Uranium Enrichment

http://www.world-nuclear.org/information-library/nuclear-fuel-cycle/conversion-enrichment-and-fabrication/uranium-enrichment.aspx

(Updated February 2019)

- Most of the 500 commercial nuclear power reactors operating or under construction in the world today require uranium 'enriched' in the U-235 isotope for their fuel.

- The commercial process employed for this enrichment involves gaseous uranium in centrifuges. An Australian process based on laser excitation is under development.

- Prior to enrichment, uranium oxide must be converted to a fluoride so that it can be processed as a gas, at low temperature.

- From a non-proliferation standpoint, uranium enrichment is a sensitive technology needing to be subject to tight international control.

- There is a significant surplus of world enrichment capacity.

Uranium found in nature consists largely of two isotopes, U-235 and

U-238. The production of energy in nuclear reactors is from the

'fission' or splitting of the U-235 atoms, a process which releases

energy in the form of heat. U-235 is the main fissile isotope of

uranium.

Natural uranium contains 0.7% of the U-235 isotope. The remaining

99.3% is mostly the U-238 isotope which does not contribute directly to

the fission process (though it does so indirectly by the formation of

fissile isotopes of plutonium). Isotope separation is a physical process

to concentrate (‘enrich’) one isotope relative to others. Most reactors

are light water reactors (of two types – PWR and BWR) and require

uranium to be enriched from 0.7% to 3-5% U-235 in their fuel. This is

normal low-enriched uranium (LEU). There is some interest in taking

enrichment levels to about 7%, and even close to 20% for certain special

power reactor fuels, as high-assay LEU (HALEU).

Uranium-235 and U-238 are chemically identical, but differ in their

physical properties, notably their mass. The nucleus of the U-235 atom

contains 92 protons and 143 neutrons, giving an atomic mass of 235

units. The U-238 nucleus also has 92 protons but has 146 neutrons –

three more than U-235 – and therefore has a mass of 238 units.

The difference in mass between U-235 and U-238 allows the isotopes to

be separated and makes it possible to increase or "enrich" the

percentage of U-235. All present and historic enrichment processes,

directly or indirectly, make use of this small mass difference.

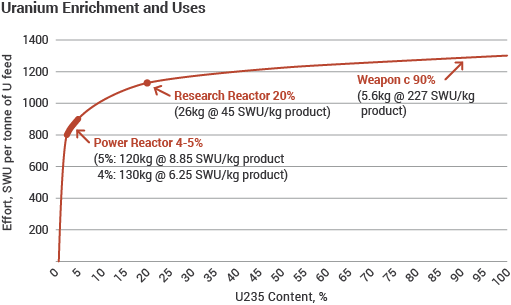

Some reactors, for example the Canadian-designed Candu and the

British Magnox reactors, use natural uranium as their fuel. (For

comparison, uranium used for nuclear weapons would have to be enriched

in plants specially designed to produce at least 90% U-235.)

Enrichment processes require uranium to be in a gaseous form at

relatively low temperature, hence uranium oxide from the mine is

converted to uranium hexafluoride in a preliminary process, at a

separate conversion plant.

There is significant over-supply of enrichment capacity worldwide,

much of which has been used to diminish uranium demand or supplement

uranium supply. The ability of enrichment to substitute for uranium (see

description of underfeeding below) has become more significant as

centrifuge technology has taken over, since this means both lower SWU

costs and the need to keep the centrifuges running, so capacity remains

on line even as demand drops away.

Although 13 countries have enrichment production capability or

near-capability, about 90% of world enrichment capacity is in the five

nuclear weapons states. These plus Germany, Netherlands and Japan

provide toll enrichment services to the commercial market.

International Enrichment Centres, Multilateral approaches

Following proposals from the International Atomic Energy Agency

(IAEA) and Russia, and in connection with the US-led Global Nuclear

Energy Partnership (GNEP), there are moves to establish international

uranium enrichment centres. These are one kind of multilateral nuclear

approaches (MNA) called for by IAEA. Part of the motivation for

international centres is to bring all new enrichment capacity, and

perhaps eventually all enrichment, under international control as a

non-proliferation measure. Precisely what "control" means remains to be

defined, and will not be uniform in all situations. But having ownership

and operation shared among a number of countries at least means that

there is a level of international scrutiny which is unlikely in a

strictly government-owned and -operated national facility.

The first of these international centres is the International Uranium

Enrichment Centre (IUEC) at Angarsk in Siberia, with Kazakh, Armenian

and Ukrainian equity so far. The centre is to provide assured supplies

of low-enriched uranium for power reactors to new nuclear power states

and those with small nuclear programs, giving them equity in the

project, but without allowing them access to the enrichment technology.

Russia will maintain majority ownership, and in February 2007 the IUEC

was entered into the list of Russian nuclear facilities eligible for

implementation of IAEA safeguards. The USA has expressed support for the

IUEC at Angarsk. IUEC will sell both enrichment services (SWU) and

enriched uranium product.

In some respects this is very similar to what pertained with the

Eurodif set-up, where a single large enrichment plant in France with

five owners (France – 60%, Italy, Spain, Belgium and Iran) was operated

under IAEA safeguards by the host country without giving participants

any access to the technology – simply some entitlement to share of the

product, and even that was constrained in the case of Iran. The French

Atomic Energy Commission proposed that the new Georges Besse II plant

which replaced Eurodif should be open to international partnerships on a

similar basis, and minor shares in the Areva subsidiary operating

company Societe d'Enrichissement du Tricastin (SET) have so far been

sold to GDF Suez (now Engie), a Japanese partnership, and Korea Hydro

and Nuclear Power (KHNP) – total 12%.

The three-nation Urenco set-up is also similar though with more

plants in different countries – UK, Netherlands and Germany – and here

the technology is not available to host countries or accessible to other

equity holders. Like Russia with IUEC, Urenco (owned by the UK and

Netherlands host governments plus E.On and RWE in Germany) has made it

plain that if its technology is used in international centres it will

not be accessible. Its new plant is in the USA, where the host

government has regulatory but not management control.

A planned new Areva plant in the USA has no ownership diversity

beyond that of Areva itself, so will be essentially a French plant on US

territory. The only other major enrichment plant in the Western world

is USEC's very old one, in the USA.

The Global Laser Enrichment project which may proceed to build a

commercial plant in the USA has shareholding from companies based in

three countries: USA (51%), Canada (24%) and Japan (25%).

Enrichment Processes

A number of enrichment processes have been demonstrated historically

or in the laboratory but only two, the gaseous diffusion process and the

centrifuge process, have operated on a commercial scale. In both of

these, UF6 gas is used as the feed material. Molecules of UF6

with U-235 atoms are about one percent lighter than the rest, and this

difference in mass is the basis of both processes. Isotope separation is

a physical process.*

*One chemical process has been demonstrated to pilot plant

stage but not used. The French Chemex process exploited a very slight

difference in the two isotopes' propensity to change valency in

oxidation/reduction, utilising aqueous (III valency) and organic (IV)

phases.

Large commercial enrichment plants are in operation in France,

Germany, Netherlands, UK, USA, and Russia, with smaller plants

elsewhere. New centrifuge plants are being built in France and USA.

Several plants are adding capacity. China’s capacity is expanding

considerably, in line with domestic requirements. With surplus capacity,

Russian plants operate at low tails assays (underfeeding) to produce

low-enriched uranium for sale.

World enrichment capacity – operational and planned (thousand SWU/yr)

| Country | Company and plant | 2013 | 2015 | 2020 |

| France | Areva, Georges Besse I & II | 5500 | 7000 | 7500 |

| Germany-Netherlands-UK | Urenco: Gronau, Germany; Almelo, Netherlands; Capenhurst, UK. | 14,200 | 14,400 | 14,900 |

| Japan | JNFL, Rokkaasho | 75 | 75 | 75 |

| USA | USEC, Piketon | 0* | 0 | 0 |

| USA | Urenco, New Mexico | 3500 | 4700 | 4700 |

| USA | Areva, Idaho Falls | 0 | 0 | 0 |

| USA | Global Laser Enrichment, Paducah | 0 | 0 | 0 |

| Russia | Tenex: Angarsk, Novouralsk, Zelenogorsk, Seversk | 26,000 | 26,578 | 28,663 |

| China | CNNC, Hanzhun & Lanzhou | 2200 | 5760 | 10,700+ |

| Other | Various: Argentina, Brazil, India, Pakistan, Iran | 75 | 100 | 170 |

| Total SWU/yr approx | 51,550 | 58,600 | 66,700 | |

| Requirements (WNA reference scenario) | 49,154 | 47,285 | 57,456 |

Source: World Nuclear Association Nuclear Fuel Report 2013 & 2105, information paper on China's Nuclear Fuel Cycle, Areva 2014 Reference Document for most 2013 figures.

