The State of Nuclear: Interview with Former Secretary of Energy Spencer Abraham (Part 1)

Written by Nick Hodge

http://www.outsiderclub.com/the-state-of-nuclear-interview-with-former-secretary-of-energy-spencer-abraham-part-1/1781

Posted December 31, 2015 at 1:10AM

I spoke yesterday with former Secretary of Energy Spencer Abraham about the state of nuclear

in the country and the world. Below is the first half of our talk, in

which Mr. Abraham touts the ability of nuclear to fight climate change

as well as its safety record. You can read Part 2 here.

Enjoy,

Nick Hodge

Publisher, The Outsider Club

Nick Hodge: I'm talking today with Spencer Abraham, former U.S. Senator, Former Secretary of Energy under George W. Bush. Currently, he's Chairman and CEO of his consulting firm, The Abraham Group, and he sits on or Chairs the board of several energy-related companies. Mr. Abraham, it's a pleasure to be able to talk nuclear energy with you today.

Spencer Abraham: Thanks, Nick. Good to be with you.

Nick: I'll get right to it... There are 430-some operable nuclear reactors in the world right now. Over 60 are being built, the most at one time in the past 25 years. And hundreds more on order or planned. Are we finally witnessing the nuclear renaissance that people have talked about for so long?

Mr. Abraham: Well I hope we are. When I was Energy Secretary one of our objectives was to try to really pave the way for a nuclear renaissance that would allow us to — in the United States — begin to expand the fleet of reactors, and also to make sure we had the ability to keep online reactors that were aging.

But I think there are several things that are making it more likely that we are going to see some real progress on the nuclear front. Certainly at the top of the list is the emergence of global concern over climate change issues. It's hard — even for the people who've long opposed nuclear power — to fight nuclear energy and global warming at the same time. People now recognize the critical role that nuclear power plants play in the production of electricity without emissions of greenhouse gases. And so I think as that awareness combines with the concerns about the amount of emissions, it's providing a strong political base for expanding nuclear.

And I think — at least in the community of people who focus on issues that relate to nuclear safety — the growing realization that while, of course events like the tragedy at Fukushima need to be studied and need to be addressed... that by and large nuclear plants operate very efficiently and very safely. And the folks who basically are running nuclear operations and companies are doing an exceptional job of balancing their responsibilities to the company with their responsibilities to their communities.

Enjoy,

Nick Hodge

Publisher, The Outsider Club

Nick Hodge: I'm talking today with Spencer Abraham, former U.S. Senator, Former Secretary of Energy under George W. Bush. Currently, he's Chairman and CEO of his consulting firm, The Abraham Group, and he sits on or Chairs the board of several energy-related companies. Mr. Abraham, it's a pleasure to be able to talk nuclear energy with you today.

Spencer Abraham: Thanks, Nick. Good to be with you.

Nick: I'll get right to it... There are 430-some operable nuclear reactors in the world right now. Over 60 are being built, the most at one time in the past 25 years. And hundreds more on order or planned. Are we finally witnessing the nuclear renaissance that people have talked about for so long?

Mr. Abraham: Well I hope we are. When I was Energy Secretary one of our objectives was to try to really pave the way for a nuclear renaissance that would allow us to — in the United States — begin to expand the fleet of reactors, and also to make sure we had the ability to keep online reactors that were aging.

But I think there are several things that are making it more likely that we are going to see some real progress on the nuclear front. Certainly at the top of the list is the emergence of global concern over climate change issues. It's hard — even for the people who've long opposed nuclear power — to fight nuclear energy and global warming at the same time. People now recognize the critical role that nuclear power plants play in the production of electricity without emissions of greenhouse gases. And so I think as that awareness combines with the concerns about the amount of emissions, it's providing a strong political base for expanding nuclear.

And I think — at least in the community of people who focus on issues that relate to nuclear safety — the growing realization that while, of course events like the tragedy at Fukushima need to be studied and need to be addressed... that by and large nuclear plants operate very efficiently and very safely. And the folks who basically are running nuclear operations and companies are doing an exceptional job of balancing their responsibilities to the company with their responsibilities to their communities.

You'll Never Be On The Inside!

So join Outsider Club today for FREE. You'll learn how to

take control of your finances, manage your own investments, and beat

"the system" on your own terms. Become a member today, and get our

latest free report: "The Coming Uranium Rush."

Nick: You bring up a lot of good points there, some

of which I'd like to flesh out as we go. But it's a perfect segue into

the two degrees Celsius talk that's been going around recently,

especially with the recent UN Climate Talks in Paris. In order to limit

the global temperature rise to two degrees Celsius by the end of the

century, the International Energy Agency (IEA) says that we need to

double installed nuclear capacity to 930 gigawatts by 2050. What's your

view on this? Can this be done?

Mr. Abraham: Well it can't be done unless we really

put to rest this — all of this — misinformation about nuclear power and

nuclear power plants that has basically built up over the last — really

since Three Mile Island. It's time for people to discuss nuclear energy

with honesty and without scare tactics. Some of the opposition we've had

to nuclear has been based on very — in my judgment — weak arguments.

And yet the media has too often highlighted the worst case scenarios and

not paid enough attention to the record. So we gotta change the — if

you would — public perceptions. And that's happening, I think.

In addition, there needs to be commitment by those in government to

not do anything to make it possible to move new plants forward without

proper scrutiny and oversight... but to not create artificial barriers

that prevent that from happening... and to not allow those who want to

stop nuclear at all costs from being built to tie up the development of

new nuclear plants in all sorts of time-consuming and lengthy and

expensive litigation and regulation.

Nick: I couldn't agree more and since we're talking

about safety we can stay there for now. I always tell people that

nuclear energy is the safest form of modern energy there is per

kilowatt-hour generated when you factor in all the life-cycle costs of

mining the uranium compared to mining coal or drilling for oil and gas.

And then when you take into consideration the lifetime costs of

emissions and position of asthma and other diseases that are related to

carbon pollution.... nuclear energy is the safest. Can you articulate

why that is and what the government is doing to keep nuclear energy as

safe as you and I know it is?

Mr. Abraham: Well, first of all, it's safe because

it is a clean — in terms of emissions — it's a clean form of energy. I

think it constitutes at least — or close, certainly — two thirds of all

the emission-free power generation in the United States. And so that's

why it's safe — because it isn't producing byproducts, which are

potentially injurious to health and the environment.

But what I think tends to happen when we have these generational

incidents — the issue of Three Mile Island, the more recent Fukushima,

and then the actions that took place in Chernobyl, which I think stand a

little unique because of the nature of what was really being done

there... is that meanwhile all over the planet nuclear plants operate

safely under intense government scrutiny, under generally approved,

uniform kinds of safeguards that are constantly being tested.

And then when we do have an incident... even if it's an incident as

unforeseeable as the tsunami which struck the facilities in Japan, which

by the way make that very unique because nuclear plants are often near

water, almost always very close to — if not always right on —

coastlines, there are very few situations in which they're also on fault

lines of potential 9.0 earthquakes. But when they do happen — on those

very rare occasions — new policies and regulations designed to prevent

that event from happening again are immediately undertaken. And we have

strong rules and very heavy penalties in place if those rules are

broken.

Look for part two next week, when we get into uranium supply, potential shortfalls, and why the price of uranium needs to rise.

Call it like you see it,

Nick Hodge

Nick is the Founder and President of the Outsider Club, and

the Investment Director of the thousands-strong stock advisory, Early

Advantage. Co-author of two best-selling investment books, including

Energy Investing for Dummies, his insights have been shared on news

programs and in magazines and newspapers around the world. For more on

Nick, take a look at his editor's page.

The U.S. Media Empire Is Crumbling

Written by Nick Hodge

http://www.outsiderclub.com/our-media-empire-is-crumbling-like-minded-people/1721?r=1

Posted November 4, 2015 at 3:04PM

It’s been some time since we focused on anything outside the market.

And there have been a few news items catching my eye recently.

So let’s start there before settling into our now-usual routine.

For starters, Americans’ trust in mainstream media remains at an all-time low.

As recently as 1999, trust in the media was as high as 55%.

