| Forward to a Friend Refer a Friend to Outsider Club |

Having trouble viewing this issue? View Online |

|

Saudi Arabia Abandoning Oil

https://mail.google.com/mail/u/0/#all/153c3a2e5cd89d20

And it's all thanks to this unique

type of fuel, which is quickly but quietly being adopted worldwide.

The fuel is so economic, so clean, and so powerful... 120 countries are adopting it to fuel their futures.

The Saudis, China, India, and Russia are all on board. So is Obama.

Even the world's oil giants are on board. Shell has admitted that this fuel is "the future backbone of the world

energy system."

And as that happens, a tiny $1 company will find itself in the spotlight, as it has the best chance of

bringing the necessary quantities of this fuel to market. Full

details here.

|

| Terror, Trump, Wife Spats, and Gold | ||||

| By Gerardo Del Real | Tuesday, March 29, 2016 | ||||

|

I hope everyone had a great weekend and enjoyed the holiday. We waited until after the weekend for the weekly recap due

to the holiday.

The attacks in Brussels early last week and in Lahore Pakistan on Sunday March 27th were sober reminders of

the delicate and fragile state our world finds itself in.

Even after the bombing in Lahore on Sunday,

which took the lives of at least 70 people — mostly women

and children — by the end of the week the bulk of the media’s attention

was again focused on a Twitter war from earlier in the week. I

can’t make this stuff up.

The Twitter war started when an anti-Trump Super PAC, Make America Awesome, pushed ads depicting a naked

Melania Trump out to women in Utah. “Meet Melania Trump, your next first lady,” the ad said.

“Or, you could support Ted Cruz on Tuesday.”

The Donald shot back and warned

Cruz to “Be careful, Lyin' Ted, or I will spill the beans on your

wife!” That was followed by Trump retweeting a meme in which an

unflattering picture of Cruz’s wife was posted next to a pic of Melania

Trump which stated 'No need to “Spill The Beans” The images are worth a

thousand words.'

If that wasn’t presidential

enough for you, by the end of the week Cruz had called Trump a

“sniveling coward” and was fending off allegations of a prostitution

scandal, accusing Trump of planting the story through people at the

National Enquirer who were friendly to him.

These are the top two candidates on the right, in line for a shot at the Presidency. Never mind the fact

that both sides decided it was perfectly okay to reduce two accomplished women to the most superficial level, their looks.

The exchange is highlighted because it shows the substance you can expect from some of our presidential

candidates in the months that follow and the disconnect between what the country needs — good policy

discussions — and what it gets.

To be clear, we’re here to make

money and we can talk about Hillary and her transgressions —

and probably will — at a future time, but the lunacy contrasted with the

seriousness of the domestic and global situation should be of concern

to anyone who’s paying attention.

The Week in Metals

Last week there were a lot of calls for the bottom in gold and silver and a deterioration of the dollar. We

took the other side and continue to. Here’s the excerpt from last week’s recap:

That turned out to be a good call as gold fell as low as $1,208, a 3% loss for the week and the

lowest since February 23.

Gold looks to be headed

towards its first monthly loss of 2016, although it’s still up a robust

15% for the year. Silver closed the week at $15.20 per ounce, while

copper and oil remained relatively unchanged at $2.29/lb and $39.46 per

barrel

respectively.

The Week in Juniors

Canasil Resources (TSX-V: CLZ)(OTC: CNSUF)

We talked about Canasil Resources last week and true to form it keeps delivering with the drill bit.

On March 23, the company announced that its JV partner Orex had an intercept of 32 meters of 255 g/t

silver, starting 10 meters vertically below the

surface.

Orex has also confirmed that the Phase 2 drill program, planned for 3,000 meters in approximately 20 drill holes,

commenced on March 16, 2016.

It’s hard to make discoveries if you’re not looking. Canasil and Orex have kept looking

and are positioning themselves well for the next bull market.

Pilot Gold (TSX-V: PLG)(OTC:

PLGTF)

Also on March 23, Pilot Gold announced it had commenced infill and step-out drilling on a property we

think has excellent shallow-oxide gold potential, the Goldstrike property in southwestern Utah.

The primary target is Carlin-style shallow, oxide gold mineralization. Pilot Gold acquired 100%

of the Goldstrike Project through the acquisition of Cadillac Mining Corporation in August, 2014.

