Asia’s $800 Billion Nuclear Splurge to Unlock Uranium Motherlode

http://www.bloomberg.com/news/articles/2015-05-07/asia-s-800-billion-nuclear-splurge-to-unlock-uranium-motherlode

A nuclear-power boom in Asia that’s set to drive up uranium prices is

triggering a resurgence in mining in Australia, home to the world’s

largest reserves.

Almost $800 billion

of new reactors are under development in the region, driven by China

and India where demand is climbing for the emission-free energy.

The value of uranium plunged in the wake of the 2011 Fukushima

nuclear disaster in Japan. Now, with contract prices forecast to jump

more than 60 percent, suppliers in Australia are planning about half a

dozen new mines.

“Australia is very well placed,” said Brian Reilly, managing director

of Canadian miner Cameco Corp.’s local unit, in a telephone interview.

“China and India will be very significant customers down the track.”

The mines on the drawing board in Australia, which holds a third of

the world’s known uranium reserves, include the Kintyre project, a joint

venture between Cameco and Mitsubishi Corp., that won government

approval last month.

China will need the equivalent of about 1,000 nuclear

reactors, 500,000 wind turbines or 50,000 solar farms as it steps up

its fight against climate change. The country in March approved

construction of its first nuclear power project since Fukushima brought

the program to a standstill.

Global Warming

India also views its push for new power plants as part of its effort to curb global warming. Cameco agreed last month to sell uranium from its Canadian mines to India.

Australia’s Prime Minister Tony Abbott last year signed an agreement

with India that opens the door for uranium sales and may help producers

such as BHP Billiton Ltd. and Rio Tinto Group-controlled Energy

Resources of Australia Ltd. Similar accords were signed last decade with

China and Russia.

Toro Energy Ltd. expects production at its Wiluna mine to start in

2017 or 2018, Chief Executive Officer Vanessa Guthrie said in an a phone

interview. The company has been seeking to bring in an Asian partner

and “in the last few months, the interest in Wiluna in particular, and

in the uranium market in general, has really started to increase,” she

said.

Cameco’s Yeelirrie mine and the Vimy Resources Ltd.-led Mulga Rock

project are also planned in Western Australia, which lifted a ban on

uranium mining in 2008. Exports from the four projects could exceed A$1

billion ($790 million) a year by the end of the decade if prices

recover, the state government estimated.

Exports Forecast

Exports from Australia are forecast to rise

at an average annual rate of 8 percent, according to government

estimates. The country supplies about 11 percent of global output and

has about 31 percent of the world’s reserves.

The expansion of new mines in Australia has been dogged in the past

by government prohibitions and opposition from environmentalists. The

Labor Party dropped its more than two-decade long ban on new uranium

mines in 2007, while leaving state governments with the power to reject

mining proposals.

While the nuclear-power boom in China and India bodes well, the

industry faces headwinds in the form of bulging inventories as the

planned mines in Australia wait for higher prices to kick in.

Both Cameco, which says price uncertainty makes it too hard to

estimate when Kintyre will begin, and Toro need long-term contract

prices to jump more than 35 percent from current levels of about $50 a

pound to make their projects viable. Contract prices are forecast to

rise to about $80 a pound in 2020, according to JPMorgan Chase & Co.

“When the market turns, we’ve seen this historically, it will

typically turn quickly and sharply, and we need to be ready,” said

Cameco’s Reilly.

Asia's projected $781 billion nuclear energy investment needs continuing international cooperation

World Nuclear Association Press Release: 15 January 2015

http://www.world-nuclear.org/Press-and-Events/Press-Statements/Asia-s-projected-%24781-billion-nuclear-energy-investment-needs-continuing-international-cooperation/

Continuing the strong cooperation between Chinese and international

nuclear companies will ensure that China can play its part in the global

nuclear supply chain.

WNA Director General Agneta Rising said:

"We must build on the international partnerships forged in

developing China's nuclear generation programme so that China can play

its part in delivering the global expansion of clean and reliable

nuclear energy the world so clearly needs."

Ms Rising was speaking at World Nuclear Spotlight 2015 conference, taking place in Beijing, China on 15 January 2015.

Ms Rising was speaking at World Nuclear Spotlight 2015 conference, taking place in Beijing, China on 15 January 2015.

The potential market for the global nuclear supply chain is set out in The World Nuclear Supply Chain: Outlook 2030 report, which is launched today by the World Nuclear Association

The report's findings including:

1. Under a reference scenario that envisages the start-up of 266

new reactors, an investment of some $1.2 trillion would be required by

2030.

2. Taking into account nuclear power plant construction and

refurbishment projects for long-term operation the international market

for suppliers could be worth $30 billion per year.

3. The largest region of growth will be Asia - primarily China -

where 47 reactors are currently under construction and a further 142 are

forecast by 2030. Investment in nuclear projects in Asia could reach

$781 billion over the period.

Press copies of The World Nuclear Supply Chain: Outlook 2030 are available on request from the media contacts listed below.

Media Contacts

Jonathan Cobb: +44(0)20 7451 1536

David Hess: +44(0)20 7451 1543

David Hess: +44(0)20 7451 1543

China Climate Pledge Needs 1,000 Nuclear Plant Effort

Don't Miss Out —

Follow us on:

Steam

rises from cooling towers at the Junliangcheng power station in

Tianjin, China. In his agreement last week with President Barack Obama,

Chinese President Xi Jinping committed to cap carbon emissions by 2030

and turn to renewable sources for 20 percent of the country’s energy.

Photographer: Tomohiro Ohsumi/Bloomberg

Nov. 21 (Bloomberg) -- China, which does nothing in small

doses, will need about 1,000 nuclear reactors, 500,000 wind

turbines or 50,000 solar farms as it takes up the fight against

climate change.

Chinese President Xi Jinping agreement last week with

President Barack Obama requires a radical environmental and

economic makeover. Xi’s commitment to cap carbon emissions by

2030 and turn to renewable sources for 20 percent of the

country’s energy comes with a price tag of $2 trillion.

The pledge would require China to produce either 67 times

more nuclear energy than the country is forecast to have at the

end of 2014, 30 times more solar or nine times more wind power.

That almost equals the non-fossil fuel energy of the entire U.S.

generating capacity today. China’s program holds the potential

of producing vast riches for nuclear, solar and wind companies

that get in on the action.

“China is in the midst of a period of transition, and that

calls for a revolution in energy production and consumption,

which will to a large extent depend on new energy,” Liang

Zhipeng, deputy director of the new energy and renewable energy

department under the National Energy Administration, said at a

conference in Wuxi outside of Shanghai this month. “Our

environment is facing pressure and we must develop clean

energy.”

‘Run its Course’

By last year, China had already become the world’s largest

producer of wind and solar power. Now, with an emerging middle

class increasingly outspoken about living in sooty cities

reminiscent of Europe’s industrial revolution, China is looking

at radical changes in how its economy operates.

“China knows that their model, which has done very well up

until recent times, has run its course and needs to shift, and

they have been talking about this at the highest levels,” said

Paul Joffe, senior foreign policy counsel at the Washington,

D.C.-based World Resources Institute.

Meeting the challenge is anything but assured. China has

already run into difficulty managing its renewables. About 11

percent of wind capacity sat unused last year because of grid

constraints, with the rate rising to more than 20 percent in the

northern provinces of Jilin and Gansu, according to the China

Renewable Energy Engineering Institute.

‘Chinese Dream’

With its huge population, China is a country accustomed to

eye-popping goals. Some have worked, such as the rapid growth

and poverty reduction from the market reforms of the past two

decades. Others, though, have exposed central planning run amok,

such as Mao Zedong’s Great Leap Forward in the 1950s to

collectivization and industrialization.

Xi sees no alternative to going big. “Letting children

live in a good ecological environment is a very important part

of the Chinese dream,” he said last week as he welcomed Asian

leaders to a summit in Beijing. His words aren’t just lip

service -- pressure is building.

Pollution Protests

Protests over pollution at least three times this summer

turned violent in Chinese cities. In Hangzhou, in the eastern

part of the country, rioters overturned cars and set fire to

police vehicles in May because of plans to build a waste

incinerator near a residential neighborhood.

In the weeks leading up to last week’s APEC summit, China

closed factories and limited traffic in Beijing so the air

wouldn’t be offensive to visiting dignitaries. In the capital,

141 enterprises were asked to cut production from Nov. 3 to Nov.

11, according to the Municipal Environmental Protection Bureau.

Xinhua News Agency said limits were placed on 3,900 plants in

Hebei province and 1,953 firms in Tianjin city.

