plane from Baltimore to

visit this company's facilities and met with the top brass... the CEO

and all the scientists working there.

Because of their tight security, I had to fax my ID a week in advance. Why?

They operate out of a naval base on the West Coast. There are even armed guards at the gates.

No surprise there. This stuff is top-secret!

This company's technology is launching an entirely new era of human history.

It holds the key to freeing human beings from breast, prostate, lung, lymphoma, leukemia, and brain cancer...

It could free us from Alzheimer's, arthritis, and heart disease... from nursing homes and the indignities of old age.

And while this company has returned over 300% gains to investors in just the last seven months...

It's on the cusp of rapid advancements and is beginning to receive

the kind of commercial backing and attention we like to see in a

promising new technology...

In short, it's about to sign contracts with major pharmaceutical

companies. And that could make the 300% gains so far look tiny by

comparison.

Possibly the most exciting thing about this little company, though,

is that it's also minting millionaires out of the everyday people who

own its shares.

Today, without missing a beat, you need to get in on this mammoth profit saga that's about to explode.

I'll give you all the details over the next few minutes.

4x Your Money in 7 Months

I'm Nick Hodge, founder of the Outsider Club and managing editor of the highly-aggressive investment service Early Advantage.

Since early last year, I've been sounding the alarm on this little biotech company... while it was trading at just $0.50.

No other analyst covered this stock. Most people didn't pay attention.

And that was a BIG mistake!

Like anything else, they just can't believe breakthroughs of this magnitude until it's too late.

I don't want you to make the same mistake... and miss the next round of huge profits.

Because when the stock bolted for its first round of 300% gains, I

made some everyday folks very happy and extremely rich. Some of them

made hundreds of thousands of dollars.

They made FOUR TIMES their money in half a year.

For instance...

A fellow named Geoffrey M. wrote in to say, "I've made serious money with you on .

Sold my long accumulated position (handsomely) when I was allowed to

get into their private placement for 300,000 units. I'm a subscriber for

life and strong disciple. Thanks!"

Joe A. chimed in, "Nick, I have made nice money with your recommendations and was able to get into private placement for 50,000 units (which includes 25,000 warrants at $1.35). Keep those recommendations coming."

And Brit H. told me, "Hi Nick, I decided to lock in some profits on and

so it's the second triple-digit winner with you this year. I'm looking

forward to the next. Not only for the profits, but also because these

companies are promising and your research is well done."

But here's what's really exciting...

There's still time to get in at less than $3.00 a share. The only caveat: the window to get into this play is extremely tight.

Remember, it's already up 300%, and ink could be put to paper with a major pharmaceutical company any day.

This time around, I suggest you get in now or risk missing out.

Over the next few months, I'm forecasting a move to $5.00 — or more —

as the company starts signing contracts with major pharmaceutical

companies that simply can't get Blue Blood anywhere else.

Let's dive into the details....

The World's Only "Blue Blood" Supplier

Blue Blood is real blood that comes from an extremely rare wild sea snail. But here's the problem...

There are only 100,000 of these rare snails left in the ocean. They

can only be found off the coast in California. And the numbers are fast

depleting.

What's so special about this blood?

Blue Blood contains a complex protein molecule, and it's an

indispensable ingredient in over 100 drugs and vaccines that

pharmaceutical companies desperately want to bring to market.

In short, this protein activates your body's immune system and tells

it to let the vaccine kill whatever bad cells need killing... something

that has never been done before.

Let me show you how groundbreaking and historical all this is...

To understand how Blue Blood Protein works, you have to go back to the early days of vaccines 50 years ago.

You see, medical researchers would take something harmful like a virus, kill it, and then inject it into your body.

Your immune system would see the inactive virus and learn how to attack it in the future.

That's how we fought polio and rubella viruses for decades.

But What About Cancer?

The problem with cancer cells is they look like your body's own cells and trick your immune system to ignore them.

The body's immune system sees the cancer cells and says, "This is my own. I shouldn't attack or kill it."

And they keep growing into huge tumors until your body is no longer able to handle it.

In short, cancer cells are like stealth planes: "Invisible."

