There Will Be War

https://secure.outsiderclub.com/o/web/148270

When North Korean missiles strike Japan, South Korea, or Los Angeles...

When Iran orders Hezbollah to unleash its entire arsenal of 120,000 missiles on Tel-Aviv and Jerusalem...

When Russian, Chinese, or North Korean hackers cut power to the entire U.S. Eastern Seaboard, including Washington, D.C...

When Islamic jihadists fly drones into a football stadium and disperse VX gas or a deadly virus or drop bombs...

What will your money and stocks be worth then?

Dear Reader,

As a child, he was a spoiled brat... a sadistic bully.

Today, he’s revered.

Over 25 million people view him as a living god.

But he’s a mass murderer... a 21st century Adolph Hitler.

And if you’re smart...

You’ll prepare yourself for what he wants to do next.

And what he wants to do next...

Could make you rich.

Or kill you.

And there’s nothing the United States, or any other country, can do to stop him.

This is Kim Jong Un, the exalted supreme leader of North Korea.

He’s crazy. A total nutjob.

But he is not stupid.

He is though reckless, unpredictable, and quite possibly delusional.

We believe he possesses at least 40 nuclear bombs.

And he’s feverishly developing an arsenal of intercontinental missiles to deliver them.

His often-stated goal: to have the ability to vaporize any U.S. city from Los Angeles to Florida at will.

And, short of assassinating him, we can’t do anything to stop him.

China, his main patron and benefactor, will not stop him.

In short, this crazed despot with a ridiculous haircut is holding us,

the most powerful country in the world, hostage to his megalomaniacal

dreams.

It’s an intolerable situation...

One that keeps many Americans, and not just those at the Pentagon, up at night.

But there is a silver lining in this.

Because in every crisis there exists opportunity.

An opportunity for financial gain.

The classic example...

In 1939, when Hitler's Stormtroopers were goose-stepping across Europe...

A young man named John Templeton bought $100 worth of every European

stock trading below $1 on the New York and American stock exchanges.

And he did it with borrowed money, no less.

Because within this crisis, he saw his opportunity.

And he seized it!

And by seizing it, he became a living legend.

After the war, John Templeton went on to found Franklin Templeton, the mutual fund company.

By the time he retired, he was worth billions.

In a moment, I’ll introduce you to another living legend, someone you’ve no doubt heard of.

An extraordinary gentleman who, year after year, decade after decade, through good times and bad...

Through wars and recessions, through stock market panics and stock market bubbles...

Has shown untold numbers of everyday people how to become millionaires

Indeed, his investment recommendations have produced a long list of quadruple-digit gains.

A few are listed below:

- 7,900% on Biogen

- 5,760% on Johnson & Johnson

- 5,602% on Amgen

- 4,237% on ASA

- 3,353% on America Online

- 3,315% on Quest Rare Minerals

- 3,163% on Procter & Gamble

- 2,848% on CMGI

- 2,618% on Industrias Peñoles

- 2,168% on Agnico Eagle

- 1,912% on Laramide

- 1,559% on Rare Element

- 1,553% on AngloGold

- 1,485% on Silver Std

- 1,291% on Pinetree

- 1,073% on Whole Foods

(To show you his list of triple-digit gains would take up too many pages.)

I want you to meet some of the people who have leveraged these gains to become millionaires.

People who were once just like you.

People like Martin Williamson from Arizona, who captured a 1,000+% gain:

I took what was left of an ailing IRA and bought 150,000 shares of [company] for $93K. Yesterday, that account closed out above $1 million.

In a moment, this extraordinary gentleman will tell you directly how, starting today, you could become a millionaire, too.

But before he does...

I want to ask you a question.

What do you think will happen...

When North Korea’s Kim Jong Un, a modern-day Hitler, to avenge some insult or provocation — an assassination attempt, perhaps...

Orders his artillery batteries to open fire on South Korea...

Resulting in the deaths of hundreds of thousands of people, including

American soldiers among the approximately 30,000 stationed along the

North Korean border?

Or, now that he’s believed to possess nuclear-tipped long-range missiles...

Launches an attack on Guam, Hawaii, Los Angeles, Chicago, or other American cities?

If that or some similar attack were to unfold...

If ISIS or Al-Qaeda places a briefcase containing a deadly

radiation-emitting neutron bomb in a trash can in New York’s financial

district, a.k.a., Wall Street, and detonates it...

Or, using store-bought drones, some other jihadist terrorist group

disperses a deadly virus or bacterium inside a sports stadium in Los

Angeles, Miami, or Chicago...

Or if Russian, North Korean, or Chinese hackers attack our electric

grid, shutting it down, holding it up for ransom, or destroying it...

As they’ve shown time and time again that they can...

As reported in the Washington Post and by other news outlets:

“Hackers allied with the Russian government have devised a

cyberweapon, dubbed CrashOverride, that has the potential to be the most

disruptive yet against electric systems that Americans depend on for

daily life.”

It could leave large swaths of our country without power for weeks, months, if not years...

There’d be no internet... no lights... no heating or

air-conditioning... no gas at the pumps... no anything that is computer-

and electricity-dependent — which is almost everything...

People fitted with pacemakers could drop dead where they stand.

People fitted with insulin pumps could go into diabetic shock and die.

And you... you won’t be able access the money in your checking and

savings accounts to buy food — food that’s rapidly spoiling on store

shelves...

And there’d be no record of your stock or bond holdings, because

every digital transaction will have been erased, including Bitcoin

accounts.

And when banks and ATMs run out of cash...

What do you think will happen...

To the price of gold?

It doesn’t require much thought.

Gold will explode. It will skyrocket!

Gold could rise to $5,000 an ounce, or more!

And that price explosion could figuratively happen overnight.

So, should you run out today and buy as many gold bars as you can carry?

No, of course not.

A standard gold bar weighs roughly 27 pounds... clearly not something

you can keep in your pocket to trade for goods and services.

Besides, one gold bar would cost you roughly a half-million dollars.

So what kind of gold should you buy?