Previous mining at

Goldstrike occurred from 1988 to 1994, with 209,000 ounces of gold

produced from

12 shallow pits, at an average grade of 1.2 grams Au/tonne. RC infill

and step-out drilling commenced on the Historic Mine Trend on March 2,

2016.

Here’s how Pilot described the drill program in its release from March 23:

Goldstrike is located in the eastern Great Basin, immediately adjacent to the Utah/Nevada Border, and

is a Carlin-style gold system, similar in many ways to the prolific deposits located along Nevada's Carlin trend.

Like Kinsley Mountain —

which Pilot is 79% owner of and also a project we think has great

potential — and Newmont's Long Canyon deposit, Goldstrike represents

part of a growing number of Carlin-type systems located off the main

Carlin

and Cortez trends in largely under-explored parts of the Great Basin.

We like the Goldstrike and Kinsley properties more than we like the current share structure, which,

after its recent C$4.47 million private placement at C$.25, now shows 149.7 million fully-diluted shares outstanding.

However, it is well

cashed up, with approximately C$14 million cash on hand and the company

has one

of the most respected geologists in VP Exploration and Geoscience Moira

Smith. The same Moira Smith who led the team that discovered Long

Canyon,

which was sold to Newmont for US$2.3 billion in 2011.

There is also pressure to

deliver at both Goldstrike and Kinsley later in the year. The

company’s assets in Turkey went from being the flagship assets to only

mentioned in passing at the end of its corporate presentation due to the

volatility in the region.

We’ll continue to keep an

eye on Pilot and expect good results from Goldstrike and Kinsley.

Whether or not that presents an opportunity for shareholders to make

money on those good results will be largely a matter of the entry points

afforded

to us during the next several months.

Millrock Resources (TSX-V: MRO)(OTC: MLRKF)

On March 21, prospect-generator Millrock Resources announced that the company has assumed an option agreement on the

Lord Nelson Tenures (“LNT Property”) from Geofine Exploration Consultants (“GFX”). The mineral tenures are owned by Teuton

Resources Corp. (“Teuton”) (TSX-V; TUO), and have been under option to GFX since October 2010.

The LNT Property adjoins

and expands to the south upon Millrock’s Poly property. It is situated

at the juncture between the Del Norte mineralized trend further to the

south and the X Zone VMS horizon located on Millrock’s Poly Property.

The LNT Property consists

of five tenures covering approximately 2,450 hectares. The expanded

Poly

property, now consisting of 9,770 hectares, is located 34 kilometers

northeast of the town of Stewart, British Columbia, and is bisected by

Highway

37A and the Stewart Power Line.

We like Millrock’s share structure with 53 million shares fully-diluted.

We like the jurisdictions it operates in — Alaska, Southwest USA, Sonora, Mexico, and most

recently the “Golden Triangle” district of British Columbia.

We also like the commodity diversification

in the portfolio. Millrock currently has 27 active exploration projects:

eight gold, copper, and zinc properties in Alaska, three gold /

polymetallic projects in British Columbia, a uranium project in New

Mexico, and

15 gold, silver, and copper projects in Mexico.

We are familiar with and

like the management team. We are also familiar with several of the

strategic

and influential shareholders who are backing the company financially. We

will keep an eye on Millrock and see how it executes the

prospect-generator

model. In a bull market we want to see companies that have multiple

shots at a discovery and that limit dilution to their shareholders.

With a fully-diluted market cap of approximately C$13.25 million, Millrock could deliver great gains

if it can execute its business model.

Many of the companies we are watching are already seeing pullbacks and we anticipate further

pullbacks in the next several months.

Companies without potential catalysts will definitely suffer. It’s called exploration and

development. We need a little more of both before we see a sustained rebound in the sector.

To your wealth,

Gerardo Del Real

Editor, Resource Stock Digest

THE IMAGE OF PERMIAN BASIN.....???

https://www.google.com/search?q=permian+basin&tbm=isch&tbo=u&source=univ&sa=X&ved=0ahUKEwizqdiziOrLAhXFnZQKHXO3B_AQsAQIJw&biw=1024&bih=637#imgrc=7V3PCWmQI8VpAM%3A

Introducing New Texas Oil

The REAL reason oil is in the dumps...