But attaching Blue Blood Protein to cancer cells is like attaching reflectors to a once-invisible stealth plane.

All of a sudden, your body's radar begins to see cancer cells as foreign objects and starts killing them.

In short, Blue Blood offers a solution that, according to Popular Science, "Could Cure Cancer."

Not only would that be a world-changing event that would bring relief

to millions of people... it would also generate billions in revenue for

this tiny biotech firm.

Over the next 12 months, we'll see a phenomenal opportunity to make money from what I call the Blue Blood revolution.

Right now, this tiny company is the only one in the world that can

supply Blue Blood Protein to the market... at up to $900,000 per gram.

What's even more exciting from an investing standpoint is this

supplier is so incredibly small, with enough space to run wild, that

early shareholders are literally getting rich with a single stake.

Based on the numbers alone — the amount of Blue Blood these guys are

producing now (I'll show you numbers in a bit) and the current market

value of it — we're looking at a possible upside of an additional 300% -

500% in the next 12 months.

Remember, over the last 7 months alone, the stock has climbed 300%.

At that rate, you could turn every $5,000 into $20,000 in quick time.

Just imagine the money you have right now and multiply by four or even five times...

Like I did when I suggested this company months ago, I am making the

same call now to get in at under $3.00. Only this time around, the stock

is heading for the stratosphere quickly...

Not Mentioned Anywhere

The question you're probably asking is:

If this is so big, why haven't I heard of this before today?

The way it works in this business, you just can't win if you don't

have an inner circle of contacts in various industries who share details

of the next breakthrough or moneymaking trend before it makes

headlines.

Of course, I do my due diligence to confirm the merits of each story.

But one of the main reasons my firm has become one of the largest

newsletter publishers in the world is because of our connections.

Which brings me to the next point...

This is not something you'll likely hear about in the news anytime soon, regardless of how cutting-edge it is...

You bet we couldn't find this company mentioned anywhere in the

Wall Street Journal,

Fortune,

Forbes, or any other mainstream financial publications.

Why?

Because the company is ridiculously small. And mutual funds and other

large financial institutions are legally prohibited from investing in

tiny companies — their charters just won't allow it.

You can also bet the major pharmaceutical companies in negotiations

with this tiny biotech have barred it from using their names with a

non-disclosure agreement. They don't want their competitors to know how

utterly reliant on Blue Blood they actually are.

Sad thing is, most investors will never hear about this tiny biotech player. And if they do, it'll be too late.

Well, that's just too bad, because starting today, you'll be way

ahead of the curve when you finally buy this stock for under $3 a share.

In fact, there are several reasons why this little company is a winner regardless of how you look at it.

Here's what I mean...

Companies with competitive advantages like Coca-Cola, Wrigley, Hershey, Apple, Wal-Mart, and Amazon jump right to the front.

Biotech firms like Amgen, which soared 10,421%, and Celgene, which

climbed 20,838%, both had incredible moats made of countless patents.

Their huge profit margins, consistent growth, and dominance made investors very wealthy.

Well, this tiny biotech company I want you to own today is building its own legacy with several

impenetrable moats... and will soon take its place among the most innovative companies in the world.

Here are the amazing facts propelling this tiny Blue Blood company forward towards greatness:

Moat #1:

Global Monopoly on Production

and Supply of Blue Blood Protein

Traditionally, drug companies sent divers into the ocean to search

for Blue Blood Limpets. If they found some, they'd extract the blood.

And then the Limpets would die.

But this operation added to the scarcity of Limpets and left only 100,000 in the waters off the coast of California.

This little biotech company has changed all that.

What did they do?

They patented a way to grow the same limpets... on land!

And they also patented a way to extract their Blue Blood... WITHOUT killing them.

This startling video explains it all.

No company in the world can provide any competition or steal this

tiny biotech's proprietary methods of producing Blue Blood on a

commercial scale.

It also means that any pharmaceutical company in the world that needs Blue Blood to make vaccines or drugs can only get it from this tiny biotech player.

Truly, this is groundbreaking stuff.

But the story only gets juicier when you add this next moat around the company...

Moat #2:

Biggest Multi-Billion Dollar Client List...