A government previously focused on growth at all costs has

suddenly become sensitive to its environmental challenges,

activists say.

‘Social Discontent’

Smog in Beijing and Shanghai made the authorities “realize

that it has to take measures to rein in pollution, otherwise it

will cause social discontent,” said Li Shuo, a climate policy

researcher at Greenpeace East Asia. “Health is of immediate

concern to everyone.”

The targets Xi announced alongside Obama have been hailed

as a boost for negotiations at a United Nations conference

beginning Dec. 1 in Lima, Peru. Envoys from more than 190

nations are seeking to craft a global pact that world leaders

will sign next year in Paris.

The U.S. part of the deal includes a push to cut greenhouse

gas emissions to 26 to 28 percent below 2005 levels by 2025. The

current U.S. target is to reach a level of 17 percent below 2005

emissions by 2020. The Obama administration will likely have to

achieve these cuts largely through regulatory methods.

For China to succeed, it will have to install the clean

energy equivalent of Spain’s entire generating capacity each

year until 2030, according to Bloomberg New Energy Finance data.

It has achieved that only once -- last year.

‘Challenges Addressed’

“The fact is the Chinese government know they need to

clean things up,” Martijn Wilder, head of the global

environmental markets practice at law firm Baker & McKenzie,

said by phone from Sydney. “China is a developing country.

There are challenges, but those are rapidly being addressed.”

Electricity demand will rise 46 percent by 2020 and double

by 2030, according to the International Energy Agency. China

currently depends on coal for two-thirds of its energy, more

than any other Group of 20 country except South Africa.

The shift to renewables stands to benefit nuclear reactor

makers including General Electric Co. and Areva SA, along with

wind turbine manufacturers led by Xinjiang Goldwind Science &

Technology Co. and Vestas Wind Systems A/S. It also provides

expansion opportunities for China’s solar panel makers such as

Yingli Green Energy Holding Co. and Trina Solar Ltd., the two

biggest suppliers.

Energy Spending

“China, as one of the world’s biggest energy consumers,

must catch up as it lags behind other countries on energy

security and energy supply diversification,” said Chen

Kangping, chief executive officer of JinkoSolar Holding Co.,

China’s third-largest solar manufacturer.

In all, China will spend $4.6 trillion upgrading its power

industry by 2040. Nuclear and renewables alone will garner $1.77

trillion in new investment, taking 79 percent of all the funding

for power plants built in China, the IEA said in its World

Energy Outlook on Nov. 12. Fossil fuels get the remaining share.

The nuclear industry is under tighter scrutiny after the

Fukushima disaster and faces a manpower shortage. All those new

reactors will require large uranium supplies and as many as

1,000 workers each, Credit Suisse Group AG said.

Much of the change will come from a different economic mix,

said Joffe, of the World Resource Institute. China is already in

the midst of a long-term “rebalancing” of its economy,

shifting from a reliance on heavy industry to less energy-intensive service businesses, he said.

To contact Bloomberg News staff for this story:

Feifei Shen in Beijing at

fshen11@bloomberg.net;

Iain Wilson in Tokyo at

iwilson2@bloomberg.net

To contact the editors responsible for this story:

Reed Landberg at

landberg@bloomberg.net

Reg Gale

Modi Hails Indian Uranium-Supply Accord With Cameco

Don't Miss Out —

Follow us on:

The accord was announced Wednesday as Indian Prime Minister Narendra Modi visited Ottawa, the first such trip by a PM from that nation in a generation. Cameco stock rose the most in five months in Toronto.

India is the fastest growing market for nuclear power after China. The nation is extending electricity supplies to serve more of its 1.24 billion population. It operates 21 reactors; another six are being built and due to come online by 2017.

While nuclear power isn’t the cheapest option, it’s preferable from an environmental perspective, Modi said. “This is an effort to save the world from global warming and climate change,” Modi told reporters.

India’s Department of Atomic Energy will acquire 7.1 million pounds of uranium concentrate, Saskatoon, Saskatchewan-based Cameco said in a statement.

“This is a new port of entry, if you will, for Cameco’s uranium and we’re glad to have it open,” Chief Executive Officer Tim Gitzel said in a phone interview.

Cameco rose 5.7 percent to C$20.07 in Toronto, the highest close since Dec. 3.

Nuclear Fuel

“We haven’t done nuclear business with India for 40 years and to see that market open up, it’s great, not just for Cameco, but for India and Canada,” said Robert Gill, who helps manage about C$3.5 billion including Cameco shares at Lincluden Investment Management Ltd. in Oakville, Ontario.Modi said ahead of his trip that a nuclear-power accord was a priority. Canadians have a less positive outlook on supplying the fuel -- an Internet survey from the Angus Reid Institute published Tuesday showed 60 percent of respondents opposed helping develop India’s nuclear energy industry.

India already has uranium supply accords with Russia, Kazakhstan, France and Uzbekistan.

“The relatively modest supply agreement is, in our view, effectively a first step in potentially a more significant longer-term arrangement with India,” Greg Barnes, a Toronto-based analyst at TD Securities Inc., said in a note to clients.

Modi Seeks to Accelerate India-Australia Trade Pact Talks

Don't Miss Out —

Follow us on:

Nov. 18 (Bloomberg) -- Prime Minister Narendra Modi said he

wants to speed up negotiations on a comprehensive economic

partnership agreement with Australia as he seeks better access

for Indian businesses to the nation’s markets.

“This is a natural partnership arising from our shared

values, interests and strategic maritime location,” Modi told

reporters in Canberra today before addressing the Australian

Parliament.

Modi’s address comes a day after China and Australia

completed negotiations on a free-trade agreement and President

Xi Jinping told parliament he wants greater security ties with

Australia. China’s trade with Australia dwarfs that of India by

10 times and Prime Minister Tony Abbott said today he wants to

sign a trade accord with the South Asian nation by the end of

next year.

India is an “emerging, democratic superpower of Asia,”

Abbott told reporters. “The trade relationship is

underdeveloped and Prime Minister Modi and I have spent quite

some time this morning talking about what we need to do to

really crank up the trade relationship.”

Both India and Australia are seen by President Barack Obama

as important supporters of the U.S. pivot into the Asia-Pacific,

designed to counter China’s growing influence and territorial

claims in the region.

Uranium Sales

Abbott visited India in September and signed an agreement

for civil nuclear cooperation, opening the door for uranium

sales to the nation. During the visit, the nations agreed to

hold their first bilateral naval exercises in 2015.

“Security and defense are important and growing areas of

the new India-Australia partnership for our advancing regional

peace and stability,” Modi said today.

The nations agreed to extend defense cooperation to cover

research, development and industry engagement and hold

“regular” meetings of their defense ministers and military

staff, the leaders said in a joint statement.

Counter-terrorism cooperation will be enhanced to cover

transnational crimes including illegal migration.

Modi Masks

Last night, Modi addressed 21,000 people at Sydney’s

Olympic Park where he promised visas for Australian tourists

would soon be made available on arrival at Indian airports.

Supporters waved the nation’s tri-color flag and donned Modi

masks and T-shirts as they made their way into the arena.

His trip to Australia, where he attended the Group of 20

summit in Brisbane at the weekend, comes six months after his

landslide election win and is the first bilateral visit by an

Indian prime minister since 1986, according to his Twitter feed.

About 300,000 people born in India live in Australia,

according to the 2011 census. Relations between the two

countries have improved since 2009 when a wave of attacks on

Indian students studying in Melbourne, Australia’s second-biggest city, resulted in a drop in applications for student

visas.

India, which has an appetite for Australia’s coal, gold and

copper, is the nation’s 10th largest trading partner, accounting

for about A$15 billion ($13 billion) in exports and imports

including services, according to Australia’s Department of

Foreign Affairs and Trade.

Australia in December 2011 overturned a ban on uranium

exports to India initiated because the nation wasn’t a signatory

to the Nuclear Non-Proliferation Treaty. Exporting uranium to

India, which is seeking to curb power shortfalls crippling the

economy, will help Australian miners such as BHP Billiton Ltd.

and Rio Tinto Group-controlled Energy Resources of Australia

Ltd.

To contact the reporter on this story:

Jason Scott in Canberra at

jscott14@bloomberg.net

To contact the editors responsible for this story:

Rosalind Mathieson at

rmathieson3@bloomberg.net

Edward Johnson

Australia's Uranium

(Updated April 2015)http://www.world-nuclear.org/info/Country-Profiles/Countries-A-F/Australia/

- Australia's uranium has been mined since 1954, and three mines are currently operating. More are planned.

- Australia's known uranium resources are the world's largest – 31% of the world total.