That fell to 51% as the dot-com bubble exploded and we argued about chads in Florida.

Trust in media then climbed back up to 54% in 2003 — but fell all the way to 44% in 2004 as no WMDs were found.

Since then, the number of Americans who trust the media has not gone

back over half, registering all-time lows of 40% in 2012, 2014, and

again this year.

Since then, the number of Americans who trust the media has not gone

back over half, registering all-time lows of 40% in 2012, 2014, and

again this year.

Indeed, since 2007, “the majority of Americans have had little or no trust in the mass media,” Gallup recently reported.

It continued:

Even more so when you learn that trust in the media by younger Americans — those aged 18 to 49 — is even lower than the national average. Just 36% of that age demographic trusts the news.

The 64% of younger Americans that don’t trust the media is who you should be looking to to solve the problems of today for tomorrow.

And boy, are there problems.

You’ve got an oligarch leading polls for the Republican presidential primary the same year the United States was shown to be an oligarchy. I’m referring to Trump. And that’s all the words I’ll spend on the lunacy that is his candidacy.

Beyond the political dog-and-pony show, though, papered-over problems continue to fester beneath the surface.

From ISIS and Volkswagen to wage growth and zero interest rates, a global culture of moral decay and sinister elitism has left the everyman weary today and wary of tomorrow...

Note: This is an excerpt from the October 2015 issue of Nick Hodge's Like Minded People. To read the rest of the story and gain access to Nick's stock portfolio click here.

And there have been a few news items catching my eye recently.

So let’s start there before settling into our now-usual routine.

For starters, Americans’ trust in mainstream media remains at an all-time low.

As recently as 1999, trust in the media was as high as 55%.

That fell to 51% as the dot-com bubble exploded and we argued about chads in Florida.

Trust in media then climbed back up to 54% in 2003 — but fell all the way to 44% in 2004 as no WMDs were found.

Indeed, since 2007, “the majority of Americans have had little or no trust in the mass media,” Gallup recently reported.

It continued:

This decline follows the same trajectory

as Americans’ confidence in many institutions and their declining trust

in the federal government’s ability to handle domestic and international

problems over the same time period.

All this continues to be in line with the events of a generational

Fourth Turning, which we’ve covered at length in these pages over the

past two years.Even more so when you learn that trust in the media by younger Americans — those aged 18 to 49 — is even lower than the national average. Just 36% of that age demographic trusts the news.

The 64% of younger Americans that don’t trust the media is who you should be looking to to solve the problems of today for tomorrow.

And boy, are there problems.

You’ve got an oligarch leading polls for the Republican presidential primary the same year the United States was shown to be an oligarchy. I’m referring to Trump. And that’s all the words I’ll spend on the lunacy that is his candidacy.

Beyond the political dog-and-pony show, though, papered-over problems continue to fester beneath the surface.

From ISIS and Volkswagen to wage growth and zero interest rates, a global culture of moral decay and sinister elitism has left the everyman weary today and wary of tomorrow...

Note: This is an excerpt from the October 2015 issue of Nick Hodge's Like Minded People. To read the rest of the story and gain access to Nick's stock portfolio click here.

Related Articles

The Media is Wrong: Fear Inflation

The media is blaming gold's price drop on the end of inflation fears. They couldn't be more wrong.

Libertarians on the Rise

Many popular thinkers are equating a fall in traditional norms with a rise in liberty-minded views...

U.S. Government Officials Said To Be Working On 'Media-Leak' Legislation To Impose Censorship

Audacious oligarchy, indeed.

Brian Williams is Proof Media Lies

One of the most-watched nightly

news anchors in America was just caught red-handed falsifying war

reports to glorify war. It's propaganda at its finest.

Obama's Secret Pipeline

The REAL reason why he vetoed the Keystone XL Pipeline

And why this $3.4 trillion move could ignite a $1 stock...

Turning every $1,000 invested into $1,304,000 starting January 2016

Dear Reader,

http://www.angelnexus.com/o/web/91067

Do you ever wonder why Obama so strongly opposes the Keystone Pipeline, even as he claims to support America’s shale revolution?

And even as this pipeline could support America’s energy independence — one of Obama’s key policies?

Well, my investigation uncovered something astonishing...

The real reason why Obama vetoed the Keystone Pipeline...

And why we’ll never see it constructed, no matter how much it supports the U.S. economy or our national security.

As it turns out, Obama is busy constructing a "secret pipeline"...

A pipeline that’s key to his entire energy plan...

To his climate plan...

Even to his budget plan and foreign policy.

In early 2015, while Congress was approving the Keystone bill that

was ultimately vetoed... Obama was busy cutting multibillion-dollar

deals for this "secret pipeline."

And a number of "in the know" billionaires (that’s with a "b") are already jumping on this opportunity.

For instance, Bill Gates has earmarked $35 million to build a start-up for this project.

So has Microsoft co-founder and fellow billionaire Paul Allen, who’s personally shelled out $80 million.

Then there’s Amazon billionaire Jeff Bezos, who’s invested $19.5 million of his personal money in secret pipeline projects.

Last August, PayPal billionaire Peter Thiel staked $2 million on this pipeline.

And the biggest stake comes from billionaire investor George Soros,

who has tripled his secret pipeline position to a whopping $126 million.

So while everybody is bickering about the Keystone Pipeline, the really smart money has its eye on this.

And for good reason...

This pipeline is a truly massive energy project in size and scope.

In fact, it could soon power four out of every five American homes...

Span 76 countries on six continents...

And supply power to a third of the world’s population.

I’m talking about 2 billion people...

Many who have never paid a light bill but who will now have access to 24/7 electricity.

All thanks to this secret pipeline.

That’s why the price tag for this could reach a staggering $3.4 trillion — equal to the U.S. government’s annual fiscal budget.

Bottom line: It makes the Keystone Pipeline look like a grade-school science project.

So can you see why some of America’s most prominent billionaires are buying into this?

It’s ushering in a major energy shift like we haven’t seen in decades.

Yet the media is completely unaware of it, as are most investors.

The only reason I know about this is because I’ve been an insider in the world energy scene for the past decade.

In fact, I’m in direct contact with the key players — government

officials, policy makers, energy companies, and insiders — that will

drive this situation into a staggering profit opportunity.

That includes four little-known companies lined up to cash in as

these "secret pipelines" go up across the U.S. and around the world...

I’ve been to their operations. Seen their sites.

Met their CEOs, management, and workers.

And I’ve analyzed the numbers.

They’re small plays. Some trade for $1 or less.

But using history as a guide, they have the potential to surge 10,000% or more.

And you don’t have to invest millions like the big guys.

By my count, just a small $1,000 stake could explode into $1,304,000.

Enough to fund your whole retirement on just one single play.

By January 31, 2016... a specific event will begin to launch these companies’ shares to the stratosphere...

Turning a handful of early investors rich beyond their wildest dreams.

As you’ll see, this has happened before — twice, in fact.

And BOTH times, it spun off a group of brand-new millionaires.

In a moment, I’ll reveal four ultra-lucrative picks for this opportunity...

Plus, I’ll share details on the event that will send them skyrocketing for life-altering gains.

But first, allow me to explain this explosive situation and why it could...

Turn Every $1,000 into $1,304,000... Starting January 31st

You see, while $3.4 trillion is flowing to these pipelines worldwide...

And while the price tag for just one could reach $8 billion...

It’s NOT in the construction or operations where everyday investors can get rich.

It’s in the unusual type of fuel, the companies that produce it, and a

crisis brewing right now that could send these little-known plays

shooting to the heavens.

Let me explain...

Demand for this fuel is soaring thanks to these secret pipelines.

Worldwide, it’s quickly becoming the #1 source of power for over 2 billion people.

For the first time ever, over 76 countries are adopting it to meet their growing energy demand.

In fact, in order to meet the growing need for electricity worldwide, use of this fuel has to grow by 136%!

That’s the consensus among industry leaders and leading politicians.

For instance, the IEA — the global energy agency — recently confirmed, "use of this [fuel] has to double."

And even oil giant Exxon admits, "The world has to double its use of

[this energy] if it’s going to meet its surging electricity demand."

This is why Big Oil is diversifying into this fuel...