The Who's Who of Big Pharma

Blue Blood drugs are already approved and in use in Europe and Asia.

But what about the U.S.?

The largest and most influential drug companies are now signing

contracts to secure their reliable supply of Blue Blood ONLY from this

little company.

In short, these big companies are poised to commercialize a variety of Blue Blood-based drugs to treat various diseases, like...

But that barely scratches the surface. Check out this question and answer from my private site visit:

- Amgen is developing a therapy for systemic lupus that's in Phase 1

- Biogen Idec has a multiple sclerosis therapy in Phase 4

- GlaxoSmithKline owns a therapy for dermatitis in Phase 1

- Neovacs' Crohn's disease vaccine is in Phase 2

- Samsung Medical Center's prostate cancer vaccine is in Phase 2

- National Cancer Institute's leukemia vaccine is in Phase 2

- Memorial Sloan-Kettering Cancer Center is in Phase 1 with its prostate cancer vaccine

- Stanford University's brain cancer vaccine is in Phase 1

- Axon Neuroscience's Alzheimer's disease vaccine recently entered Phase 1

According to the Government's National Cancer Institute...

"Optimer Pharmaceuticals is at

phase II clinical trials with a breast cancer vaccine, Celldex

Therapeutics is in phase II clinical trials with a glioblastoma vaccine,

and Biovest International is evaluating a vaccine for non-Hodgkin

lymphoma in phase III trials."

And all of them are utterly dependent on Blue Blood.

Bottom line: If one of these companies — be it Pfizer, the largest

pharmaceutical company in the world by sales, or Novartis, the third

largest in the world by sales — is to begin selling Blue Blood-based

therapies and vaccines, a multi-billion dollar industry will emerge.

And this tiny company — the only one capable of providing a

reliable source of Blue Blood product — will emerge a billion dollar

company, passing its wealth on to you if you hurry and get in now at

this ground floor price!

On the surface, it all sounds a lot like science fiction.

Call it what you will, but it's already making my readers rich and

will do the same for you if you decide to ride this once-in-a-lifetime

opportunity starting today.

Just how much money can this company make with a global monopoly on Blue Blood Protein?

Moat #3:

Huge Profit Potential and Financial Stability

It's no surprise rich drug companies are spending top dollar to secure their stash of the stuff.

As each drug goes through the three stages of clinical trials, every single one uses specific amounts of Blue Blood Protein.

For Phase 1 of clinical trials, each drug uses 3-5 grams of Blue

Protein. With over 100 drugs, that's up to 500 grams of protein.

How about Phase 2?

It takes 50-100 grams of Blue Protein to get through that phase. That's a mind blowing 10,000 grams of protein.

How much money can this little company make at this point?

Blue Blood Protein costs about $35,000 per gram for lower grade.

Those 100 drugs will need 10,500 grams just to get approved by the FDA.

That totals over $367 million right there.

But keep in mind... if higher grade Blue Blood is required — at up to

$900,000 per gram — the total quickly jumps to almost $1 billion.

And that's without even mentioning Phase 3 potential.

If you were to go beyond that, the numbers would be truly off the charts.

Just take a look at the company's revenue projections below:

That kind of revenue would make this tiny biotech stock — currently trading below $3.00 — an $18.00 stock.

An 800% increase in share price!

Now, I don't want you to think that all those 100 drugs will make it to the market.

Given the history of the FDA, many drugs don't see the light of day after Phase 1 and 2 trials. They just fail at the labs.

But here's what to keep in mind...

Even if just 10 of those drugs get approved for the market, the company will still rake in billions a year.

In fact, this company has publicly stated it can earn over $800

million in the next two to three years. That's nearly eight times its

current value with a market cap around $100 million.

And over the long haul, it's securing royalties on the long-term

sales of blockbuster drugs brought to the market that utilize the power

of Blue Blood.

But it doesn't end there.

Moat #4:

Exclusive Groundbreaking Vaccines

Not only is the company supplying Blue Blood for other drugs... it's developing its own drugs as well.

Here's what I mean.

It just acquired the worldwide license and exclusive rights to

develop, manufacture, and sell vaccines to treat an infection known as Clostridium difficile (C. diff) from an agreement with a Canadian university.