* Diffusion, closed mid-2013, US centrifuge proposed.

'Other' includes Resende in Brazil, Rattehallib in India and Natanz in Iran. At end of 2012 Iran had about 9000 SWU/yr capacity operating, according to ISIS and other estimates.

The Euratom Supply Agency Annual Report 2014 estimated world nameplate capacity at 56 million SWU, Russia 28 million SWU, Urenco 18.1 million SWU and Areva 7.5 million SWU.

'Other' includes Resende in Brazil, Rattehallib in India and Natanz in Iran. At end of 2012 Iran had about 9000 SWU/yr capacity operating, according to ISIS and other estimates.

The Euratom Supply Agency Annual Report 2014 estimated world nameplate capacity at 56 million SWU, Russia 28 million SWU, Urenco 18.1 million SWU and Areva 7.5 million SWU.

The feedstock for enrichment consists of uranium hexafluoride (UF6) from the conversion plant. Following enrichment two streams of UF6

are formed: the enriched ‘product’ containing a higher concentration of

U-235 which will be used to make nuclear fuel, and the ‘tails’

containing a lower concentration of U-235, and known as depleted uranium

(DU). The tails assay (concentration of U-235) is an important quantity

since it indirectly determines the amount of work that needs to be done

on a particular quantity of uranium in order to produce a given product

assay. Feedstock may have a varying concentration of U-235, depending

on the source. Natural uranium will have a U-235 concentration of

approximately 0.7%, while recycled uranium will be around 1% and tails

for re-enrichment often around 0.25-0.30%.

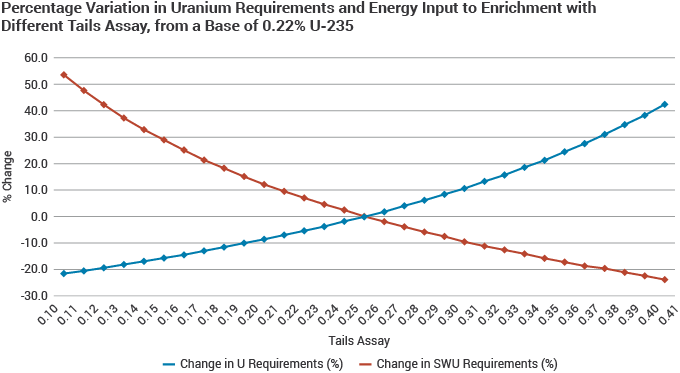

The capacity of enrichment plants is measured in terms of 'separative work units' or SWU. The SWU is a complex unit which indicates the energy input relative to the amount of uranium processed, the degree to which it is enriched (i.e. the extent of increase in the concentration of the U-235 isotope relative to the remainder) and the level of depletion of the remainder – called the ‘tails’. The unit is strictly: kilogram separative work unit, and it measures the quantity of separative work performed to enrich a given amount of uranium a certain amount when feed and product quantities are expressed in kilograms. The unit 'tonnes SWU' is also used.

For instance, to produce one kilogram of uranium enriched to 5% U-235 requires 7.9 SWU if the plant is operated at a tails assay 0.25%, or 8.9 SWU if the tails assay is 0.20% (thereby requiring only 9.4 kg instead of 10.4 kg of natural U feed). There is always a trade-off between the cost of enrichment SWU and the cost of uranium.

Today, 5% U-235 is the maximum level of enrichment for fuel used in

normal power reactors. However, especially in relation to new small

reactor designs, there is increasing interest in higher enrichment

levels. Some small demand already exists for research

reactors. High-assay LEU (HALEU) may be 10-20% U-235 for certain special

power reactor fuels. However such HALEU is best produced onsite where

it is converted from fluoride and made into fuel, to avoid the need for

special transport packages for HALEU UF6.

The first graph shows enrichment effort (SWU) per unit of product. The second shows how one tonne of natural uranium feed might end up: as 120-130 kg of uranium for power reactor fuel, as 26 kg of typical research reactor fuel, or conceivably as 5.6 kg of weapons-grade material. The curve flattens out so much because the mass of material being enriched progressively diminishes to these amounts, from the original one tonne, so requires less effort relative to what has already been applied to progress a lot further in percentage enrichment. The relatively small increment of effort needed to achieve the increase from normal levels is the reason why enrichment plants are considered a sensitive technology in relation to preventing weapons proliferation, and are very tightly supervised under international agreements. Where this safeguards supervision is compromised or obstructed, as in Iran, concerns arise.About 140,000 SWU is required to enrich the annual fuel loading for a typical 1000 MWe light water reactor at today's higher enrichment levels. Enrichment costs are substantially related to electrical energy used. The gaseous diffusion process consumes about 2500 kWh (9000 MJ) per SWU, while modern gas centrifuge plants require only about 50 kWh (180 MJ) per SWU.

Enrichment accounts for almost half of the cost of nuclear fuel and

about 5% of the total cost of the electricity generated. In the past it

has also accounted for the main greenhouse gas impact from the nuclear

fuel cycle where the electricity used for enrichment is generated from

coal. However, it still only amounts to 0.1% of the carbon dioxide from

equivalent coal-fired electricity generation if modern gas centrifuge

plants are used.

The utilities which buy uranium from the mines need a fixed quantity

of enriched uranium in order to fabricate the fuel to be loaded into

their reactors. The quantity of uranium they must supply to the

enrichment company is determined by the enrichment level required (%

U-235) and the tails assay (also % U-235). This is the contracted or

transactional tails assay, and determines how much natural uranium must

be supplied to create a quantity of Enriched Uranium Product (EUP) – a

lower tails assay means that more enrichment services (notably energy)

are to be applied. The enricher, however, has some flexibility in

respect to the operational tails assay at the plant. If the operational

tails assay is lower than the contracted/transactional assay, the

enricher can set aside some surplus natural uranium, which it is free to

sell (either as natural uranium or as EUP) on its own account.

This is known as underfeeding.* Utilities are increasingly seeking to

control this flexibility of operation in contracts, and themselves get

some of the benefit from underfeeding.

* The opposite situation, where the operational tails assay is

higher, requires the enricher to supplement the natural uranium

supplied by the utility with some of its own – this is called

overfeeding.

In respect to underfeeding (or overfeeding), the enricher will base

its decision on the plant economics together with uranium and energy

prices. The World Nuclear Association's 2015 Nuclear Fuel Report

estimates that by underfeeding the enrichers have the potential to

contribute 5700 to 8000 tU/yr to world markets to 2025 on the basis of

typical Western 0.22% tails assay, much of this potential in

Russia, where tails assays are normally 0.10% U-235.

With reduced demand for enriched uranium following the Fukushima

accident, enrichment plants have continued running, since it is costly

to shut down and re-start centrifuges. The surplus SWU output can be

sold, or the plants can be underfed so that the enricher ends up with

excess uranium for sale, or with enriched product for its own inventory

and later sale. The inertia of the enrichment process thus exacerbates

over-supply in the uranium market and depresses SWU prices (from

$160/SWU in 2010, the spot price in March 2016 was $60). With forecast

overcapacity, it is likely that some older cascades will be retired.

Obsolete diffusion plants have been retired, the last being some belated activity at Paducah in 2013.

Natural uranium is usually shipped to enrichment plants in type 48Y

cylinders, each holding about 12.5 tonnes of uranium hexafluoride (8.4

tU). These cylinders are then used for long-term storage of DU,

typically at the enrichment site. Enriched uranium is shipped in type

30B cylinders, each holding 2.27 t UF6 (1.54 tU).

| Supply source: | 2000 | 2010 | 2015 | projected 2020 |

| Diffusion | 50% | 25% | 0 | 0 |

| Centrifuge | 40% | 65% | 100% | 93% |

| Laser | 0 | 0 | 0 | 3% |

| HEU ex weapons | 10% | 10% | 0 | 4% |

The three enrichment processes described below have different

characteristics. Diffusion is flexible in response to demand variations

and power costs but is very energy-intensive. With centrifuge technology

it is easy to add capacity with modular expansion, but it is inflexible

and best run at full capacity with low operating cost. Laser technology

can strip down to very low level tails assay, and is also capable of

modular plant expansion.

Centrifuge process

The gas centrifuge process was first demonstrated in the 1940s but

was shelved in favour of the simpler diffusion process. It was then

developed and brought on stream in the 1960s as the second-generation

enrichment technology. It is economic on a smaller scale, e.g.

under 2 million SWU/yr, which enables staged development of larger

plants. It is much more energy efficient than diffusion, requiring only

about 40-50 kWh per SWU.