And why Wildcatters, Big Oil, and OPEC are ditching oil to spend $5 Trillion on a new fuel...

That will ignite a tiny 50-cent stock... starting now!

— "Hands down the most profitable investment." — Forbes— "It's the new Black Gold" — Financial Post

Dear Reader, http://www.angelnexus.com/o/web/97427 There’s a new energy boom quietly raging in the oil fields of West Texas. Check out these images of a giant project being built there right now:  As amazing as it sounds, this has nothing to do with oil... or even gas, coal, and nuclear. Instead it’s a much more lucrative form of energy... One that’s much more abundant... reliable... and cleaner... And could mint more Texas-sized fortunes than any oil boom in history. I call it the "New Texas Oil." Because on June 11, 2015, the state of Texas discovered something astonishing... Something that could not only change the way Americans power their homes forever... But also change the fortunes of everyday Americans who know what’s going on... and move quickly. It found that — just like oil — Texas is blessed with more of this energy than any other state in the country. And in the heart of the Permian Basin, just miles away from where oil was first discovered in 1901... It built a rig to extract the "New Texas Oil" instead. A move that kicked off what the Wall Street Journal is calling "the next Texas energy boom"... Now the race is on... Over a thousand oil rigs have shut down... A new generation of wildcatters is striking overnight fortunes... And land holding millions of barrels of oil is going untapped... all for this "New Texas Oil." As you read this, $5 trillion (that’s with a "t") is beginning to flow to this overlooked power source. That includes big money investments from oilmen who are swapping the "black gold" for this new form of energy. Like billionaires Ray and Hunter Hunt, heirs of the Hunt Oil fortune, who recently started a "New Texas Oil" firm to cash in on the boom. Or the Rockefeller family heirs who recently dumped ALL of their oil investments and staked $860 million into this fuel instead. And one oil billionaire from Russia — the world’s largest oil exporter — recently plunked down $450 million on a "New Texas Oil" company. Wood Mackenzie, the major oil consulting firm, even calls it...

"The New Shale"

The Financial Post agrees, calling it "the new Black Gold."— Major oil consultancy firm That’s why even oil giants are joining the rush for this new power source. ExxonMobil estimates use of the "New Texas Oil" to soar by 2,000%. The French giant Total is on a buying spree for shares of "New Texas Oil" companies. It’s now investing half-a-billion each year in this new kind of fuel. The CEO of Shell even goes so far as to call it "the dominant backbone of the future energy system." Shell put its money where its mouth is, staking $53 million on a "New Texas Oil" play. Let’s not forget OPEC. Kuwait... Egypt... Abu Dhabi. All these Gulf State oil giants are scrambling to get their hands on the "New Texas Oil." Reuters reports it considers the new energy race "nearly as important as the current battle for oil market share." Even Saudi Arabia, with its aging oil fields, is making a staggering $109 billion investment in "New Texas Oil." According to the Saudi oil minister, "I believe [New Texas Oil] will be even more economic than fossil fuels." Now the Saudis aim to compete against Texas as THE global powerhouse for this new energy. Look. We’re talking about a ton of oil money here. Texas money. Big Oil. And OPEC. After the fracking bust and oil price slide... They’re all going after "New Texas Oil"... And for good reason... The Energy Information Administration just reported it’s the "fastest-growing source of U.S. electricity." Soon, this fuel could power 2.5 million households in the Lone Star State alone. 27 million homes in America... And 1.8 billion homes worldwide... The IEA — the global energy agency — even predicts it could become "the world’s single biggest source of energy." USA Today agrees, saying "this will be the biggest source of energy in the future." I’m talking about a global energy transformation on a scale NEVER seen before... Bigger than coal to the Industrial Revolution... or oil to the 20th century... Neither of which EVER supplied power to this many people. "Like shale oil," reports CNBC, "[New Texas Oil] is shaking up the world energy scene." According to Business Insider, "just as the shale revolution has made millionaires out of farmers, drove down the price of natural gas and dramatically transformed the geopolitical landscape, the new rush will also reshape our energy economy." One Bloomberg headline even reads,

"The Way Humans Get Electricity is About to Change Forever"

So are the fortunes of early investors who get a piece of this action.— Bloomberg But even though there’s never been a better time in history to tap the "New Texas Oil"... And even though this could mint even more brand-new fortunes than the shale boom... I doubt 1 in 1,000 Americans know about the energy boom currently raging in the Lone Star State. Or how they can get a piece of the cash the "New Texas Oil" investments are gushing. Just like they didn’t see the shale boom coming... or busting. And lost out on the new fortunes minted. The only reason I know about this is because I’ve been an insider in the world energy scene for the past decade. That puts me in a unique position to hear about under-the-radar stories like this long before the mainstream catches on... and that’s when all the REAL money is made. Here’s what I know... In order to stake your claim on a share of the "New Texas Oil"...