According to this extraordinary gentleman...

Coins — gold coins!

And he favors one gold coin in particular: the Saint-Gaudens Double Eagle $20 coin.

He recommends you buy as many as you can afford.

But beyond gold coins, where else does he recommend you invest your money as protection against the unthinkable?

Now, before I tell you which gold investments he’s personally buying, holding, and recommending to everyone willing to listen...

A bit of background...

His most recent BUY GOLD recommendation was published last year on February 5, 2016, just a few dollars off its bottom.

And a great many people took notice.

Coincidentally or not, shortly after making that call, many investors began fleeing stocks.

As of August 2016, Reuters reported 22 consecutive weeks of stock selling.

Global investment management company BlackRock reported it suffered $288 billion in withdrawals from its U.S.-based stock funds.

And much of that money was headed... where?

Into gold.

Bank of America reported $5.8 billion in gold fund buying in just a three-week span.

Investors were rushing out of stocks and piling into gold — just as they had done during the 2008 Great Recession.

And not only were everyday Joes running to gold...

- George Soros bought $123 million worth of gold.

- Stanley Druckenmiller, the hedge fund billionaire, piled

into gold as well... placing more than $320 million of his own money

into gold.

- David Einhorn moved 10% of his $11 billion Greenlight Capital portfolio into gold.

- Ray Dalio, John Paulson, Barry Rosenstein, and Jim Simons — all billionaires — also bought gold.

Hedge funds, too, bought gold, and they are buying gold still:

- “Hedge Fund Stars are Backing Gold” — May 13, 2016 (MarketWatch)

- “Hedge Funds Are Hiding Out in Gold” — November 6, 2016 (Bloomberg)

- “Hedge Funds Pile Into Gold at Fastest Pace Since 2007” — June 1, 2017 (Zero Hedge)

So, are you too late?

Of course not!

When it comes to gold, there’s no such thing as too late.

Of course, it’s always better to buy gold, or any investment, at or near its bottom.

And as you’ll soon see, catching stocks, gold, and other commodities

near their bottoms is a trademark of this extraordinary gentleman.

But returning to gold for a moment — before we move on to his other

investment recommendations, which will no doubt shock you and

potentially make you rich...

What do you think could be even better than owning gold coins or gold bars right now?

I’ll save you time.

Owning gold-mining stocks!

As this world-famous investor pointed out in his critically acclaimed book, Goldbug!...

Even when stocks and bonds cratered during the Great Depression of the 1930s...

Shares of gold miners were heading to the moon!

It makes sense! They produce the gold.

On a percentage basis, when physical gold takes off, many gold miners will shoot even higher.

Nonetheless, when a crisis or catastrophe rears its ugly head, you’d better own gold coins, gold miners, or both.

Certainly not cash.

Cash is like the car in your driveway. Every year, it loses more and more of its value.

Since 1913, when the U.S. Federal Reserve was established and the

dollar was worth a dollar, its value has gone nowhere but down.

In 2013, $1 was worth only $0.05.

Today, it’s worth even less. See the graphic below.

But beware: Do not buy the gold miners now being recommended on MarketWatch, CNBC, Yahoo Finance, or other websites.

Those gold miners are already way overbought.

The herd has been drinking heavily from that stream.

What you want to do instead, as this successful investor is always fond of saying, is drink upstream from the herd.

Below are five gold miners this world-class investor recently added to his personal gold portfolio.

And every one is upstream from the herd.

Gold Miner #1:

A “gold streaming” company.

In other words, it doesn’t physically mine gold.

Instead, in exchange for financing, it purchases all or part of the gold that miners dig up.

And it does it at a fixed price well below the going market rate.

For example, according to the company’s 2017 first-quarter report, the average price it paid for gold was just $391 per oz.

Compare that to the $1,200-$1300 range gold is currently trading at, and you can see why this company alone could make you rich.

Worldwide, this company has “streaming contracts” with 29 different gold mines.

For these reasons and more, the Motley Fool wrote in a recently published article that this stock could very well be “the world’s most perfect stock.”

Gold Miner #2:

In 2000, when the company was a small outfit, just starting out...

The company’s founder, always thinking outside of the box, shared

with the public the geological data on one of his gold properties.

And he said: Anyone who can locate 6 million ounces on that property, I’ll pay you $575,000!

Bingo! On that one property, more than 110 gold sites yielding spectacular gold reserves were identified.

Those discoveries turned the company into one of the most profitable gold miners in the industry today.

In the most recent year on record, this gold miner, now with 13

operating gold mines, pulled 2.9 million ounces of gold out of the

ground.

At today’s market rate, that gold is worth roughly $4 billion.

Gold Miner #3:

This gold miner has been around for a long, long time.

How long? Long enough that it’s been able to pay an annual cash dividend for the past 36 years!

And for the fifth consecutive year, the company’s annual gold production has exceeded its annual guidance.

With that in mind, it now states that over the next three years, it expects to increase its gold production by a stunning 30%.

So if its past performance is an indication, you could reasonably expect it to beat guidance again, increasing its production even more than 30%.

As one independent analyst stated, it is “one of the best managed companies among the senior miners, and should outperform its peers in the future.”

Gold Miner #4:

This South African gold miner, which trades on the NYSE, is another “must-own” gold miner.

It began operations in 1944, during WWII.

Currently, it’s the third-largest producer of gold in the world. Last year it produced 3.6 million ounces.

It owns 17 mines in nine countries across three continents. And it also owns silver and uranium mines.

If you can only afford to pick one gold miner to own, this one is an excellent choice.

Gold Miner #5:

This gold miner is really unique. It could easily outperform all four previously mentioned miners.

Its founder was the founder of Goldcorp, one of the 600-pound gorillas in the gold-mining space.

And partly because he led Goldcorp to a 31% annual return for 10 years straight, this past January he was inducted into the Mining Hall of Fame.

As for his new company, which he founded in 2012, and from which he takes only a $1 annual salary...

It’s already profitable... debt-free... sports a market cap just shy of $1 billion... and pays shareholders a monthly dividend.