And why Obama is pushing the construction of hundreds of these pipelines.

But here’s where it gets interesting...

Right now, supply of this vital fuel is rapidly shrinking.

Take a look...

It confirms annual demand already exceeds supply by 40 million pounds.

What’s more, these secret pipelines are throwing fuel on this fire.

They’re adding at least 33 million new pounds of demand.

This means we’re looking at an imminent 35% supply deficit.

I’m telling you, in all my years in the energy market, I’ve never seen a supply gap like it.

Especially one where the resource is so vital for so many people.

Fact is, there’s just not enough fuel for these new pipelines, which a third of the world’s population relies on for electricity.

The Crisis Nobody is Talking About Can Make You Rich

If that’s not enough, producers are closing or halting operations.

They simply can’t make a profit at the current low price.

Several years ago, there were 500 companies producing it.

Today, there are fewer than two-dozen.

The current low price has removed 96% of suppliers from the market... And right at the moment that these pipelines are going up everywhere.

To make matters worse, a geopolitical crisis beginning this year will instantly remove 50% of global supply from Western markets.

It will happen overnight... in the blink of an eye... and without notice.

In short, the situation is critical. Supply of this fuel is already short. Global demand is more than doubling from these pipelines. At the same time, supply is shrinking, with an imminent 50% supply cut this year.

Unless fuel prices go up, all of these new pipelines will shut down.

If this happens, a third of the world will go without power... so it won't happen. World leaders won’t let it happen. Prices MUST go up. It’s inevitable.

The only question is... how high will they go?

JP Morgan says the price has to go up at least 250% in order for producers to make a profit, so they can meet the massive supply needs of these new pipelines.

Meanwhile, legendary investor Rick Rule compares the current scenario to...

"A Dam About to Break"

Rule says, "Prices MUST go up from here."

According to him, "The question is not 'if,' but 'when.'"

So I set out to find exactly when.

And I’ve pinned down the date to January 31st of 2016.

On that day, this explosive situation will come to a head.

A specific event will light the fuse, blowing the lid off of the whole thing...

A handful of plays will surge for life-altering gains...

And if history is any indication, they could turn just $1,000 into $1,304,000.

I can say this with 100% certainty because it’s NOT the first time this has ever happened.

In fact, the same scenario has happened TWICE before...

The first time was in 1973. A supply gap formed, fuel prices rose to fill the gap, and early investors made a fortune as prices rose 10-fold.

The same thing happened in 2003.

Surging demand...

Vanishing supply...

And rapidly disappearing stockpiles.

What happened? That’s right, the fuel price skyrocketed to fill the gap.

In fact, the price of fuel for these secret pipelines jumped 13-fold.

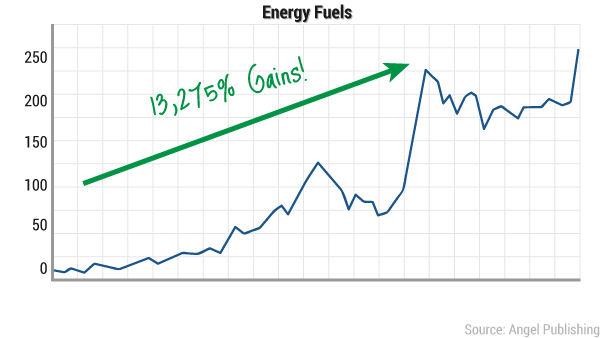

I think you’ll agree that’s spectacular. But it’s nothing compared to what companies that produce the fuel did.

For the Third Time in History...

Get this: One company, International Enexco, surged for a stunning 114,300% return. Take a look at the chart:

Amazing... and you know what’s even more incredible? It wasn’t even the biggest winner.

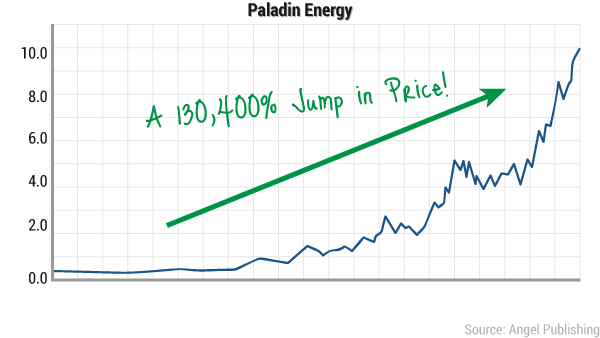

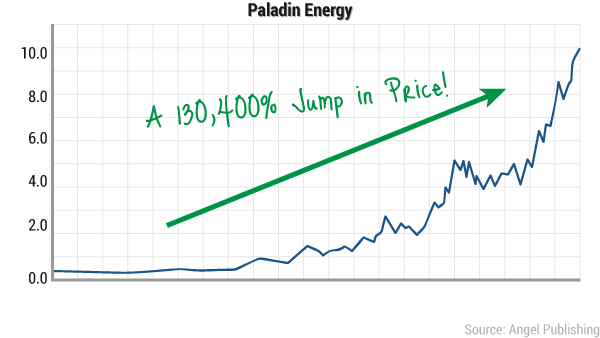

Another company, Paladin Energy, surged for a staggering 130,400% return.

All on this single play.

Incredible.

Take a look in your wallet right now...

Imagine every $10 turning to $11,455... every $100 turning to $114,550.

Not a decade from now, but in just three or four short years.

And there were other smaller — yet still amazing — winners.

Like one company, Laramide Resources, which jumped 30,800%.

But here's the important thing for you to understand: History is about to repeat itself.

I've been tracking this situation for 10 years... watching as it unfolds. I can tell you without a bit of doubt that this is happening now.

And as Obama pushes these "secret pipelines" around the world, the supply deficit is about to soar.

$3.4 Trillion of Investment

For instance, in January 2015 while Congress was busy passing the Keystone bill he would quickly veto... Obama was visiting India, which has agreed to build 12 secret pipelines at a cost of $3 billion each.

In fact, they will soon supply 30% of the India's energy.

Mind you, that’s in a country of 1 billion.

And that’s why costs of this global program are staggering.

According to Forbes, the price tag could reach $1 trillion.

That bears repeating...

$1 trillion. Just for India.

India is willing to spend $1 trillion because this pipeline will provide a cheap, reliable source of energy.

One that could lift 800 million of its people out of poverty.

After he left India, Obama traveled to Saudi Arabia. The Saudis want to build 16 secret pipelines over the next 20 years at an undisclosed cost.

When he returned from his trip to countries eager to build secret pipelines... Obama vetoed the bill approving the Keystone XL pipeline that Congress had passed.

Sales Exploding by 6,600%

Last August, Obama even made a pact with China, which is now planning to construct hundreds of these pipelines.

In fact, this will now be China’s key energy source over the next few decades.

According to Bloomberg, China will need to build 1,000 of these pipelines...

Spend $2.4 trillion...

And expand its use by as much as 6,600%...

Just to meet that goal.

Amazing, right?

But it’s not so crazy when you consider the energy needs of 1.3 billion people — one-fifth of the world’s population.

And as China’s population soars alongside its economy, it will only need more and more.

So in India and China — two nations that comprise a third of the world’s population — this is shaping up to be their key energy source.

Over Two Billion New Customers

And it’s not just in these Asian giants, either.

In fact, "secret pipelines" are going up everywhere around the world...

Right now, 76 countries on six continents are building these pipelines... with no end in sight.

Argentina is building two for $20 billion. The United Arab Emirates is spending $40 billion on four of them. Even Nigeria is interested, to the tune of $80 billion. Vietnam, Turkey, Belarus, Bangladesh... they're all signed on to build these secret pipelines.

At the same time, supply of their vital fuel is already short.

Again, take a look at this chart...

That means over one-third of these pipelines are inoperable...

A crisis that will put a third of the world in the dark unless prices go up.

But before I go on, let me answer something that’s probably on your mind...

What exactly are these pipelines? And what is the fuel they harness?

Of course, I’m talking about nuclear energy.

And as you can probably guess, the fuel is the nuclear reactor fuel: uranium.

Which begs the question...

Why is Obama — and the rest of the world — spending trillions on nuclear energy?