- In 2014 Australia produced 5897 tonnes of U3O8 (5000 tU). It is the world's third-ranking producer, behind Kazakhstan and Canada. All production is exported.

- Australia uses no nuclear power, but with high reliance on coal any likely carbon constraints on electricity generation will make it a strong possibility.

- In 2015 the South Australian government set up a royal commission into the potential for nuclear power.

Contents

- Operating mines

- Prospective mines and expansion

- Economic benefits of mining uranium

- Uranium exports from Australia

- Uranium resources

- Nuclear power prospects in Australia

- UMPNER report 2006 and follow-on

- National Generators Forum 2006

- IFNEC participation

- ATSE action plan 2014

- SA royal commission 2015

- Earlier background to considering nuclear power

- Electricity options

- Radioactive wastes

- Research & development, isotope production

- Appendix: A brief history of Australian uranium mining

The Australian economy is unique in the OECD in that about 20% of GDP

is accounted for by mining and mining services (in 2012). Uranium is a

small part of this economically, but in energy terms, uranium (3944 PJ

in 2012-13) comprises one-quarter of energy exports.

In the 1930s ores were mined at Radium Hill and Mount Painter in SA

to recover radium for medical purposes. As a result a few hundred

kilograms of uranium were also produced.

Uranium ores as such were mined and treated in Australia initially from the 1950s until 1971. Radium Hill, SA, Rum Jungle, NT, and Mary Kathleen,

Queensland, were the largest producers of uranium (as yellowcake).

Production ceased either when ore reserves were exhausted or contracts

were filled. Sales were to supply material primarily intended for USA

and UK weapons programs at that time. However, much of it was used for

electricity production.

The development of civil nuclear power stimulated a second wave of

exploration activity in the late 1960s. A total of some 60 uranium

deposits were identified from the 1950s through to the late 1970s, many

by big companies with big budgets. (Since then only two significant new

ones have been found: Kintyre and Beverley Four Mile. The minor

exploration boom 2002-07 was driven by small companies focused on

proving up known deposits.)

Mary Kathleen began recommissioning its mine and mill in 1974. Other

developments were deferred pending the findings of the Ranger Uranium

Environmental Inquiry, and its decision in the light of these. Mary

Kathleen's second production phase was1976 to the end of 1982.

The Commonwealth Government announced in 1977 that new uranium mining

was to proceed, commencing with the Ranger project in the Northern

Territory. This mine opened in 1981. In 1979, Queensland Mines opened Nabarlek

in the same region of Northern Territory. The orebody was mined out in

one dry season and the ore stockpiled for treatment from 1980. The mine

site is now rehabilitated.

A brief history of Australian uranium mining is appended. See also Former Australian Uranium Mines appendix.

Australian Uranium Production and Exports

| 2005-06 | 2006-07 | 2007-08 | 2008-09 | 2009-10 | 2010-11 | 2011-12 | 2012-13 | 2013-14 | ||

| Production | tonnes U3O8 | 9949 | 9581 | 10095 | 10278 | 7150 | 7036 | 7701 | 8954 | 5512 |

|---|---|---|---|---|---|---|---|---|---|---|

| Exports | tonnes U3O8 | 10252 | 9518 | 10151 | 10114 | 7555 | 6950 | 6917 | 8391 | 6702 |

| Exports | $A million | 545 | 658 | 887 | 1030 | 758 | 610 | 607 | 823 | 622 |

For tU, divide by 1.1793.

Production and export by calendar year:

| 2002 | 2003 | 2004 | 2005 | 2006 | 2007 | 2008 | 2009 | 2010 | 2011 | 2012 | 2013 | 2014 | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| production (tonnes U3O8) |

8083 | 8930 | 10592 | 11217 | 8954 | 10145 | 9941 | 9413 | 6958 | 7056 | 8244 | 7488 | 5897 |

| production (tonnes U) |

6854 | 7572 | 8982 | 9512 | 7593 | 8603 | 8430 | 7982 | 5900 | 5983 | 6991 | 6350 | 5000 |

| exports (tonnes U3O8) |

7637 | 9612 | 9648 | 12360 | 8660 | 10232 | 9663 | 9706 | 6888 | 6628 | 8116 | 7317 | |

| exports (tonnes U) |

6476 | 8151 | 8181 | 10481 | 7344 | 8676 | 8194 | 8230 | 5841 | 6170 | 6882 | 6205 | |

| exports (A$ million FOB) |

363 | 398 | 411 | 573 | 529 | 881 | 749 | 1116 | 608 | 586 | 776 | 705 | |

| export value* ($A/kg U3O8) |

47.57 | 41.41 | 42.58 | 46.36 | 61.06 | 86.11 | 77.54 | 114.9 | 88.3 | 88.4 | 95.6 | 96.2 | |

| export value* (US$/lb U3O8) | 11.73 | 12.24 | 14.22 | 16.03 | 20.88 | 32.77 | 50.24 | 48.77 |

* $A from declared net FOB estimates, $US calculated from this.

Source: Dept of Resources, Energy & Tourism

Source: Dept of Resources, Energy & Tourism

Recent Production from Individual Mines

(tonnes of U3O8)

(tonnes of U3O8)

| 2005-06 | 2006-07 | 2007-08 | 2008-09 | 2009-10 | 2010-11 | 2011-12 | 2012-13 | 2013-14 | |

|---|---|---|---|---|---|---|---|---|---|

| Ranger | 5183 | 5256 | 5273 | 5678 | 4262 | 2677 | 3284 | 4313 | 1113 |

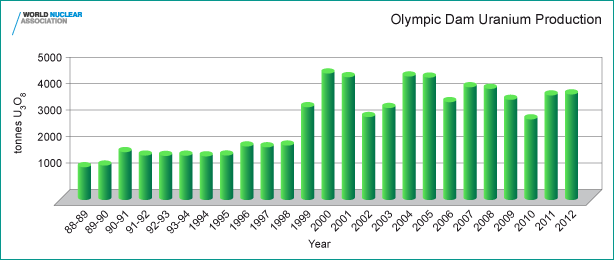

| Olympic Dam | 3912 | 3474 | 4115 | 3974; | 2258 | 4012 | 3853 | 4064 | 3988 |

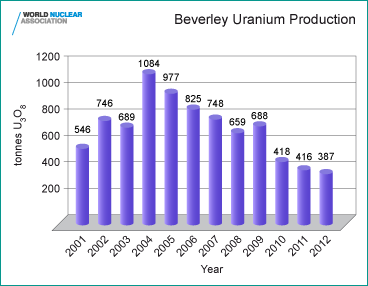

| Beverley | 854 | 847 | 707 | 626 | 630 | 347 | 413 | 453 | 188 |

| Honeymoon | 0 | 151 | 124 | 37 | |||||

| Four Mile | 0 | 186 | |||||||

| Total | 9949 | 9577 | 10095 | 10278 | 7150 | 7036 | 7701 | 8954 | 5512 |

Calendar year 2011 production of U3O8:

2641 t from Ranger, 3954 t from Olympic Dam, 416 t from Beverley, 45 t

from Honeymoon, total 7056 tonnes (5983 tU). Calendar year 2012 U3O8

production: 3710 t from Ranger, 3992.5 t from Olympic Dam, 386.7 t from

Beverley, 154.6 t from Honeymoon, total 8244 tonnes (6990.6 tU).

Calendar year 2013 U3O8 production: 2960 t from Ranger, 4008.7 t from Olympic Dam, 407.4 t from Beverley, 112 t from Honeymoon, total 7488 tonnes (6349.6 tU).

Calendar year 2013 U3O8 production: 2960 t from Ranger, 4008.7 t from Olympic Dam, 407.4 t from Beverley, 112 t from Honeymoon, total 7488 tonnes (6349.6 tU).