According to professor Mario Monteiro, discoverer of the C. diff technology, "[This

company's] vision has made it possible for our scientific discovery to

migrate from the lab to the hands of industry. I'm confident that in

time, this vaccine will prove to have saved many lives."

This is life-changing news because C. diff is a growing cause of mortality in hospitalized patients and causes more than 330,000 infections in the U.S. every year.

Heck, the cost of C. diff treatment in the U.S. and Europe is already estimated at more than $7 billion annually.

No doubt this tiny biotech company will eat away a huge chunk of this money.

And this is just the company's first proprietary drug. There could be more in the pipeline.

After all, it owns the world's only commercial supply of Blue Blood.

Which brings me to my next point...

Moat #5:

Blue Protein Cannot Be

Artificially Produced or Synthesized

No one else can

artificially make Blue Blood.

As Popular Science puts it, "Blue Blood is too big and complicated to synthesize."

If no lab can artificially create a Blue Blood substitute, then

researchers and scientists who create breakthrough therapies have no

choice but to team up with the only supplier in world...

And that's our little trail-blazing biotech company.

Keep in mind, this isn't some wild speculation.

When I first recommended this company, it was trading at just $0.50 a share.

Over the last seven months, the stock bolted for a 300% gain, making some of my readers, who listened to my call, wealthy.

I am making the call again for you to get in today under three bucks a share.

Those who don't listen this time will miss out on the biggest biotech start-up in modern day history.

For good reason...

Why You Need to Jump on This

Opportunity Now at Under $3.00 a Share

The stock is garnering momentum and attention worldwide. It can only stay a secret for so long.

First off, this tiny company just got added to the S&P Dow Jones

TSX Venture Select Index. Essentially, this is a list of 48 companies

that are the "best in breed" and meet specific liquidity criteria.

Another thing: All throughout 2013, the company released

peer-reviewed research and presented at medical conferences... so word

is also getting out in the medical community.

What about new contracts?

It has signed an irrevocable, worldwide license to own the technology

developed through a Collaborative Research Agreement between it and big

pharma's Bayer...

It's also signed an agreement with a company in late-stage trials for

a breast cancer vaccine. And there are other ones in the pipeline.

Let me also mention this quickly... and this is incredible.

I just got alerted that the California Fish & Wildlife Department

is courting this tiny biotech company for its expertise and guidance on

how to protect the 100,000 Limpets that remain in the wild...

This is like asking a heroin dealer to help regulate the heroin market.

No doubt this tiny company's goal will be to help influence the

strictest regulations for the wild harvest of sea Limpets... effectively

sealing its monopoly, since it's the only one that can birth them on

land.

Which begs the question... How much money can you really make from a small investment in this sub-$3 stock by getting in now?

A 4,752% Return Could Be Possible

Considering the science-rocking discovery of Blue Blood Protein...

this is a rare opportunity to take advantage of once-in-a-lifetime-type

gains.

To be frank, I actually don't know how ridiculous the profits could get. Why?

This company's stock could surge 10-fold in the near future alone based on its influence in the biotech space.

It's simply so game-changing, examples of past scientific developments may be completely pointless.

However, for the sake of comparison, I'm going to show you what

happens when truly world-changing scientific discoveries are made and

how they create personal wealth.

One such discovery dates back to a runny nose...

In the mid-1980s, a man by the name of H. DuBose Montgomery got a

fairly severe cold. As he tried to recover, he began to wonder why the

medical world hadn't yet perfected a cure for this malady that affects 1 billion people every year.

It may not seem like much, but in truth, a legend was born...

Not only did Montgomery go on to co-found a company now known as

Gilead Sciences, but his work in antiviral medicines transformed the

world.

Gilead Sciences went on to perfect something known as small molecule antiviral therapeutics in 1992.

In short, these things have had a profound effect on everything from the common cold to HIV.

The rest is history — and it was unbelievably profitable for early-bird investors. Take a look:

The stock absolutely erupted from a measly $0.57 per share to nearly $28. That's a gain of 4,752%.

Just $200 into this company would have yielded $9,700.

Imagine if you put in more... $3,000 would have turned into nearly $150,000.

