Peak Oil Barrel

The Reported Death of Peak Oil Has Been Greatly Exaggerated

World Oil Production

A guest post by David Archibald

The views expressed in this post do not necessarily reflect the views of Dennis Coyne or Ron Patterson.

The BP Statistical Review of World Energy has oil production data by country up to the end of 2015. This is what that looks like from 1988:

The United States increased production by 5.1 million barrels per day

from 2010 to 2015. The increase in production from countries around the

Persian Gulf over the same period was slightly less at 5.0 million

barrels per day. The increase in total world production was 8.4 million

barrels per day so the rest of the world declined by some 1.7 million

barrels per day. This was despite Canadian production rising 1.0 million

barrels per day from oil sands developments plus some other increases

from Russia, Brazil, Colombia etc. Most oil producing countries are in

well-established long term decline or plateau at best. How these trends

will interact can approached from a bottom-up basis. To that end, the

following graphs show likely production profiles by region for the next

five years.

Saudi Arabia used to be the world’s swing producer. That role has

been taken by the shale drillers of the United States. The graphic

assumes that enough shale wells are drilled each year to keep US

production flat – profitless prosperity. Mexico’s decline is well

established for geological reasons and Venezuela’s decline continues for

political reasons.

Russian production has held up well and, combined with fields in

development, it is assumed that Russian production remains in plateau.

The Norwegian and UK production declines are well established.

Algeria and Egypt are in decline. It is assumed that Libyan

production does not recover from Tony Blair and Nicholas Sarkozy’s

adventure in regime change.

Iranian production peaked in 1974 at 6.1 million barrels per day as

the Shah tried to overtake Saudi production. It is assumed that Iranian

production is geologically limited. Iraqi production continues rising

despite the civil war in that country. Currently at over 4.0 million

barrels per day, Iraq’s geological endowment should see production

continuing to rise towards 9.0 million barrels per day.

Most oil producing countries in the Asia Pacific region are in well

established decline. They were joined by China in 2016 which has two thirds of its production

from giant oilfields that have been in production for decades and now

have high water cuts and high operating costs. The graph assumes that

China will contribute 1.3 million barrels per day of a 2.1 million

barrel per day decline for the region over the next five years.

Adding all those production profiles results in production in 2022

that is five million barrels per day lower than world production, per

BP’s statistics, in 2015. That could be offset by a faster rise in Iraqi

production combined with increased shale oil production. According to

this graphic from BTU Analytics:

There are some 290,000 remaining shale oil well locations remaining in the United States. By Enno Peter’s work,

about 62,000 shale wells have been drilled in the United States to

date. Peak drilling year was 2014 with 14,262 wells drilled for 2.46

million barrels per day of production in January 2015. About half of

that number of wells need to be drilled each year now to offset decline

in US shale oil production.

From all of the above, not an original conclusion – the US shale oil

well inventory is likely to buffer the oil price for at least the next

five years.

David Archibald is author of American Gripen: The Solution to the F-35 Nightmare

This entry was posted in Uncategorized and tagged Canada, China, Gulf of Mexico, Iran, Iraq, Kuwait, Libya, Light Tight Oil, LTO, OPEC, Peak Oil, Russia, Saudi Arabia, shale oil, US Oil Production, World Oil Production. Bookmark the permalink.

Peak Oil Barrel

The Reported Death of Peak Oil Has Been Greatly Exaggerated

Looking Back 10 Years After Peak Oil

This is a guest post by Verwimp Bruno.

All views expressed here are those of Verwimp Bruno and do not necessarily represent those of Ron Patterson.

1. INTRODUCTION

Peak Oil is the moment in time when,

on a global scale, the maximum rate of oil production is reached. The

moment after which oil production, by nature, must decline forever.

Since Earth is a closed system, next to this production (supply) event,

there must be an equal demand event: Peak Oil Consumption. Since there

are no substantial above ground deposits, Peak Oil Production and Peak

Oil Consumption must coincide. The world consists of a lot of different

countries, some of which are already far beyond peak oil production That

leads to the assumption the world as a whole reaches peak oil

production. On the demand side, it is worth looking, because different

countries have different economies, different degrees of development,

and so on, if, while some countries still experience significant growth

in oil consumption, some countries are already well beyond Peak Oil

Consumption by now.

2. PRODUCTION vs CONSUMPTION

The production history of crude oil is

well documented. For all relevant OPEC and NON-OPEC countries the data

are gathered by Peakoilbarrel.com here, OPEC Charts, and here, Non-OPEC Charts,

respectively. It is clear some countries have reached peak oil

production long time ago. For readers of this blog, familiar with these

data, this is no surprise. Still world oil production is growing,

because some countries make up for the countries that are losing

production. Many readers of Peakoilbarrel.com wonder when the exact

moment will be when global oil production will have reached that

ultimate peak. But how relevant is that moment? Will it bring doom,

gloom, the end of motoring, plastics and tooth paste. It might be more

interesting to know whether your country is before, beyond or at Peak

Oil Consumption right now. And what about coal and natural gas?

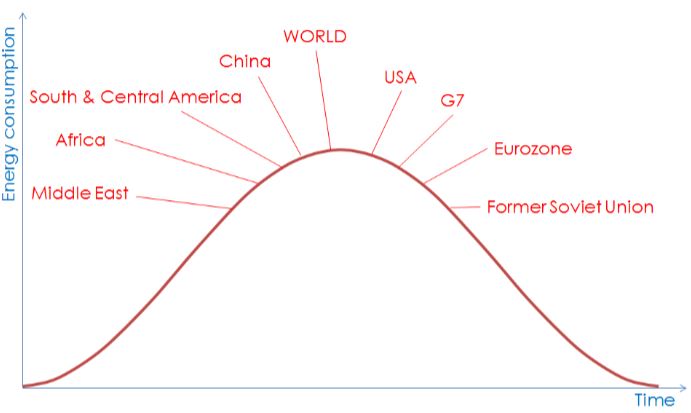

3. THE BELL-SHAPED CURVE

Finite resources tend to be exploited

as fast as possible, resulting in an ever increasing

“production” (“mining” is the more correct term), until a limit is

reached, after which production declines. The result is the bell-shaped

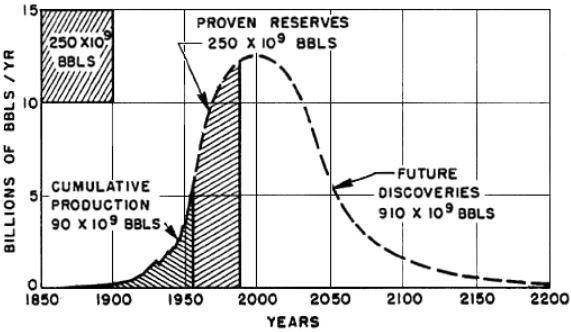

curve M. K. Hubbert showed the world in A.D. 1956:

We all know this curve did not

materialize exactly this way. The peak was set at 13billion barrels

per year, while the world produces some 32 billion barrels per year now.

Nevertheless that production must decline sooner or later. Oil is still

a finite resource.

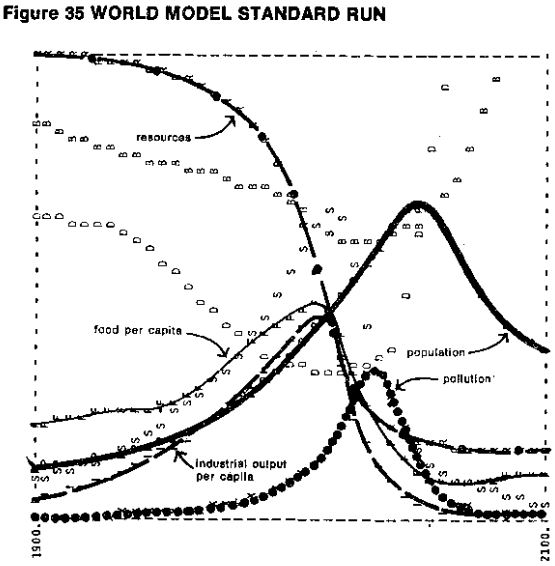

In A.D. 1972 researchers from M.I.T.

wrote Limits to Growth, Report to the Club of Rome. They analyzed the

word as a whole and took different parameters into consideration: Finite

resources, finite absorbing capacity of the world’s ecosystems

(climate!) and human population. The standard run of their model looked

like this:

In this graph resources are depictured

as an inverse cumulative function, starting at 100% in the upper left

corner and ending at near zero in the bottom right corner. When that

graph wouldn’t have been cumulative, it would have been a bell-shaped

curve. The ‘industrial output per capita’ curve reflects the use of

resources and is indeed bell-shaped. The graph with the ‘S’-dots,

indicates services per capita. That graph goes higher than industrial

output, and starts to decline later. The contemporary

deindustrialization of the USA and Europe, and their growing service

economies are in line with the standard run of the World Model.