Simple.

It’s the only cheap, climate-friendly source capable of meeting their power needs.

Nuclear power meets all the checklists that solar and wind can’t.

Reduces electricity costs... check.

Cuts carbon emissions... check.

Capable of powering entire countries... check.

This fuel is a win-win for the environment and economy.

That’s why the political consensus for this is incredible:

Obama.

Democrats.

Republicans.

Even hard-core environmentalists.

As The Washington Post reports, "Climate change is forcing environmentalists to support nuclear power."

Just recently, 71 environmental scientists and researchers signed a letter in support of nuclear energy.

All are on board.

They all support billions invested in nuclear power.

None of the crazy political feuding we’ve seen over the Keystone Pipeline.

So this is an unstoppable trend, and one that’s heating up right now.

Which brings me to the "elephant in the room."

That is, Japan.

HUGE Market-Moving Event #1:

By January 31, Japan Will Restart 10% of Its Reactors

Japan is restarting its fleet of 43 nuclear reactors without question.

The first restart, of the Sendai 1 reactor, occurred in August 2015. Sendai 2 was restarted in mid-October.

Each one requires vast inspection time to ensure it's safe.

Japan's Nuclear Energy Institute hinted that three more could come online in the very near future, saying "Takahama 3 could restart late December and Takahama 4 early next year."

At that point, Japan will have reached critical mass, with more than 10% of its reactor fleet up and running. I view that as the catalyst for the next nuclear supercycle to begin.

It's all downhill from there. Japan has vowed that nuclear will once again make up nearly a quarter of its energy mix.

Fact is, it has no choice.

Its economy is in tatters as a direct result of the post-Fukushima shutdown of power plants.

Once accounting for 30% of the nation's electricity needs, nuclear has fallen to zero.

In its place, Japan has imported massive quantities of oil and gas at crazy-high prices.

This in turn has triggered a massive trade deficit, forcing the cash-strapped government to take on even more debt and print even more money.

Utilities are losing $30 billion every year from increased fuel costs.

And Japanese consumers are feeling the pinch, with 50% electricity rate hikes.

Consumer demand is plummeting as fewer people have money for goods after paying their light bills.

So the Japanese government is rushing at full speed to get its nuclear reactors online.

And I’m not exaggerating when I say this event will be THE game-changer for uranium.

You see, the memory of Fukushima is the only thing still weighing on the uranium sector.

That’s why the markets haven’t priced in the real supply gap.

But that’s all about to change...

Once a critical mass of reactors actually go back on online... investors will rush into uranium stocks.

Utilities will rush in as well, as they're need to secure future supply for their own reactors... sending prices up even further.

But you won’t want to wait until then. It will be too late... and you’ll miss out on the early entry points.

And this is key...

In fact, getting in just early enough could mean the difference between a few nice percentage points on your portfolio statement...

Or a massive retirement windfall.

It’s your choice.

But if you want the second option, you’ll want to act right now.

And you’ll want to act on the four specific plays I’m sharing with you today...

The next uranium 10-, 100- and 1,000-baggers.

Just like Paladin Energy, which skyrocketed from one cent to $10.34 — a staggering 130,400% return in just three short years.

Yes, Japan’s nuclear move is HUGE...

Yes, it will have a huge psychological impact on the markets...

But it’s NOT the only major event that will drive uranium through the roof.

Far from it...

In fact, fear of climate change is forcing a dramatic global shift from fossil fuels to nuclear energy.

Event #2:

The Government's #1 Solution to Global Climate Crisis

Now, regardless of how you feel about global warming, the reality is that the world is mobilizing to cut its CO2 emissions.

And Obama is leading this massive drive... especially in high-pollutant countries like India and China.

Wind and solar power simply can’t meet the energy needs of these fast-growing nations.

Like it or not, the only realistic zero-carbon emission solution is nuclear power.

The IEA said that in order for the world to meet its climate reduction goals, "nuclear power needs to double."

That’s why Obama’s leading energy advisor calls nuclear energy "essential to our carbon reduction goals."

Obama’s Climate Action Plan confirmed this statement.

And in last year’s "climate change accord" with China, nuclear energy was the big winner.

This pact requires China to add 1,000 gigawatts of zero-carbon energy.

In turn, that requires a total of 1,000 new nuclear reactors.

That’s 150% more nuclear reactors than currently exist in the world!

Then there’s India — a new major polluter — which is catching up to China in carbon emissions.

In early 2015, Obama pushed through a "nuclear breakthrough" with India as part of their climate talks...

A move that will lead to 30 new nuclear reactors, supplying electricity to a sub-continent of 800 million people.

These two deals will spread nuclear power like never before.

67 new reactors are under construction...

166 are being planned...

And 322 more have been proposed.

That's a 136% boost from the current number of online reactors.

This marks the greatest number of reactors in construction since the 1970s, when the first uranium supercycle kicked off.

Billions of new people in over 76 countries will now rely on nuclear power for their electricity.

But here’s the real kicker...

Event #3:

"Vladimir Putin Seizes a Monopoly of the World’s Uranium Supply"

Putin is now a one-man uranium cartel.

He owns 50% of the global uranium stockpile and controls 45% of the global supply.

These are incredible numbers.

And it’s shocking more people don’t realize this...

Russia is a major supplier in itself, sure.

But I’m talking about its neighbor Kazakhstan — a country Putin pretty much owns.

Kazakhstan is the world’s #1 uranium producer, mining 40% of the current supply.

You see, Russia recently signed the Eurasian Union compact with three of its neighbors.

One of the only countries to sign it? That’s right: Kazakhstan.

In effect, this is now the OPEC for uranium. Call it UPEC.

The Russian nuclear energy company, Rosatom, pretty much has first dibs on all of Kazakhstan’s supply.

And Rosatom is a major exporter of nuclear energy, building power plants in 13 countries.

Plus, get this:

Nuclear power provides electricity to one out of five American homes.

America is the largest consumer of uranium, at least for now.

And it relies on foreign countries for 90% of its uranium supply.

Our major supplier is — you guessed it — Russia.

And that’s not even the worst part...

Russia is now the largest owner of America’s uranium deposits.

A recent acquisition gave Russia control of one-fifth of America’s reserves. And they can choose to export to Russia, China, or any country if they wish.

So with the continued Cold War raging between Washington and Moscow...

Sanctions on Russia...

And Putin’s history of using energy exports to coerce Europe...

The potential for a severe uranium supply disruption in the very near future seems inevitable.

It’s an incredible situation — one that’s obviously lucrative to anyone paying attention.

If Putin chooses to withhold even some of his supply, the uranium price is going through the roof.

No question about it.

Bottom line:

"Uranium prices are

inevitably going to soar"

You have the fundamentals, with the current supply crunch and skyrocketing demand...

The swing in market psychology, with Japan switching on 10% of its reactors by January 2016...

And you have escalating geopolitical crises, where nearly 50% of global uranium is produced, stockpiled, or otherwise controlled by Putin.

It’s all coming to a head right now.

You know how much money is at stake.

You’ve seen how past swings have sent nuclear fuel stocks soaring as high as 100,000%.

This situation — and its wealth potential — is a no-brainer.

The only question now is...

Which plays are best positioned to repeat those incredible historic gains?

I’ve screened hundreds of these producers and narrowed it down to four of the best.

Let me start with my #1 pick...

The $1 Stock Jumping

10,000% in 2016

It’s a $1 stock.

And it’s currently sitting on the most valuable uranium deposit in history... the last source of untapped high-grade uranium in the world.

It’s located in Canada's Athabasca Basin, the site of the world’s most valuable uranium mines.

And this field is the crown jewel of the region.

A recent resource estimate confirms it holds 105 million pounds of high-grade uranium, although more drilling since then means it's probably at 150 million pounds or more by now.

Even at the current ultra-low uranium price — around $40 per pound — that’s a $3.99 billion asset.

That’s pretty astounding.

Analysts were stunned. Even the company’s CEO was blown away.

And this stock has a very tiny market cap... just $225 million.

But what’s really incredible is that the markets haven’t sent this stock shooting to the heavens.

You’ll see why in a second... why this is such a lucrative opportunity and why you need to jump on it so quickly.