The centrifuge process has been deployed at a commercial level in

Russia, and in Europe by Urenco, an industrial group formed by British,

German and Dutch governments. Russia's four plants at Seversk,

Zelenogorsk, Angarsk and Novouralsk account for some 40% of world

capacity*. Urenco operates enrichment plants in the UK, Netherlands and

Germany and one in the USA.

* In 2012 Russia was commissioning 8th

generation centrifuges with service life of up to 30 years. The last 6th

& 7th generation ones were installed in 2005, and 8th generation

equipment has been supplied since 2004 to replace 5th generation models

with a service life of only 15 years.

In Japan, JNC and JNFL operate small centrifuge plants, the capacity

of JNFL's at Rokkasho was planned to be 1.5 million SWU/yr. China has

two small centrifuge plants imported from Russia. China has several

centrifuge plants, the first at Hanzhun with 6th generation centrifuges

imported from Russia. The Lanzhou plant is operating at 3.5 million

SWU/yr but expanding to 6.5 million SWU/yr by 2020, and Hanzhun is

operating at 2.2 million SWU/yr. Others are under construction. Brazil

has a small plant which is being developed to 0.2 million SWU/yr.

Pakistan has developed centrifuge enrichment technology, and this

appears to have been sold to North Korea. Iran has sophisticated

centrifuge technology which is operational, with estimated 9000 SWU/yr

capacity.

In both France and the USA plants with late-generation Urenco

centrifuge technology have been built to replace ageing diffusion

plants, not least because they are more economical to operate. As noted,

a centrifuge plant requires as little as 40 kWh/SWU power (Urenco at

Capenhurst, UK, input 62.3 kWh/SWU for the whole plant in 2001-02,

including infrastructure and capital works).

Areva's new €3 billion French plant – Georges Besse II – started

commercial operation in April 2011 and reached full capacity of 7.5

million SWU/yr in 2016. As noted above, customers hold more than 10%

equity in Areva’s operating subsidiary SET.

Urenco's new $1.5 billion National Enrichment Facility in New Mexico,

USA commenced production in June 2010. Full initial capacity of 3.7

million SWU/yr was reached in 2014, and capacity reached 4.7 million

SWU/yr in 2015 – enough for 10% of US electricity needs.

Following this, Areva was planning to build the $2 billion, 3.3

million SWU/yr Eagle Rock plant at Idaho Falls, USA. In 2009 it applied

for doubling in capacity to 6.6 million SWU/yr. It is now cancelled, and

in 2018 Orano requested the NRC to terminate the licence.

USEC, now Centrus, was building its American Centrifuge Plant

in Piketon, Ohio, on the same Portsmouth site where the DOE's

experimental plant operated in the 1980s as the culmination of a very

major R&D programme. Operation from 2012 was envisaged, at a cost of

$3.5 billion then estimated. It was designed to have an initial annual

capacity of 3.8 million SWU. Authorisation for enrichment up to 10% was

sought – most enrichment plants operate up to 5% U-235 product, which is

becoming a serious constraint as reactor fuel burnup increases. A

demonstration cascade started up in September 2007 with about 20

prototype machines, and a lead cascade of commercial centrifuges started

operation in March 2010. These are very large machines, 13 m tall, each

with about 350 SWU/yr capacity and requiring regular maintenance.

However the whole project was largely halted in July 2009 pending

further finance, although a demonstration cascade became operational in

October 2013 as "the centerpiece of the RD&D program with DOE." It

was licensed for 7 million SWU/yr enrichment up to 10% U-235, but

operations ceased in February 2016.

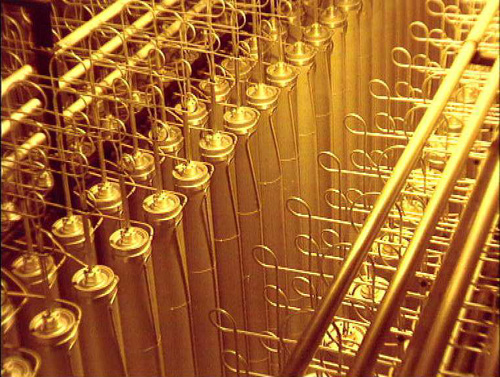

A bank of centrifuges at a Urenco plant

Like the diffusion process, the centrifuge process uses UF6

gas as its feed and makes use of the slight difference in mass between

U-235 and U-238. The gas is fed into a series of vacuum tubes, each

containing a rotor 3 to 5 metres tall and 20 cm diameter.* European

centrifuges produce 40-100 SWU/yr. When the rotors are spun rapidly, at

50,000 to 70,000 rpm, the heavier molecules with U-238 increase in

concentration towards the cylinder's outer edge. There is a

corresponding increase in concentration of U-235 molecules near the

centre. The countercurrent flow set up by a thermal gradient enables

enriched product to be drawn off axially, heavier molecules at one end

and lighter ones at the other.

* USEC's American Centrifuges are more than 12 m tall and

40-50 cm diameter. The Russian centrifuges are less than one metre tall.

Chinese ones are larger, but shorter than Urenco's.

The enriched gas forms part of the feed for the next stages while the depleted UF6 gas goes back to the previous stage. Eventually enriched and depleted uranium are drawn from the cascade at the desired assays.

To obtain efficient separation of the two isotopes, centrifuges

rotate at very high speeds, with the outer wall of the spinning cylinder

moving at between 400 and 500 metres per second to give a million times

the acceleration of gravity.

Although the volume capacity of a single centrifuge is much smaller

than that of a single diffusion stage, its capability to separate

isotopes is much greater. Centrifuge stages normally consist of a large

number of centrifuges in parallel. Such stages are then arranged in

cascade similarly to those for diffusion. In the centrifuge process,

however, the number of stages may only be 10 to 20, instead of a

thousand or more for diffusion. Centrifuges are designed to run for

about 25 years continuously, and cannot simply be slowed or shut down

and restarted according to demand. Western cascades are designed for

0.18 to 0.22% tails assay, Russian ones for 0.10%.

Laser processes

Laser enrichment processes have been the focus of interest for some

time. They are a possible third-generation technology promising lower

energy inputs, lower capital costs and lower tails assays, hence

significant economic advantages. One of these processes is almost ready

for commercial use. Laser processes are in two categories: atomic and

molecular.

Development of the Atomic Vapour Laser Isotope Separation (AVLIS, and

the French SILVA) began in the 1970s. In 1985 the US Government backed

it as the new technology to replace its gaseous diffusion plants as they

reached the end of their economic lives early in the 21st century.

However, after some US$ 2 billion in R&D, it was abandoned in USA in

favour of SILEX, a molecular process. French work on SILVA ceased

following a 4-year program to 2003 to prove the scientific and technical

feasibility of the process. Some 200kg of 2.5% enriched uranium was

produced in this.

Atomic vapour processes work on the principle of photo-ionisation,

whereby a powerful laser is used to ionise particular atoms present in a

vapour of uranium metal. (An electron can be ejected from an atom by

light of a certain frequency. The laser techniques for uranium use

frequencies which are tuned to ionise a U-235 atom but not a U-238

atom.) The positively-charged U-235 ions are then attracted to a

negatively-charged plate and collected. Atomic laser techniques may also

separate plutonium isotopes.

Most molecular processes which have been researched work on a principle of photo-dissociation of UF6 to solid UF5+,

using tuned laser radiation as above to break the molecular bond

holding one of the six fluorine atoms to a U-235 atom. This then enables

the ionized UF5 to be separated from the unaffected UF6 molecules containing U-238 atoms, hence achieving a separation of isotopes.* Any process using UF6 fits more readily within the conventional fuel cycle than the atomic process.

* A similar principle can be used in enriching atomic lithium, with magnetic separation of the ionised atoms, leaving pure Li-7.

The main molecular laser process to enrich uranium is SILEX, which utilises UF6

and is now known as Global Laser Enrichment (GLE). In 2006 GE Energy

entered a partnership with Australia's Silex Systems to develop the

third-generation SILEX process. It provided for GE (now GE-Hitachi) to

construct in the USA an engineering-scale test loop, then a pilot plant

or lead cascade, which could be operating in 2012, and expanded to a

full commercial plant. Apart from US$ 20 million upfront and subsequent

payments, the license agreement would yield 7-12% royalties, the precise

amount depending on the cost of deploying the commercial technology. In

mid-2008 Cameco bought into the GLE project, paying $124 million for

24% share, alongside GE (51%) and Hitachi (25%). (Earlier, in 1996 USEC

had secured the rights to evaluate and develop SILEX for uranium but

baled out of the project in 2003.)