In june 2015 the leaders of the G7

gathered in Schloss Elmau, Germany, for their annual Summit. Afterwards

the Leadersʼ Declaration was released. A chapter is dedicated to climate

change. The leaders say: “Mindful of this goal (to hold the increase in

global average temperature below 2 °C. ) … we emphasize that deep cuts

in global greenhouse gas emissions are required with a decarbonisation

of the global economy over the course of this century. Accordingly… we

support … the upper end of the latest IPCC recommendation of 40 to 70%

reductions by 2050 compared to 2010 … .

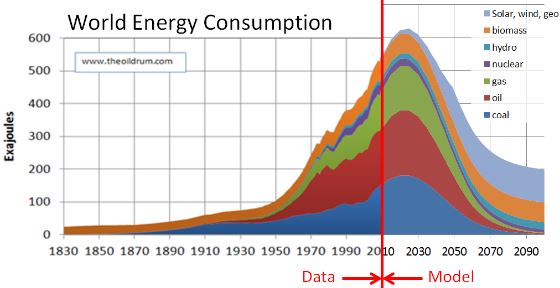

When the evolution of the energy

consumption of the world, of which nowadays approximately 85% consists

of greenhouse gas generating fossil fuels, is extrapolated to the end of

the century, when a fixed point of nearly 0% fossil fuels at A.D. 2100

and a fixed point of “40 to 70% reduction by A.D. 2050”, say 50%

reduction, is set, when the current growth in use of fossil fuels is

gradually turned in an as moderate as possible decrease, meeting the two

fixed points, when the evolution of nuclear, solar, wind, hydro

and biomass is counted in in an optimistic way, the future looks like

this diagram:

The G7, from a climate change point of

view, Hubbert from a finite resources point of view and the Club of

Rome from a combined point of view, they all predict roughly the same

bell-shaped curve. So the bell- shaped curve is going to be it. Notice

there is no significant distinction between oil, coal and gas.

4. AVAILABILITY AND AFFORDABILITY OF ENERGY AS A LIMIT

Different countries in the world have

different economies, different degrees of development,

different GDP/capita ratio and so on. But if the world as a whole is

projected to walk along this bell-shaped trajectory, it is reasonable to

hypothesize every country on itself will follow that trajectory sooner

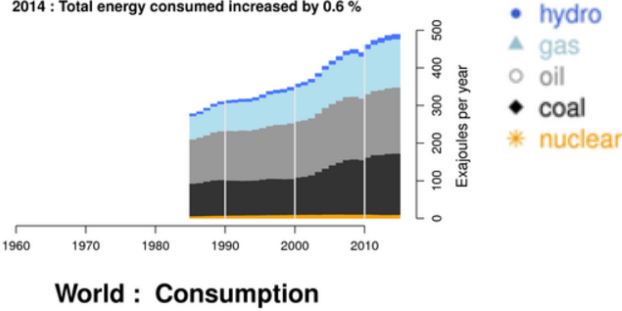

or later. Recent data until A.D. 2014, collected by BP, seem to already

give evidence of this hypothesis.

World energy consumption equals 500 exajoules per year. The curve shows growth. So availability is not yet a problem.

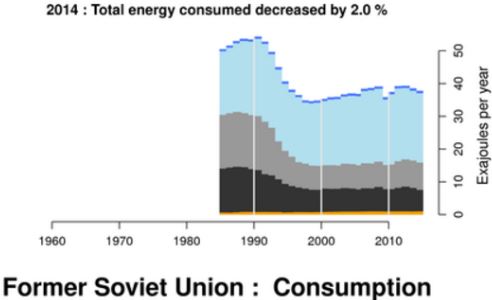

The former Soviet Union consumes a

little less than 40 exajoules. That is 8% of the global consumption and

about 25% lower than their peak in 1991. It is clear the Former Soviet

Union might never again reach the >50 exajoules they used to consume.

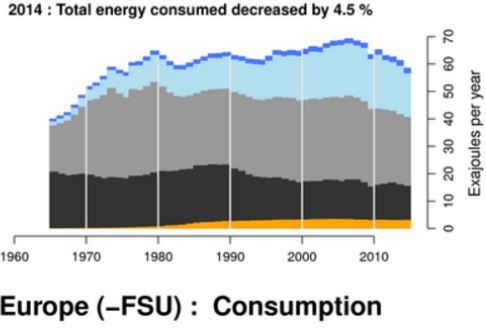

Europe minus the Former Soviet Union

consumes 60 exajoules per year. That equals 12 % of the world energy

consumption. The decline since 2006 is 18%. That is significant and

severe.

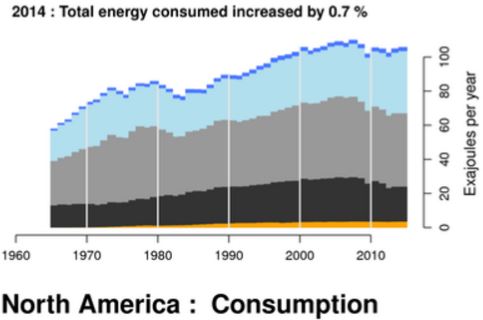

North America consumes 110 exajoules

per year. That equals 22% of the world energy consumption. The dedline

since 2008 is about 5%. That might not be statistically significant.

Nevertheless: there has been no more growth since 2000. On the global

timescale 15 years is a significant period of time.

All the above summed up, equals 42% of

the world energy consumption. Add Japan, Australia and South Africa,

with stagnant or declining energy consumption too, and the conclusion

is: “Half of the world’s energy production is consumed in countries with

declining or stagnant energy consumption. These are all the mature

first world economies.

The decline in energy consumption

might be caused by local availability issues or affordability

issues. Most probable explanation might be: heavy industries have left

these countries, the poor and the elderly –groups with less than average

energy consumption- are growing groups in these societies.

5. PROJECTIONS

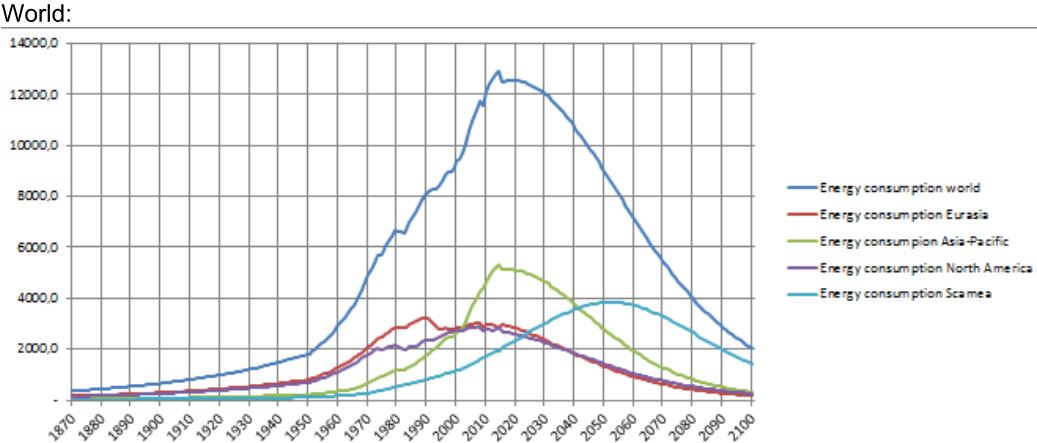

The above graph, in Mtoe, is

constructed using Hubbert Linearization. This technique is unreliable

unless the available data suggest the bell-shaped curve has already gone

thru its first infliction point, and it gains reliability when the peak

is reached or passed. This means there are enough data for the world,

for Eurasia and for North America. There are not enough data for

Asia-Pacific, nor for south and Central America, Africa and the Middle

East. To reduce the mathematical problem to a system of two equations

and two unknown variables, South and Central America, Middle East and

Africa were grouped and called “Scamea” in the graph.

The sudden drop in 2015 is artificial. It

results from the fact that the latest data points in the linearization

of the global data are slightly above the trend line.

The results of this exercise are:

– Europe and the former Soviet Union (Eurasia), has peaked.

– North America has peaked.

– Asia Pacific is peaking as we speak.

– The

group consisting of South and Central America, the Middle East and

Africa had a large potential for growing energy consumption.

6. OIL, COAL, GAS

Historical data show the growth in

coal, oil and gas consumption vary widely in time and space. But the

decline of coal, oil and gas consumption coincides more or less,

especially in times of crisis: Former Soviet Union post 1990 and Europe

post 2006. This supports affordability, rather than availability is the

root cause of declining consumption. This thesis is often proposed by

Gail Tverberg.