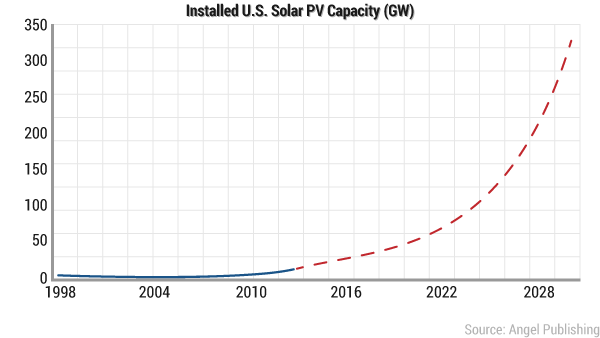

And buy in while it’s still a ground-floor opportunity. Which won’t last for long. That’s why I’ve done all the digging for you. But I’ve visited their sites... Met their CEOs, managers, and workers... And analyzed their operations. They’re small plays trading for $1 or less. But according to my research, they could surge for nothing less than 13,400% gains. And you don’t have to invest millions like the big guys. By my count, just a small $10,000 stake could explode into $1,340,000. Enough to fund your whole retirement on just one single play. Starting this year... thanks to a series of unprecedented global and U.S. political developments that are poised to hand investors the biggest profit windfall of their lives. In a moment, I’ll reveal two ultra-lucrative picks for this opportunity... I’ll share with you their names, company profiles, and ticker symbols. I’ll even show you uncut footage from inside their operations... the kind everyday investors NEVER get to see. Plus, I’ll share details on why they could skyrocket for life-altering gains starting this year. But first, allow me to explain this explosive situation and why it’s... Bigger Than the Fracking Revolution... It’s not even in the power plants that will generate energy using this fuel. Instead it’s in the technological revolution that’s underway right now... A rush to develop new breakthroughs to tap this fuel cheaper and much more efficiently than is currently done. Just like the fracking revolution that was driven by new technology to extract oil... Which sent the price of oil plunging... dramatically altering the world’s energy landscape... The new energy boom in Texas is also being sparked by cutting-edge technologies... Ones that are poised to reap tens of billions. As Business Insider reports, "no other technology is closer to transforming power markets." That’s why this energy revolution is setting off as we speak. After all, the "New Texas Oil" has been around for decades. But breakthrough advances that more efficiently convert it to electricity recently caused the price to dramatically plummet... Take a look at this incredible chart...  In fact, the cost of New Texas Oil has plummeted 94% in just the last seven years! Up until last year most analysts wrote it off as "impractical" because of the cost... Now it’s cheaper than oil, LNG, gas, and coal. And equal to the cost of almost every other power source — what’s known as "grid parity" in the energy field. "Even if coal were free to burn, power stations still couldn’t compete," reports the Guardian. USA Today reports, "It costs less than you can build a fossil fuel plant for, no matter the source of energy." Never before has a new form of electricity gone from theoretical possibility to practical reality this fast. Now take a look at the other half of this story. How this is about to overtake the entire global electricity market — a multi-trillion-dollar industry. Here’s a chart showing worldwide use of the "New Texas Oil" since the price began dropping precipitously. Demand Has Skyrocketed 13,800%   In other words, for every 10 homes powered in 2000... 1,390 homes were powered in 2014. Last year alone, the world generated 40 gigawatts of new power from the New Texas Oil. That’s equal to... 40 new nuclear power plants And 70 new coal-fired plants At this rate of astronomic growth, says Jon Wellinghoff, chairman of the Federal Energy Regulatory Commission, "[New Texas Oil] is going to overtake everything."

"The [New Texas Oil] Is Going to Overtake Everything."