Right now, this company is an easy $8 to $10 a share in value.

But once uranium prices skyrocket, as they will this year, it could climb to $20, $30, even $50.

What’s more, analysts all agree this play is a major acquisition target.

I can list off several companies that are circling this tiny miner, waiting to bid up its shares.

So with this many bidders and this much attention, we’re looking at a hot premium for the acquisition price. And I’ve seen premiums that doubled the market value of a company... easy.

Not to mention the markets will certainly shoot the stock up higher than the bidding price.

That all sounds great, but the real question is, "When will this happen?"

The best part is that we don’t have to guess...

You see, the reason why the market hasn’t factored in this new uranium discovery is due to a weird anomaly in the resource markets.

The chart below shows it...

It predicts when a junior miner is about to soar with remarkable accuracy.

Here’s how it works...

After the explorer makes the initial discovery, its share price soars. That happened with this company, as shares climbed 233% from 2013 through 2014 as the discovery was made.

Then, after the resource estimate, the company’s shares usually tank. Again, that happened here. Shares fell by half through 2015 after the resource estimate was put out in January.

But it’s in a tiny six-month window surrounding the Preliminary Economic Assessment — the PEA stage — where the real opportunity lies.

After the PEA report is released, a junior miner takes off... like clockwork.

And right now, for this $1 stock, we are currently in that window.

So this company is going through the roof... no matter what.

But here’s why this is REALLY a perfect storm of profit...

I expect an updated PEA to be released early next year... right as the uranium price is soaring.

The markets will already be piling into these stocks.

And believe me, when they do, even weak uranium miners will skyrocket.

So an incredible company like this — one with an unprecedented asset... releasing its PEA report right as the uranium market begins soaring early next year, and right as dozens of big uranium producers are entering into a fierce bidding war...

Well, it’s about as close to guaranteed as anything I’ve ever seen in all my years in the markets.

The markets will pile into this stock in a frenzy...

And $100 a share for this company by the end of 2016 is not out of the question.

But you’ll need to act now, while it’s still trading at $1.

This way you can ride the tidal wave of profits for 10,000% gains.

Or enough to turn a portfolio of $10,000 into $1 million.

Plays like this one have returned similar gains — even without this kind of incredible asset.

Its upside potential truly has NO limits.

So you can take action early while there’s still time, I include the name, ticker symbol, and profile of this play in my FREE report: "The Third Supercycle: How to Grab 10,000% Profits on the Coming Uranium Boom."

But before I show you how to get your hands on this groundbreaking research absolutely FREE...

Allow me to share a few details on three other potential 100-baggers I’ve identified.

Three 100-Baggers

Third Supercycle Play #2: My next pick is a spin-off of the first company I mentioned and could hand investors the same profits, if not more. You see, this play mimics the performance of its parent company. For instance, when my first pick recently jumped by 20%, this one soared by 50%... in just two weeks. Only thing is, it trades for just 1/10th the price — which means you only need a very tiny stake to see the windfall of your life. I expect it to double, even triple the gains of my first pick. So 20,000% gains or more is not out of question. That’s enough to turn a $500 investment into a million-dollar retirement nest egg. Similar plays like it have done just as well. Better, in fact.

Third Supercycle Play #3: This third pick may be the one I’m most excited about. Legendary investors Rick Rule and Doug Casey own a 16% stake in this company. And Marin Katusa, one of the world’s leading energy experts, calls it a "screaming buy." You see, the CEO and founder of this company has a proven track record of making shareholders very rich, very quickly. He previously brought to market the major uranium miner UEC Corp. And during the second supercycle, UEC returned incredible gains. First it jumped 583% in just four months. Then it took off for 3,426% gains. Now, he’s brought to market a play just like it with similar profit potential. What’s more, it’s highly likely that its one high-grade uranium project, located on the uranium-rich Athabasca Basin, will become a spin-off company. This move will hand investors a fortune. And analysts project this to happen within the next six months, right as uranium is heating up. The combination of these two developments, plus its high-grade quality project, could send this $0.60 stock soaring by over 10,000%.

Third Supercycle Play #4: My final pick is now the #1 developer of one of the world’s largest, most prospective uranium projects in the world. A recent acquisition has placed it in control of a whopping 100 million pounds of uranium — a multibillion-dollar asset. It’s the kind of asset that would send this play through the roof on a massive uranium price upswing. During the last uranium supercycle, this company soared for incredible 11,700% gains. Right now, it’s trading dirt-cheap at just $0.35. And with this new billion-dollar asset, it could even beat that performance this time around.

So I included all the details on this lucrative pick — and the three others — in my FREE report: "The Third Supercycle: How to Grab 10,000% Profits on the Coming Uranium Boom."

Each of these companies could hand you 100-fold gains over the coming months.

And let me be clear:

While you’re virtually guaranteed to make money investing in uranium stocks...

If you know where to look and when to buy, it could mean the difference between just doubling your money...

And retiring wealthier than you ever dreamed.

I only know where to look because of my extensive "boots-on-the-ground" investigations.

I go out to the mines... the deposits... the operations...

I meet with the management, which is a crucial (yet overlooked) asset for any resource company...

And I see "behind the scenes," pulling up the curtain on the quarterly earnings report.

While traveling the world, I’ve combed the entire uranium sector from top to bottom.

And these four picks — the ones I just described — are the cream of the crop. Hands down.

Again, I’ve included full details on these four 100-baggers in my FREE report: "The Third Supercycle: How to Grab 10,000% Profits on the Coming Uranium Boom."

Here’s a quick preview of what you’ll get:

- All four company names and ticker symbols.

- Thorough company profiles based on firsthand analysis, including information you won’t find on CNBC, Forbes, or even in industry journals.

- The analyst "consensus" you won’t hear in press releases... but I hear from hobnobbing with industry insiders.

- And details of their assets, holdings, and upcoming dates for company reports.

All I ask is that you give my advisory research service, Early Advantage, an absolutely free test drive.

Join the Club

Hi. I'm Nick Hodge.

I'm an investment analyst here at Angel Publishing in Baltimore, Maryland.

I'm also editor of Nick Hodge's Early Advantage, the resource for big profits from little-known breakthroughs and disruptive technologies in energy, electronics, technology, agriculture, and more.

No sector is off limits.

In just the past few years, I've brought investors massive, rapid-fire gains from companies in multiple sectors, such as:

- 159% on Xethanol Inc. (in 3 months)

- 119% on Cree

- 316% on Akeena Solar

- 101% on JA Solar

- 245% on Organovo

- 426% on Alternate Energy Holdings (in just 3 months)

- 110% on Solarfun Power

- 113% on DNI Metals

- 391% on BYD Company (in 3 months)

- 73% on World Energy Solutions (2 days)

- 62% on Maxwell Technologies (3 months)

- 82% on Capstone Turbine (7 months)

- 78% on PowerSave Energy (3 months)

But know this: Off of just one of my recommendations, you could make the type of money that could change your portfolio... or even your life.

How do I know? It’s already happened.

One guy by the name of Dan Leopold wrote to me about one of my recent recommendations...

"I made over $100,000 with you on the first run a year or so ago..."

I’ve had to redact the stock name there because it’s an active play

that’s still making people money, and it wouldn’t be fair to those

currently holding positions.Donald McMillan shared his story, too:

"I did very well on two picks. Pretty lucky with a profit of $27,649!"

And Anthony Reymond recently wrote me to say:

"This is the most profitable

service in almost 10 years of trading. Pure and simple. [Three picks]

have been triple-digit winners for me. As a friend of mine who speaks

broken English would say, 'THANK YOU VERY BIG.'"

But my favorite is from Tom Donaldson, who made nearly half a million dollars on a single trade:

"Nick — My account is now over $450,000. Happy with the gains so far! Thanks!"

So as you can see, I continually provide the potential for huge gains.And I can tell you this...

It takes a lot of hard work and boots-on-the-ground research to maintain the success I’ve experienced.

Whether it’s flying out to California and speaking with an aquaculture expert to get the inside details on a world-changing medical discovery...

Or taking a tour with Canadian CEOs to uncover the newest intelligence in the world of energy...