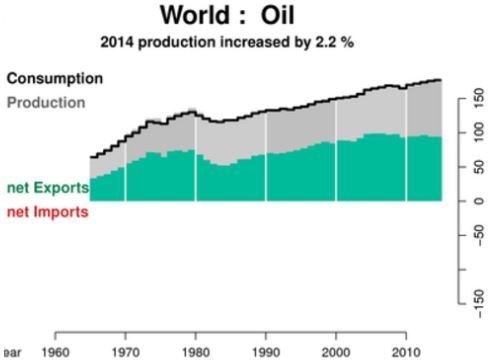

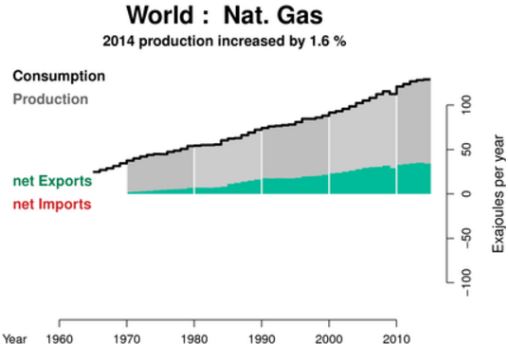

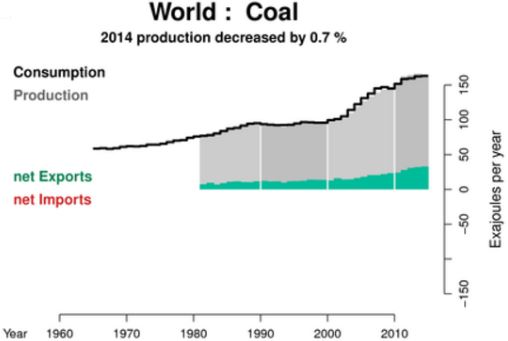

More than half of the world’s oil

production is traded on the international markets. Still Net Export

Mathematics, or the Export Land Model, shows severe concern about future

oil availability to importing nations. For gas only a third of the

world’s production is traded on the international markets. For coal it

is only a fourth. Applying ELM on coal or gas will paint a grim future

for importing countries as well as for countries dependent on the

revenue of their exports.

7. CONCLUSIONS

Peak Oil translates into Peak Oil

Consumption. Peak Oil Consumption comes with Peak Energy Consumption.

Half of the world has passed the point of maximum energy consumption.

This point is marked by large scale economic crisis. Asia Pacific is

approaching that point now. For energy importing countries with still

growing energy consumption Peak Energy Consumption may rather be

triggered by coal or gas, since these global markets are tighter than

the oil market. Renewables do not play any role.

8. CREDITS

All data: BP 2015. BP Statistical Review of World Energy June 2015

Limits to growth, Meadows et. Al., Universe Books, 1972.

G7 Leaders’ Declaration, G7 Germany, 2015.

Hubbert, M. K., Nuclear energy and the fossil fuels, Drilling and petroleum practice, American Petroleum Institute, 1956.

Graphs: by www.mazamascience.com

Other graphs: by author.

This entry was posted in Uncategorized and tagged European Consumption., FSU consumption, North America oil consumption, Peak Oil, World Oil Production. Bookmark the permalink.

I am assuming you mean renewables do not play any role in peak oil/gas/coal production or consumption. However, I’m guessing you believe that Peak Solar and Peak Wind energy will also occur not long after peak oil/gas/coal.

The thesis on renewables was not elaborated in this post, but if there might have been a significant impact of renewables on a global scale, I would have seen it in my analysis of the data. And that was not the case.

I have no data on BC. They may have an advantage of their hydro.

A great set of data and framing within LTG models and the projected response to climate change: many thanks. It helps my understanding. But relating to your last sentence, you have supplied a diagram that projects future World Energy, which does include substitution of fossil with renewable energy, which alters considerably the proposed future total energy available over this century (this diagram frames a proposed response to climate change as I understand it).

Perhaps with the LTG standard scenario in mind, do you have any thoughts also on per capita energy consumption varying regionally? Clearly endogenous population growth rates, discounting inter-regional migration, vary greatly, with some populations at or below replacement levels. Indian sub continent for example shows an extraordinary mosaic of population growth rates from very high to low.

Population growth- or the lack thereof- might turn out to be more important than growth of renewables.

It is very hard to predict what might happen when it comes to birth rates, but consider the case of Brazil. The birth rate there fell so far and so fast it caught everybody by surprise.

So far as I can tell this sea change came about mostly because television and maybe the internet allowed younger women there the OPPORTUNITY to see other younger women living their lives without kids or with only one or two kids.From there they took it on themselves to quit having more than one or two kids.

This could not have happened without the Catholic church losing its grip on sexual mores, and it could not have happened without affordable and readily available birth control.

Outfits such as ISIS and Dumpling Boy’s NK commies might be able to keep their citizens in the dark, but so far as the rest of the world goes- television and internet are IN.

Even the most remote Indian village will likely soon have at least one or two small battery operated solar charged tv sets and radios and the villagers will be gathering around whenever the proud owner wants to show it off.

The demographic transit might accelerate beyond all routine expectations.

This paper has explored the effects of television, and in particular of programs such as soap operas, on women’s fertility. Our analysis draws on the experience of Brazil, a country where soap opera watching is ubiquitous and cuts across social classes. We exploit differences in the timing of entry into different markets of Rede Globo, which until the early 1990s had an effective monopoly on novelas production in Brazil, to estimate the impact of Globo availability on fertility choices. We find that, after controlling for time varying controls and for time-invariant area characteristics, the presence of the Globo signal leads to significantly lower fertility. This effect is stronger for women of low socioeconomic status, as measured by education or durable goods ownership. The effect is also stronger for women who are in the middle and late phases of their childbearing life, suggesting that television contributed more to stopping behavior than to delayed first births, consistently with demographic patterns documented for Brazil. Finally, suggestive evidence in the last part of the paper indicates that the results may be interpreted not only in terms of exposure to television, but also of exposure to the particular reality portrayed by Brazilian novelas. Our findings have important policy implications for today’s developing countries. In societies where literacy is relatively low and newspaper circulation limited, television plays a crucial role in circulating ideas. Our work suggests that programs targeted to the culture of the local population have the potential of reaching an overwhelming amount of people at very low costs, and could thus be used by policymakers to convey important social and economic messages

(e.g. about HIV/AIDS prevention, children’s education, the rights of minorities,

etc.).

“Singapore government offers cash incentives to boost the fertility rate” https://www.youtube.com/watch?v=wSLfo5ZxU9c

Actually I do not believe renewables will stop the decline in energy consumption, once a region plunges into large scale economic crisis. It is clear renewables are a good thing, but in the larger sceme of things, they do not make such a big difference.

I, unfortunately, do not have acces to a detailed set of demographic data. Sure your question is a good one, but I can’t answer.

It’s a recipe for disaster, I see internal friction in coming years (before resource problems start to happen). Already the seats for legislature are frozen because any change will generate protests mainly from states (cultures) who have significantly reduced their birth rates.

I guess sometime in future, India will revert to it’s natural state of multiple nations. I just hope some kind of framework is worked out to collectively deal with Islamic invasions from the North.

I posted a link about research into solar storms toward the end of the last main article yesterday. I would appreciate it if you would read the link, which you may have seen already, and perhaps answer a couple of questions I posted with it.

You are THE MAN in this forum when it comes to astronomy. Thanks in advance!

There is an article entitled: ARE SOLAR STORMS DANGEROUS TO US? which is a good summary.

http://earthsky.org/space/are-solar-storms-dangerous-to-us

As for stars in general I would recommend: STARS HAVE EARTH-LIKE WEATHER.

http://www.space.com/3994-stars-earth-weather.html but this is kind of esoteric stuff.

Your link is older, mine is about brand new research and verification of very powerful solar storms now documented within the last thousand years.

I posted a long comment about the possible consequences with this link yesterday on the older article.

Hopefully some other folks, especially engineering types familiar with the grid, will comment on that link. My amateur conclusion is that such a storm could easily put us in a mad max scenario, maybe permanently.

One should distinguish between the electrical effects of a solar storm (relatively slow) and the EMP (electromagnetic pulse) produced by a nuclear explosion (fast). Nuclear EMP can destroy electronics; the solar storm disturbance won’t, in my opinion.

The solar storm can induce a large DC current in power lines, causing a utility-scale transformer to move out of its operating region, overheat, and fail. Replacing one of those transformers can take years. Northern areas are more likely to be affected than the southern US.

Components can be added to the power grid to dissipate the DC current. Because the solar particles move slower than light speed, we can see it coming with solar observation satellites and have an hour to turn things off, losing power for a while but preventing damage.

We should of course spend the money to add the components to protect the grid.

A sharp cutoff of oil imports seems to me more likely to cause a Mad Max scenario (though not like the movie, where they were short of nearly everything, but apparently had plenty of gasoline and car parts).

My modest knowledge of probability theory allows me to understand that the odds of an extremely powerful storm, one many times larger than the Carrington event, are pretty low, probably less than one in five hundred in any given year.

I don’t worry about our getting hit by an asteroid, or invaded by little green men, but I really wonder about the odds of an EXTREMELY powerful solar storm happening, a storm many times more powerful than any we know about.

So far as I can tell, the grid is NOT properly protected and the odds are extremely high it will not get the upgrades it needs for this purpose.

If it weren’t for the fact of the historical record, we would not know for instance about an extraordinarily powerful earthquake that occurred in the south central part of the USA a couple of hundred years ago. This area is not even MENTIONED when earthquake risks are discussed. Not one person out of a thousand knows about it.