Even crazier, the share price is actually much higher these days.

All told, in the years since, the stock price has risen to $45.87 (a total gain of almost 8,000% — or 80x your money).

And this isn't the only company that's done something like this. In fact, it's actually one of the less profitable examples.

Check it out:

- 10,421%

Amgen

brought Epogen and Neupogen to the market between 1989 and 1990, taking

its revenue from $2.8 million to over $1 billion. Had you gotten in

early, you could have been rewarded with a 10,421% gain — enough to roll

$10,000 into a cool $1.04 million.

- 11,350%

Novo

Nordisk specialized in diabetic care, and brought the drugs Novonorm

and PrandiMet to the market, as well as the groundbreaking diabetic drug

Victoza, which brought in $2.7 billion. Its stock returned a

life-changing 11,350%.

- 29,258%

Biogen

Idec blazed a trail by launching the first multiple sclerosis drug,

Avonex, which achieved $1 billion in sales. No surprise the investors

cashed in a staggering 29,258% gain, turning a small $2,000 into a

whopping $585,160.

- 20,838%

Celgene

has more than 300 clinical trials and is building a strong reputation

for its intellectual property rights, including bringing miracle

blockbuster drug Thalomid to the market. The stock has exploded 20,838%

— enough to turn $5,000 into $1 million.

As you can see, we're talking anywhere from 50 times up to nearly 300 times your cash.

I told you this was once-in-a-lifetime-type stuff here. These things

don't come around often. And I don't know of a single other person who's

on top of this opportunity like I am right now...

None of those companies, like Amgen or Celgene, had the kind of advantages and monopoly this little biotech player enjoys today.

With everything panning in favor of this company right now, the stock

is poised for historical highs, and investors — including you, if you

hurry — could become rich from a one-time investment.

As you saw at the start of this presentation, some everyday folks are already cashing in on huge profits. Now, it's your turn.

I hope you jump on this opportunity before the door shuts on this $3.00-a-share deal.

If this sounds like something that interests you, then I'm ready to send you my free report on this situation: "Minting Millions from the Magic Molecule."

You'll also know the ticker symbol and up to what price to buy this little gem.

Best of all, I'd like to send you this report absolutely free of charge.

All I ask in return is that you take a risk-free trial membership to my research publication Early Advantage.

What exactly is Early Advantage... and how can it make you rich from groundbreaking investment research?

I Spend Millions on My Research

You already know the best way to make a lot of money is to get in the

game early — before a company makes news with a major discovery in the

mining sector or energy sector... the creation of some disruptive

technology... or breakthroughs in agriculture or health.

It's the reason I meet with start-up CEOs in Silicon Valley... visit

actual farmers... inspect mines in Alberta and Ontario... attend obscure

conferences and trade shows... and conduct private one-on-one

interviews.

All in the name of giving you the early advantage on any moneymaking

or money-saving opportunity available, long before the rest of the

market catches on.

That's what Early Advantage is all about.

I've been on the cutting edge for years, discovering major

life-changing, moneymaking opportunities that other financial

institutions don't cover.

For example...

- Before 3D printing made the news, I told my readers about a company

called Organovo that develops three-dimensional (3D) human tissue

printing technology to create tissue on demand for research and surgical

applications. Since then, the stock has surged over 570%.

- Then there's Natcore Technology, a company with a number of patented

technologies that any solar company can use to double the efficiency of

current solar cells while cutting costs in half. I flew to New York to

visit the company's facilities and was impressed with what I saw. In

less than 3 months, my readers were able to secure a 128% gain.

Quite often, my investigations lead to companies that you may never hear or read about in mainstream news publications like the Wall Street Journal or Forbes...

But that's okay with me; the gains for my readers are real — no

matter how many mainstream publications ignore the opportunities.

If the stock is everywhere, there is no way you'll ever make any

money on it. But that's what's great about my approach, and it has

rewarded my readers handsomely.

Whether with 3D-printed human tissue, solar breakthroughs, or the initial run of this Blue Blood company, members of Early Advantage have been raking in the gains.