There are five more gold miners worth buying — all owned by this legendary investor.

But I’ll let him tell you the name and ticker symbols of all these companies later on.

So who is he? This gentleman who I and others have called extraordinary, amazing, and legendary?

If you haven’t already guessed his name...

Listen to this true story...

It’s what transformed him into an international celebrity and prompted Wall Street to declare him a genius.

The story actually begins almost 100 years ago...

When Owning Gold Is Illegal

In 1933, Franklin D. Roosevelt was elected President of the United

States by promising to end the Great Depression and create jobs.

To fund a long list of programs designed to stimulate the economy, known as the New Deal, he printed money.

(Sound eerily familiar?)

But he couldn’t print enough money fast enough to pay for all these New Deal programs.

Because at that time, as required by law, every dollar printed had to be backed by 1/35th troy ounce of gold.

In the meantime, panicking Americans were withdrawing their gold from banks.

So Roosevelt hatched a plan to make all that gold belong to the government.

He signed Executive Order 6102, declaring gold ownership illegal — a federal crime, punishable by up to 10 years in prison.

Every American was ordered to hand over their gold to the government.

(Unbelievable, right? But absolutely true!)

Adding insult to injury, for every ounce turned in, American citizens were paid only $20.67.

So the government, now flush with gold, shifted the printing presses into high gear.

Fast-forward to 1944 (this part is important, as you’ll see): the U.S. and 43 other countries met in Bretton Woods, New Hampshire.

There they agreed, for purposes of international trade, that the

price of gold would be permanently set at $35 per ounce, and also that

all currencies would be tied to gold and the U.S. dollar.

Remember, it’s still illegal for American citizens to own gold.

Now fast-forward to the 1960s.

This extraordinary gentleman, fresh out of service in military

intelligence, went to work on Wall Street as a junior security analyst

with A.M. Kidder & Co.

Soon he was promoted to Senior Security Analyst.

Six months later he was promoted again, this time to write Kidder’s weekly market newsletter.

And one year later, in recognition of his many successful market predictions, the weekly newsletter was renamed The Dines Letter.

Yes, this extraordinary gentleman is none other than the legendary Mr. James Dines.

So

what did he do next that elevated him into the ranks of living legends

alongside Warren Buffett, George Soros, John Paulson, Jack Bogle,

Charlie Munger, and others?

So

what did he do next that elevated him into the ranks of living legends

alongside Warren Buffett, George Soros, John Paulson, Jack Bogle,

Charlie Munger, and others?

It begins with the charts he kept hidden in his desk while writing The Dines Letter.

Why hidden? Because back in the 1960s, charting, or technical

analysis, as it’s now called — identifying trends and timing the market —

was considered “voodoo economics.”

To be outed as a chartist, a market timer, was a death sentence on Wall Street.

Had Kidder & Co. known he had kept many charts hidden in his desk — and at home — he would’ve been fired on the spot.

How ironic then that those charts, which allowed him to time the markets to near perfection, were the basis for so many of his successful investment recommendations...

Which, in turn, earned him a string of rapid promotions.

Plus, he was being quoted in the New York Times, Wall Street Journal, Barron’s, and on radio and TV shows.

Years later, when he wrote a book titled Technical Analysis...

It was immediately hailed as a "classic" when a Barron's reviewer wrote:

"It is the most comprehensive text ever written on the entire arcane

field of investment analysis. This book was deliberately designed to

attract the novice and then turn him into a pro. The established pro

could learn much from it. We wholeheartedly recommend that you read the

book."

The London Financial Times wrote:

"Mr. Dines has done for Technical Analysis what Graham & Dodd has done for Fundamental Analysis."

Unfortunately, the book is now out of print. But old copies are being sold new in the rare books markets for about $1,000 each.

But then Mr. Dines went too far...

While still at Kidder & Co., his charts and analyses revealed

that gold would rise in a “historic bull market,” as the dollar was

about to be devalued.

So, of course, he began recommending gold and gold stocks in The Dines Letter.

But that didn’t sit too well with Kidder & Co.

Because owning gold was still illegal!

Therefore, he was told to never recommend gold stocks again.

If he refused, he’d be fired.

Well, he refused.

So he was fired.

And no other brokerage house would hire him. He was considered too risky. A rebel. Unwilling to toe the company line.

So he did the unthinkable...

He published The Dines Letter on his own as a pay-to-subscribe newsletter.

Which was unheard of.

Because at that time, investment newsletters were only published by

brokerage houses, and they were distributed to their customers free of

charge.

Undeterred, Mr. Dines immediately hopped on a plane and flew to South Africa.

There he discovered gold miner Blyvoor, which was trading for $1 a share and paying an annual dividend of $1 a share.

He recommended it.

He figured that if his readers held the stock for just one year, they would double their money because of the dividend!

But, as it turned out...

Blyvoor rose to $3 a share.

And his newsletter quickly took off.

As for A.M. Kidder & Co., they went bankrupt.

Which proved to Mr. Dines that God exists!

Not too long afterwards, he heard of another gold miner, Agnico

Eagle, which stubbornly refused to sell gold for the mandated $35 an

ounce.

He immediately contacted its CEO, Paul Penna.

They became fast friends, and because the stock was severely

undervalued in Mr. Dines’ opinion, at just $1 a share, he also

recommended it to his readers.

It eventually traded as high as $74 a share...

A gain of 7,300%.

Fast-forward to 1974. President Gerald Ford finally lifts the prohibition against owning gold.

Mr. Dines promptly predicted, based on his charts, that gold would

rise from its fixed level of $35 an ounce to over $400 an ounce...

A gain of at least 1,043%.

It was a preposterous idea. He was laughed at. Ridiculed.

The same way people today laugh at the notion that gold could rise to $5,000 an ounce or more.

But Mr. Dines had the last laugh, as he often does.

And The Dines Letter readers who followed his recommendation

to buy gold saw their gold not only reach $400 an ounce, but soar past

it to $850 an ounce in just a few short years.