I think the combination of growing renewable energy and energy efficiency is having a very strong downward effect on both price and the peak resource effect. Years ago I predicted this would set up an oscillation effect and it seems to be coming true. What this does is make the traditional fossil fuel business extremely sensitive to price while the resource depletion scenario is causing production costs to rise. Not a good time to be in the oil and gas business where they have to keep pulling rabbits out of the hat to keep up production and then find that success steals away the money. All the while, renewables and efficiency are eating away at demand. If demand falls a little then prices fall a lot.

Then what with the ff industry??

Meanwhile, back in the development labs, the cost effectiveness of wind/solar/efficiency relentlessly pursues its way downward, as is inevitable with any new tech.

Surely people in ff’s can see all that- and what to do about it- move over to the rising sun.

I know my grandparents lived through it. Grew up in stone cabins in semi-wilderness with oxen, got to see the transistion to cars, airplanes, rockets, radio, TV, refrigerators, jets ….

I guess we and those following will see major disruptions in technology, industry, agriculture and nature. The disruptions will follow faster and faster.

“Alternative/renewable” energy will never support growth or prosperity for humanity on that scale or anywhere near it.

The “alternative/renewable” energy future you all toss around as if it were inevitable will never happen in a world where whole economies are tanking.

You might say that an “alternative/renewable” energy boom can employ everyone and save whole economies. This would mean that at least for 20 years or more we would have to ramp up energy use just when energy is declining and becoming more expensive. Not going to happen.

First of all Jeffy, your assertions are ridiculous very poorly thought out.

I was illustrating how fast change was and how it is accelerating, not using it for forecasting.

The energy back then and now was low quality, inefficient and used inefficiently. It was nowhere near free at a time when making a dollar or two a day was good money.

You said”The “alternative/renewable” energy future you all toss around as if it were inevitable will never happen in a world where whole economies are tanking. ”

Oh come on now, renewable energy is available at several magnitudes the rate of fossil fuel and far cheaper and more efficient than fossil fuels. The amount is virtually unlimited compared to fossil fuels.

http://idlewords.com/talks/web_design_first_100_years.htm

787? A nice midsize aircraft capable of crossing the Pacific and about 20 percent more efficient than it’s predecessors. Apparently no market for the big ones at the time.

Passenger aircraft are hitting the 100 mpg/passenger. The new turbofans being installed recently will move that toward 120 pmpg.

NASA is researching blended body passenger aircraft, which will give a large boost in fuel efficiency and structural strength.

Gulfstream has new wing shapes that reduce shock wave formation on the wings.

I flew sailplanes. Hours in the air with no fuel use, but most people don’t want to spend time circling in lift or riding ridge and cloud street lift. Nice and quiet though with a great view. They only hit about 140 mph.

https://www.youtube.com/watch?v=qGDAczCDsTE

Lockheed’s concept blended body heavy lifter to replace the C5

Now down to important business. Can you or anybody tell me a sensible use for a new long range stealth bomber?

The only possible opponents to such an anachronism would be russia or china, both of which could easily defeat them with far cheaper means very well known to those skilled in the art.

A few cover fighters could take out any standard jets that might find a bomber in the dark.

In any case, the detection will be much later than with non-stealthy aircraft, giving little time to respond. If they are detected at all.

The major use for stealth aircraft is to make the enemy be really nervous about attacking or sending up it’s non-stealth aircraft.

Look up the P-61 Black Widow. Not good to have one of those or a Mosquito on your tail in the dark.

There is one being rebuilt to fly in Reading PA.

The Widow’s Web http://www.maam.org/p61/p61_recovery.htm http://www.maam.org/p61/p61_rest.htm

And all recoverable.

Gawd! what a lot of work on that wreck!

I remember the P61. Thought at the time, just use a Mossy, or a Ju88. Saves lots of time and money.

Whoever wrote that piece doesn’t have a clue about modern advances and technology. Why even your hair shampoo has very advanced technology. Every area has advanced. Aircraft, cars, trains, paper, electronics, almost all materials have made huge advances. Heating, insulation, just about everything has advanced technologically.

Our understanding of the world and how it works is light years past the 1950’s.

Definitely written by someone who is too lazy to even look past the surface, in fact not even look at the surface.

Physics, aside from some elegant is just sorting out the Standard Model of the 1970’s.

Google has made a oracle machine- sort of, but pales in what Haber did.

Here is some clarification from the end of last thread.

Here’s how things go wrong. A business gets a $10,000 start up loan. Out of that loan they pay say $6500 in individual wages, salaries and dividends and the rest of if they use to purchase equipment, supplies, marketing, energy costs, insurance etc, etc. Now, all of the $10,000 originally borrowed must eventually be figured into the prices of the products or services that the business must charge in order to make a profit and remain in business. So as this process goes on through time there is a rate of flow of prices that must be at the very least $10,001.

This shows that price of inflation and so an ever increasing loss of your purchasing power is built into the system. Hence current free market theory is systematically flawed. This uncorrected and ever widening “Gap” in the rate of flow of income compared to price is the most and unrecognized fact that brings the system into imbalance.

For over a year that imbalance between input price and flow of income for oil industry was over 60%.

In the past 10 years, your posited “ever widening “Gap” in the rate of flow of income compared to price” has been shrinking like crazy because of declining interest rates. [I am of the opinion that low interest rates CAUSE deflation. (Because, in theory, with zero interest rates there is no cost of capital. You just keep rolling over the zero interest loan and never pay it back.)]

Actually, I do not think that I understand one single word of what you wrote. But, since this web site seems to be the premier web site with respect to money, and economics [almost everybody on this site claims to know how to run the economy, manage the money supply, set economic policy better than the Federal Reserve, or anyone else in the world] I am sure that you are wealthy beyond my wildest dreams.

Maybe you can describe a better “theory” to replace the systematically flawed free market theory. Might be worth a Nobel Prize in economics.

Maybe ok during the “emergency” of 2008-2009. But starting in 2010 there should have been small increases made every so often, maybe 1/4% every six months. By now we would be at 2.5% or so.

We have a rapidly aging population who is earning no income. To a simple thinker like me, that isn’t a good thing.

I worked at a bank some during summer breaks in college. I recall all of the retired people who came in, they all had their savings in CD’s that were paying decent interest rates.

I know you have done fine by being a savy investor, but I do not think you are the rule, but the exception.

My grandparents all lived through the depression, none ever owned stocks. I have a finance degree, which granted doesn’t mean much, but should at least theoretically give me a leg up, but I am not so confident trading stocks.

The idea was to save and pay into social security for 40-50 years and then be able to retire. Financial repression has cut into retirement income big time, which has surely hurt the US economy in many ways.

This is all just cost accounting. Clueless, have you heard the stories from grandparents what they remember about deep recessions or depressions? They will always say “there was just no money”. You can even go to Greece today and hear the same thing. I have explained how the lack of purchasing power is built into the system in two paragraphs. What is your explanation for “there is just no money”? If possible in 2 paragraphs.

Anyway this post was just tied from last thread from the Enno’s post on and it had to do with KSA oil production and profitability of the marginal producers.

Thanks for the elaboration. I would like to read it again, as well as Watcher’s in the previous thread, and try to digest and think about it some more.

I think what you miss is the added value that the business provides for its customers, compared with its inputs. A shop selling apples that charges 50% above the price for which it bought the apples, makes perfectly sense for its customers.

The capitalistic system is the best invention mankind has ever come up with. Just look at the improvement in human well being (life expectancy, child mortality, etc) over the last 400 years. It just needs a very good oversight, which many governments are struggling with to provide.

When I got to the stage where I started my own business, I was so naive that I was shocked to see the lawyer put down as the purpose of the company “to maximize income (narrowly defined as money) to the stockholders!

I had thought the purpose of a company, and of a life, was to make the world a better place. That was the income I had hoped for.

Nope, that company went on to make money for me and lots of others, by making stuff like things that whizzed around the only planet we have looking for things/people to kill. Very effectively, too.

This condemns me to spend my last minutes trying to atone for my sins. That’s why I keep pushing for a switch of priority from making killers to making things that make the world a better place.

Needs a good oversight! That’s for sure. Got ideas?

Are there any limits to “making things that make the world a better place”? And if there are limits to the production and consumpiton of “things,” what does this mean for the future of capitalism? To the future of the polity, culture and society of the United States? To human flourishing?:

Here’s Wallis:

I think Wallis has cherry picked and distorted Marx’s thought, because Marx was without a doubt every bit as much of a Positivist and a product of the Enlightenment as what Adam Smith was.

Nevertheless, I do like what Wallis has to say, even though I disagree that his thinking enjoys Marx’s imprimatur.

To this end, the best strategy is to identify the most supply constrained and economically irreplaceable resource, and maximise its consumption whilst actively suppressing substitution strategies. It is clear to many here that oil is that resource, so we should all in the interests of humanity suppress all efficiency policies, substitution with alternative resources or technologies, and actively encourage non-essential consumption.