Or even interviewing Montel Williams in the hopes of discovering the next 1,000% gainer in the market...

There’s not a stone I won’t turn over if I think there’s money to be made on the other side.

I Spend Millions on My Research

You already know the best way to make a lot of money is to get in the game early — before a company makes news with a major discovery in the mining or energy sector... the creation of some disruptive technology... or breakthroughs in agriculture or health.

I’ll go to any extent I feel necessary to make sure things are on the up-and-up before I recommend something other folks might put their money into.

I don’t simply sit behind a desk, stare at a computer screen, and pick a stock based on some arcane information from an annual report.

That’s for the no-talent hacks that think they know what they’re doing.

Not me. I do the real research most analysts don’t feel like doing — or can’t afford to do.

I’ve been in a three-man helicopter over the Canadian wilderness... stood on the edge of 500-foot-deep mines... and attended $5,000/seat conferences across the country... all in the name of securing the full stories behind the biggest wealth-creating opportunities in the world.

You can even say I’ve hobnobbed with the financial elite...

If you didn’t already know, the "other guy" in that snapshot is John Paulson, American hedge fund guru and billionaire.

We were both invited to a closed-door investment summit in Puerto Rico recently, and we had a nice little chat.

It’s pretty obvious these things don’t happen for analysts who refuse to leave the office — or get out of bed.

But I do it because it’s what I love to do. It’s what I’ve always loved to do.

Giving readers like YOU the early advantage on any moneymaking or money-saving opportunity available long before the rest of the market catches on.

That's what Early Advantage is all about.

I've been on the cutting edge for years, discovering major life-changing, moneymaking opportunities that other financial institutions don't cover.

Just to give you a better idea:

- Before 3D printing made the news, I told my readers about a company called Organovo. It develops three-dimensional (3D) human tissue-printing technology to create tissue on demand for research and surgical applications. Since then, the stock has surged over 570%.

- Then there's Natcore Technology, a company with a number of patented technologies that any solar company can use to double the efficiency of current solar cells while cutting costs in half. I flew to New York to visit the company's facilities and was impressed with what I saw. In less than three months, my readers were able to secure a 128% gain.

- And I've closed, in total, more than 210 double- and triple-digit winners on my stock recommendations alone by locating little-known wealth-building opportunities before the masses knew about them.

For 30 days, you'll have the chance to profit from every single one of the winning investments I’ve shared exclusively with my followers... without risking a single dime.

I want you to see for yourself how potentially profitable Early Advantage really could be for you.

Simply put, the minute you claim your copy of "The Third Supercycle: How to Grab 10,000% Profits on the Coming Uranium Boom," you'll immediately receive 60 full days of unrestricted access to the following:

- Quick Profits E-alerts: Get flash updates on the latest moneymaking scoops from my profit alerts. These obscure recommendations — that cannot wait a minute — will be delivered straight to your inbox seconds after they're written, as profitable opportunities could surface tomorrow.

- Regular Portfolio Updates: You'll know exactly what's happening with each profit-making play in your model portfolio, including regular updates and any news that will send the stock soaring further or when to sell for maximum profits.

- The Members-Only Early Advantage Website: Your gateway to my secure online platform for members only, with my no-nonsense research reports, commentary, picks, and current portfolio. You'll even get fast-track commentary on how to get the most out of my service.

- Research Videos: You'll have full access to my "boots-on-the-ground" research videos when I travel around the country investigating companies, visiting their facilities, and talking to CEOs. That way, you can follow my travels from your living room.

Unbelievable Value!

So how much does all this cost?

The short answer is: nothing.

I’ve convinced my publisher to give you a special deal... one that we’ve never offered before.

Now, I've seen research services like Early Advantage sell for $10,000 or more.

There are also "analysts" on Wall Street who pay thousands for these small-audience subscriptions.

Some of these analysts work in hidden niches of the market, making millions per year to research new ways to play upcoming trends.

To them, services like mine are a leg up on the competition, and they would happily pay $10,000 or more per year, since it’s really a fraction of the cost some "professionals" shell out for research like this.

But even though I could see this service going for that much, I know it would be difficult for everyday investors to participate at such high a price...

So I asked myself, What’s the absolute minimum I could ask people to pay for this service? What's reasonable? What's fair, considering the fundamental value?

After all, Angel Publishing and Outsider Club are in the publishing biz, and we have to keep the lights on here. That, and many of the companies I recommend with this predictive investment strategy require deep investigation.

That last part means I have to travel out to worksites... talk to the geologists and engineers... rub elbows with the people on drill decks and in core shacks... and meet with the CEOs and other executives.

So after crunching the numbers, I finally settled on a price of $1,599 per year for this service. At least, that will be the regular price of this service moving forward.

It’s easy to understand why: One single recommendation could easily pay for your entire subscription.

For example, one of my followers, Chris G., recently sent me this note:

"Thanks Nick, I grabbed a quick 36% gain today. That'll take care of this year's subscription price!"

Another of my followers, who wishes to remain anonymous, chimed in, "I just renewed Early Advantage. Made $6,000 on one play, so my membership has more than paid for itself. Keep 'em coming!"Another one of my followers, Donald M., said he made a profit of $27,649 last year.

That’s enough to pay for 17 years of my research!

Todd S. is up a bit more, saying...

"Thanks to Early Advantage, I'm planning to retire a multi-millionaire!"

Given these kinds of gains, I'm sure you'll agree $1,599 is a bargain.But you won’t have to pay that.

Reply Immediately and Receive My "Charter Member" Pricing

As one of my invited subscribers, I’m prepared to offer you the entire Early Advantage subscription for just a fraction of the cost...

In fact, you’ll pay 50% less than others pay for 12 months of my profit alerts.

That’s a HUGE discount off the normal price!

Simply click the "Subscribe Now" button below to see your final pricing.

I truly believe this third uranium supercycle is the single best opportunity I’ve ever discovered. I want to make absolutely sure you don't miss out on your chance to profit from it.

But there’s no telling how long this offer will be open, especially considering that many of the companies are small now but could be hitting the mainstream soon.

Even if we can at some point reopen this offer, it will likely only be to a handful of people and will probably come with the full price tag.

It’s a truly unique opportunity.

Because when I release my next alert, you could be up and running on your own path to becoming... well, much better off financially!

Subscribe at the end of this presentation to start receiving your profit alerts each month!

You're Minutes Away From Starting

You simply cannot afford to not join my research service immediately.

Click the "Subscribe Now" button below to receive my latest alert, and you could be on your way to riding the biggest gains of your life.

And if you're still not convinced, you have 30 days to decide if my brand-new strategy is really right for you!

You have my personal guarantee...

My "Keep Everything & Risk Nothing" DOUBLE GUARANTEE

You see, I stand behind every piece of advice, insight, and recommendation I make with 100% confidence. Your complete satisfaction is guaranteed — or your money back!

So I want you to go ahead and take a FULL 30 DAYS to have a good look at every breakout company I've uncovered.

And then, if for any reason you're not totally thrilled...

Just tell us to send your money back, and we'll promptly refund every penny, NO QUESTIONS ASKED.

You’ll get all the details about the third uranium supercycle and the four 100-baggers primed to soar... all the exclusive information on the members-only Early Advantage website... all the reports and investment guides... all the recommendations... all the articles and investing tips.

And if you join me today, I will give you access to three bonus reports — ABSOLUTELY FREE:

- "The 'Giga Net' Revolution"

- "Minting Millions from the Magic Molecule"

- "How to Make 213 Times Your Money with Blue Light Technology"

All three bonus reports are yours FREE when you agree to test-drive Early Advantage for 30 full days starting right now.

The intel in just one of these special briefings could easily pay for your membership many times over...

And they're yours to keep — no matter what your final decision is. But you must act fast...

As you’ve seen, history’s third uranium supercycle is forming right now. The opportunity is hot.

By January 31st, it will kick into gear. And by then it will be way too late.

You’ve seen the charts. You’ve seen the proof. You’ve seen the wealth and money.

Here’s what I suggest you do right now...

Click the link below to get started right away.

You’ll be able to review everything on the next page before your order is final.

And remember, this offer is risk-free for 30 days.