A gain of 2,329%.

In hindsight, Barron’s magazine (owned by Dow-Jones Company) dubbed his gold call “one of the most fantastic investment calls on record.”

Of course, gold’s rise would eventually come to an end.

In 1982, Mr. Dines told his subscribers to “sell gold” based on what he was seeing in his charts.

Sure enough, shortly afterwards, gold began its 70% three-year decline.

But not before subscribers to The Dines Letter had an opportunity to lock in their 20-fold gold profits.

Years later, when everyone was reeling from the “tech wreck” of the 2000s, he issued a buy call on gold again.

At that time, it was trading at $250 an ounce — near its lowest price in decades.

Of course, now it’s trading 5X higher at around $1,250 an ounce!

But speaking of the tech wreck and drinking upstream from the herd...

Here’s proof that ignoring the recommendations of this master investor could cost you dearly!

In 1984, he recommended a penny stock.

A little-known tech company trading for $0.43 a share (adjusted for splits).

Apple Computer.

It subsequently rose to $163.63.

Had you been a reader of The Dines Letter back then, invested $10,000 in Apple, and held onto your shares...

For an otherworldly gain of 37,953%...

You’d now be sitting on close to $3.8 million.

Just because you were a reader of The Dines Letter and you took action!

But wait, it gets better!

Ten years later, right around 1994, long before most people even knew what the internet was...

Mr. Dines was investigating its potential.

He started creating charts on some “very interesting internet stocks.”

One year later, during a 1995 lecture in San Francisco, he declared

to a packed house of investors, nearly all of whom weren’t even aware

that the internet existed...

That the internet would revolutionize the world.

That it would have a greater impact on the world and on commerce than the Gutenberg printing press 500 years earlier.

Laughter and ridicule ensued, again.

Nonetheless, he recommended selected “internet stocks” to his readers.

For example, he recommended they buy Amazon, then trading at $4.77 (adjusted for splits).

Today, of course, Amazon trades around $1,000 a share.

A gain of 20,864%.

Had you been one of his readers, acted on his recommendation, and invested $10,000 in Amazon...

Today, you’d be sitting on well over $2 million!

He also recommended:

- America Online at $2.78 a share. His readers had the chance to ride it to a high of $96... a gain of 3,353%.

- CMGI at $5.53 a share. The stock hit a high of $163 a share... a gain of 2,848%.

And there were seven more internet stocks, including Yahoo, that he recommended.

All in one issue of The Dines Letter.

There’s no counting how many “internet millionaires” that one issue of The Dines Letter helped create.

And many are still readers of The Dines Letter today.

Like Margorie Gakich of California, who’s been a loyal reader for 40 years!

But as good as the internet run was, Mr. Dines saw clouds gathering.

His charts were showing that too many investors were drinking from that stream.

On December 3, 1999, he told his subscribers of his concern that

professional money managers and new internet mutual funds were pouring

into the stock market and that this was strongly signaling a market top.

He told his readers to sell.

60 days later the tech wreck began, and millions of everyday investors were slaughtered.

Which is yet another reason why Moneyline called Mr. Dines:

"One of the most extraordinary men in America today; a man with a

long and glorious reputation as one of the first people to call real

turns in our marketplaces over the years!”

In fact, over the last 21 years… Mr. Dines has correctly predicted the Dow's major market moves 19 out of 21 times!

That’s an unheard of success rate of over 90%.

In fact, over the last 21 years… Mr. Dines has correctly predicted the Dow's major market moves 19 out of 21 times!

That’s an unheard of success rate of over 90%.

He’s made many other predictions over the years, nearly all of which came true.

Nearly 40 years ago, he predicted China would be a “major new economic force” and would “dominate the 21st century.”

This when China’s GDP was just $175 billion, a mere fraction of the $11 trillion dragon it is today.

Of course, many of these predictions made his readers millionaires.

Readers like Stanley Stein:

Turning $125,000 into $1 million!

I turned 65, I lost my job and my wife died. I took my retirement funds and after several false starts, subscribed to The Dines Letter. You enabled me to take roughly $125,000 and turn it into $1 million after taxes.

Let Mr. Dines tell you when the tide is turning next, and then you, too, could make $1 million!

Now, before I close this letter...

I’ve selected two more niches to quickly share with you that Mr.

Dines is currently bullish on and that could easily help you become a

millionaire.

This first one, you’re probably going to say, no way!

Which, as I’ve shown you, is what most investors say every time Mr. Dines makes a seemingly outrageous market prediction.

And the reason they’re always disbelieving is because Mr. Dines has the charts and they don’t.

Then, of course, when his predictions come true... they’re too late to drink upstream from the herd.