In April 2016 GE and Hitachi notified their intention to exit GLE,

and during subsequent negotiations Silex funded 76% of GLE’s R&D at

Wilmington, North Carolina. GLE is well advanced in commercialising the

SILEX process, and has an agreement with the US Department of Energy to

enrich about 300,000 tonnes of depleted uranium tails at Paducah,

Kentucky to natural-grade uranium.

In February 2019 Silex Systems and Cameco agreed to buy out the GEH

76% share in GLE for US$ 20 million on a deferred payment basis, so that

Cameco holds 49% of GLE and Silex 51%. Cameco has an option to purchase

an additional 26% of GLE. The agreement calls for Silex and Cameco to

pay $300,000 per month to complete construction of the prototype

enrichment facility, known as Wilmington Test Loop, which has been

partially built by GEH. The agreement is contingent upon US government

approvals. Silex said: "The Paducah commercial opportunity respresents

an ideal path to market for our disruptive SILEX laser enrichment

technology."

GE had earlier referred to SILEX, which it rebadged as GLE, as

"game-changing technology" with a "very high likelihood" of success. GLE

is completing the test loop program, the initial phase of which has

already been successful in meeting performance criteria, and engineering

design for a commercial facility has commenced. GLE is operating the

test loop at Global Nuclear Fuel's Wilmington, North Carolina fuel

fabrication facility – GNF is a partnership of GE, Toshiba, and Hitachi.

In October 2007 the two largest US nuclear utilities, Exelon and

Entergy, signed letters of intent to contract for uranium enrichment

services from GE Hitachi Global Laser Enrichment LLC (GLE). The

utilities may also provide GLE with support if needed for development of

a commercial-scale GLE plant. In August 2010 TVA agreed to buy $400

million of enrichment services from GLE if the project proceeds.

In mid-2009 GEH submitted the last part of its licence application

for this GLE plant at Wilmington, and following review of provisions for

the physical protection of special nuclear material and classified

matter, material control and accounting, plus further review by the NRC

Atomic Safety and Licensing Board, a full licence to construct and

operate a plant of up to 6 million SWU/yr was issued in September 2012.

GLE will now decide in the light of commercial considerations on whether

to proceed with a full-scale enrichment facility at Wilmington. The

project, enriching up to 8% U-235, could be operational in a few years,

and ramp up to capacity fairly quickly.

In August 2013 GLE submitted a proposal to the DOE to establish a “$1

billion” laser enrichment plant at Paducah, Kentucky to enrich

high-assay tails (above 0.34% U-235) owned by DOE to natural uranium

level (0.7% U-235). There is about 115,000 tonnes of these at Paducah

and Portsmouth (among a total of 550,000 t tails). In November 2013 the

DOE announced that it would proceed with contract negotiations to this

end. In January 2014 GLE told the NRC that though negotiations with the

DOE continued, it expected to apply for a licence later that year to

build and operate the Paducah Laser Enrichment Facility (PLEF) which

would enrich the tails over about 40 years to natural grade, for sale.

GLE expects licensing to take 2-3 years. Negotiations with the DOE

continued into 2016, and in November an agreement was signed with the

DOE for it to supply about 300,000 tonnes of high-assay tails,

justifying construction by GLE of the plant in the early 2020s. PLEF

would become a commercial uranium enrichment production facility under a

US NRC licence, producing about 100,000 tonnes of natural-grade uranium

over 40 years or more. The DOE would dispose of the reduced-assay

balance. The estimated plant size is 0.5 to 1.0 million SWU/yr, since

purchases of DU may not exceed 2000 t/yr natural uranium equivalent.

Applications to silicon and zirconium stable isotopes are also being developed by Silex Systems near Sydney.

CRISLA is another molecular laser isotope separation

process which is the early stages of development. In this a gas is

irradiated with a laser at a particular wavelength that would excite

only the U-235 isotope. The entire gas is subjected to low temperatures

sufficient to cause condensation on a cold surface or coagulation in the

un-ionised gas. The excited molecules in the gas are not as likely to

condense as the unexcited molecules. Hence in cold-wall condensation,

gas drawn out of the system is enriched in the U-235 isotope that was

laser-excited. NeuTrek, the development company, is aiming to build a

pilot plant in USA.

Gaseous diffusion process

The energy-intensive gaseous diffusion process of uranium enrichment

is no longer used in the nuclear industry. It involves forcing uranium

hexafluoride gas under pressure through a series of porous membranes or

diaphragms. As U-235 molecules are lighter than the U-238 molecules they

move faster and have a slightly better chance of passing through the

pores in the membrane. The UF6 which diffuses through the membrane is thus slightly enriched, while the gas which did not pass through is depleted in U-235.

This process is repeated many times in a series of diffusion stages

called a cascade. Each stage consists of a compressor, a diffuser and a

heat exchanger to remove the heat of compression. The enriched UF6 product is withdrawn from one end of the cascade and the depleted UF6 is

removed at the other end. The gas must be processed through some 1400

stages to obtain a product with a concentration of 3-4% U-235. Diffusion

plants typically have a small amount of separation through one stage

(hence the large number of stages) but are capable of handling large

volumes of gas.

Commercial uranium enrichment was first carried out by the diffusion

process in the USA, at Oak Ridge, Tennessee. The process was also used

in Russia, UK, France, China and Argentina as well, but only on a

significant scale in the USA and France in recent years. Russia phased

out the process in 1992 and the last diffusion plant was USEC's Paducah

facility, which shut down in mid-2013. It is very energy-intensive,

requiring about 2400 kWh per SWU*. USEC said that electricity accounted

for 70% of the production cost at Paducah, which was the last of three

large plants in the USA originally developed for weapons programs and

had a capacity of some 8 million SWU per year. It was used to enrich

some high-assay tails before being finally shut down after 60 years'

operation. At Tricastin, in southern France, a more modern diffusion

plant with a capacity of 10.8 million kg SWU per year had been operating

since 1979 (see photo below). This Georges Besse I plant could produce

enough 3.7% enriched uranium a year to fuel some ninety 1000 MWe nuclear

reactors. It was shut down in mid-2012, after 33 years' continuous

operation. Its replacement (GB II, a centrifuge plant – see above) has

commenced operation.

* It has been estimated that 7% of total US

electricity demand was from enrichment plants at the height of the Cold

War, when 90% U-235 was required, rather than the reactor grades of

3-4%for power generation.

In recent years the gaseous diffusion process had accounted for about

25% of world enrichment capacity. However, though they have proved

durable and reliable, gaseous diffusion plants reached the end of their

design life and the much more energy-efficient centrifuge enrichment

technology has replaced them.

The large Georges Besse I enrichment plant at Tricastin in France (beyond cooling towers) was shut down in 2012.

Most of the output from the nuclear power plant (4x915MWe net) was used to power the enrichment facility.

Most of the output from the nuclear power plant (4x915MWe net) was used to power the enrichment facility.

Electromagnetic process

A very early endeavour was the electromagnetic isotope separation

(EMIS) process using calutrons. This was developed in the early 1940s in

the Manhattan Project to make the highly enriched uranium used in the

Hiroshima bomb, but was abandoned soon afterwards. However, it

reappeared as the main thrust of Iraq's clandestine uranium enrichment

program for weapons discovered in 1992. EMIS uses the same principles as

a mass spectrometer (albeit on a much larger scale). Ions of

uranium-238 and uranium-235 are separated because they describe arcs of

different radii when they move through a magnetic field. The process is

very energy-intensive – about ten times that of diffusion.

Aerodynamic processes

Two aerodynamic processes were brought to demonstration stage around

the 1970s. One is the jet nozzle process, with demonstration plant built

in Brazil, and the other the Helikon vortex tube process developed in

South Africa. Neither is in use now, though the latter is the forerunner

of new R&D. They depend on a high-speed gas stream bearing the UF6

being made to turn through a very small radius, causing a pressure

gradient similar to that in a centrifuge. The light fraction can be

extracted towards the centre and the heavy fraction on the outside.

Thousands of stages are required to produce enriched product for a

reactor. Both processes are energy-intensive - over 3000 kWh/SWU. The

Helikon Z-plant in the early 1980s was not commercially oriented and had

less than 500,000 SWU/yr capacity. It required some 10,000 kWh/SWU.

The Aerodynamic Separation Process (ASP) being developed by Klydon in

South Africa employs similar stationary-wall centrifuges with UF6

injected tangentially. It is based on Helikon but pending regulatory

authorisation it has not yet been tested on UF6 - only light isotopes

such as silicon. However, extrapolating from results there it is

expected to have an enrichment factor in each unit of 1.10 (cf 1.03 in

Helikon) with about 500 kWh/SWU and development of it is aiming for 1.15

enrichment factor and less than 500 kWh/SWU. Projections give an

enrichment cost under $100/SWU, with this split evenly among capital,

operation and energy input.