Operating mines

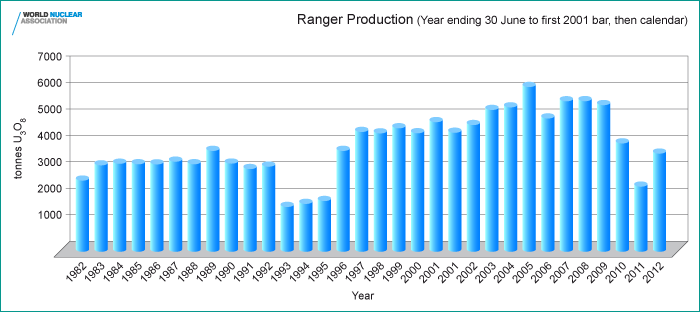

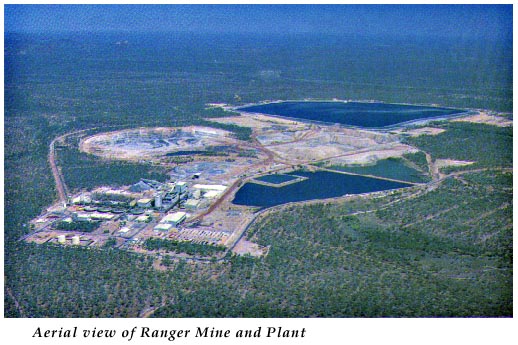

The Ranger mine

and associated town of Jabiru is about 230 kilometres east of Darwin,

in the Northern Territory, surrounded by the Kakadu National Park, a

major tourist attraction. The mine opened in 1981 at a production rate

of approximately 3300 tonnes per year of uranium oxide and has since

been expanded to 5500 t/yr capacity. Mining of the second pit was 1997

to 2012, and this is now being backfilled. Treatment is conventional

acid leach. Future development will be underground, and application was

made for approval of this in January 2013. A final decision of whether

to mine the Ranger Deeps is expected at the end of 2014. Ranger is owned

by Energy Resources of Australia Ltd (ERA), a 68.39% subsidiary of Rio

Tinto.

During 1988 the Olympic Dam project,

then a joint venture of Western Mining Corporation and BP Minerals,

commenced operations about 560 km north of Adelaide, in an arid part of

South Australia. The massive deposit is underground, some 350 metres

below the surface, and is the largest known uranium orebody in the

world. The large underground mine produces copper, with gold and uranium

as major by-products. Annual production capacity for uranium oxide has

been expanded from 1800 to 4600 tonnes U3O8.

It is now owned by BHP Billiton, following its 2005 takeover of WMC

Resources. There are plans to greatly increase the mine's size and

output, by accessing the orebody with a huge open pit, about 4.1 x 3.5

km and 1000m deep. (Further details below)

About 80% of the uranium is recovered in conventional acid leach of

the flotation tailings from copper recovery. Most of the remaining 20%

is from acid leach of the copper concentrate, but that concentrate then

still contains up to 0.15% uranium. Hence the copper must be smelted at

site, since selling it to overseas smelters would create both processing

and safeguards complications for the smelter operator. This could

change as part of a major envisaged expansion.

Both Ranger and the now-closed and rehabilitated Nabarlek mines are

on aboriginal land in the Alligator Rivers region of the Northern

Territory. Aboriginal people receive royalties of 4.25% on sales of

uranium from Northern Territory mines. The total received simply from

Ranger is now over $207 million, and $14 million came from Nabarlek.

The Olympic Dam mine is on formerly pastoral land in the middle of

South Australia. A town to accommodate 3500 people was built at Roxby

Downs to service the mine. The 18,000 ha mine lease is managed as a

nature reserve.

The small Beverley mine

in South Australia started operation late in 2000, 520 kilometres north

of Adelaide, on the plains north-west of Lake Frome. It was Australia's

first in situ leach (ISL) mine, accessing a palaeochannel deposit in

sand in a saline aquifer. It was licensed to produce 1180 t/yr U3O8

(1000 tU), and reached this level in 2004, though production has

declined since. It is owned and operated by Heathgate Resources Pty Ltd,

an associate of General Atomics in the USA. In December 2010 the

company received government approval to mine the Beverley North

deposits, and in the last two years of operation almost all production

through the Beverley plant came from this north orebody which is

contiguous with the Four Mile deposits. Mining of Beverley ceased at the

end of 2013, and of Beverley North early in 2014.

The Four Mile leases are contiguous with Beverley, and mining the

east orebody by ISL commenced in April 2014. Resources are split between

the west and the east orebodies, and the northeast orebody is also

prospective. Uranium recovery is through Heathgate’s Pannikin satellite

ion exchange plant then trucking the loaded resin to the main Beverley

plant for stripping (elution) and precipitation, as is done at two US

mines. Alliance Resources Ltd is a 25% free-carried joint venture

partner after Heathgate's Quasar subsidiary farmed into the project.

Production is at about 1200 t U3O8 per year.

The Honeymoon

ISL mine in South Australia commenced operation in 2011. The owners

received government approval to proceed with ISL mine development in

November 2001 but reassessed its ore reserves and Uranium One, based in

Toronto, finally moved to development in 2007. In 2008 Mitsui agreed to

join the project as 49% joint venture partner, and a construction

contract was then let. Operations were ramping up to 400 t/yr. In 2012

production was expected to be 275 tonnes U3O8,

at $47/lb – three times the average cost of production in Kazakhstan.

In fact it produced less. Mitsui largely funded the development and

commissioning, but then withdrew from the project in 2012. In November

2013 Uranium One closed the mine and put it on care and maintenance

until uranium prices improved.

For more detail of mines, see paper: Australia's Uranium Mines.

Uranium resources at mines and major deposits (tonnes U3O8)

| Mine or deposit | type | Reserves | Measured & Indicated Resources |

Inferred Resources |

|---|---|---|---|---|

| Ranger | hard rock, open pit | 9,675 | 63,377 | |

| Olympic Dam | hard rock, underground | 358,530 | 1,749,800 | 749,570 |

| Beverley | palaeochannel, ISL | 21,000? | ||

| Honeymoon | palaeochannel, ISL | 2,890 | 5,400 | |

| Jabiluka | hard tock, underground | 67,700 | 16,440 | 57,500 |

| Four Mile | palaeochannel, ISL | 14,000 | 17,700 | |

| Samphire | palaeochannel and basement granite | 19,000 | ||

| Kintyre | hard rock | 25,600 | 2,400 | |

| Yeelirrie | calcrete | 52,500 | ||

| Wiluna | calcrete | 11,000 | ||

| Mulga Rock | palaeochannel and lignite | 27,100 | ||

| Valhalla | hard rock | 24,765 | 5,860 | |

Resources are additional to reserves.

Prospective mines and expansion

The Jabiluka

uranium deposit in the Northern Territory was discovered in 1971-73, 20

kilometres north of Ranger. It is surrounded by the Kakadu National

Park, but the mine lease area is excluded from the National Park and

adjoins the Ranger lease. It has resources of over 130 000 tonnes of

uranium oxide, and is one of the world's larger high-grade uranium

deposits. A mining lease was granted in 1982 but development was stalled

due to disagreements with the Aboriginal traditional owners. Then with

the Australian Labor Party coming to power in the 1983 federal election,

Commonwealth approval was withdrawn and development ceased. In 1991

Energy Resources of Australia (ERA), the operator of the adjacent Ranger

mine, bought the Jabiluka lease from Pancontinental for A $125

million.

Following the 1996 change of government and further approvals,

development of the underground mine proceeded with an 1150 metre access

decline and a further 700 metres of excavation around the orebody.

However, mining was deferred until agreement could be reached regarding

treatment of Jabiluka ore at the Ranger mill. ERA (whose parent company

is Rio Tinto) will not proceed with the mine until there is agreement

from the local Mirrar Aboriginal people.

For Olympic Dam BHP

Billiton undertook a major feasibility study on greatly expanding the

mine, and in 2009 it released the 4600-page environmental impact

statement for the project. This was approved by state and federal

governments in October 2011. The plan is to develop a large open pit

with associated infrastructure over 11 years and lift uranium production

to 19,000 tonnes U3O8

per year. The open pit would mean that up to 98% of the ore is mined

rather than 25% of it. Most of the uranium would be separated at the

mine, but up to 2000 t/yr would be exported in copper concentrates,

requiring a smelter for these in China or Japan which is subject to

safeguards. New infrastructure would include a 280 ML/day desalination

plant on Spencer Gulf, supplying 200 ML/day to the operation, and 650

MWe increase in power supply. The present underground mining would

continue in the narrow northern part of the orebody. However, in August

2012 the company said that it would investigate a new and less-costly

design for its planned open-pit expansion, which meant it could not

approve the project in time to meet a government deadline in December.

In November 2012 the state government granted a four-year extension,

conditional on the company spending $650 million on pre-project research

on heap leaching and on community work.

In November 2014, in a general announcement about productivity, BHP

Billiton flagged a 27% increase in copper production at Olympic Dam from

2018, and a doubling from that level subsequently by “a low-risk

underground expansion with significantly lower capital intensity than

the previous open cut design. This has the potential to deliver over

450,000 tonnes of copper production a year at first quartile C1 costs by

the middle of next decade”. The uranium implications were not

mentioned, but assuming the same ore as today, it would mean about 5000 t

U3O8 (4200 tU) per year from 2018 and some 9400 t U3O8 (8000 tU) per year in mid-2020s.