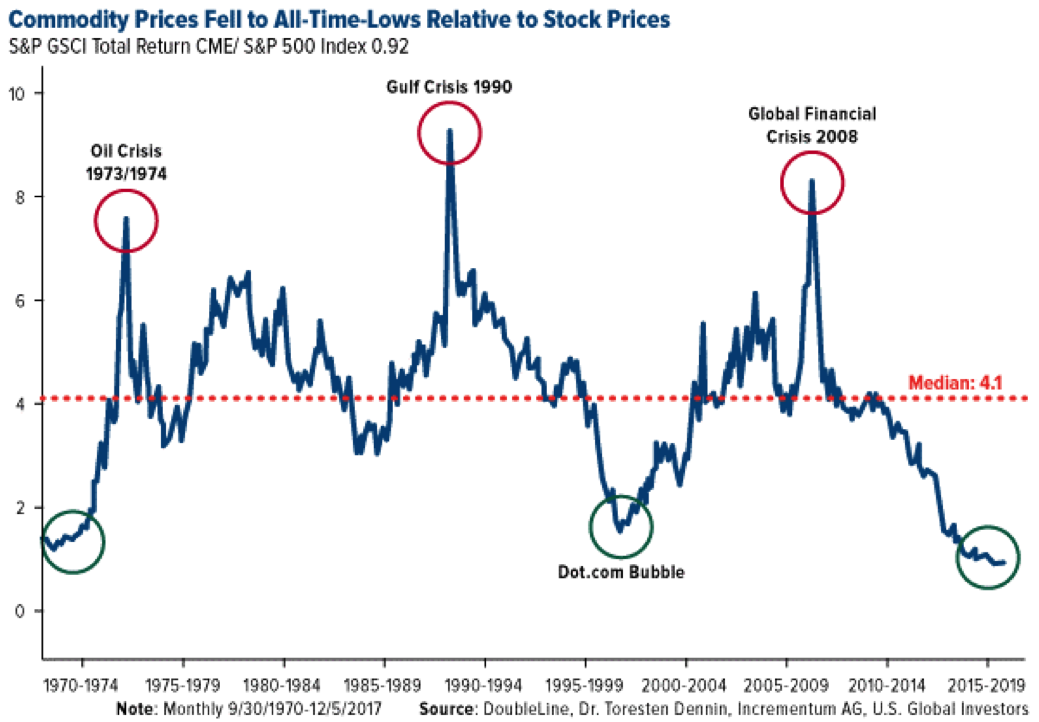

So now consider...

There is a commodity — a relatively rare metal — for which life on this planet is increasingly dependent.

Demand for it is far outstripping supply, and that will continue to be true for years to come.

Therefore, the price of this metal is practically guaranteed to keep rising.

By the way, the last time Mr. Dines recommended this metal to his readers, as he’s now doing again, its price skyrocketed from $8 a pound to $138 a pound.

A gain of 1,625%.

It’s uranium.

And the reason Mr. Dines is so bullish on it again is because...

With Fukushima now a distant memory, nuclear power is very fashionable again.

30 countries are now operating a combined 449 nuclear reactors.

And these countries and their utility companies cannot buy enough uranium fast enough to keep their reactors running.

Worldwide, uranium consumption stands at 190 million pounds a year, but only 140 million pounds a year is produced.

50 million pounds less than is needed!

Making matters worse, here in the U.S. we gobble up 25% of the world’s production.

So there’s a real fear the lights around the world could go out unless more uranium is mined... and quickly.

After all, France relies on nuclear energy to supply 72% of its electricity.

Belgium relies on nuclear energy to supply 52% of its electricity.

In Sweden, 40% of the electricity comes from nuclear power.

In Switzerland, 34%.

In fact, in 2016, 13 countries relied on nuclear power to supply at least 25% of their electricity.

Now listen to this, and your palms will really start itching...

No less than 60 new nuclear reactors are currently under construction in 15 different countries.

In the U.S. there are plans for five new reactors, beyond the four already under construction now.

China is building two new nuclear power plants in Iran, with four more on the drawing board.

The world’s largest nuclear power plant is being built in Hong Kong and will be the prototype for one planned for England.

China will also build two nuclear power plants in Argentina.

And for itself, China is building a new nuclear power plant every few months.

It plans to triple its nuclear capacity within the next five years.

Altogether, worldwide, over 160 nuclear power plants are planned and over 300 more are proposed.

So what does that tell you?

Nuclear power plant construction is surging — again!

But uranium to power these plants is still in woefully short supply.

Therefore, you’d have to be crazy to think uranium prices won’t be heading sharply higher.

Unfortunately, you just can’t go out and buy uranium and trade it for a gain.

But you can buy uranium miners!

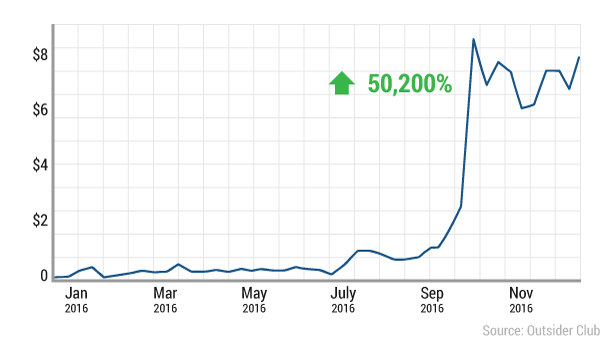

In the early 2000s, at the beginning of the last uranium bull market,

Mr. Dines recommended Mega Uranium, a miner that was trading at $0.46 a

share.

It eventually hit $8.98 a share...

A gain of 1,852%.

Had you been a reader of The Dines Letter back then and heeded Mr. Dines’ buy recommendation, investing $10,000 in Mega Uranium...

In no time at all you could’ve made yourself $185,200.

At that time, he also recommended uranium miner Pinetree, trading for $1.16 a share.

Its shares bounced up to $16.13 a share...

For a gain of 1,291%.

A $10,000 investment in Pinetree would have earned you $129,100.

Want a second chance to win the uranium jackpot?

Here are two underpriced uranium companies Mr. Dines is holding onto as we head into uranium’s next bull market...

Uranium Miner #1:

Not only is it the most “awarded” uranium explorer in the world...

It also owns the world’s richest uranium deposits!

The company sits on approximately 108.3 million pounds of proven

reserves. Exploration for further deposits is ongoing as we speak.

Total value of its uranium deposits: roughly $2.2 billion.

In other words, it’s sitting on uranium that’s worth about 18 times the company's current market cap.

If this company isn’t grossly undervalued, no company is.

Which could explain why Chinese mining company CGN, anticipating a

uranium boom, jumped in and bought a 20% stake in the company this past

December.

Uranium Miner #2:

A junior miner that enjoys the best of both worlds.

It owns uranium mines (in the U.S. and Australia). And it also operates mines (in Australia) as joint ventures.

It’s a Canadian company, and its wholly owned Australian mine is one of the largest undeveloped uranium mines in Australia.

Even more impressive, one of its joint venture mines ranks “first in the world for recoverable uranium!”

Of course, the herd hasn’t caught on to this gem. It trades over the counter for just around $0.20 a share.

Accordingly, Mr. Dines thinks this company has tremendous upside.

If it takes off like his Mega Uranium pick did, with a 1,852% gain...