One chemical process has been demonstrated to pilot plant stage but

not used. The French Chemex process exploited a very slight difference

in the two isotopes' propensity to change valency in

oxidation/reduction, utilising aqueous (III valency) and organic (IV)

phases.

Enrichment of reprocessed uranium

In some countries used fuel is reprocessed to recover its uranium and

plutonium, and to reduce the final volume of high-level wastes. The

plutonium is normally recycled promptly into mixed-oxide (MOX) fuel, by

mixing it with depleted uranium.

Where uranium recovered from reprocessing used nuclear fuel (RepU) is

to be re-used, it needs to be converted and re-enriched. This is

complicated by the presence of impurities and two new isotopes in

particular: U-232 and U-236, which are formed by or following neutron

capture in the reactor, and increase with higher burn-up levels. U-232

is largely a decay product of Pu-236, and increases with storage time in

used fuel, peaking at about ten years. Both decay much more rapidly

than U-235 and U-238, and one of the daughter products of U-232 emits

very strong gamma radiation, which means that shielding is necessary in

any plant handling material with more than very small traces of it.

U-236 is a neutron absorber which impedes the chain reaction, and means

that a higher level of U-235 enrichment is required in the product to

compensate. For the Dutch Borssele reactor which normally uses 4.4%

enriched fuel, compensated enriched reprocessed uranium (c-ERU) is 4.6%

enriched to compensate for U-236. Being lighter, both isotopes tend to

concentrate in the enriched (rather than depleted) output, so

reprocessed uranium which is re-enriched for fuel must be segregated

from enriched fresh uranium. The presence of U-236 in particular means

that most reprocessed uranium can be recycled only once - the main

exception being in the UK with AGR fuel made from recycled Magnox

uranium being reprocessed. U-234 is also present in RepU, but as an

alpha emitter it does not pose extra problems. Traces of some fission

products such as Tc-99 may also carry over.

All these considerations mean that only RepU from low-enriched,

low-burnup used fuel is normally recycled directly through an enrichment

plant. For instance, some 16,000 tonnes of RepU from Magnox reactors*

in UK has been used to make about 1650 tonnes of enriched AGR fuel, via

two enrichment plants. Much smaller quantities have been used elsewhere,

in France and Japan. Some re-enrichment, eg for Swiss, German and

Russian fuel, is actually done by blending RepU with HEU.

* Since Magnox fuel was not enriched in the first

place, this is actually known as Magnox depleted uranium (MDU). It

assayed about 0.4% U-235 and was converted to UF6, enriched to 0.7% at

BNFL's Capenhurst diffusion plant and then to 2.6% to 3.4% at Urenco's

centrifuge plant. Until the mid 1990s some 60% of all AGR fuel was made

from MDU and it amounted to about 1650 tonnes of LEU. Recycling of MDU

was discontinued in 1996 due to economic factors.

A laser process would theoretically be ideal for enriching RepU as it

would ignore all but the desired U-235, but this remains to be

demonstrated with reprocessed feed.

Tails from enriching reprocessed uranium remain the property of the

enricher. Some recycled uranium has been enriched by Tenex at Seversk

for Areva, under a 1991 ten-year contract covering about 500 tonnes UF6.

French media reports in 2009 alleging that wastes from French nuclear

power plants were stored at Seversk evidently refer to tails from this.

Enrichment of depleted uranium tails

Early enrichment activities often left depleted uranium tails with

about 0.30% U-235, and there were tens of thousands of tonnes of these

sitting around as the property of the enrichment companies. With the

wind-down of military enrichment, particularly in Russia, there was a

lot of spare capacity unused. Consequently, since the mid 1990s some of

the highest-assay tails have been sent to Russia by Areva and Urenco for

re-enrichment by Tenex. These arrangements however cease in 2010,

though Tenex may continue to re-enrich Russian tails. Tenex now owns all

the tails from that secondary re-enrichment, and they are said to

comprise only about 0.10% U-235.

After enrichment

The enriched UF6 is converted to UO2 and made

into fuel pellets – ultimately a sintered ceramic, which are encased in

metal tubes to form fuel rods, typically up to four metres long. A

number of fuel rods make up a fuel assembly, which is ready to be loaded

into the nuclear reactor. See Fuel Fabrication paper.

Environmental Issues

With the minor exception of reprocessed uranium, enrichment involves

only natural, long-lived radioactive materials; there is no formation of

fission products or irradiation of materials, as in a reactor. Feed,

product, and depleted material are all in the form of UF6, though the depleted uranium may be stored long-term as the more stable U3O8.

Uranium is only weakly radioactive, and its chemical toxicity – especially as UF6

– is more significant than its radiological toxicity. The protective

measures required for an enrichment plant are therefore similar to those

taken by other chemical industries concerned with the production of

fluorinated chemicals.

Uranium hexafluoride forms a very corrosive material (HF –

hydrofluoric acid) when exposed to moisture, therefore any leakage is

undesirable. Hence:

- in almost all areas of a centrifuge plant the pressure of the UF6 gas is maintained below atmospheric pressure and thus any leakage could only result in an inward flow;

- double containment is provided for those few areas where higher pressures are required;

- effluent and venting gases are collected and appropriately treated.

Notes & References

General sources

Heriot, I.D. (1988). Uranium Enrichment by Centrifuge, Report EUR 11486, Commission of the European Communities, Brussels.

Kehoe, R.B. (2002). The Enriching Troika, a History of Urenco to the Year 2000. Urenco, Marlow UK.

Wilson, P.D. (ed)(1996). The Nuclear Fuel Cycle – from ore to wastes. Oxford University Press, Oxford UK.

IAEA 2007, Management of Reprocessed Uranium – current status and future prospects, Tecdoc 1529.

Kehoe, R.B. (2002). The Enriching Troika, a History of Urenco to the Year 2000. Urenco, Marlow UK.

Wilson, P.D. (ed)(1996). The Nuclear Fuel Cycle – from ore to wastes. Oxford University Press, Oxford UK.

IAEA 2007, Management of Reprocessed Uranium – current status and future prospects, Tecdoc 1529.

Nuclear Fuel Cycle / Conversion Enrichment and Fabrication / Conversion and Deconversion

Conversion and Deconversion

(Updated January 2019)

http://www.world-nuclear.org/information-library/nuclear-fuel-cycle/conversion-enrichment-and-fabrication/conversion-and-deconversion.aspx

- Uranium enrichment requires uranium as uranium hexafluoride, which is obtained from converting uranium oxide to UF6.

- Conversion plants are operating commercially in the USA, Canada, France, Russia and China.

- Deconversion of depleted UF6 to uranium oxide or UF4 is undertaken for long-term storage of depleted uranium in more stable form.

Uranium leaves the mine as the concentrate of a stable oxide known as U3O8

or as a peroxide. It still contains some impurities and prior to

enrichment has to be further refined before or after being converted to

uranium hexafluoride (UF6), commonly referred to as

'hex'. Both processes are normally included in the step between the mine

and enrichment plant – referred to as 'conversion'.

Conversion plants are operating commercially in the USA, Canada,

France, Russia and China. The main new plant is Areva’s Comurhex,

operating between two sites in France. China’s capacity is expected to

grow considerably through to 2025 and beyond to keep pace with domestic

requirements.

World Primary Conversion Capacity

| Company | Location | Nameplate capacity (tonnes U/yr as UF6) |

Approx capacity utilisation |

Capacity utilisation tU/yr |

| Cameco | Port Hope, Canada | 12,500 | 50% | 6250 |

| TVEL (Rosatom) | SGCE Seversk, Russia | 18,000 | 100% assumed | 18,000 |

| Areva | Pierrelatte, France | 15,000 | 70% | 10,500 |

| ConverDyn | Metropolis, USA |

7000 |

100% | 7000 |

| CNNC | Lanzhou, China* | 5000 | 80% | 4000 |

| IPEN | Brazil | 100 | 70% | 70 |

| World Total | 57,600 | 45,820 |

World Nuclear Association Nuclear Fuel Report 2017; World Nuclear Association information paper on China's Nuclear Fuel Cycle.

* Information on China's conversion capacity is uncertain. An

additional 9000 t/yr plant is reported to be under construction at

Lanzhou, as well as a 3000 tU/yr plant at Hengyang in Hunan.

Conversion process

The main, 'wet' process, is used by Cameco in

Canada, by Areva in France, at Lanzhou in China and Seversk in Russia.

For the wet process, the concentrate is first dissolved in nitric acid.