Cameco and Mitsubishi (70:30%) bought the Kintyre deposit

in WA in 2008 from Rio Tinto for uS$ 495 million. Cameco initially

envisaged starting mine construction in 2013 and operation in 2015, to

produce 2700 to 3600 t U3O8 per year for 15 years. In mid-2012 Cameco put the project on hold pending firmer uranium prices or lower development costs.

BHP Billiton applied to bring its Yeelirrie, WA, deposit into production and projected 2000 t/yr U3O8 production

from 2014, though in February 2010 approval was sought for production

at 3500 t/yr. However, in 2011 the project was wound down due to high

treatment costs and in 2012 it was sold to Cameco for US$ 340 million.

In November 2014 Cameco requested the WA EPA to cancel the earlier

environmental application, and submit a new one involving production at

7500 t U3O8 per year, and to assess the application under new 2012 EPA procedures.

Toro Energy is well advanced with plans to produce 750 t/yr U3O8 from its Wiluna

project, comprising the shallow Lake Way and Centipede-Millipede

deposits and the nearby Lake Maitland deposit in WA, from 2016.

Energy & Minerals Australia is developing the Mulga Rock deposits in WA, with ISL production targeted for 2014, and that from lignite in 2016.

The largest prospective Queensland mine is Paladin's Valhalla, 40 km north of Mount Isa. This is a major deposit but was stalled to 2012 by state government policies.

UraniumSA Ltd has its Samphire project south of

Whyalla on the Eyre Peninsula. Both main orebodies are amenable to ISL

mining, though the aquifers are very saline. In 2011 further

mineralisation, some high-grade, was identified in or on the granite

basement opening up the prospect of open pit mining.

There has been increasing foreign equity in Australian uranium

deposits. As well as the Honeymoon, Kintyre and Yeelirrie projects

above, in February 2009 Mega Uranium sold 35% of the Lake Maitland

project to the Itochu Corporation (10% of Japanese share) and Japan

Australia Uranium Resources Development Co. Ltd. (JAURD), acting on

behalf of Kansai Electric Power Company (50%), Kyushu Electric Power

Company (25%) and Shikoku Electric Power Company (15%) for US$ 49

million. In 2006 Sinosteel bought 60% of Pepinini's Curnamona project

for A$ 31 million, and in 2009 China Guangdong NPC bought 70% of Energy

Metals' Bigrlyi project for A$ 83.6 million. Both are early-stage

exploration ventures.

For more detail of mine prospects see paper: Australia's Uranium Deposits and Prospective Mines.

Economic benefits of mining uranium

About 1200 people are employed in uranium mining, at least 500 in

uranium exploration, and 60 jobs are in regulation of uranium mining.

Uranium mines generate about A$ 21 million in royalties each year (in

2005: Ranger $13.1 million, Beverley $1.0 million and Olympic Dam $6.9

million attributable to uranium). Corporate taxes amount to over $42

million per year.

Uranium exports from Australia

Australian production is all exported, and over the six years has averaged over 8600 t/yr U3O8,

and in 2012 provided 12% of world uranium supply from mines. Uranium

comprises about 35% of the country's energy exports (4150 PJ av) in

thermal terms.

Australia's uranium is sold strictly for electrical power generation only, and safeguards are

in place to ensure this. Australia is a party to the Nuclear

Non-Proliferation Treaty (NPT) as a non-nuclear weapons state. Its

safeguards agreement under the NPT came into force in 1974 and it was

the first country in the world to bring into force the Additional

Protocol in relation to this – in 1997. In addition to these

international arrangements Australia requires customer countries to have

entered a bilateral safeguards treaty which is more rigorous than NPT

arrangements.

The value of Australia's uranium oxide concentrate exports is

considerable, and in 2009 they reached a value of over A$ 1.1 billion.

However, production problems at Olympic Dam from late 2009 into 2010 set

production back considerably over those two years, then the Fukushima accident in March 2011 softened prices.

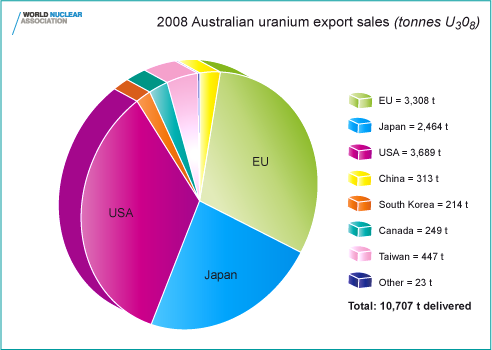

In 2013, U3O8 sales were to North America

(mainly USA) 2201 t (33.6%), Europe 2480 t (37.8%) and Asia 1873 t

(28.6%). (These figures are deliveries of Australian product to

customers’ converter accounts and exclude third party material purchased

to fulfill contract obligations.)

The nations which currently purchase Australia's uranium are set out

below, though up to date details on country destinations is not

available. All have a large commitment to nuclear power:

The USA generates around 30% of the world's nuclear power. Much of

its uranium comes from Canada, but Australia is a major source. Europe

depends heavily on nuclear power and EU countries are also major

customers. Japan, South Korea and now China are important customers due

to their increasing dependence on nuclear energy.

Customer countries' contracted imports of Australian uranium oxide

concentrate may be summarised as follows, though detailed information

has not been readily available in recent years: (see also the reactor table):

- USA: up to 5000 tonnes per year (the apparent level in 2013).

- EU: up to 3500 tonnes per year, including Belgium, Finland, France, Germany, Spain, Sweden, UK. Apparently about 2300 t in 2013.

- Japan: up to 2500 tonnes per year.

- South Korea: up to 1500 tonnes per year.

- China: about 500 tonnes per year.

- Taiwan: up to 500 tonnes per year.

- Canada and South Africa: both are uranium producer countries with nuclear power plants and which buy a small amount from Australia occasionally.

Australia is a preferred uranium supplier to world, especially East

Asian, markets where demand is growing most rapidly. In 2006 a bilateral

agreement was concluded with China, enabling exports there, and in 2007

a similar agreement was signed with Russia, which came into force in

2010. An agreement with the United Arab Emirates (UAE) came into force

in 2014, making the total 22 (covering 47 countries) and another with

India is being negotiated. Australia could readily increase its share of

the world market because of its low cost resources and its political

and economic stability.

As well as uranium sold to overseas customers (mainly utilities) by

the four mining companies, Energy Metals Ltd, an exploration company

with majority Chinese ownership, has an export permit. In December 2011

it announced the sale of 68 tonnes of U3O8 to

its parent company, China General Nuclear Power, for shipment in 2012.

(CGN’s wholly-owned subsidiary, China Uranium Development Co., is Energy

Metals’ largest shareholder with a 60.6% stake. The company sources

uranium from Australian producers.)

Environmental aspects of uranium exports are notable: Shipping 7000 tonnes of U3O8 as

in 2010 is the energy equivalent of shipping 140 million tonnes of

thermal coal. Australia's present thermal coal exports are over 100

million tonnes, requiring between 3,000 and 4,000 voyages of bulk

carriers through environmentally sensitive regions such as the Great

Barrier Reef. Export coal also has an environmental impact through the

provision of harbours and railways.

Uranium resources

On the basis of December 2012 data Australia has 29% of the world's

uranium resources (under US$ 130/kg) – 1.7 million tonnes of uranium.

Almost half of Australia's 1.174 million tonnes of Reasonably Assured

Resources of uranium in this price category were actually in the under

$80/kg U category when this was last reported.

The world’s Reasonably Assured plus Inferred Resources in the $130/kg category are tabulated in the Supply of Uranium information paper.

A review of Australia’s uranium is provided in Australia’s Uranium: Resources, Geology and Development of Deposits.

The vast majority of Australia's uranium resources to $130/kgU) are

within five deposits: Olympic Dam (the world's largest known uranium

deposit), Ranger, Jabiluka, Kintyre and Yeelirrie.

Despite restrictive state government policies and perhaps in

anticipation of their disappearance, uranium exploration gathered pace

during 2006, with more than 200 companies professing an interest,

compared with 34 the previous year, and A$ 80 million being spent.

Expenditure then more than doubled, to A$ 182 million in 2007, A$ 227

million in 2008, A$ 180 million in 2009 and A$ 190 million in 2011. It

then declined abruptly to A$ 98 million in 2012.

Uranium exploration has been illegal in Victoria and New South Wales,

and remains so in Victoria. Uranium mining is being reinstated in

Queensland after a few years break.