Benny J. called in to say:

"Success story? Let's say stories! I had a doubler with Organovo. Bought

at 0.50 which has now given me 280% and I have not sold any yet. And my

$25,000 investment in Natcore is now worth $95,000! Another 280%! Big

compliment to your service Nick. It is the absolute best service I have

had, and I am going to be a lifetime member."

Anthony R. also shared his experience:

"Hi Nick, I'm looking forward for the next 'Natcore,' 'Organovo,' and ' .' Early Advantage

is the most profitable service in almost 10 years of trading. Pure and

simple. As a friend of mine who speaks a broken English used to say to

me, "Thank you very big!"

Others are more straightforward. Bob D. simply chimed in with:

"Needless to say, your picks have

been very rewarding. Thanks for all your hard work and "hand holding"

during these volatile markets. It is always reassuring to get your

timely e-mails."

Or William S., who said:

"Dear Nick, I

enjoy your insight into market assessments. I have religiously followed

your tips and recommendations... and made lots of money!"

Rest assured, these are the opportunities that can make you rich in the game. And that's my sole purpose here.

In short, that's the work I do on behalf of my readers, and it's made

them a lot of money and the most satisfied in the investment business.

There are just too many great opportunities hidden in the market

making great gains for everyday investors... while you sit on the

sidelines.

As activity heats up in the biotech space and the masses catch onto

this story, expect late investors to push the price through the roof.

I want you in before this happens, and I'll help make this decision easy for you right now.

Below is a List of What You'll Get

I will send you my report "Minting Millions from the Magic Molecule" free of charge when you take a no-risk trial of Early Advantage.

It spells out all the details on this hot little biotech stock that

will no doubt hold the crown as the most profitable and important

company of the next decade.

Because of the urgency of this play, you'll have access to that info minutes after you sign up. But that's not all you'll get.

You'll also have full access to...

- Quick Profits E-alerts: Get flash updates on the

latest moneymaking scoops from my profit alerts. These obscure

recommendations — that cannot wait a minute — will be delivered straight

to your inbox seconds after they're written, as profitable

opportunities could surface tomorrow.

- Regular Portfolio Updates: You'll know exactly

what's happening with each profit-making play in your model portfolio,

including regular updates and any news that will send the stock soaring

further or when to sell for maximum profits.

- The Members-Only Early Advantage Website: Your gateway to my secure online platform for members only, with

my no-nonsense research reports, commentary, picks, and current

portfolio. You'll even get fast-track commentary on how to get the most

out of my service.

- Research Videos: You'll have full access to my

"boots-on-the-ground" research videos when I travel around the country

investigating companies, visiting their facilities, and talking to CEOs.

That way, you can follow my travels from your living room.

- Outstanding Customer Support: If you ever have any

questions or concerns, you can call our Customer Support staff at any

time and receive live help between 9:30 a.m. and 4 p.m. EST.

Within minutes of signing up, you'll receive an email with your password to the Early Advantage website... your ultimate gateway to unheard-of profits in cutting-edge sectors ahead of the crowd.

I encourage you to read the research reports you'll see there. Many of the recommendations are still considered major "buys."

Be sure to scan the "Getting Started" window to help you know how to get the most out of this service.

Given all that, at this point you must be asking, "How much does Early Advantage cost?

Lock in This Low Subscription Rate Today

I don't have to tell you how much it costs to uncover the kind of information I do.

One minute, I am jetting to California to check out the latest in

breakthrough biotech. Next minute, I'm hopping to Ottawa or landing in a

floatplane on a lake in Saskatchewan.

This is by no means a cheap operation. But it's worth the research.

No doubt the money you'll make from my picks will always be several times what you pay for my research.

Consider this: One of my readers, Peter H., recently said, "I did very well on two picks. Pretty lucky with a profit of $27,649."

Another of my followers, who wishes to remain anonymous, chimed in, "Hey

Nick. I bought Renesola (SOL) in late March at $2.95, today it's

trading at $6.35 (up 18% just today), so I've more than doubled my

money. Thanks for the great pick."

In fact, just the profits from one recommendation could pay for your

subscription several times over. Just how much does it cost?

One full year of Early Advantage is only $499.