Therefore in the best interests of humanity Ron should immediate close and remove this website, and actively troll the few remaining PO aware sites out there, and send campaign contributions to the most corrupt wanabe political leaders he can find. At the same time of course he should continue personal and local preparations to survive a low energy and resource constrained future, because we will need as many intelligent and far-sighted community leaders as we can get if we are to survive the transition at all.

Needless to say this post is partly, but not entirely, /sarc

There is no doubt that Posivism and Progressivism are linchpins of the “national faith” of the United States.

As Thomas E. Buckley explains, they were part of the “political theology” of Thomas Jefferson, which laid the foundation for “a set of shared beliefs fundamental to the development of a national faith.”

The decay of traditional and unjust political institutions and the remarkable success of the scientific conquest of nature unloosed the hope that all impediments to human happiness would be progressively removed.

If we fast-forward to the present, we see the Positivist faith is still very much alive in the United States. As Matthew Schneider-Mayerson writes in Peak Oil, “most Americans have an implicit faith in the development of new technologies to provide energy for future generations.”

In his surveys of more than a thousand peakists which he conducted in 2011, however, Schneider-Mayerson found that most peakists did not share this fundamental tenet of America’s national faith. He quotes one promient peakist: “It’s too late for cheery myths about how technology, wind hybrids, biofuels, hydro-electric dams, solar energy, or hydrogen will save us and let our society continue as it is.”

“Using Barbara Ehrenreich’s and Karen Cerulo’s analyses of American optimism,” Schneider-Mayerson goes on to explain, “I highlight the ways that peakism deviated from the American ‘dominant social paradigm’ of implicit faith in technological and the inexhaustibility of crucial resources.”

So since 2011, have peakists converted to the “dominant social paradigm”? Or are you merely attempting to convert them?

And furthermore, just to set the record straight, at no time did Wallis or I ever assert “we should all in the interests of humanity suppress all efficiency policies, substitution with alternative resources or technologies, and actively encourage non-essential consumption.”

That is pure straw-manning.

I sometimes wonder if The Oil Drum was killed off because it’s owners saw further attempts at promotion were counter productive. I think the peak oil ‘movement’ can never exist because the more clearly you see our predicament, the less you want to talk about it. A bit like the deep/dark greens.

We have LOTS of movements.

But I can’t say there is any thing afoot that can be called a peak oil movement.

The small handful of people who follow the issue in blogs such as this one might reasonably be called a subset or clique of people involved in the larger environmental movement.

I don’t see it.

I’m here to know how quickly the Bakken might peak to better understand the economics for fracking.

I read all the comments/predictions about a future without oil, but I don’t think those are directly tied to peak oil. What happens as a result of peak oil is not the same as discussing the geology and economics of oil exploration.

Since the Carter days I have been aware that oil is not unlimited. And I have been amazed that more planning wasn’t started then to prepare for the decline. But I don’t acknowledging a limited resource is the same as a “movement.”

It could have evolved, or stayed much the same and continued to thrive, with the emphasis moving to other topics.

Running a site that big with that much content is a hell of a lot of work for no pay.

One more thing.

Progressivism, as many of the descendants of slaves and native Americans can testity to, in addition to its positive side has had a dark side to it too. And, as Arundhati Roy explains, the dark side of Progressivism has not gone away:

My own idea of a better place is very far removed from the usual “more of everything” idea.

If I have enough lumber, I would far rather have more forest than yet more lumber. And to me, enough is not a whole hell of a lot and is usually fairly easy to get.

I have done enough travel to know that most people don’t in fact have enough, but I also, being an engineer habituated to think up solutions, think it would not be a huge problem to get them enough without ruining the future.

India, for example, has enormous reserves of solar they aren’t even thinking of exploiting, and in ways that are straight out easy and cheap to do. Example, village solar ovens.

I tried to sell that idea without much luck. They surprised me with the remark that such an oven could also burn bodies, and save a lot of effort gathering wood.

It would behoove the wealthy to assure that each Indian, and all others who don’t have enough, to get enough. Fast. Before they are forced to move into the wealthy’s front room.

My vision of a better world is closer to David Korten’s “Change the story, change the Future”.

And so on.

Of course, population is a huge problem. I think education by way of such things as soap opera has been proven to work, fairly fast. My Indian friends told me “Dallas” helped the population problem far more than all government efforts.

I have funded that sort of thing. Don’t know, but think I got a satisfactory return on investment.

Okey. let’s just stop for a second and have a look at where we started with this conversation. My above post started when Caelan asked me to clarify the post where I responded to Watcher question: “Why there is always a question in the media that SA/OPEC somehow has an obligation to cut?”

So my post was about lack of purchasing power of consumers and NOT about different “ism”. Problem with this forum is that commentators are not mindfully reading so we start with oil and end up with totally irrelevant conversation. As you can clearly see Clueless admits in his post that he does not understand one word about what I am talking about but feels urge to comment. May I ask what people are commenting about if they don’t understand comment in the first place? This is hilarious.

So why there is always a question in the media that SA/OPEC somehow has an obligation to cut? And who needs whom?

Generally speaking, I don’t have much use for Watcher’s arguments about prices etc not really mattering, because they absolutely do, in the longer term at least and usually in the short term as well.

But let us suppose we can keep oil supplies up to the amount currently needed to maintain bau by subsidizing the producers. In reality, they will be running at a loss but society will be making up that loss for them. The every day or nominal price of oil could be way above or way below the true price of it, meaning with the subsidy included.

Now let us suppose we could subsidize the tight oil industry to the tune of two hundred billion bucks annually, this figure being one I pulled out of thin air.

IF the extra oil thus provided keeps the wheels of business as usual turning without too much squeaking, and without SEIZING UP, the subsidy would be a BARGAIN in comparison to the alternative- economic depression due to a major shortage of oil. Of course at some future time, the subsidy would eventually grow so large society would simply be unable to pay it.

So -When Watcher says you gotta have it, you WILL HAVE IT, price be damned, he DOES have a point. UP TO a point, anyway.

Now as far as every body laying the responsibility for a cut at Saudi feet, that’s like a bunch of older kids expecting their parent’s to bail them out of financial troubles for no other reason than the parents bailed them out IN THE PAST.

It is not in their overall best interests, as they see things, for the Saudis to cut production, or else they would have done so.

FIRST point. The Saudis are engaged in a defacto economic / military war with some very worrisome enemies, and the current cheap price of oil is working very much in their favor. They have enormous reserves, their enemies do not.

SECOND point. The Saudis may not yet be satisfied that the rest of the OPEC countries are CONVINCED the Saudis will not bail out their cheating asses again, as has happened in the past.

The Saudis are perhaps waiting for some SERIOUS guarantees from the rest of OPEC, and maybe some outside producers as well, that quotas will be honored.

Third, the House of Saud is currently embroiled in a succession crisis , and may be running on autopilot, for now. Once a new leadership is in place, and has had time to consolidate control, the new leadership may abandon some current policies and put some new ones in place. Such policy changes might include cutting production.

Fourth, there may be some unofficial cooperation taking place between the USA and SA. Cheap oil is very much in the overall economic and political interests of the USA for now. It is helping our allies and our own people to a far greater extent than it is hurting us, excepting of course the people in the domestic oil patch.

Politics is a hard ball game, and politicians do not hesitate to throw one percent of voters off the bus and under the wheels to curry favor with the other ninety nine percent, regardless of party affiliation.

I am NOT saying anybody from Foggy Bottom is twisting Saudi arms to keep the price of oil DOWN, but unless I am a DUNCE , I am on rock hard ground saying our diplomats are NOT pressuring the Saudis to cut production.

Incidentally I seldom have much good to say about any politician, but imo the OBUMBLER will go down in history as an average or better than average president overall. Maybe even a really good one, SO LONG as he does not overreach and hand control of the federal government to the R’s for a a decade or two or three as a result.

Yesterday or day before I pissed Ron ( Sorry, Ron! ) off by saying Obama doesn’t give a a damn about the oil patch. I do believe he cares at the personal level, but that his hands are tied at the presidential level by party and national economic considerations.

A republican would do precisely what Obama has done when it comes to oil prices, except a republican might allow oil exports and approve the Keystone. Neither action would have any serious impact on the price of oil, in terms of the really big picture.

No, that was not what you said. You referred, several times, to Obama as “Obumbler”. That was what pissed me off. Now you might have said Obama had bumbled several things, and named them. That would have been your opinion and I would have respected that. But you did not. You called him Obumbler because he did not order the oil companies to cut production to support oil prices.

Really Mac, you could have done better than that.

He failed to see to it that his justice department prosecuted any banksters. This one issue alone, combined with his going along with the construction of an American police state apparatus spying on ALL of us has been a truly MAJOR failing in my estimation.

I generally refer to Donald Trump as the CHUMP and HRC as the Harpy ( not here ) or worse and I can’t remember ever saying anything in this forum positive about any of the current republican candidates or recent republican presidents.