A $10,000 investment could once again pay out $1.9 million!

Opportunities like these are why Jack Kirik of Illinois has been a loyal subscriber to The Dines Letter for 8 years!

Thank you for making me a fortune. I have been a subscriber to The Dines Letter for 8 years and will continue to subscribe until God has some other plan for me.

But gold and uranium are far from the only investment niches Mr. Dines is extremely bullish on.

For example, this next investment niche might also surprise you...

Although Mr. Dines does not smoke anything, he favors marijuana — as an investment.

In fact, as far back as 2014, Mr. Dines was drinking upstream from the herd when it came to the marijuana industry.

He was recommending pot stocks to his readers when other investment newsletters were too scared to consider them.

He even lost a bunch of subscribers when he began recommending them.

That was their loss, of course.

Because his pot stock recommendations produced gains as high as 2,650%!

Had you listened to Mr. Dines a few years back and invested $10,000 in one of his pot recommendations...

You’d be about $275,000 richer today.

But do not buy pot stocks today!

When the herd started drinking from that stream they drove pot stock valuations sky high.

Now, they’re in correction mode — even though many Johnny come lately’s are still bidding them up.

But this pot boom has not come and gone.

Mr. Dines is confident that a second wave — a second boom — bigger than the first is on the horizon.

But for the moment he’s keeping his powder dry.

And relying on his charts to show him when they’re close to rock bottom.

Just as he was able to do with uranium stocks.

He published his buy alert when they were within $0.90 of the bottom — right before they soared 1,650% higher.

Just as he did also with gold, publishing his buy alert on February

5, 2016, within a few dollars of gold shares’ rock-bottom prices.

So what will be the match that lights up pot stocks again?

Obviously, when the U.S. government, and not just individual states, legalizes marijuana...

And banks can finally accept deposits from marijuana businesses and make loans to them...

And when large U.S. corporations start binge buying marijuana businesses.

All of which could happen a lot sooner than you think.

To that end, Mr. Dines has selected three pot stocks — his lucky 3.

Companies that are either in a position to be bought out by larger companies at a premium...

Or companies that could grow much larger, organically, on their own.

Like Altria Group (formerly Philip Morris) did.

Now it’s one of the world's largest producers and marketers of tobacco and related products, with a market cap of $144 billion.

And many suspect that once marijuana becomes legal at the federal

level, Altria and other tobacco companies will swoop in and buy up many

marijuana businesses.

Which brings us back to Mr. Dines’ “lucky 5.”

All five are in Mr. Dines’ current “pot portfolio.”

Pot Stock #1:

With a current market cap of $1.3 billion, this company is one of the behemoths within the medical marijuana sector.

In fact, it produces more medical marijuana than any other company in the world.

It has approximately 665,000 square feet, about the size of 13 football fields, on which it grows marijuana.

Plus, it’s also an aggressive buyer of other marijuana companies.

As of June 2017, sales have more than doubled compared to the same quarter last year.

Pot Stock #2:

This

company is also in the medical marijuana sector, but rather than

developing new marijuana blends like Pot Stock #1, it sells existing

blends.

As of May 2017, its revenue has risen 2.3 times since last year.

And unlike most other marijuana companies, it’s been profitable for

the past four consecutive quarters. As of May 2017, it has already

generated $20.4 million in revenues and $6 million in net income for the

year.

Plus, it has the lowest “grow” costs in the industry.

Also, like Pot Stock #1, it’s been busy acquiring other companies in addition to growing organically.

In fact, in January, its board of directors approved a $100 million

project that'll increase its growing capacity from its current 300,000

square feet to 1 million square feet by early next year.

Pot Stock #3:

Today, this company is the only major “certified organic” marijuana grower.

And because it produces a premium product, it also charges a premium price.

The company has recorded single-week sales of over $250,000.

Also, as last reported, the company has $10.4 million in current assets compared to only $2.7 million in current liabilities.

In other words, this company is cash rich — and an easy target for a big dollar buyout.

It trades over the counter in the $2.20 range. But Mr. Dines thinks

that with patience, you could eventually buy it for much less.

And with that, it’s time for me to formally introduce myself...

My name is Nick Hodge, founder of The Outsider Club and publisher of numerous highly regarded investment newsletters: Wall Street’s Underground Profits, The Crow's Nest, Early Advantage, and others...

So why, you must be wondering, am I writing to you about Mr. Dines’ stock recommendations — all of which I strongly endorse — and his newsletter, The Dines Letter?

So why, you must be wondering, am I writing to you about Mr. Dines’ stock recommendations — all of which I strongly endorse — and his newsletter, The Dines Letter?

Two reasons:

One, my readers’ interests will always outweigh any “corporate rivalries or jealousies.”

Therefore, I have no problem recommending a competitor — even if it takes money out of my company’s pocket.

Especially if that competitor has consistently — decade in and decade

out — made investment recommendations that have helped make his readers

extremely wealthy, as Mr. Dines has done.

So I’d be ashamed of myself if I did not recommend him to my own readers.

Reason two: Mr. Dines does not do it on his own.

He has no need to.

Word of mouth has been his greatest ally.

He’s been written about or appeared on:

| 60 Minutes | Fortune |

| The MacNeil-Lehrer Report | Forbes |

| The Nightly Business Report | Newsweek |

| PBS | Business Week |

| Louis Rukeyser's Wall Street Week | Time |

| New York Magazine | The Christian Science Monitor |

| The Wall Street Journal | The Washington Post |

| Barron's |

And that’s only a small list of publications and TV programs where he and his investment calls have been touted.

Moneyline called Mr. Dines:

"One of the most extraordinary men in America today; a man with a

long and glorious reputation for being one of the first people to call

the real turns and the strategic moves that have happened in our

marketplaces over the years."

And though I’ve known of Mr. Dines for many years and continue to be a loyal subscriber to The Dines Letter...

The world changed for me when I heard Mr. Dines speak last year at a sold-out investors conference in San Francisco.