But even though it’s the fastest-growing energy market in the world...— Chairman of the Federal Energy Regulatory Commission (FERC) ... A $120 billion industry poised to become the world’s largest power source... overtaking coal, oil, and nuclear... It still represents LESS THAN half of 1% of the global power mix. But that’s rapidly changing now... As the cost of every other energy commodity — like oil and coal — inevitably goes up... The price of "New Texas Oil" will continue to go DOWN. That’s because — unlike oil — the price isn’t limited by any kind of scarcity, only by technology. And if there’s one thing we all know about technology — from VCRs to microwaves to computers to cell phones... It’s that over time, it goes down in price and up in performance. In other words, there’s NO limit to how cheap it could get — besides zero. As a result we’re seeing an unprecedented surge of demand for the "New Texas Oil." One unlike anything seen since the rise of coal in the Industrial Revolution. Or oil in the 20th century. As UBS Bank reports...

"We’re At The Beginning of a New Era in the Power Markets."

Every single second a new "rig" goes up to extract this power... or a plant to harness it....— UBS Bank Worldwide... From China and India... To Africa and the Middle East... The "New Texas Oil" is disrupting the entire field of energy. And becoming essential to powering millions of households in over 130 countries. Deutsche Bank predicts the "New Texas Oil" market to reach $5 trillion globally. Money that will flow from billions of new customers... and into the pockets of early investors like you. A $5 Trillion Market in the Making... Bloomberg Energy Finance forecasts it could soon make up least 30% of the world’s power grid. That’s 1.8 billion households. A massive surge of 19,900% in use. This would make it the leading source of electricity for the entire world. Displacing gas, oil, coal, and just about everything else. While making a whole class of new energy wildcatters incredibly rich. No other form of energy can grow at this astonishing rate — not even close. So why haven’t you heard about it? Well, until recently, the mainstream media has been too focused on the shale boom, LNG, and other fads. But not me. Thanks to my energy industry contacts, I not only called the shale oil bust exactly two months before oil crashed...  In fact, in a 2007 book, Investing in Renewable Energy, I and my fellow authors predicted the inevitable rise of the "New Texas Oil"...  We predicted its potential to power billions of homes worldwide. But back then everybody laughed me off. Just as they did when I predicted the shale boom’s bust. They called the "New Texas Oil" a fantasy — and said that actual oil and coal would dominate the market forever. But the investors who listened to me could have already positioned themselves for life-altering gains. You see, a few "New Texas Oil" companies that emerged have already made investors rich in no time flat. These are the "first wave" companies bringing the new technology to market. "The New 10- and 100-Baggers Of Energy"  Pretty good, right? Few investors will ever see a return like this. But one Canadian energy play, CSIQ, blew this out of the park. It jumped for 1,957% in just 12 months...  Think that's good? Consider another "New Texas Oil" play, which surged from just $1 to over $90.  But get this... One "New Texas Oil" play — SOPW — took off for astronomic gains of 9,233% in a little over a year’s time!  That’s one of the biggest and quickest gains I’ve EVER seen in the markets. You could have started with just a little over $10,000 and retired a millionaire the next year. I’ve never seen anything like it. These returns are certainly great, and could have changed your life — even with a very small investment. But don’t worry if you missed out. Because I think we’ve just seen a blip compared to the potential of the new Texas energy boom... Leading energy analysts predict this fuel could...

New startups with far more advanced technology and cheaper manufacturing processes. The future Exxons, Chevrons, and Shells of the "New Texas Oil." And you can buy them for $1 or less. In just a moment, I’ll share with you the details on two ground-floor plays set to launch this energy revolution full throttle in 2016. And make investors rich once again — while cutting your light bill to just pennies a day. That includes perhaps the biggest breakthrough in the history of the energy markets... one that could double the power output — while slashing the price of "New Texas Oil" in half. But before I do, allow me to show you why the new Texas energy boom is still in its infant stages. And why RIGHT NOW is the best time to get in — while it’s still minting millionaires.