I might have had a few nice things to say about Jimmy Carter maybe, and I recently said I will vote for Bernie Sanders if he gets the nomination. I also said that if the election comes down to HRC and the Chump I will stay home and get drunk and cry for my country.

I have said that Obama is going to go down a big winner in historical terms for the Democrats, but that OCARE was and may remain a Pyrrhic victory for the democrats since it resulted in the R’s wiping the floor of congress with them and may yet be one of the key issues in the next election. It probably WILL be a key issue although it may not get that much publicity.

If the R’s win, they have a shot at appointing a lot of Justices to the Supreme Court over the next eight years.

Coming from me, OBumbler is actually pretty close to an AFFECTIONATE nickname. Obama has accomplished a good bit when it comes to reforming drug laws, and he has done more to preserve the environment for sure than any republican would have done.

On the other hand he has done next to nothing to improve the schools of this country- although he had the political capital to do something, after the same fashion Nixon ( Tricky Dick) had the capital and credentials that enabled him to open relations with the Chinese.

If he could run for a third term, I would vote for him in preference to the CHUMP for damned sure, and in preference to most of the current R candidates, maybe all of them.

I will not refer to Obama as the Oxxxxx again in this forum since it offends you.

Something tells me that if I live another twenty years I will be looking back on his administration as the part of the GOOD OLD DAYS.

Nixon’s ‘special message’ to Congress proposing universal health care.

Your response to me contained your thought of “Financial repression .” WTF is that???

I just said that, in my opinion, zero interest rates produce deflation! That is what you [based upon your posts] are suffering from. That is, all of these companies could borrow to drill at essentially a zero interest rate, so they never would have to pay it back [if they can keep rolling the loan]. So, they do not have to make any money to stay in business. Which is what is screwing YOU!

Based upon current economics, their loans should be north of 20%. Which is still less than a lot of credit card interest.

So, what is it that you are “sorry” for???

I guess that a Masters Degree in Accounting and a minor in Economics has been wasted on me.

I was apologizing because I thought maybe it seemed like I was commenting on more than that.

I’m not so bright sometimes, especially when trying to skim thru stuff here. I have reread the posts above, still don’t follow. Sorry I’m dense.

You are not dense.

Here is again my point:

Under the current financial system only A as purchasing power is available while the total cost of production is never less than A (salary) + B (other costs). So the total rate of flow of price (A+B) will always tend to exceed the rate of flow of total individual purchasing power (A). So you have constant deficit of individual purchasing power due to inherent price inflation. So the self liquidating market is currently impossible. System is unstable even during the so called “boom”

Warren Buffett does not take a salary, yet has billions of $ to spend. Other billionaires that you might have heard about that took/or are taking virtually no “salary” include Zuckerberg, Jobs, The Walton family, the Kennedy family, the Rockefeller family, the founders of Google, and hundreds of others.

Now, to the people you have never heard of: The owners of virtually every small business in America who take dividends, sell stock, borrow money using their businesses as collateral, etc. and essentially spend far more than they reap in “salary.”

I never inherited one dime. I worked almost 50 years before retiring. And I have made and spent more from investments than I earned in salary. I will not say how much I earned, but I probably averaged earning enough salary by the 4th month that social security taxes were no longer being withheld.

I personally have met hundreds of people who inherited more than they will ever earn in salary.

Short conclusion: Your formula is defective.

Without even knowing, I will go out on a limb and make a clueless “guess” that Shallow Sand has received most of his income throughout his life from something other than by receiving a “Salary.”

Not that there is much of any compensation of any kind in the last year re: stripper oil wells.

Do you really think that oil just magically appears out of the ground for Shallow Sand?? Really??? It never appeared to you that there are some actual human beings that are doing the drilling/maintaining/operating/trucking that oil and require the “salary”?? Really??? That “salary” (A) + other cost of supplies and machinery and equipment (B) forms the total rate of flow of price for that one barrel of oil. Do you get that? That flow of price (A+B) is always greater than the purchasing power (A).

A+B > A

I am sorry to say but you really don’t get this very simple cost accounting concept. Few months ago we debated and you displayed lack of understanding that stock market is zero-sum game and you are boasting that you are savvy investor. I would say you are very lucky investor. It is no problem if we don’t know some things. I don’t know lot things like for example why anybody is still drilling. Problem is if do not accept that maybe we don’t know some things. Not accepting is what always causes you suffering.

Which is also irrelevant if it doesn’t take into account longer time scales, such as the cumulative negative effects (social, spiritual, environmental, etc.) of this so-called capitalism.

And less naive statements from those who seem to think that it just needs a very good oversight from the current crops of so-called government.

Illusion, from the album, ‘Unknown Way’

(For increasingly-‘expensive’ oil, just add progressively more boots and a heavier energy-transfer system.) (But, hey, the energy transfer system works just fine. And repeat after me; ‘technology will solve our problems’. Now say that over and over again until we/they believe it.) (The organisms that created all that oil could also represent the human figure, seeing as we are talking about energy and resource squander.)

Technology does solve millions of problems. We are just scratching the surface of sustainable natural technology and you want us to stop.

I suppose you just got right up and ran when you were a baby. Never laid there pooping in your pants, or crawling around wiping up the dirty floor. Nope not you, right up to running from day one.

…While our figure just keeps spinning the wheel of technology until it can’t anymore, and maybe disappears forever by its own making.

Stay tuned…

BummerToo bad that I won’t be around to receive my very own personal drone-delivered Monsanto human, complete with a custom-ordered double-wide Kardashian™ trailer.Currently, humans seem quite maladaptive, which makes notions of genetic engineering, at least in certain contexts, laughable and naive.

[prime minister, Narendra] Modi has repeatedly said India would not accept constraints on its development as part of any climate deal. Unlike China’s submission to the UN in June, India’s does not spell out when its emissions might peak.

“China Will peak emissions by 2030 and reduce carbon intensity 60-65% by 2030 against 2005 level”

—–

Confucius says: “Promises made in distant future never honored.”

The East is just using Climate change as a means to de-industrialize the west so they are the only game in town. The more de-industrialize the west becomes the more resources become available in the east! The con-game of the century!

Meanwhile over in Indonesia: http://www.cnn.com/2015/09/17/asia/indonesian-haze-southeast-asia-pollution/&rct=j&q=&esrc=s&sa=U&ved=0CBQQFjAAahUKEwitvIO7rOHIAhUJHR4KHWoKC94&sig2=anwcEje_dH5oTsdoX78wdw&usg=AFQjCNEYD6svmCf2R6ou5G97CaPS7_hujw

Farmers are torching peat bogs in order to make room for plantations, including plantations for bio-fuels. Oh the sadistic Irony: “We must destroy the planet so we can grow more bio-fuels to save it”

That is likely an unfair characterization of the dynamic going on. On the one side of the ledger we have the American egotistical, legacy-obsessed, attention-span-challenged rubes (Obama, Kerry) who fancy themselves global leaders and political sophisticates who must set an example. On the other side of the equation, we have the asian bureaucrats who are focused like a laser-beam on their export-oriented economies. Does it really come as any surprise that when it comes to the inevitable carrot or stick prodding that, in the end, the asians agree to make promises that sound nice but for which they know they are entirely unaccountable? And if the industrial economy of the west chooses to get hung by its own rope, who is it that should stop them?

Latest demand numbers (Aug-Sept data – Energy Aspects)

India:

Indian oil demand rose strongly to 3.82 mb/d in September, with y/y growth at a record 0.5 mb/d, led by diesel, gasoline and naphtha. October is likely to see similar demand strength, given the usual seasonal buying ahead of Indian festivities and another low base last year. Diesel led the y/y growth once again in September, rising by a record 0.25 mb/d. A light monsoon season has led to a pick-up in diesel use in agriculture. Part of the y/y growth was also driven by a very weak base last year, as floods curtailed industrial and agricultural activity. The Indian government’s goal of building 30 km/day of roads will also be positive for diesel. Gasoline demand increased by 0.11 mb/d to 0.53 mb/d, with the year-to-date growth at 15%. IOC and HPCL continue to import gasoline, including a recent tender for around 0.5 mb for November delivery.

Europe:

Total European demand in August was higher y/y by 0.38 mb/d to 14.05 mb/d, supported by sustained momentum from Italian (up y/y by 0.12 mb/d at 1.30 mb/d), and Spanish (higher y/y by 53 thousand b/d at 1.20 mb/d) demand. ULSD and gasoline demand continued to drive growth in these two countries, up collectively by 15.3% and 13.4%. Meanwhile, heating oil restocking helped French demand rise y/y by 38 thousand b/d to 1.70 mb/d. This, together with very strong growth from Turkey (+0.26 mb/d y/y) where vehicle sales continue to soar (+35%), was able to offset weakness in German demand, lower y/y by 57 thousand b/d at 2.48 mb/d, the fourth decline in six months. German demand is likely to have remained weak in September and October, partly stemming from low Rhine river levels, which meant inland stocks were run down, distorting underlying demand figures somewhat. Indeed, consumer heating oil stocks have risen, which is usual ahead of the winter, but commercial stocks have been falling, with preliminary September data showing German commercial inventories at their lowest since May. Demand elsewhere however stayed strong, with preliminary French demand higher y/y by 4.1% in September, on continued restocking of heating oil.