It was there that I approached Mr. Dines and broached the subject of permitting my company, The Outsider Club, to be the exclusive marketer and distributer of The Dines Letter.

To my amazement, negotiations ensued, and eventually we struck a deal.

And among the various provisions that I agreed to, one in particular concerns you.

Now, if for some odd reason you never heard of Mr. Dines and The Dines Letter before today...

You nevertheless know that investment newsletters — newsletters that can’t come close to the wealth-building potential of The Dines Letter — often charge their readers thousands of dollars per year.

Even though they have never produced the numbers of quadruple-digit gains The Dines Letter has produced.

- 7,900% on Biogen

- 5,760% on Johnson & Johnson

- 5,602% on Amgen

- 4,237% on ASA

- 3,353% on America Online

- 3,315% on Quest Rare Minerals

- 3,163% on Procter & Gamble

- 2,848% on CMGI

- 2,618% on Industrias Peñoles

- 2,168% on Agnico Eagle

- 1,912% on Laramide

- 1,559% on Rare Element

- 1,553% on AngloGold

- 1,485% on Silver Std

- 1,291% on Pinetree

- 1,073% on Whole Foods

Any one of those could have made you a millionaire many times over.

Yet, those other newsletters will still charge you $3,000, $4,000, $5,000, or more per year.

But not The Dines Letter.

A one-year subscription to The Dines Letter...

Eight issues, typically 16 pages each, including charts...

And the double Annual Forecast Issue, typically over 40 pages, including charts...

10 issues in all...

Is priced at only $295.

And it’s been that price for as long as I can remember.

It’s one of the true great bargains among investment newsletters.

And Mr. Dines insists it remain that way.

That the price never be raised.

Because he wants everyone to have access, at an affordable price, to

the kinds of investment research he’s world famous for providing.

Research that, month in and month out, offers you the chance to achieve enduring wealth and prosperity.

You should also know...

The money Mr. Dines helps his readers make... combined with the fact that The Dines Letter is the oldest independent, continually published investment newsletter in America...

Is why he has never, and does not today, offer any refunds.

In his typical “straight-to-the-point” way, he states:

“If you will not risk $295 for the opportunity to make millions

— to live for the rest of your days in wealth and in happiness —

as many of my readers clearly do — do not bother yourself further.

Seek your fortune elsewhere, and do not subscribe.”

But when you do subscribe... Mr. Dines offers you this FREE gift

And it couldn’t come at a better or more needed time.

Consider...

U.S. first quarter GDP came in at a pitiful 1.2%.

Therefore, the economy is clearly weak.

And one more — just one more — Fed interest rate hike could be the final nail in the coffin for the U.S. economy... and the investment markets.

Because history shows us...

Whenever the Fed raises interest rates, as it’s now doing, it ends (10 out of 13 times) in a market crash and a recession.

It should also be noted, every Republican president since Ulysses S.

Grant has seen a recession in his first term, including Ronald Reagan.

But more ominously still...

The stock and bond markets are now ridiculously overpriced.

Price/earnings ratios and bond prices are sky high.

All based on the inflated expectations surrounding President Trump’s economic goals, many of which have hit the wall.

For example:

- We can’t expect the type of infrastructure spending the markets want.

- Trump is making some headway on regulatory reform, but it’ll take a long time to see the effects.

- Health care, of course, is a fiasco. It’s not clear how that’s going to be resolved, if at all.

- Trump still has to contend with Syria, China, Iran and North Korea.

- And the issue of Russian hacking is still out there. So we could see investigations and hearings drag on for years.

However, on the brighter side, if you want to call it that…

Rising geopolitical tensions and domestic political turmoil could be

the perfect fuel to cause an explosion in the price of gold.

Which is why nations like Russia and China have been buying up gold literally by the ton.

And there are other powerful forces that could also combine to boost the price of gold.

For one, demand for physical gold already exceeds the current gold supply.

And know this, too...

“Paper gold contracts,” such as gold futures and gold ETFs, largely determine the price of gold.

But these gold contracts represent maybe 100 times or more the actual amount of physical gold backing those contracts.

It’s a classic case of the emperor having no clothes!

Nonetheless, as long as these contracts are continually rolled over or settled for paper money, “the system” works fine.

However, as soon as gold contract holders demand physical gold in settlement...

Because the stock or bond markets are crashing, and a recession or depression is clearly on the horizon…

These gold contract holders will be quite shocked to discover there’s not nearly enough physical gold to go around.

And at that point, a gold buying panic could arise.

A stampede into gold on a scale never seen before.

The price of gold could then skyrocket by thousands of dollars per ounce.

And gold mining stocks could see their values increase tenfold or more.

That’s why Mr. Dines wants to immediately put in your hands a FREE copy of his classic book: Goldbug!

In this updated edition, condensed from the classic textbook-sized edition, you will discover why you absolutely must put some of your money into gold right now!

Throughout its abridged 88-pages, Mr. Dines details in simple, plain

English why petty politics and past and current economic policies are

leading us, individually and as a country, to financial ruin.

Countless unprepared Americans... investors and non-investors alike... could see their lives completely devastated.

Indeed, our entire way of life is now threatened by politicians whose only goal is to get re-elected at any cost.

And it is we — you and me — who will bear that cost.

In scope, Goldbug! is both a prophetic and a historical document.

It shows you why only gold can protect your wealth from the political

and economic mismanagement of today’s “just print more money”

governments.

Why capitalism itself is threatened!

It’s a fascinating and cinematic work of unparalleled importance.

Goldbug! should be read by every American — and it should be assigned reading in every high school, college, and university.

Jim Puplava, host of FinancialSense.com, said:

“If you really want to gain an

understanding of gold, what led up to various events that you’ve seen in

your lifetime and more importantly where we’re going in the future, I

highly recommend that you pick up a copy of Goldbug! It’s well written, easy to understand, and you don’t have to be a rocket scientist to get the big picture.”

Mike Campbell, host of Money Talks, wrote:

“The Goldbug! book

is so timely with what’s happening in the world and what’s happening

with the world of gold. I found this book absolutely fascinating. And I

adored how the book shows you how to protect yourself.”