The resulting clean solution of uranyl nitrate UO2(NO3)2.6H2O

is fed into a countercurrent solvent extraction process, using tributyl

phosphate dissolved in kerosene or dodecane. The uranium is collected

by the organic extractant, from which it can be washed out by dilute

nitric acid solution and then concentrated by evaporation. The solution

is then calcined in a fluidised bed reactor to produce UO3 (or UO2 if heated sufficiently).

Alternatively, the uranyl nitrate may be concentrated and have

ammonia injected to produce ammonium diuranate, which is then calcined

to produce pure UO3.

Crushed U3O8 from the dry process and purified uranium oxide UO3 from the wet process are then reduced in a kiln by hydrogen to UO2:

U3O8 + 2H2 ===> 3UO2 + 2H2O ΔH = -109 kJ/mol

or UO3 + H2 ===> UO2 + H2O ΔH = -109 kJ/mol

This reduced oxide is then reacted in another kiln with gaseous hydrogen fluoride (HF) to form uranium tetrafluoride (UF4), though in some places this is made with aqueous HF by a wet process:

UO2 + 4HF ===> UF4 + 2H2O ΔH = -176 kJ/mol

The tetrafluoride is then fed into a fluidised bed reactor or flame

tower with gaseous fluorine to produce uranium hexafluoride, UF6. Hexafluoride ('hex') is condensed and stored.

UF4 + F2 ===> UF6

Removal of impurities takes place at each step.

The alternative, 'dry' process is used in the USA.

In the dry process, uranium oxide concentrates are first calcined

(heated strongly) to drive off some impurities, then agglomerated and

crushed. At Converdyn’s US conversion plant, U3O8 is first made into impure UF6 and this is then refined in a two-stage distillation process.

UF6, particularly if moist, is

highly corrosive. When warm it is a gas, suitable for use in the

enrichment process. At lower temperature and under moderate pressure,

the UF6 can be liquefied. The liquid

is run into specially designed steel shipping cylinders which are thick

walled and weigh over 15 tonnes when full. As it cools, the liquid UF6 within the cylinder becomes a white crystalline solid and is shipped in this form.

The siting, environmental and security management of a conversion

plant is subject to the regulations that are in effect for any chemical

processing plant involving fluorine-based chemicals.

Secondary sources of conversion supply

Secondary supply of equivalent conversion services includes UF6 material from commercial and government inventories, enricher underfeeding, and DU tails recovery. Uranium and plutonium recycle effectively adds to this. All these were estimated at 26,000 tU in 2013 but with the end of the Russian HEU supply to the USA, they are now much less – an estimated 10,000 tU in 2017. By 2030 they are predicted to be less than 9000 tU.Depleted uranium and deconversion

Up to 90% of the original uranium feed ends up as depleted uranium (DU), which is stored long-term as UF6 or preferably, after deconversion, as U3O8, allowing HF to be recycled. It may also be deconverted to UF4,

which is more stable, with much higher temperature of volatalisation.

To early 2007, about one-quarter of the world's 1.5 million tonnes of DU

had been deconverted.

The main deconversion plant is the 20,000 t/yr one run by Areva NC at

Tricastin, France, and over 300,000 tonnes has been processed here. The

technology has been sold to Russia. Two plants have been built by

Uranium Disposition Services (UDS) at Portsmouth and Paducah, USA, with

capacities of 13,500 and 18,000 t/yr respectively. A 6500 t/yr plant is

being built at New Mexico in the USA by International Isotopes (INIS).

In the UK, Urenco ChemPlants has built a 15,000 t/yr plant.

Uranium Deconversion Plants

| Operator | Location | Capacity tU/yr |

| Areva | Tricastin, France | 20,000 |

| Richland, Washington, USA | small | |

| Urenco ChemPlants | Capenhurst, UK | 15,000 |

| Mid America Conversion Services | Portsmouth, Ohio, USA | 13,500 |

| Paducah, Kentucky, USA | 18,000 | |

| INIS Fluorine Products | Hobbs, New Mexico, USA | 6500 (construction on hold) |

| Tenex | Zelenogorsk, Russian Federation | 10,000 |

Russia’s W-ECP deconversion plant is at Zelenogorsk Electrochemical

Plant (ECP) in Siberia. The 10,000 tU/yr deconversion (defluorination)

plant was built by Tenex under a technology transfer agreement with

Areva NC, so that depleted uranium can be stored long-term as uranium

oxide, and HF is produced as a by-product. The W-ECP plant is similar to

Areva’s W2 plant at Pierrelatte in France and has mainly west European

equipment. It was commissioned in December 2009.

Russia is also building a plant at Angarsk to deconvert UF6 to UF4, recovering some HF in the process. Capacity of 2000 tU/yr was planned for 2012, with subsequent increase to 6000 tU/yr.

These use essentially a dry process, with no liquid effluent. It is

the same as that used for the enriched portion, albeit at a scale of

20,000 tU/yr in the one plant.

The UF6 is first vapourised in autoclaves with steam, then the uranyl fluoride (UO2F2) is reacted with hydrogen at 700°C to yield an HF product for sale to converters and U3O8 powder which is packed into 10-tonne containers for storage.

UF6 + 2H2O ==⇒ UO2F2 + 4HF

3UO2F2 + 2H2O + H2 ===> U3O8 + 6HF

The INIS plant in Idaho uses a slightly different deconversion

followed by fluorine extraction process (FEP), on a toll basis. The

deconversion plant had been used to produce DU metal for the military

and was purchased by INIS. In this, the depleted UF6 is first vapourised in autoclaves and hydrogen is added to give depleted UO2 and anhydrous UF4 which is the main product for sale. The FEP then involves reacting some UF4 with silica to give silicon fluoride (SiF4) as a commercial co-product.

Ownership title is normally transferred to the enricher as part of

the commercial deal. It is sometimes considered as a waste, though only

for legal or regulatory reasons and in the USA, but usually it is

understood as a long-term strategic resource which can be used in a

future generation of fast neutron reactors. Any much more efficient

enrichment process would also make it into an immediately usable

resource to supply more U-235. Enrichment companies with ownership of

large amounts of depleted uranium are quite clear that their stocks are a

significant asset, though Urenco speaks of deconversion being for

long-term storage “prior to geological disposal”.

Notes & references

General references

World Nuclear Association,The Nuclear Fuel Report 2017-2035 (September 2017)Enriched uranium

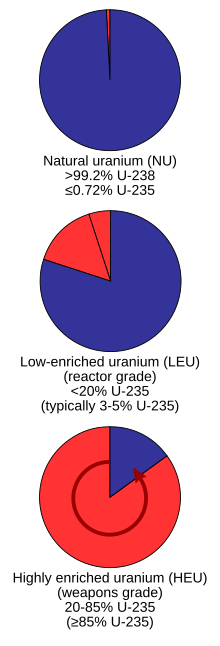

Proportions of uranium-238 (blue) and uranium-235 (red) found naturally versus enriched grades

Enriched uranium is a type of uranium in which the percent composition of uranium-235 has been increased through the process of isotope separation. Natural uranium is 99.284% 238U isotope, with 235U only constituting about 0.711% of its mass. 235U is the only nuclide existing in nature (in any appreciable amount) that is fissile with thermal neutrons.[1]

Enriched uranium is a critical component for both civil nuclear power generation and military nuclear weapons. The International Atomic Energy Agency attempts to monitor and control enriched uranium supplies and processes in its efforts to ensure nuclear power generation safety and curb nuclear weapons proliferation.

During the Manhattan Project enriched uranium was given the codename oralloy, a shortened version of Oak Ridge alloy, after the location of the plants where the uranium was enriched. The term oralloy is still occasionally used to refer to enriched uranium. There are about 2,000 tonnes (t, Mg) of highly enriched uranium in the world,[2] produced mostly for nuclear power, nuclear weapons, naval propulsion, and smaller quantities for research reactors.

The 238U remaining after enrichment is known as depleted uranium (DU), and is considerably less radioactive than even natural uranium, though still very dense and extremely hazardous in granulated form – such granules are a natural by-product of the shearing action that makes it useful for armor-penetrating weapons and radiation shielding. At present, 95 percent of the world's stocks of depleted uranium remain in secure storage.

Enriched uranium is a critical component for both civil nuclear power generation and military nuclear weapons. The International Atomic Energy Agency attempts to monitor and control enriched uranium supplies and processes in its efforts to ensure nuclear power generation safety and curb nuclear weapons proliferation.

During the Manhattan Project enriched uranium was given the codename oralloy, a shortened version of Oak Ridge alloy, after the location of the plants where the uranium was enriched. The term oralloy is still occasionally used to refer to enriched uranium. There are about 2,000 tonnes (t, Mg) of highly enriched uranium in the world,[2] produced mostly for nuclear power, nuclear weapons, naval propulsion, and smaller quantities for research reactors.