If you don’t like what you see, call me and cancel.

But if you’re still reading, I don’t think you'll need to worry, because I seriously doubt you'll be canceling...

Especially when you see what I’ve prepared for you.

Remember... your opportunity for incredible wealth could start immediately with my next alert.

I urge you not to delay.

I likely won't be able to offer this amazing deal to anyone else after this initial offer expires.

Just click here or the "Subscribe Now" below to get started... or call our customer service team at 855-877-4623.

I look forward to the wealth we'll make together.

Call it like you see it,

Nick Hodge

Editor and Creator, Early Advantage

Exposed:

http://www.angelnexus.com/o/web/91197

Warren Buffett's Secret

Marijuana Stash

Marijuana Stash

Why is the "world's greatest investor" stockpiling barrels of weed?

And could this daring move result in an explosive wave of $200 billion

in marijuana profits for savvy investors?

in marijuana profits for savvy investors?

Dear Reader,

In the heart of Denver’s "marijuana zone" sits a string of secret warehouses...

Together, they supply 120 metric tons of premium-grade marijuana — an estimated $700 million value.

Not much is known about what goes on here. They don’t advertise their names or locations. As Bloomberg reports, "the operations are still somewhat secretive."

But it’s not because they’re growing weed... now legal in Colorado.

Instead, my research shows it’s due to an incontrovertible link between these grow operations and "the world’s greatest investor."

The details of which could change everything you think you know about the explosive marijuana market.

All while minting you a fortune, as $200 billion in untapped wealth is unleashed onto the markets.

I even caught an image of this secret grow operation...

Now, before I go forward, let me make one thing clear: The details of this story are highly sensitive.

I doubt one in 1,000 Americans are privy to Buffett’s marijuana holdings.

And when Bloomberg reporters attempted to contact the normally chatty billionaire about it, he refused to comment.

But after I caught wind of this controversial story, I led a team to conduct a full-scale investigation...

And thanks to my extensive contacts inside the legal cannabis industry, I’ve gotten to the bottom of Buffett’s weed stash...

Why the "world’s greatest investor" has ties to warehouses stockpiling metric tons of marijuana...

And why this could hand life-altering profits to investors who are privy to the details.

Using history as a guide, we could see nothing less than short-term gains of 2,850%.

Which is why Buffett is far from alone.

As it turns out, the "smart money" is buying marijuana by the forklift.

Earlier this year, billionaire PayPal founder Peter Thiel staked over $75 million on marijuana holdings.

The LA Times reports Thiel is positioning himself for the inevitable end of prohibition.

And now dozens of big-name investors are following closely behind.

Like George Soros, who recently staked a fortune on the ground floor.

MarketWatch reports the billionaire is working with Big Food conglomerates to develop mass-scale growing operations...

And then there’s Tesla’s Elon Musk.

All told, Musk pocketed $133 million from this industry before it even launched.

In fact, this ground-floor opportunity is so lucrative that former

Microsoft executive Jamen Shively — who worked directly with Bill

Gates — left the software giant to begin a marijuana start-up.

According to Shively (a.k.a. the "Bill Gates of Cannabis"), the industry is on track "to create more millionaires than Microsoft."

"This Will Create More Millionaires Than Microsoft"

— Former Microsoft Exec Jamen Shively

Troy Dayton, CEO of the hedge fund ArcView Group, agrees, saying, "These are exciting times, new millionaires and potential billionaires are about to be made."— Former Microsoft Exec Jamen Shively

And it’s already happening...

Consider Colorado.

Since legalizing pot three years ago, the state has produced 4,873 new millionaires.

That’s a rate of almost five new millionaires a day!

CNN calls them "the New Marijuana Millionaires."

People who are waking up overnight to find they are sitting on a mountain of riches.

- Take Jeffery Moss, a 40-year-old Northern Washington farmer. Last year, he couldn’t afford a car and had to rely on his parents for money and his friends for meals. Now, legalization has made him a millionaire on his marijuana holdings... virtually overnight. In fact, since the state law passed last year, he’s grossed $5 million.

- Then there’s Carry Vincetti, 33, who left her job as a paralegal to join the "Green Rush" — not to sell marijuana, but as a consultant to start-up cannabis entrepreneurs. With so many people looking to make a killing on the Green Rush, her own business is booming. So far, she’s raked in a $2 million fortune.

- And there’s Allen Gustov, who lost all of his savings investing in a music venture. He and wife were sleeping on cardboard furniture and had a baby on the way when they moved out to Anaheim, California and opened a marijuana business. They went from being almost homeless to raking in over $1 million last year.

Now you can join these brand-new millionaires — without starting a business... owning a farm... or ever touching an ounce of marijuana.

In fact, in order to make a fortune from the cannabis boom...

- You don’t have to live in a state where marijuana is legal.

- You don’t have to sign any petitions or do any political advocacy.

- And you don’t have to have anything more than $25 to invest.

They don’t all grow or own weed, but they provide services that benefit those who do.

These are ancillary companies raking in the lion’s share of marijuana profits by providing software, real estate, and technology to growers.

Just like people who struck it rich in the Gold Rush by selling picks and shovels... not mining... these companies will spin off a new wave of millionaire investors.

To be sure, I’ve been to their operations and seen their sites. I’ve met their managers and workers.

I’ve pulled up the curtain on the quarterly earnings report and seen their real profit potential.

In short, I’ve gotten the inside scoop that you won’t hear from analysts sitting behind a desk.

Using history as a guide, they could deliver nothing less than 2,850% profits moving forward.

And that’s just over the next 12 months.

It’s happened before — when the government ended Prohibition...

When Atlantic City legalized gambling in the 1970s...

And other similar historic moments — what I call "crossover events."

This is when formerly illegal industries become legal... and already established companies with loyal customers generate fortunes — as do their investors.

Now, the exact same circumstances are setting us up for astronomic gains once again.

I’ll show you why these profits are inevitable... when to expect them... and what to buy.

But before I do, allow me to introduce myself...

I've Been on the Front Lines of the

Billion-Dollar "Green Rush"

For a Decade Now

I’ve been on the front lines of America’s billion-dollar "Green Rush" for the better part of a decade.

And even though the market is still only legal in some places...

I’ve shown my readers big gains on some of the hottest emerging marijuana plays.

Like a biotech developing marijuana treatments that we bought and sold for 93% gains in seven months.

Or a Canadian marijuana delivery company that handed us 73% gains in seven months.

Another company I recommended four months ago has doubled since then.

And I’ve given six-figure presentations in front of Silicon Valley bigwigs seeking my outlook on this explosive market.

I’ve even hobnobbed with the likes of famous TV host Montel Williams, who benefited from medical marijuana to treat his multiple sclerosis... and is now benefiting financially from his medical marijuana dispensary, too.

Recently I toured the facilities of Canada’s dominant medical marijuana firm... now poised to make a small fortune for investors.

All because I’m confident of one simple thing...

Legal marijuana is the kind of once-in-a-lifetime mega-trend that delivers "big wins"...

The kind you can retire early on, with more money than you know what to do with.

You see, we hardly ever see the birth of a new billion-dollar industry or the opportunity to get in before these profits are unlocked...

Much less one where money is already there under the surface.

That’s what makes the emergence of America’s newest and most lucrative industry — legal marijuana — the most extraordinary profit opportunity I’ve ever seen...

And because marijuana legalization is unfolding state by state, we have the rare opportunity to buy in before prohibition completely ends.

If you know the stories of alcohol millionaires like Joe Kennedy, then you know just how lucrative this can be...

And why Silicon Valley is now scrambling to join the "Green Rush."

In fact, at my recent Money Show presentation, I spoke to early VC investors in companies like Uber, Reddit, and Tesla Motors.

All are pouring capital into emerging marijuana start-ups... and see even bigger opportunity than anything Silicon Valley has delivered since the iPhone.

The Financial Times now calls marijuana "Silicon Valley’s hot new sector."

And as the LA Times puts it, "They’re leveraging the legalization of marijuana into a windfall."

So are Fortune 500 corporations.

This includes companies previously opposed to marijuana legalization, like...