Nuclear power prospects in Australia

Australia has a significant infrastructure to support any future

nuclear power program. As well as the Australian Nuclear Science &

Technology Organisation (ANSTO), which owns and runs the modern 20 MWt

Opal research reactor, there is a world-ranking safeguards set-up – the

Australian Safeguards & Non-proliferation Office (ASNO), the

Australian Radiation Protection and Nuclear Safety Agency (ARPANSA) and a

well-developed uranium mining industry.

However, in contrast to most G20 countries, the main driver for

nuclear power in Australia is reduction of CO2 emissions, or costs

arising from that. Apart from that, Australia's huge coal resources and

significant natural gas underwrite energy security and provide low-cost

power.

There are several legal hurdles impeding consideration of nuclear

power for Australia. NSW has a Uranium Mining and Nuclear Facilities

(Prohibition) Act 1986, and Victoria has a Nuclear Activities

(Prohibitions) Act 1983. Federally, the Environment Protection and

Biodiversity Conservation Act 1999 and Australian Radiation Protection

and Nuclear Safety Act 1988 will need to be amended to remove

prohibitions against effective regulation of nuclear power.*

*The ARPANS Act 1998 has section 10 Prohibition on certain nuclear installations, and the EPBC Act 1999 much the same in section 140A. ARPANS Act section 10:

- Nothing in this Act is to be taken to authorise the construction or operation of any of the following nuclear installations:

- (a) a nuclear fuel fabrication plant;

- (b) a nuclear power plant;

- (c) an enrichment plant;

- (d) a reprocessing facility.

- The CEO must not issue a licence under section 32 in respect of any of the facilities mentioned in subsection (1).

Fuller details and context are on the Decarbonise SA website.

UMPNER report 2006 and follow-on

In December 2006 the report of the Prime Minster's expert taskforce

considering nuclear power was released. It said nuclear power would be

20-50% more expensive than coal-fired power and (with renewables) it

would only be competitive if "low to moderate" costs are imposed on

carbon emissions (A$ 15-40 – US$ 12-30 – per tonne CO2). "Nuclear power

is the least-cost low-emission technology that can provide base-load

power" and has low life cycle impacts environmentally.

The then Prime Minister said that in the context of meeting increased

energy needs while reducing greenhouse gas emissions "if we are to have

a sensible response we have to include nuclear power". "The report

provides a thorough examination of all aspects of the nuclear fuel cycle

and the possible role of nuclear power in generating electricity in

Australia in the longer term. It provides a clear and comprehensive

analysis of the facts surrounding the nuclear industry and debunks a

number of myths. I am certain that the report will make a significant

contribution to informing public debate on these issues."

The report said that the first nuclear plants could be running in 15

years, and looking beyond that, 25 reactors at coastal sites might be

supplying one-third of Australia's (doubled) electricity demand by 2050.

Certainly "the challenge to contain and reduce greenhouse gas emissions

would be considerably eased by investment in nuclear plants." "Emission

reductions from nuclear power could reach 8 to 18% of national

emissions in 2050".

In April 2007 the Prime Minister announced that the government would

proceed to open the way for nuclear power in Australia by setting up a

nuclear regulatory regime and removing any regulatory obstacles which

might unreasonably stand in the way of building nuclear power plants.

Australia would also apply to join the Generation IV International

Forum, which is developing advanced reactor designs for deployment about

2025. The government would also take steps to remove impediments to

uranium mining. "Policies or political platforms that seek to constrain

the development of a safe and reliable Australian uranium industry – and

which rule out the possibility of climate-friendly nuclear energy – are

not really serious about addressing climate change in a practical way

that does not strangle the Australian economy."

In June 2007 the emissions trading taskforce report proposed that

Australia should move steadily to implement an emissions trading scheme

by 2012. While Australia cannot afford to wait upon a global regime, its

own should be devised so as to avoid the shortcomings of present

schemes and also articulate internationally. Both emission reduction

targets and carbon price would be low initially and ramp up. The need

for a trading scheme "more comprehensive, more rigorously grounded in

economics and with better governance than anything in Europe" was noted.

It would be designed to appeal to developing nations. The cost

increment on coal-fired power generation brought about by a carbon

emission cost would be likely to make nuclear power competitive in

Australia.

With a change of government late in 2007 the move towards nuclear

power was halted and the implementation of an emissions trading scheme

became bogged down in political rhetoric.

National Generators Forum 2006

Any proposal for building nuclear power plants would need to be

brought forward by generating companies. The National Generators Forum

published a report in 2006 on Reducing Greenhouse Gas Emissions from Power Generation

which concluded that "Stabilising emissions at present levels and

meeting base-load requirements could be achieved with nuclear power at

comparatively modest cost." While projected cost increases to 2050 could

be more than 120%, using nuclear power would halve the increase. "At

$20 per tonne of CO2 price, nuclear starts to become more cost-effective

than current fossil fuel technologies."

Cooling will be a major issue in respect to future base-load

generating capacity in Australia. At present about 80% of electricity is

produced from coal-fired plants, mostly cooled by evaporating water in

cooling towers. An estimated 400 GL/yr of fresh water is thus evaporated

and lost - about the same as Melbourne's water use. In the light of

widespread shortage of fresh water, cooling of nuclear plants would need

to be by seawater, hence coastal sites would be required* and to the

extent that nuclear plants actually replaced coal-fired plants, a very

large amount of fresh water would be freed up for other uses. Coastal

location of nuclear plants would also give rise to the possibility of

cogeneration, using waste heat or surplus heat for desalination and

production of potable water.

* A coal plant is normally sited on a coalfield

(inland), so does use a lot of water for evaporative cooling towers. A

nuclear plant can be anywhere, from the point of view of fuel supply.

IFNEC participation

In September 2007 Australia was one of eleven countries joining the

five founders in the Global Nuclear Energy Partnership (now the

International Framework for Nuclear Energy Cooperation – IFNEC).

Australia made it a condition that it is not obliged to accept any

foreign nuclear wastes, and it reserved the right to enrich uranium in

the future. In the lead up to this Australia and the USA finalized a

joint action plan for civil nuclear energy cooperation including R&D

and regulatory issues.

ATSE action plan 2014

In July 2013 the Australian Academy of Technological Sciences and

Engineering (ATSE) held a two-day conference on nuclear power for

Australia. This resulted in an action plan

in 2014, which included comparing the nuclear option with alternative

energy scenarios in the 2030-2050 timeframe, reviewing current policies

which preclude consideration of nuclear power, commence open and active

community engagement, building on overseas R&D program linkages.

SA royal commission 2015

In February 2015 the Labor state government of South Australia set up a royal commission

into the potential for nuclear power in that state, which already

produces two-thirds of Australia’s uranium. The terms of reference

include fuel cycle and high-level waste disposal as well as power

generation, and it is to report by May 2016. The inquiry is supported by

the state Liberal (conservative) opposition and the federal Liberal

coalition government, but not by the federal Labor party (though it

supports uranium mining). Assuming that the royal commission’s findings

are positive, the main question is: to what extent will they be accepted

nationally? Certainly before any nuclear capacity was built anywhere,

federal laws would need to be changed.

The first of four issues papers was published in April 2015. On

uranium exploration, ming and milling. Others will follow on: fuel

conversion, enrichment, fabrication and reprocessing; electricity

generation; and waste management. The due date for written submissions

is 24 July 2015.

Insofar as the royal commission will direct future power investment

in SA, the question of reactor unit size arises. At present the unit

size of any generating unit there is regulated at 260 MWe, though

modelling has shown 500 MWe units are possible. Small modular reactors

would therefore be indicated. But if transmission links were expanded a

SA nuclear power plant with large reactors could serve the eastern

states.

Earlier background to considering nuclear power

See also WNA's Appendix on Australian Research Reactors.

In 1953 the Australian Parliament passed the Atomic Energy Act, which

established the Australian Atomic Energy Commission (AAEC). AAEC's

functions included advising the Government on nuclear energy matters,

and the Commission quickly decided that effective and informed advice

could only be provided if there was underlying expertise directly

available to it. Hence in 1955 it established a research establishment

at Lucas Heights, near Sydney and began assembling a world class team of

scientists and engineers. It also began construction of a materials

testing reactor, HIFAR, which first achieved criticality and started up

on Australia Day, in January 1958.

The AAEC's research program was initially very ambitious and included

studies of two different power reactor systems, on the base of

substantial multi-disciplinary research in the fields of physics,

chemistry, materials science and engineering. Later, recognising

Australia's potential as a source of uranium, AAEC also undertook an

experimental research program in the enrichment of uranium.