And best of all, Goldbug! is absolutely FREE when you subscribe to The Dines Letter.

Now, I have a gift for you!

It’s the perfect complement to The Dines Letter and Goldbug!

And, like Goldbug!, as a new subscriber to The Dines Letter, you get it FREE!

Listen to this...

Just as Mr. Dines shows you in Goldbug! how power-mad politicians and ill-conceived economic policies are destroying the fabric of our country and our democracy...

My newsletter Wall Street’s Underground Profits — which I personally write and edit... and which you will receive FREE for the next three months when you subscribe to The Dines Letter...

Shows you how to leverage the never-ending blunders and missteps of Washington for personal financial gain.

Now, I admit...

Wall Street’s Underground Profits has yet to provide quadruple-digit gains on a regular basis, like Mr. Dines does in The Dines Letter.

But I do excel at uncovering stocks that produce strong triple-digit gains!

For example:- 1,480% on Lithium X

- 531% on K92 Mining

- 489% on Almadex Minerals

- 241% on Ivanhoe Mines

- 226% on Pioneering Technology

- 211% on Golden Leaf Holdings

- 316% on Akeena Solar

- 245% on Organovo

- 426% on Alternate Energy Holdings

- 391% on BYD Company

- 240% on Brazil Resources

- And many more

To help everyday Americans earn fast, safe profits.

Subscriber Dan Leopold wrote to tell me:

I made over $100,000 with you!

Anthony Raymond wrote:

This is the most profitable service in almost 10 years of trading.

Pure and simple. Three picks have been triple-digit winners for me!

And Tom Donaldson made almost a half-million dollars on just one of my recommended trades!

Nick — My account is now over $450,000!

On the second Friday of every month, I’ll send you a brand new issue of Wall Street's Underground Profits, full of my most recent recommended buys.

Even if you have little to no experience buying stocks...

I’ll show you how, in just three months, you could become quite rich by following my instructions.

For example, had you invested $10,000 in a rare earth company that I recommended when it was trading for just $0.15 a share...

Four and half months later, you could’ve pocketed close to $245,000!

With that $245,000, you could’ve bought a second home, a boat, or permanently secured your retirement.

So now, you have a choice...

You can continue to invest the way you always have...

And always get the same results.

Or you could want better — an opportunity to make far more money regularly, like clockwork.

This is the opportunity I’m offering you.

Seize it!

Just as John Templeton seized his opportunities so many years ago — and by doing so became a billionaire.

James Dines can help you.

I can help you.But you’ve got to take that first step.

Subscribe to The Dines Letter.

You’ll receive:

-

10 issues of The Dines Letter

-

The most recent condensed edition of Mr. Dines’ seminal work Goldbug!

-

3 FREE months of Wall Street's Underground Profits

These are the tools with which you can build yourself a life of comfort and financial freedom.

And inside your very first issue of The Dines Letter, you’ll discover every one of the stocks Mr. Dines is currently recommending...

Their names and ticker symbols...

35 stock recommendations in all, in seven different categories.

Including Mr. Dines’ 10 stock recommendations I mentioned above:

- The 5 gold miners that could see a 10x increase in

valuation when the “you-know-what” (war with North Korea, cyber warfare

with Russia, economic meltdown, or recession) hits the fan.

- The 2 uranium miners that could be the biggest

beneficiaries of a world (led by the U.S., China, Russia, and Europe)

moving ever faster towards nuclear energy.

- The 3 pot stocks that are quickly becoming giants within the marijuana industry or prime buyout targets for any number of international conglomerates.

These are the stocks that could make you rich and independently wealthy.

Stocks personally selected by James Dines.

James Dines, who has picked more triple- and quadruple-digit winners for his readers than anyone I know.

Subscribe to The Dines Letter right now.

Click the “Subscribe Now” button below.

When you do, it’ll take you to a secure and encrypted page, where you can review everything you’ll receive:

-

10 information-packed, stock recommendation-filled issues of The Dines Letter

-

Goldbug! — called “the Bible of the Goldbugs” for everyone looking to protect themselves in a dangerous world

-

And three FREE months of my newsletter Wall Street's Underground Profits, where making money is the order of the day — every day!

Do not delay. Do not hesitate. You’re just one breaking-news headline away from being too late.

Call it like you see it,

Founder and Publisher, Wall Street's Underground Profits

YES! I Want to Receive The Dines Letter!

@nickchodge on Twitter

@nickchodge on Twitter

Now, Gupta proclaims: “It’s time for a medical marijuana revolution.”

Now, Gupta proclaims: “It’s time for a medical marijuana revolution.”

This man, Hugh Hempel, recently gave a TED talk describing how he invested in medical marijuana.

This man, Hugh Hempel, recently gave a TED talk describing how he invested in medical marijuana.

Patrick Stewart, the Golden-Globe-nominated actor from X-Men and Star Trek, enthusiastically backs medical marijuana research.

Patrick Stewart, the Golden-Globe-nominated actor from X-Men and Star Trek, enthusiastically backs medical marijuana research.

For

over a decade, I’ve advised readers like you on emerging opportunities

all over the world. You might’ve even seen me on CNBC.

For

over a decade, I’ve advised readers like you on emerging opportunities

all over the world. You might’ve even seen me on CNBC.

Ron Paul, the long-time Congressmen from Texas, backed medical marijuana and doesn’t believe it’s a crime.

Ron Paul, the long-time Congressmen from Texas, backed medical marijuana and doesn’t believe it’s a crime.

I’ve

been lurking in the shadows... doing research late into the night...

talking to cannabis executives well before anyone even thought marijuana

would be legalized.

I’ve

been lurking in the shadows... doing research late into the night...

talking to cannabis executives well before anyone even thought marijuana

would be legalized.

Britton tried the “pins and needles” approach to relieving the pain he felt every Sunday... but it didn’t help.

Britton tried the “pins and needles” approach to relieving the pain he felt every Sunday... but it didn’t help.