- Big Tobacco

- Big Ag

- Big Pharma

All are putting down billions outside the purview of the government or the media.

Cannabis is even moving to Wall Street, where it could soon be traded just like any commodity.

The CEO of VC firm Privateer Holdings predicts, "Six to 12 months from now there will be investment banks who will have analysts following cannabis like they follow healthcare or agricultural commodities."

These "smart money" moves all point to one unavoidable conclusion...

The time to (legally) pocket massive profits from marijuana is now.

And for good reason...

Over the last 24 months, the legal market has surged from zero to a $2.7 billion industry.

A newly released market report even called legal marijuana:

"America's Fastest-Growing Industry"

— Troy Dayton, CEO of the ArcView Group

Smartphones came in a distant second.— Troy Dayton, CEO of the ArcView Group

Last year, sales skyrocketed 74%.

The year before, 64%.

No market has taken off at this rate since the tech boom began in the early '90s.

But moving forward, this will look like a drop in the bucket.

Think about it...

Medical marijuana is legal in 23 states...

Recreational use in a mere four states.

Four others have decriminalized it.

And these are just the first dominos to fall.

New laws are rapidly advancing in half of all 50 states, red and blue alike.

The customers already exist. The market is already there. The profits are just now being tapped.

Which is why this millionaire growth story is only just beginning.

And why the 2016 elections will unlock the marijuana industry’s untapped profit potential...

I’m talking about the imminent end of marijuana prohibition, thanks to a series of little-known bills on the state and federal levels.

Now, that may sound like a bold prediction, but the writing is on the wall. Anyone who’s paying attention can see it.

Explosive Profit Catalyst:

The Imminent End

of Prohibition in 2016

At least 17 states are lined up to fully legalize marijuana.

And more are joining the wave, no matter who wins the White House.

The political consensus is growing.

Pew Research polls show 53% of the American public supports legalization.

63% of Republicans under 30 support legal marijuana.

And Republican support for legalization has more than doubled in the last five years.

That’s why Republican presidential candidates are now jumping on board, including Trump, Bush, Cruz, and Walker...

In fact, Newsweek recently called 2016 "The Marijuana Election."

Like it or not, we could see "green states" from sea to shining sea by early November.

And as Forbes predicts, "[This move] will make investors extremely wealthy."

I agree.

But what’s the REAL upside potential?

Now, while legal sales of marijuana have climbed to $2.7 billion...

We’re just seeing the results of four states legalizing recreational use.

So as it spreads across the Union, it’s not hard to imagine this story will look a whole lot different.

After all, we’re looking at tens of millions of new and already existing customers.

This is a giant "mountain of money" waiting to be unlocked.

When all is said and done, estimates put the legal market at an astronomic $200 billion.

That’s an incredible sales surge of 7,300%...

The kind of astronomic growth that turns everyday folks into millionaires.

And I’m not talking about 10, five, or even three years from now... but over the next 24 months.

Phenomenal 7,300% Sales Surge...

in 24 Months

The Daily Bell takes it a bit further, calling it the "profit opportunity of the 21st century."

And one hedge fund owner told Wall Street investors, "There is a massive potential. It is untapped. It is just sitting there below the surface and it is ready to come above ground."

Now, some may still be opposed to legalizing marijuana. They may think it’s unethical or immoral.

And I respect anyone’s views.

But when you consider the tide of public opinion...

The growing number of states lining up for legalization...

And the massive profits about to be unleashed as a result...

I think you can agree legal marijuana is inevitable, as are the profits at stake.

So the way I see it, you have two choices...

You can sit on the sidelines and miss out on the profit opportunity of the 21st century...

Or you can ride the tidal wave of inevitable profits for retirement wealth, however you feel about marijuana.

In a moment, I’ll share with you the three best ways to cash in on this $200 billion wealth trend.

The future Anheuser-Busches, Bacardis, and Miller-Coors of marijuana.

But first, let me show you just how much money is up for grabs...

When can you expect to see it...

And why I’m so confident these profits are inevitable.

To give you an idea: First, we’ll have to go back to the end of Prohibition in the 1930s...

When alcohol stocks skyrocketed for unbelievable 10-fold gains in under a year...

Even as the rest of the stock market tanked!

This is what I consider a "crossover event" — illegal markets becoming legal.

Time and time again, these market anomalies have handed investors a fortune.

Let me explain...

The Biggest Profit Opportunity in 83 Years

The writing is on the wall.

FDR wins the election by a landslide.

One of his central promises?

The repeal of Prohibition.

FDR’s victory was easy to anticipate at least months before.

So were the legalization bills that passed in several states.

And much like the situation we’re seeing now, alcohol’s legalization was all but inevitable.

That’s why, even though it would be another year before Prohibition was actually repealed...

It didn’t matter.

Alcohol stocks — known as "repeal stocks" — soared to the heavens.

But since selling liquor was still illegal, only three kinds of American companies were available:

- Medicinal

- Industrial (i.e. cars)

- Ancillary purposes... like antifreeze

Today a blue-chip giant, this company was relatively new at the time.

In June 1932, it traded for just $5.

But then it soared to $10... $30... and $50.

By July 1933, five months before Prohibition was even repealed, it soared to $64...

A massive gain of 1,180% in just 12 months.

Then there’s American Commercial Alcohol, a leading producer of alcohol for cars.

It soared from $8 in 1932 to $20... and then to $50.

By July, it had reached $90.

That's a 1,025% gain in just 15 months.

And there’s National Distillers, the largest provider of medicinal alcohol, which surged from $12 to $125.

Let’s not forget Canada, where alcohol was still legal...

And where major suppliers surged as the American market opened up once again.

Take Hiram-Walker, the maker of Canadian Club, which soared from $2 in 1932 to $59 just 12 months later.

A gain of 2,850%.

But the biggest "repeal stock" home run was the bottle manufacturer Libbey Owens-Ford...

In fact, the Chicago Institute of Securities would list it as one of the top stocks of the next two decades...

All told, the stock surged for incredible 11,326% gains.

Enough to turn just $10,000 into over a million-dollar nest egg.

Now, these gains are great and all...

But how did investors really do?

How Joe Kennedy REALLY Got Rich

(HINT: Not Bootlegging)

Now, you might have heard the legendary story of how the Kennedy patriarch accumulated his riches...

Laying the foundations of the famous family fortune.

To this day, many claim Kennedy built his empire by illegally bootlegging alcohol.

But in reality, that was only a small part of it.

Instead, Kennedy made his REAL fortune in just three simple steps...

- He anticipated Prohibition’s end early

- He bought shares of bottle manufacturers and other ancillary companies

- And then rode the tidal wave of life-changing profits as alcohol shares surged in 1933

All by investing in alcohol-related stocks like National Distillers and Libbey-Owens Ford.

Now you can do the same.

And while you might not make millions like Kennedy...

If you know the companies to buy and take action early, just like Kennedy did...

THIS could be the biggest profit windfall of your life — hands down.

And this is just one past example.

Whenever an industry becomes legal, investors get rich.

History has proven this time and time again.

Consider the next big "crossover event" — the (partial) legalization of gambling in the 1970s...

Guess What Happened When

Gambling Became (Somewhat) Legal...

Atlantic City passes a historic bill legalizing gambling.

The law leads to Native Americans winning a series of historic court battles...

Paving the way for legalized gambling in Indian reservations everywhere.

The result?

Gaming stocks take off... even as the market is tanking.

Take Bally Manufacturing, the country’s largest casino slot-maker.

It trades at $5.

But then it shoots up to $10... $30... as high as $68 by September.

A gain of 1,260% in just nine months.

Then there’s the Las Vegas casino operator Golden Nugget.

It surges from $5 at the beginning of the year to $45 by August...

A gain of 800% in eight months.

And these are just a handful of examples. Dozens of hotel, airline, and real estate stocks soared for 1,000% gains or more in just months. Many were ancillary companies poised to profit from the legalization of gambling in Atlantic City.

But the biggest home run by far was Resorts International — the lead casino for Atlantic City.

That’s a whopping 31,432% gain... in just two short years.

Good enough to turn every...

- $100 into $31,432

- $1,000 into $313,432

- $10,000 into $3,313,432