This price takes you into our profitable world of investing and gives

you full access to all my research, including the Blue Blood Protein

revolution sweeping across the medical landscape.

You'll get full details on how this company is blazing a trail and

enjoying a virtual monopoly as the world's only supplier of Blue Blood

Protein.

Join Early Advantage

Without Taking Any Risk

Best of all, you can access this research with no risk whatsoever. Here's what I mean...

As soon as you join Early Advantage today, you'll be able to access your free report, "Minting Millions from the Magic Molecule."

I am confident this research will put profits in your pocket.

Take the next 60 days to soak in my research. Comb the Early Advantage website. Look at my track record. There are even archives of reports and issues that you can skim through at any time.

Put some money into some of my open recommendations. Many are still "buys."

Everything is just waiting there for you.

During your 60-day trial period, if you're not completely satisfied

with my research... or you don't think you can prosper financially

through my recommendations...

Simply let me know, and I'll refund every cent. No hard feelings, and

no line of questioning — you'll receive all your money back

immediately.

You can even keep your free report or any other piece of intelligence you get... regardless of what you do.

Your free report spells out all you need to know to take full advantage of this Blue Blood biotech opportunity immediately.

And you can do so with absolutely no risk. Either you're satisfied, or your money back.

I look forward to the profits we'll make together.

Sincerely,

Nick Hodge

Editor and Creator, Early Advantage

P.S. I've spent the last 7 months making the call on this tiny

biotech company, starting when it was trading at just $0.50 a share. I

made readers who listened a boatload of money. Now it's under $3.00 a

share — still a once-in-a-lifetime deal.

I am making the call again for you to own this tiny biotech company,

which owns worldwide patents on a cancer cure that's set to hit the

market soon. And this time, I hope you don't let the opportunity slip

away. To ensure you get in today, please access your free report, "Minting Millions from the Magic Molecule," below.

A

couple days ago we started getting a deluge of new queries from

subscribers about something called “blue blood” — teasing a company that

was about to sign contracts with major pharmaceutical companies, and

which had a “lockdown” on a secret “blue blood” protein that will cure

cancer.

I was a little baffled at first, because I hadn’t actually seen the

ad — but more folks kept asking what “blue blood” was, so I looked a

little closer and finally did find that we had a copy of that email in

the vast Gumshoe teaser vaults. So let’s solve it for you, shall we?

The newsletter being promoted here is Early Advantage, from

Nick Hodge, and it’ll run you $499 per year at the current price. Dunno

what else they may be investing in, but we can at least get you this

answer for a better price. Like, more free-ish. Then you can think it

over and discuss it on your own … feel free to subscribe to Early

Advantage if you like, but don’t do so just to learn what the secret

“blue blood” thingamajiggery is all about.

Here’s the opening of the pitch:

“Tiny Biotech Owns World’s Only Source Of Rare Cancer-Curing Chemical

“Early investors are looking to bank 300 times their money

“This urgent video has live footage of the company in action….

“At the center of it all is its main product, which is on a worldwide lockdown: ‘Blue Blood.’”

Irregulars Quick Take

Paid members get a quick summary of the stocks teased and our thoughts here.

Join as a Stock Gumshoe Irregular today (already a member? log in at top right)

Frankly,

that sounds like hooey. And probably the kind of teaser that should

have us all running for the exits (or at the very least, hitting the

delete key), but a core precept of Gumshoedom is that even if a stock is

touted with ridiculous, overhyped promise — like curing cancer with a

secret chemical that only they own — it doesn’t mean it’s worthless.

We have to go into this with an open mind — it’s almost certainly not

as good as the teasers say it is, but that doesn’t mean it’s bad.

So what is it? Honestly, once we were into the ad a few paragraphs

and saw the little snippet of video for this “blue blood” business we

had our answer quickly at hand … but we don’t want to spoil the

surprise, so let me share a few more of the clues they tossed out for

us:

“Amgen, Pfizer, Merck, Abbott, Bayer, and others pay $35,000–$900,000 for one gram of this molecule.

“A single biotech company trading under $3 controls the world’s only source.

“Its stock is already up 300%!

“Highly rich Blue Blood Protein — which really is blue — is extracted