"A New Gold Rush for Investors"

In early 2015, President Obama visited India where he set up a deal to export the "New Texas Oil."— Forbes A move that Forbes said "could signal a gold rush for investors." Since then it’s attracted a whopping $200 billion in outside investment. "New Texas Oil" companies and utilities are scrambling to get a piece of India’s electricity market — the third largest in the world behind China and the U.S. In India, only 600,000 homes are currently powered by this energy. But soon Deutsche Bank says the energy will represent one-quarter of India’s power capacity. Mind you, I’m talking about a country with 800 million people — one of the world’s largest consumer markets. All told, the "New Texas Oil" could bring electricity to over 200 million people in India alone. An astronomic 33,000% surge in growth. Just to give you an idea of how far-reaching this could be... That’s five times the number of people worldwide who currently get power from the "New Texas Oil." All in one country. The price tag for this incredible expansion is estimated to reach $1 trillion. How does the country’s government plan to pay for the project? Simple — in the huge energy savings seen by local governments, businesses, and customers. India isn’t the only one undergoing such a large-scale energy shift... $3.7 Trillion Its "New Texas Oil" projects are growing at over 200% annually. This year it will build the equivalent of 17 nuclear power plants worth of "New Texas Oil" projects. And in the next five years, China alone will QUADRUPLE the world’s entire capacity. That’s 60 million new homes powered in the Red Giant alone. A NASA satellite images show how a Chinese "New Texas Oil field" has tripled in capacity since 2012.  Why? China is seeking to lower its dependence on oil and coal, which it has to import at high prices. Not to mention the air pollution that’s wreaking havoc on the health of its citizens. One study found 4,400 people die in China every single day from diseases and illness related to smog. A 2015 study showed breathing Beijing's air is the equivalent of smoking 40 cigarettes a day. That’s why China is already the world’s leading market for this much cleaner form of energy. But from here, the numbers grow astronomically. Almost impossible to believe. A leading Chinese energy agency plans to make the "New Texas Oil" its #1 source of electricity. A plan that would cost as much as $2.7 trillion. All told, the new form of energy could make up exactly one-third of its power grid. Or enough to deliver power to 540 million new people! 1.8 Billion New Customers In fact, "New Texas Oil" is becoming a vital fuel source worldwide. Right now, 120 countries on six continents are replacing coal and gas with it. And as the price keeps dropping, this trend will only accelerate. Again, take a look at this chart...  As prices plunged 94% in just the past seven years, demand skyrocketed. Since 2000, use has surged 13,280% — and that’s just for starters. Remember, it still generates less than half of 1% of global electricity. Worldwide this will become a dominant power source — powering 1.8 billion homes. But before I go on, let me answer something that’s probably on your mind... What exactly is "New Texas Oil"? Of course, I’m talking about solar. And I know what you might be thinking, but this is unlike solar you’ve seen before. In fact, solar power has been around for well over a century... since Albert Einstein first discovered it. But this new form of solar is much cheaper and more powerful than anything before it. I call it "Solar 2.0." And it’s the new solar cell design — a combination of breakthrough technologies — that have triggered the steep 94% price drop I’ve already shown you. Now solar is cheaper than coal and gas — without subsidies. In places like Abu Dhabi — where there are no tax credits for it — solar farms are powering homes for 30% cheaper than natural gas... and half the cost of coal. Or take Texas, which is now seeing a solar energy boom, with its massive land reserves and abundant sunshine. A record deal was recently inked with bids at around $0.03 per kWh. That’s 58% cheaper than gas. And three times cheaper than coal. Shortly after, Warren Buffett’s Nevada utility signed a solar deal at what Bloomberg calls "the cheapest electricity rate in the U.S." Take that in for a second. I mean, this was considered unthinkable just a few years ago when solar was considered a nice but impractical source of energy — one that would not be used at all if it weren’t for climate tax credits. But subsidies or not, the solar market has reached a critical threshold — and there’s no turning back. Even the U.S. Energy Secretary says "solar will grow without subsidies." Whether you like it, believe in it, want it, or not — the Solar Age is here. One global mega-bank calls solar "an unstoppable juggernaut." And as USA Today puts it: "the solar energy revolution is past the point of no return."

"Past the Point of No Return"

Consider the Pentagon.— USA Today While it’s now the world’s single largest consumer of oil... That’s all about to change. On 124 military bases in 33 states, solar farms are going up. All military branches — Army, Navy, Air Force, Marines — are joining the rush. The Defense Department invested $7 billion in solar in one single day. The Navy is investing in what will be the world’s largest solar farm... one that will supply power to fourteen of its southwestern U.S. bases. Some of the world’s biggest Fortune 500 corporations are lining up behind solar, too. Google, for example, is investing $300 million to do it... Apple is investing nearly $1 billion! Everywhere you look, America’s biggest companies are going all in on solar... including:  The examples go on and on. The world’s leading billionaires are tossing their fortunes at solar, expecting massive returns. For example, on November 30, 2015, a dream team of billionaire titans including...