The 238U remaining after enrichment is known as depleted uranium (DU), and is considerably less radioactive than even natural uranium, though still very dense and extremely hazardous in granulated form – such granules are a natural by-product of the shearing action that makes it useful for armor-penetrating weapons and radiation shielding. At present, 95 percent of the world's stocks of depleted uranium remain in secure storage.

Grades

Uranium as it is taken directly from the Earth is not suitable as fuel for most nuclear reactors and requires additional processes to make it usable. Uranium is mined either underground or in an open pit depending on the depth at which it is found. After the uranium ore is mined, it must go through a milling process to extract the uranium from the ore. This is accomplished by a combination of chemical processes with the end product being concentrated uranium oxide, which is known as "yellowcake", contains roughly 60% uranium whereas the ore typically contains less than 1% uranium and as little as 0.1% uranium (Henderson 2000). After the milling process is complete, the uranium must next undergo a process of conversion, "to either uranium dioxide, which can be used as the fuel for those types of reactors that do not require enriched uranium, or into uranium hexafluoride, which can be enriched to produce fuel for the majority of types of reactors". Naturally-occurring uranium is made of a mixture of U-235 and U-238. The U-235 is fissile meaning it is easily split with neutrons while the remainder is U-238, but in nature, more than 99% of the extracted ore is U-238. Most nuclear reactors require enriched uranium, which is uranium with higher concentrations of U-235 ranging between 3.5% and 4.5%. There are two commercial enrichment processes: gaseous diffusion and gas centrifugation. Both enrichment processes involve the use of uranium hexafluoride and produce enriched uranium oxide.

A drum of yellowcake (a mixture of uranium precipitates)

Reprocessed uranium (RepU)

Reprocessed uranium (RepU) is a product of nuclear fuel cycles involving nuclear reprocessing of spent fuel. RepU recovered from light water reactor (LWR) spent fuel typically contains slightly more U-235 than natural uranium, and therefore could be used to fuel reactors that customarily use natural uranium as fuel, such as CANDU reactors. It also contains the undesirable isotope uranium-236, which undergoes neutron capture, wasting neutrons (and requiring higher U-235 enrichment) and creating neptunium-237, which would be one of the more mobile and troublesome radionuclides in deep geological repository disposal of nuclear waste.Low enriched uranium (LEU)

Low enriched uranium (LEU) has a lower than 20% concentration of 235U; for instance, in commercial light water reactors (LWR), the most prevalent power reactors in the world, uranium is enriched to 3 to 5% 235U. Fresh LEU used in research reactors is usually enriched 12% to 19.75% U-235, the latter concentration being used to replace HEU fuels when converting to LEU.[3]Highly enriched uranium (HEU)

A billet of highly enriched uranium metal

Highly enriched uranium (HEU) has a 20% or higher concentration of 235U. The fissile uranium in nuclear weapon primaries usually contains 85% or more of 235U known as weapons-grade, though theoretically for an implosion design,

a minimum of 20% could be sufficient (called weapon(s)-usable) although

it would require hundreds of kilograms of material and "would not be

practical to design";[4][5] even lower enrichment is hypothetically possible, but as the enrichment percentage decreases the critical mass for unmoderated fast neutrons rapidly increases, with for example, an infinite mass of 5.4% 235U being required.[4] For criticality experiments, enrichment of uranium to over 97% has been accomplished.[6]

The very first uranium bomb, Little Boy, dropped by the United States on Hiroshima in 1945, used 64 kilograms of 80% enriched uranium. Wrapping the weapon's fissile core in a neutron reflector (which is standard on all nuclear explosives) can dramatically reduce the critical mass. Because the core was surrounded by a good neutron reflector, at explosion it comprised almost 2.5 critical masses. Neutron reflectors, compressing the fissile core via implosion, fusion boosting, and "tamping", which slows the expansion of the fissioning core with inertia, allow nuclear weapon designs that use less than what would be one bare-sphere critical mass at normal density. The presence of too much of the 238U isotope inhibits the runaway nuclear chain reaction that is responsible for the weapon's power. The critical mass for 85% highly enriched uranium is about 50 kilograms (110 lb), which at normal density would be a sphere about 17 centimetres (6.7 in) in diameter.

Later US nuclear weapons usually use plutonium-239 in the primary stage, but the jacket or tamper secondary stage, which is compressed by the primary nuclear explosion often uses HEU with enrichment between 40% and 80%[7] along with the fusion fuel lithium deuteride. For the secondary of a large nuclear weapon, the higher critical mass of less-enriched uranium can be an advantage as it allows the core at explosion time to contain a larger amount of fuel. The 238U is not fissile but still fissionable by fusion neutrons.

HEU is also used in fast neutron reactors, whose cores require about 20% or more of fissile material, as well as in naval reactors, where it often contains at least 50% 235U, but typically does not exceed 90%. The Fermi-1 commercial fast reactor prototype used HEU with 26.5% 235U. Significant quantities of HEU are used in the production of medical isotopes, for example molybdenum-99 for technetium-99m generators.[8]

The very first uranium bomb, Little Boy, dropped by the United States on Hiroshima in 1945, used 64 kilograms of 80% enriched uranium. Wrapping the weapon's fissile core in a neutron reflector (which is standard on all nuclear explosives) can dramatically reduce the critical mass. Because the core was surrounded by a good neutron reflector, at explosion it comprised almost 2.5 critical masses. Neutron reflectors, compressing the fissile core via implosion, fusion boosting, and "tamping", which slows the expansion of the fissioning core with inertia, allow nuclear weapon designs that use less than what would be one bare-sphere critical mass at normal density. The presence of too much of the 238U isotope inhibits the runaway nuclear chain reaction that is responsible for the weapon's power. The critical mass for 85% highly enriched uranium is about 50 kilograms (110 lb), which at normal density would be a sphere about 17 centimetres (6.7 in) in diameter.

Later US nuclear weapons usually use plutonium-239 in the primary stage, but the jacket or tamper secondary stage, which is compressed by the primary nuclear explosion often uses HEU with enrichment between 40% and 80%[7] along with the fusion fuel lithium deuteride. For the secondary of a large nuclear weapon, the higher critical mass of less-enriched uranium can be an advantage as it allows the core at explosion time to contain a larger amount of fuel. The 238U is not fissile but still fissionable by fusion neutrons.

HEU is also used in fast neutron reactors, whose cores require about 20% or more of fissile material, as well as in naval reactors, where it often contains at least 50% 235U, but typically does not exceed 90%. The Fermi-1 commercial fast reactor prototype used HEU with 26.5% 235U. Significant quantities of HEU are used in the production of medical isotopes, for example molybdenum-99 for technetium-99m generators.[8]

Enrichment methods

Isotope separation is difficult because two isotopes of the same element have very nearly identical chemical properties, and can only be separated gradually using small mass differences. (235U is only 1.26% lighter than 238U.) This problem is compounded by the fact that uranium is rarely separated in its atomic form, but instead as a compound (235UF6 is only 0.852% lighter than 238UF6.) A cascade of identical stages produces successively higher concentrations of 235U. Each stage passes a slightly more concentrated product to the next stage and returns a slightly less concentrated residue to the previous stage.There are currently two generic commercial methods employed internationally for enrichment: gaseous diffusion (referred to as first generation) and gas centrifuge (second generation), which consumes only 2% to 2.5%[9] as much energy as gaseous diffusion (at least a "factor of 20" more efficient).[10] Some work is being done that would use nuclear resonance; however there is no reliable evidence that any nuclear resonance processes have been scaled up to production.

Diffusion techniques

Gaseous diffusion

Gaseous diffusion is a technology used to produce enriched uranium by forcing gaseous uranium hexafluoride (hex) through semi-permeable membranes. This produces a slight separation between the molecules containing 235U and 238U. Throughout the Cold War, gaseous diffusion played a major role as a uranium enrichment technique, and as of 2008 accounted for about 33% of enriched uranium production,[11] but in 2011 was deemed an obsolete technology that is steadily being replaced by the later generations of technology as the diffusion plants reach their ends-of-life.[12] In 2013, the Paducah facility in the US ceased operating, it was the last commercial 235U gaseous diffusion plant in the world.[13]Thermal diffusion

Thermal diffusion utilizes the transfer of heat across a thin liquid or gas to accomplish isotope separation. The process exploits the fact that the lighter 235U gas molecules will diffuse toward a hot surface, and the heavier 238U gas molecules will diffuse toward a cold surface. The S-50 plant at Oak Ridge, Tennessee was used during World War II to prepare feed material for the EMIS process. It was abandoned in favor of gaseous diffusion.Centrifuge techniques

Gas centrifuge

A cascade of gas centrifuges at a U.S. enrichment plant

The gas centrifuge process uses a large number of rotating cylinders

in series and parallel formations. Each cylinder's rotation creates a

strong centripetal force so that the heavier gas molecules containing 238U move tangentially toward the outside of the cylinder and the lighter gas molecules rich in 235U

collect closer to the center. It requires much less energy to achieve

the same separation than the older gaseous diffusion process, which it

has largely replaced and so is the current method of choice and is

termed second generation. It has a separation factor per stage of 1.3 relative to gaseous diffusion of 1.005,[11]

which translates to about one-fiftieth of the energy requirements. Gas

centrifuge techniques produce close to 100% of the world's enriched

uranium.