Mid-East:

Middle Eastern oil demand for the top seven countries increased seasonally in August to 6.51 mb/d, higher y/y by 0.26 mb/d, led by Iraq, where demand increased by 0.15 mb/d to a record high of 0.75 mb/d. A low 2014 base driven by the IS invasion and strong seasonal demand for fuel oil (up y/y by 31%) from the power generation sector supported. Saudi Arabian demand increased y/y by 0.13 mb/d to 2.86 mb/d, with gasoline higher by 27 thousand b/d, and jet higher by 11 thousand b/d, both supported by increased travel following the end of Ramadan. Growth in fuel oil (+56 thousand b/d) and crude burn (+79 thousand b/d at 0.85 mb/d) remained elevated as temperatures soared (CDD’s were higher y/y by 6.5%) and electricity loads hit a record high. Diesel demand, however, declined y/y for the third consecutive month—possibly due to soaring temperatures dampening construction activity and fuel oil continuing to displace diesel in the power generation sector. But, with Saudi Arabia allocating $1 trillion for construction projects, with a particular focus on rail and road programmes including the Riyadh Metro, Dammam Rail, Saudi-Bahrain Causeway, overall demand growth should remain strong. In fact, GCC countries have seen no slowdown in construction, with UAE, Qatar, Kuwait approving a slew of projects, particularly in the road and housing sectors.

Brazil:

Brazilian August demand was lower y/y by 0.1 mb/d at 2.44 mb/d, with gasoline down by 84 thousand b/d and diesel by 68 thousand b/d. Ethanol demand, however, was higher by 48% y/y at 0.32 mb/d, buoyed by cheap prices. Combined gasoline and ethanol demand rose by 2% y/y to 1.0 mb/d. But ethanol output was lower y/y by 20% in the second half of September as heavy rains in the south hampered sugar mill operations, which may support gasoline demand going forward. Still the outlook for gasoline and diesel demand remains gloomy given the government’s latest forecast of a 2.4% GDP fall this year.

Russia-FSU

Preliminary August FSU demand was pegged at 4.9 mb/d, up y/y by 78 thousand b/d. Russian demand continues to come in stronger than expected as rouble depreciation has supported industrial activity, despite a severe recession. July demand totalled 3.8 mb/d, a near one-year high, and slightly up y/y. Demand is being led by naphtha, gasoil and other products.

South Korea:

South Korean August oil demand increased y/y by 0.1 mb/d to 2.38 mb/d, the strongest growth since March. Diesel demand led, up y/y by 59 thousand b/d to 0.44 mb/d, partly due to a weak base. Naphtha demand rose y/y by 45 thousand to 1.19 mb/d as cracker utilisation picked up in early August. However, utilisation has eased since, as ethylene margins for cracking naphtha weakened amid the Tianjin blast and slowing demand in China, and the return of Japanese crackers from maintenance. Gasoline demand was up y/y by 6 thousand b/d. Fuel oil demand also rose y/y by 6 thousand b/d, despite high nuclear availability, as temperatures were hotter y/y (26% more CDDs). However, butane demand dropped y/y by 22 thousand b/d, as low fuel prices have rendered switching to butane-fueled autogas vehicles unattractive, a trend we see persisting. Moreover, there are signs the Korean economy is slowing as exports posted their sharpest fall in six years in August. Exports account for roughly half of Korea’s GDP, and shipments to China, which absorbs a quarter of the total, dropped by 8.8% y/y in August. Hence, oil demand, particularly naphtha, growth is likely to weaken over the rest of the year.

China:

Chinese apparent consumption totalled 10.28 mb/d in August, with y/y growth at 0.56 mb/d (5.7%). But actual demand growth is likely to be weaker due to product stockbuilds.

Gasoline apparent demand was flat m/m at 2.75 mb/d, higher y/y by 0.44 mb/d in August, supported by strong SUV sales, even though overall car sales have contracted. Naphtha demand eased slightly to 0.85 mb/d in August, but weaker cracker margins and a seasonal easing in gasoline demand are likely to weigh on naphtha demand for the rest of the year. LPG demand and imports, meanwhile, remained high on rising PDH capacity.

Apparent demand for diesel rose y/y by 0.12 mb/d to 3.53 mb/d as the lifting of the annual fishing ban in August helped. But industrial activity remains muted, leading to record diesel exports of nearly 0.18 mb/d, although run cuts and TARs may help ease exports in early Q4 15.

Japan:

Japanese August oil demand rose seasonally m/m to 3.53 mb/d, taking it higher y/y by 71 thousand b/d, driven by naphtha (+47 thousand b/d), jet fuel (+30 thousand b/d), crude burn (+25 thousand b/d) and gasoline (+21 thousand b/d) offsetting weakness in LPG (-40 thousand b/d) and fuel oil (-20 thousand b/d). Much like in Korea, naphtha demand continues to grow, higher y/y for the seventh straight month, partly as the 2015 naphtha cracker turnaround schedule (<0.5 Mtpy between April-August) was lower than in 2014 (~0.7 Mtpy). Moreover, the competitiveness of naphtha has also seen its usage in petchem plants rise, displacing LPG. But with the return of naphtha crackers from maintenance, petchem margins have started to fall, which together with an unexpected drop in industrial output, will weigh on naphtha demand going forward. Elsewhere, despite the restart of Japan’s Kyushu Electric nuclear plant on 11 August, fuel oil demand in August did not drop as sharply as expected, down by just 7% y/y compared to a drop of 12% in the first seven months of 2015, largely due to hydro generation falling y/y by 23%, the first fall in eight months. In fact, crude burn rose by 22% y/y, though this was on a small base. Slightly warmer weather (CDDs 3% higher y/y) in August also helped. But with the Japan Meteorological Agency forecasting a warmer than normal winter, fuel oil demand is unlikely to find support, especially with the gradual return of nuclear generation.

Australia

Australian oil demand was slightly lower y/y at 0.94 mb/d in August. Transportation remains the backbone of oil demand, amidst falling industrial activity. SUV sales continued to increase (up y/y by 13.6%), even as passenger car sales fell by 3.3% y/y. Total vehicle sales were up y/y by 2.6% y/y. This, together with rising dieselisation in Australia (where some 10% of passenger cars now run on diesel, up from 5.5% in 2010), supported diesel demand. Diesel demand increased by 8 thousand b/d y/y to 0.4 mb/d, offsetting the weakness in diesel usage in the mining and coal sectors, on reduced demand from China and lower prices. Gasoline demand, meanwhile, was flat y/y at 0.32 mb/d. Jet fuel demand was pegged at 0.14 mb/d, broadly flat y/y. LPG demand fell by 12 thousand b/d y/y, largely due to weak commercial demand, as industrial activity remained muted.

Canada

Canadian (August) oil demand was steady m/m at 2.37 mb/d, with y/y declines easing to 36 thousand b/d. Gasoline and diesel demand remained weak, amidst an ongoing recession.

US (July – due to EIA official monthly numbers data lag)

US July oil demand was revised lower by 0.28 mb/d, less than our expectation of 0.4 mb/d, leaving demand up y/y by 0.7 mb/d at nearly 20 mb/d, the highest since April 2008. Gasoline demand was revised down, but only by 0.1 mb/d to 9.4 mb/d, the strongest since September 2007, taking y/y growth to 0.2 mb/d (2%). August may still come in higher before demand tapers off in the autumn. Demand was strongest in PADDs 1 and 5 where product supplied rose y/y by 0.13 mb/d and 74 thousand b/d, broadly in line with trends in vehicle miles travelled (VMT) data—VMTs in the west higher by 4.7% and PADD 1 by 3.8% (South Atlantic by 5%) in July, and overall VMTs up by 4.2% y/y. But gasoline demand in PADD 3 fell y/y by 0.11 mb/d, which was at odds with VMT data that showed a 5.1% y/y increase on the Gulf Coast.

Well, sure, 99% of the world is still stuck in BAU so increased demand is to be expected in the short term.

But, I disagree that Verwimp’s conclusion is complete nonsense, what I think you are missing is disruption and paradigm change. You are convinced that what has been until now will continue forever. I find that very highly unlikely!

“If I had asked people what they wanted, they would have said faster horses.”

― Henry Ford

How many people today are asking for ‘Uberized’ driverless EVs that you can hail with your smartphone?

Disclaimer: I’m not saying that my hypothetical example above is a given, but what I am saying is that disruption and paradigm change are.

A paradigm change is happening right now for sure, poverty and inequality are running rampant and destroying lives.

We have only one way to get money into peoples hands so that they don’t die and that is to make, sell, buy, and throw out STUFF. There is no future until we figure how to change that dynamic.