The AAEC also initially convinced the Government that there would be

benefits from the construction of a "lead" nuclear power station on

Commonwealth land at Jervis Bay, south of Sydney. After competitive bids

were obtained, a reshuffle of leadership in the Government led to a

loss of interest in the proposal and the project was eventually

abandoned in 1972.

In the late 1950s nuclear power was considered for the large new

power station at Port Augusta in SA, which was eventually commissioned

in 1963 to burn very low-grade coal from Leigh Creek. In the late 1960s

Victoria's State Electricity Commission undertook preliminary studies on

building a large nuclear plant on French Island in Westernport. In 1969

the South Australian government proposed a nuclear power plant in SA to

supply the eastern states' grid. Then in 1976 the SA government in its

submission to the Ranger Uranium Inquiry said nuclear power appeared

inevitable for SA, perhaps by 2000.

In 1981, the government's National Energy Advisory Committee

presented a report on the administrative and legal issues associated

with any domestic nuclear power program. It recommended that "the

commonwealth, state and Northern Territory governments should develop

with minimum delay a legal framework using complementary legislation as

appropriate for licensing and regulating health, safety and

environmental and third party liability aspects."

In Australia the possibility of nuclear power is hindered in Victoria

and NSW, by legislation enacted by previous governments. In Victoria

the Nuclear Activities (Prohibitions) Act 1983 prohibits the

construction or operation of any nuclear reactor, and consequential

amendments to other Acts reinforce this. In NSW the Uranium Mining and

Nuclear Facilities (Prohibitions) Act 1986 is similar. In 2007 the

Queensland government enacted the Nuclear Facilities Prohibition Act

2006, which is similar (but allows uranium mining).

Electricity options

Coal provides the majority of Australia's electricity, and the full picture is given in the paper Australia's Electricity,

as an Appendix to this. This also accounts for most of the 200 Mt/yr

carbon dioxide emissions from electricity and heat production and uses

up about 400 GL/yr of fresh water for evaporative cooling. Preliminary

IEA figures show 2013 generation of 247 TWh, 64% from coal and 20.5%

from gas

Australia is fortunate in having large easily-mined deposits of coal

close to the major urban centres in the eastern mainland states. It has

been possible to site the major power stations close to those coal

deposits and thus eliminate much of the cost and inconvenience of moving

large tonnages of a bulky material. Energy losses in electricity

transmission are relatively low.

Western and South Australia have relatively less coal but plenty of

gas and also lower demand for electricity. More than half of their

electricity is derived from burning gas. Development of Tasmania's large

hydro-electric resources has put off the day when it needs any large

thermal power stations, but hydro potential is now almost fully

utilised.

In the next 15 years or so Australia is likely to need to replace the

oldest quarter of its thermal generating capacity, simply due to old

age. This is at least 8000 MWe, practically all coal-fired. If it were

replaced by gas-fired plant, there would be a reduction of about 25-30

million tonnes of CO2 emissions per year. If it were replaced by say six

nuclear reactors there would be a reduction of about 50 million tonnes

of CO2 emissions per year. Every 22 tonnes of uranium (26 t U3O8) used

saves the emission of one million tonnes of CO2 relative to coal.

In other parts of the world as well as Western and South Australia,

there was a conspicuous "flight to gas" in the late 1990s while gas

prices were low. Generating plant to utilise gas is relatively cheap and

quickly built, and at the point of use, gas-fired electricity does

cause only half the greenhouse emission of coal. It is clearly an option

to utilise more gas for electricity in Australia if low gas prices can

be maintained many years ahead.

Moving to gas would be seen by some as a great step forward for the

environment. Others would see it as a tragic waste of a valuable and

versatile energy resource. Gas can be reticulated to homes and factories

to be burned there at much greater efficiency overall.

In January 2007 the Energy Supply Association of Australia (ESAA)

completed a study on electricity supply options relative to CO2 emission

constraints in meeting projected load in 2030. For a 67% increase in

electricity load, greenhouse gas emission targets of 140%, 100% and 70%

of 2000 levels were modeled, with three supply options: all credible

technologies; without nuclear; and without both nuclear and fossil fuel

(with carbon capture and storage). Constraining CO2 emissions would

require nuclear contributing 20% of the power, with overall about 30%

increase in costs, hence a need for costing carbon to cover this. ESAA

concluded that "the widest possible range of generation technologies

will be needed."

Radioactive wastes

While Australia has no nuclear power producing electricity, it does

have well-developed usage of radioisotopes in medicine, research and

industry. Many of these isotopes are produced in the research reactor at

Lucas Heights, near Sydney, then used at hospitals, industrial sites

and laboratories around the country.

Each year Australia produces about 45 cubic metres of radioactive

wastes arising from these uses and from the manufacture of the isotopes –

about 40 m3 low-level wastes (LLW) and 5 m3 intermediate-level wastes

(ILW). These wastes are now stored at over a hundred sites around

Australia. This is not considered a suitable long-term strategy.

Since the late 1970s there has been an evolving process of site

selection for a national radioactive waste repository for LLW and

short-lived ILW. There has also been consideration of the need to locate

a secure storage facility for long-lived intermediate-level wastes

including those which will be returned to Australia following the

reprocessing of used fuel from Lucas Heights. Eventually, disposal

options for this will need to be considered also.

Low-level wastes and short-lived intermediate-level wastes will be

disposed of in a shallow, engineered repository designed to ensure that

radioactive material is contained and allowed to decay safely to

background levels. Dry conditions will allow a simpler structure than

some overseas repositories. The material will be buried in drums or

contained in concrete. The repository will have a secure multi-layer

cover at least 5 metres thick, so that it does not add to local

background radiation levels at the site.

There is a total of about 3700 cubic metres of low-level waste

awaiting proper disposal, though annual arisings are small (the 40 cubic

metres would be three truckloads). Over half of the present material is

lightly-contaminated soil from CSIRO mineral processing research

decades ago (and could conceivably be reclassified, since it is no more

radioactive than many natural rocks and sands).

Long-lived intermediate-level (category S) wastes will be stored

above ground in an engineered facility designed to hold them secure for

an extended period and to shield their radiation until a geological

repository is eventually justified and established, or alternative

arrangements made.

There is about 500 cubic metres of category S waste at various

locations awaiting disposal, and future annual arisings will be about 5

cubic metres from all sources including states & territories,

Commonwealth agencies and from radiopharmaceutical production, plus the

returned material from reprocessing spent ANSTO research reactor fuel in

Europe. This will be conditioned by vitrification or embedding in

cement, and some 26 cubic metres of it is expected by about 2020.

In March 2012 parliament passed the National Radioactive Waste

Management Bill 2010 which provides for a national repository for

low-level wastes and store for intermediate-level wastes, on land which

has been volunteered by its owners, probably at Muckaty Station in the

Northern Territory.

See further: Radioactive Waste Repository & Store for Australia, as Appendix to this paper.

Research & development, isotope production

The High Flux Australian Reactor (HIFAR) operated at Lucas Heights

near Sydney from 1958 to 2007, and was for many years the only operating

nuclear reactor in Australia. It was used for materials research, to

produce radioactive materials for medicine and industry and to irradiate

silicon for the high performance computer industry. It was a 10 MW unit

which had the highest level of availability of any research reactor in

the world. It was at the heart of almost all the research activities of

the Australian Nuclear Science and Technology Organisation (ANSTO) and

supported those of several other organisations on the same site.

In 2006 HIFAR was replaced by a new research reactor, known as OPAL

(Open Pool Australian Light-water reactor), a modern 20 MW neutron

source. It achieves over 300 operational days per year, in the top

league of the world's 240 research reactors. OPAL uses low-enriched fuel

and for Mo-99 production it irradiates low-enriched targets which are

then processed to recover the Mo-99.

In September 2012 ANSTO announced a A$ 168 million expansion of its

Sydney facilities, principally for molybdenum-99 production, the source

of technetium-99 which is widely used in nuclear medicine for diagnosis.

Current world demand is about 45 million doses (23,000 six-day TBq/yr)

per year, and the new plant will be capable of meeting about one quarter

of this from 2016 at a time when the main plants in Canada and Europe

are set to close. The new plant will more fully utilise the OPAL

reactor. The investment also covers building a plant for Synroc

wasteform.

See further: Australian Research Reactors, as Appendix to this paper, and Synroc Wasteform paper.

General Sources:

ABARE, DITR, ANSTO,

ERA & WMC/ BHP Billiton quarterly and Annual Reports

OECD NEA & IAEA, 2006, Uranium 2005: Resources, Production and Demand

Commonwealth of Australia 2006, Uranium Mining, Processing and Nuclear Energy – Opportunities for Australia?, Report to the Prime Minister by the Uranium Mining, Processing and Nuclear Energy Review Taskforce, December 2006

Alder, Keith, 1996, Australia's Uranium Opportunities, P.M.Alder, Sydney.