Zippe centrifuge

Diagram of the principles of a Zippe-type gas centrifuge with U-238 represented in dark blue and U-235 represented in light blue

The Zippe centrifuge

is an improvement on the standard gas centrifuge, the primary

difference being the use of heat. The bottom of the rotating cylinder is

heated, producing convection currents that move the 235U up the cylinder, where it can be collected by scoops. This improved centrifuge design is used commercially by Urenco to produce nuclear fuel and was used by Pakistan in their nuclear weapons program.

Laser techniques

Laser processes promise lower energy inputs, lower capital costs and lower tails assays, hence significant economic advantages. Several laser processes have been investigated or are under development. Separation of Isotopes by Laser Excitation (SILEX) is well advanced and licensed for commercial operation in 2012.Atomic vapor laser isotope separation (AVLIS)

Atomic vapor laser isotope separation employs specially tuned lasers[14] to separate isotopes of uranium using selective ionization of hyperfine transitions. The technique uses lasers tuned to frequencies that ionize 235U atoms and no others. The positively charged 235U ions are then attracted to a negatively charged plate and collected.Molecular laser isotope separation (MLIS)

Molecular laser isotope separation uses an infrared laser directed at UF6, exciting molecules that contain a 235U atom. A second laser frees a fluorine atom, leaving uranium pentafluoride, which then precipitates out of the gas.Separation of Isotopes by Laser Excitation (SILEX)

Separation of isotopes by laser excitation is an Australian development that also uses UF6. After a protracted development process involving U.S. enrichment company USEC acquiring and then relinquishing commercialization rights to the technology, GE Hitachi Nuclear Energy (GEH) signed a commercialization agreement with Silex Systems in 2006.[15] GEH has since built a demonstration test loop and announced plans to build an initial commercial facility.[16]

Details of the process are classified and restricted by

intergovernmental agreements between United States, Australia, and the

commercial entities. SILEX has been projected to be an order of

magnitude more efficient than existing production techniques but again,

the exact figure is classified.[11] In August, 2011 Global Laser Enrichment, a subsidiary of GEH, applied to the U.S. Nuclear Regulatory Commission (NRC) for a permit to build a commercial plant.[17]

In September 2012, the NRC issued a license for GEH to build and

operate a commercial SILEX enrichment plant, although the company had

not yet decided whether the project would be profitable enough to begin

construction, and despite concerns that the technology could contribute

to nuclear proliferation.[18]

Other techniques

Aerodynamic processes

Schematic diagram of an aerodynamic nozzle. Many thousands of these small foils would be combined in an enrichment unit.

Aerodynamic enrichment processes include the Becker jet nozzle techniques developed by E. W. Becker and associates using the LIGA process and the vortex tube separation process. These aerodynamic

separation processes depend upon diffusion driven by pressure

gradients, as does the gas centrifuge. They in general have the

disadvantage of requiring complex systems of cascading of individual

separating elements to minimize energy consumption. In effect,

aerodynamic processes can be considered as non-rotating centrifuges.

Enhancement of the centrifugal forces is achieved by dilution of UF6 with hydrogen or helium as a carrier gas achieving a much higher flow velocity for the gas than could be obtained using pure uranium hexafluoride. The Uranium Enrichment Corporation of South Africa

(UCOR) developed and deployed the continuous Helikon vortex separation

cascade for high production rate low enrichment and the substantially

different semi-batch Pelsakon low production rate high enrichment

cascade both using a particular vortex tube separator design, and both

embodied in industrial plant.[20] A demonstration plant was built in Brazil

by NUCLEI, a consortium led by Industrias Nucleares do Brasil that used

the separation nozzle process. However all methods have high energy

consumption and substantial requirements for removal of waste heat; none

are currently still in use.

Electromagnetic isotope separation

Schematic diagram of uranium isotope separation in a calutron

shows how a strong magnetic field is used to redirect a stream of

uranium ions to a target, resulting in a higher concentration of

uranium-235 (represented here in dark blue) in the inner fringes of the

stream.

In the electromagnetic isotope separation

process (EMIS), metallic uranium is first vaporized, and then ionized

to positively charged ions. The cations are then accelerated and

subsequently deflected by magnetic fields onto their respective

collection targets. A production-scale mass spectrometer named the Calutron was developed during World War II that provided some of the 235U used for the Little Boy nuclear bomb, which was dropped over Hiroshima

in 1945. Properly the term 'Calutron' applies to a multistage device

arranged in a large oval around a powerful electromagnet.

Electromagnetic isotope separation has been largely abandoned in favour

of more effective methods.

Chemical methods

One chemical process has been demonstrated to pilot plant stage but not used for production. The French CHEMEX process exploited a very slight difference in the two isotopes' propensity to change valency in oxidation/reduction, utilising immiscible aqueous and organic phases. An ion-exchange process was developed by the Asahi Chemical Company in Japan that applies similar chemistry but effects separation on a proprietary resin ion-exchange column.Plasma separation

Plasma separation process (PSP) describes a technique that makes use of superconducting magnets and plasma physics. In this process, the principle of ion cyclotron resonance is used to selectively energize the 235U isotope in a plasma containing a mix of ions. The French developed their own version of PSP, which they called RCI. Funding for RCI was drastically reduced in 1986, and the program was suspended around 1990, although RCI is still used for stable isotope separation.Separative work unit

"Separative work" – the amount of separation done by an enrichment process – is a function of the concentrations of the feedstock, the enriched output, and the depleted tailings; and is expressed in units that are so calculated as to be proportional to the total input (energy / machine operation time) and to the mass processed. Separative work is not energy. The same amount of separative work will require different amounts of energy depending on the efficiency of the separation technology. Separative work is measured in Separative work units SWU, kg SW, or kg UTA (from the German Urantrennarbeit – literally uranium separation work)- 1 SWU = 1 kg SW = 1 kg UTA

- 1 kSWU = 1 tSW = 1 t UTA

- 1 MSWU = 1 ktSW = 1 kt UTA

Cost issues

In addition to the separative work units provided by an enrichment facility, the other important parameter to be considered is the mass of natural uranium (NU) that is needed to yield a desired mass of enriched uranium. As with the number of SWUs, the amount of feed material required will also depend on the level of enrichment desired and upon the amount of 235U that ends up in the depleted uranium. However, unlike the number of SWUs required during enrichment, which increases with decreasing levels of 235U in the depleted stream, the amount of NU needed will decrease with decreasing levels of 235U that end up in the DU.For example, in the enrichment of LEU for use in a light water reactor it is typical for the enriched stream to contain 3.6% 235U (as compared to 0.7% in NU) while the depleted stream contains 0.2% to 0.3% 235U. In order to produce one kilogram of this LEU it would require approximately 8 kilograms of NU and 4.5 SWU if the DU stream was allowed to have 0.3% 235U. On the other hand, if the depleted stream had only 0.2% 235U, then it would require just 6.7 kilograms of NU, but nearly 5.7 SWU of enrichment. Because the amount of NU required and the number of SWUs required during enrichment change in opposite directions, if NU is cheap and enrichment services are more expensive, then the operators will typically choose to allow more 235U to be left in the DU stream whereas if NU is more expensive and enrichment is less so, then they would choose the opposite.

Downblending

The

opposite of enriching is downblending; surplus HEU can be downblended

to LEU to make it suitable for use in commercial nuclear fuel.

The HEU feedstock can contain unwanted uranium isotopes: 234U is a minor isotope contained in natural uranium; during the enrichment process, its concentration increases but remains well below 1%. High concentrations of 236U are a byproduct from irradiation in a reactor and may be contained in the HEU, depending on its manufacturing history. HEU reprocessed from nuclear weapons material production reactors (with an 235U assay of approx. 50%) may contain 236U concentrations as high as 25%, resulting in concentrations of approximately 1.5% in the blended LEU product. 236U is a neutron poison; therefore the actual 235U concentration in the LEU product must be raised accordingly to compensate for the presence of 236U.