Jef for what it is worth, I’ll be the first to agree that disruptive technology will indeed put a lot of people out of traditional jobs. As an example the blacksmiths who used to make horseshoes lost their jobs when automobiles disrupted the horse and buggy era. I’m not saying that was good for those blacksmiths at the time. They and society had to adapt. Google Tony Seba’s presentation. He has photographs showing how it only took 13 years for a NYC street full of horses and buggies to transition to a street that was full of horseless carriages.

In any case the reality is that driverless EV technology is here now and will be disrupting the old paradigm in the very near future whether any of us really wants that or not.

BTW, don’t mistake the messenger for the message I’m just reporting how I see it. It doesn’t matter what any of us thinks as to whether any of this disruption is going to have fall out or not. It is happening and things are changing really fast.

We have only one way to get money into peoples hands so that they don’t die and that is to make, sell, buy, and throw out STUFF. There is no future until we figure how to change that dynamic.

That is a description of the linear economic model and it isn’t working now. However there will be a future and I think or economies will be circular and will look more like this.

http://www.ellenmacarthurfoundation.org/

this is from MIT tech review, they don’t give hard numbers but I’ve seen some estimates in the past on how much fuel is spent searching for parking spaces that are fairly high. Driverless uber cars with a corresponding parking system. Obviously doesn’t solve “all problems” but certainly could increase efficiency and reduce consumption on activities people are already doing.

http://www.technologyreview.com/news/425850/how-vehicle-automation-will-cut-fuel-consumption/

But the biggest effects could come with full automation. Cars that park themselves—a trick GM has demonstrated with its EN-V concept vehicle—could save fuel by eliminating the need for drivers to circle the block waiting for a parking space to open up. The ambition is for a car to drop its owner off and go directly to the nearest available parking spot—even if that spot happens to be miles away, too far for the owner to walk. When it’s time to leave, the owner notifies the car with a smart phone, and it picks him or her up.

http://goo.gl/7bsgwl

Once a rite of passage for any teenager, owning a car is increasingly being overshadowed by the desire for a smartphone, a new survey shows.

In the survey of 1,200 people in four major countries by global tech design and strategy firm frog, 30% of the respondents said that they would give up their car before their smartphone.

“Given that smartphones have been commonly available for only 10 years, we expect the proportion of people who value them more than their car to grow swiftly and significantly,” frog said in a statement about the survey.

The online survey of the residents of the United States, China, Denmark and Germany found that 37% of car owners would like to give up their car outright or felt they could get by without it.

Personally, I highly doubt that I will ever buy another car in my life. In the future if I need a car I will rent, use something like Zip Car or a service like Uber. I really don’t want or need the hassels that come with car ownership.

Side note: From this survey it seems that people are still not very comfortable with the concept of driverless cars, I think I can understand where they are coming from but I also think that in another decade that won’t be an issue anymore. Humans are really good at walking… driving, not so much.

Eventually, they’ll make it to Barret-Jackson auctions.

har

The Cuban dictatorship has an overwhelming control system. When something isn’t controlled (say underage prostitute prices), it’s done on purpose, to achieve whatever dark purpose they have in mind. Cheap prostitution is used to encourage sexual tourism. The prostitutes make little money, the government oligarchs rake profits by controlling hotel, rental car, and other prices as well as keeping them under their ownership and tax system.

Published on Nov 2, 2014

The industrial age of energy and transportation will be over by 2030. Maybe before. Exponentially improving technologies such as solar, electric vehicles, and autonomous (self-driving) cars will disrupt and sweep away the energy and transportation industries as we know it. The same Silicon Valley ecosystem that created bit-based technologies that have disrupted atom-based industries is now creating bit- and electron-based technologies that will disrupt atom-based energy industries.

This is what disruption looks like in the very early phases:

http://blogs.scientificamerican.com/plugged-in/1-million-evs-sold-worldwide/

1 Million EVs Sold Worldwide

By Tali Trigg | October 29, 2015 | 1

At some point this month, one million electric vehicles (including plug-in hybrid and full battery electric vehicles) have now been sold worldwide. This took place in only six years, which is four years faster than it took non-plug-in hybrids (e.g. Toyota Prius) to reach one million in sales.

This is the highest amount of EVs to ever ply the roads, even taking into account the fact that EVs were popular twice before (1910s and 1990s). So what makes this time different?

For one, batteries. The battery technology (primarily lithium-ion) has developed increasingly with higher energy density (which partly determines range) and lower costs.

1.2 billion vehicles on the planet, one million EV’s are less than 1/1000th of the total.

It will take a lot of ff to close that gap.

I do agree, not everybody needs to own a jet to fly to a destination, everybody shares that mode of transportation, the safest travel ever.

Uber and Lyft will probably be in the ev business and the flight travel business too. Look out Lufthansa!

Makes sense to me.

Since Earth is a closed system, next to this production (supply) event, there must be an equal demand event: Peak Oil Consumption. Since there are no substantial above ground deposits, Peak Oil Production and Peak Oil Consumption must coincide.

That is a true statement if a true statement ever existed. Yet Coolreit calls it complete nonsense. And he lists places where demand is increasing to back up his story. As if consumption could outpace production! I call that complete nonsense.

As long as some countries consume more than they produce other countries must produce more than they consume. Demand muse equal production. Actually we should stop using the word demand to imply consumption. Currently the word is used primarily to imply expected future consumption. But future consumption, or demand, will equal future production and not one barrel more, whatever that may be.

Demand properly defined is a mathematical abstraction, a theoretical function that simply says the consumer will use more at any given INSTANT in time of a given product if the price is less and more if the price is higher.

Cheap oil does not increase the DEMAND for oil. It increases the CONSUMPTION of oil. Expensive oil does not decrease the DEMAND for oil. It decreases the CONSUMPTION of oil.

EVERY last technically literate person in this forum would have a hissy fit if another one misused an accepted technical definition from the hard sciences in such fashion.

If anything, the fact that the earth is not a closed system is probably one of the most reoccurring themes on this blog.

rgds

WP

A lot of energy comes to the planet in the form of sunlight. Since we are talking about energy and not only fossil fuels, the system is not closed.

As fossil fuels deplete the price will increase and other sources of energy will ramp up (wind, solar, nuclear, hydro, and geothermal). Energy efficiency will also help.

I do agree for now that the relatively small amount of electrical energy we gain from this new industry is trivial in terms of the big energy picture. But this acorn shows considerable promise of growing into a mighty oak, given time.

And while passive heating has been around since way back when, it is apt to be ramped up substantially within the foreseeable future as builders take energy efficiency and costs into account.

Your argument may be technically correct but it fails on practical grounds.

Something tells me that as time passes, people will actually be MIGRATING in substantial numbers in order to take advantage of optimal solar energy levels.

I seldom ever hear of any body moving to Vermont to retire, but millions used to move to Florida.

That migration is slowing, but the one to my part of the country, the southern mountains, is just getting well underway.

One primary reason people are moving here is that they like the overall weather better, on a year round basis. You can enjoy yourself outside here in the winter by putting on a coat and cap, but you can’t get any nakeder than naked, and that’s not enough to enjoy summer in Florida.

Another is that “damnyankees” such as my former BIG APPLE inlaws love to make fun of our backwoods hillbilly Bible thumping pistol packing culture- but they WANT to come LIVE here because crime rates as well as taxes are actually pretty low and Bible thumpers actually stop if they see you on a country road with car problems.

My last set of damnyankee inlaws retired to a little place very near Jesse Helms’ home town. It took them a while but they no longer get nervous when they see somebody walking thru a field toting a shotgun or rifle and they actually know where beef and chicken come from now. They used to believe it came out of beef and chicken factories. LOL, this is not much of an exaggeration.

There are about 122 million full time employees, but the number of part time employees remains relatively high.

With 37% of the people either under 18 or over 65 that makes 201 million people in the potential labor force. With 122 million full time employees that makes an employment gap of 79 million. It looks like there are about 6 million stay at home parents so that still leaves a gap of 73 million adults not working full time and even including part time workers that leaves 50 million adults below retirement age that are classed as non-workers.

Maybe many of them own the 28 million small businesses operating in the US?

“Global liquids production continues to outpace consumption, leading to strong inventory builds throughout the forecast period. Global oil inventory builds in the second quarter of 2015 averaged 2.3 million b/d, compared with 1.8 million b/d in the first quarter of the year. The pace of inventory builds is expected to slow in the second half of the year, to roughly 1.5 million b/d. In 2016, inventory builds are expected to slow to an average of 0.8 million b/d. ”

In my opinion, you wrote a very, very good post; concise, reasoned, well-structured, and educational. Really, one of the best posts I have come across for a while on this subject.

Why is Turkey listed under Europe?

Rgds

WP

Yes. Very little of Turkey is in Europe though, and less than a fifth of the population, mostly in Istanbul.

Coolreit was talking about oil demand; perhaps I should rephrase my question:

In terms of oil demand, why is Turkey listed under Europe?

Energy consumption has declined more in total and especially per capita in the advanced economies than I realized, and has been growing less in the lesser developed countries than I thought.

So far there has been no discussion of the role of efficiency in the comments. Here are some of my own, off the top of my head.