Hardy C. 1999, Atomic Rise and Fall – the AAEC 1953-87, Glen Haven Press.

Cawte A 1992, UNSW Press.

ABARE, DITR, ANSTO,

ERA & WMC/ BHP Billiton quarterly and Annual Reports

OECD NEA & IAEA, 2006, Uranium 2005: Resources, Production and Demand

Commonwealth of Australia 2006, Uranium Mining, Processing and Nuclear Energy – Opportunities for Australia?, Report to the Prime Minister by the Uranium Mining, Processing and Nuclear Energy Review Taskforce, December 2006

Alder, Keith, 1996, Australia's Uranium Opportunities, P.M.Alder, Sydney.

Hardy C. 1999, Atomic Rise and Fall – the AAEC 1953-87, Glen Haven Press.

Cawte A 1992, UNSW Press.

Appendix

A brief history of Australian uranium mining

The existence of uranium deposits in Australia has been known since

the 1890s. Some uranium ores were mined in the 1930s at Radium Hill and

Mount Painter, South Australia, to recover minute amounts of radium for

medical purposes. Some uranium was also recovered and used as a bright

yellow pigment in glass and ceramics.

Following requests from the British and United States governments,

systematic exploration for uranium began in 1944. In 1948 the

Commonwealth Government offered tax-free rewards for the discovery of

uranium orebodies. As a result, uranium was discovered by prospectors at

Rum Jungle in 1949, and in the South Alligator River region (1953) of

the Northern Territory, then at Mary Kathleen (1954) and Westmoreland

(1956) in north west Queensland.

In 1952 a decision was taken to mine Rum Jungle, NT and it opened in 1954 as a Commonwealth Government enterprise. Radium Hill, SA was reopened in 1954 as a uranium mine. Mining began at Mary Kathleen, Qld in 1958 and in the South Alligator region,

NT in 1959. Production at most mines ceased by 1964 and Rum Jungle

closed in 1971, either when ore reserves were exhausted or contracts

were filled. Sales of some 7730 tonnes of uranium from these operations

were to supply material primarily intended for USA and UK weapons

programs at that time. However much of it was used in civil power

production.

The development of nuclear power stimulated a second wave of

exploration activity in the late 1960s. In the Northern Territory,

Ranger was discovered in 1969, Nabarlek and Koongarra in 1970, and

Jabiluka in 1971. New sales contracts (for electric power generation)

were made by Mary Kathleen Uranium Ltd., Queensland Mines Ltd. (for

Nabarlek), and Ranger Uranium Mines Pty. Ltd., in the years 1970-72.

Successive governments (both Liberal Coalition and Labor) approved these, and Mary Kathleen began

recommissioning its mine and mill in 1974. Consideration by the

Commonwealth Government of additional sales contracts was deferred

pending the findings of the Ranger Uranium Environmental Inquiry, and

its decision in the light of these. Mary Kathleen recommenced production

of uranium oxide in 1976, after the Commonwealth Government had taken

up a 42% share of the company.

The Commonwealth Government announced in 1977 that new uranium mining was to proceed, commencing with the Ranger project

in the Northern Territory. In 1979 it decided to sell its interest in

Ranger, and as a result Energy Resources of Australia Ltd was set up to

own and operate the mine. The mine opened in 1981, producing 2800 t/yr

of uranium, sold to utilities in several countries. Production over

three years to mid 2002 averaged 3533 t/yr of uranium.

In 1980, Queensland Mines opened Nabarlek in

the same region of Northern Territory. The orebody was mined out in one

dry season and the ore stockpiled for treatment from 1980. A total of

10,858 tonnes of uranium oxide were produced and sold to Japan, Finland

and France, over 1981-88. The mine site is now rehabilitated.

At the end of 1982 Mary Kathleen in Queensland had depleted its ore

and finally closed down after 4802 tonnes of uranium oxide had been

produced in its second phase of operation. This then became the site of

Australia's first major rehabilitation project on a uranium mine site,

which was completed at the end of 1985. A Rum Jungle Rehabilitation

project also took place in the 1980s.

Australian Labor Party (ALP) policy on uranium mining has

varied over four decades. The 1971 Platform, on which the Whitlam

Government was elected in 1972, committed the party to working towards

the establishment of a domestic uranium enrichment and nuclear power

sector. But after losing government in 1975, pressure grew in the Labor

Party for a strong stance against uranium mining and export, as a

counterpoint to Liberal Coalition policies to expedite uranium mining

and export. An anti-nuclear movement gained strength and campaigned to

end Australian uranium mining.

The 1977 ALP National Conference adopted a new policy. Community

concerns with the threat of nuclear war were to be allayed by ending

uranium mining and ceasing Australia's contribution to the nuclear fuel

cycle. The change committed a future Labor government to declare a

moratorium on uranium mining and treatment and to repudiating any

commitments to mining, processing or export made by a non-Labor

government. The policy made a strong statement and was seen to provide

moral leadership.

By the time of the 1982 ALP National Conference, many in the Labor

Party were troubled about how an incoming Labor Government would

implement the party's moratorium policy. There was concern that the

repudiation of contracts would raise issues of sovereign risk and would

expose a Labor government to compensation liabilities. An amendment to

the ALP Platform in 1982 sought a compromise between the positions of

those who wanted to shut the industry down and those who felt that doing

so was neither possible nor in the national interest. It committed

Labor to a policy on uranium mining which was a classic political

compromise, the core of which endured as Labor policy for 25 years. The

policy was designed to prevent new uranium mines; limit Australia's

uranium production with a view to the eventual phasing out of mining

altogether; and provide moral leadership in ending the nuclear industry.

However, in a concession to South Australia, it also said that a

Labor government would "consider applications for the export of uranium

mined incidentally to the mining of other minerals on a case by case

basis". This was the Roxby Downs amendment, which would allow export of

uranium from Olympic Dam - a major copper and uranium deposit. So the

1982 anti-uranium policy actually authorised the development of the

world's largest uranium mine!

In the 1983 federal election the ALP won office. The 1984 ALP

National Conference then dropped the language of moratorium, repudiation

of contracts and phase-out from the Platform. For the first time the

three-mines-policy was delineated by naming Nabarlek, Ranger and Roxby

Downs (Olympic Dam) as the only projects from which exports would be

permitted. Provisional approvals for marketing from other prospective

uranium mines were cancelled.

The naming of specific mines was later deleted from the Labor

Platform in the light of the fact that Nabarlek ceased production in

1988 and under a (conservative) Coalition government Beverley started up

in 2000. The ALP policy then only allowed exports from existing mines

and prevented the establishment of new ones. This endured as a "no new

mines" policy through a change of government in 1996 until 2007, when it

was abandoned as ineffective and likely to be electorally negative due

to changed public opinion arising from global warming concerns.

Opposition to uranium mining was then left to state ALP branches and

governments. This continued in WA and Queensland until changes of

government in 2008 and 2012 respectively. (NSW and Victoria have

legislation banning uranium exploration and mining, which has not been

repealed by conservative governments.) A fourth mine, Honeymoon, started

up in South Australia in 2011.

Adapted from Senator Chris Evans speech 23/3/07 to Labor Business Roundtable, Perth.

During 1988 the Olympic Dam project

commenced operations. This is a large underground mine at Roxby Downs,

South Australia, producing copper, with uranium and gold as by-products.

Annual production of uranium started at some 1300 tonnes, with sales to

Sweden, UK, South Korea and Japan. After a A$ 1.9 billion expansion

project, production increased to over 4000 tonnes uranium per year by

mid 2001. In 2005 it was taken over by BHP Billiton.

Beverley, the first Australian in situ leach (ISL) mine started up in

2001 and closed early in 2014. Another ISL mine, Honeymoon, came on

line in 2011 and closed in 2013. Production from Four Mile started in

2014, using a satellite plant to capture the uranium from ISL and the

Beverley plant for final product recovery. Beverley and Honeymoon may

resume production with increased uranium prices.

Both Ranger and Nabarlek mines are on aboriginal land in the

Alligator Rivers region of the Northern Territory, close to the Kakadu

National Park. In fact the Ranger and two other leases are surrounded by

the National Park but were deliberately excluded from it when the park

was established. Ranger is served by the township of Jabiru, constructed

largely for that purpose. Nabarlek employees were based in Darwin and

commuted by air.

See also: Former Australian Uranium Mines paper.Australia's Uranium Mines