Gates has already invested $1 billion of his OWN money into solar — and has committed to doubling that. Warren Buffett has already invested as much as $15 billion in solar power, and is set to double down. I could go on and on. And we’re just at the very beginning of the solar rush... Remember, solar generates less than half of 1% of global energy. A recent series of developments is catapulting this market to unseen heights... promising untold fortunes in 2016 and beyond. Solar Catalyst #1: The $2.5 Trillion "Solar Mega-Alliance" The mega-group’s goal is to make solar energy the world’s dominant power source. And it's committed to mobilizing $2.5 trillion of investment from governments and corporations. On the home front, Obama’s 2015 climate plan has introduced sweeping changes to America’s power grid... Changes that spell mega-profits for the solar boom. The plan commits America to a 32% reduction in carbon emissions... But here’s what you didn’t hear from news... In order to achieve Obama’s sweeping reforms, we would need to generate at least 10% of our power from solar. Right now it makes up just 0.23% of our power mix — so we’re talking about a 45-fold surge in use.  If Hillary wins the presidency later this year, expect more reforms — even quicker. Hillary already said if she wins, her goal is to have a solar panel in every home — a total of 500 million solar panels. What’s more, even the Republican-majority Congress has now lined up behind solar. In December 2015, it unexpectedly passed a five-year extension of the solar tax credit... one that already has solar stocks moving. All of these developments mark a real "tipping point" for solar power’s energy dominance. Here’s another... The energy storage revolution — led by Elon Musk’s Powerwall Battery. Solar Catalyst #2: Nighttime Solar Power Well, the sun generates far more energy than we could ever hope to use. The key is storing it for nighttime consumption or cloudy days. That’s where solar batteries come in. Just like solar cells, battery costs are following a dramatic downward price curve. A few years ago, they cost $1,000 per kWh. The timing couldn’t have been better. The energy storage revolution is moving arm-in-arm with solar. The market was just $42 million in 2014. But when Elon Musk announced presales of his Powerwall Battery in 2015, he immediately sold $1 billion worth.  Utilities, grid operators, companies, schools — the market for these batteries is huge. By 2017, the battery market is projected to reach into the several billions — a result of the solar boom. Apple... Google... They all have teams right now racing to build more efficient batteries at lower costs. Not only that, they’re using solar batteries to power their giant warehouses full of servers. For instance, Apple recently invested $850 million to power its warehouses and offices — the largest ever commercial deal for American solar. Car manufacturers like Nissan, Mercedes-Benz, and Toyota are joining the race. So are electronics manufacturers like Samsung and Panasonic. The "holy grail" is a battery that costs $100 kWh. And on our current price down curve, we’re getting there faster than ever. Finally, there’s what I’m calling the third-generation solar cell... Solar Catalyst #3: The Biggest Solar Breakthrough in 60 Years This "Dream Team" of solar energy experts aimed to disrupt industry in two ways:

They invented a series of innovations that created the "next generation solar cell." One that could singlehandedly drop the solar price by 75% or more. That’s nothing short of transformational. The industry is scrambling for technologies that offer a few percentage points of better performance or lower cost... And their tech not only DOUBLES the power generation of industry solar cells, but has the potential to cut manufacturing costs in half... Together it would mean a 75% cut on current solar prices. Solar is already at "grid parity" with gas and coal — which most homes still use — so that would mean a 75% cut on your power bill. Imagine your bill dropping from $100 to $25 overnight — and that’s just for starters. No other form of energy could EVER profitably compete with that. Not natural gas or coal. Not even $1-a-gallon gas. In short, this disruptive technology is driving solar toward becoming the undisputed champion of global energy. The cheapest, most powerful, and most reliable form of energy ever invented. Which is why it’s poised to become the industry standard — the leading solar companies will have no choice but to adopt it, or risk going out of business. With a 75% cut in costs — plus increased sales from lower prices — it’s about as close to a "free lunch" as it gets. I recently toured its facility, saw test results, and met the team of top scientists. I’ll show you why it’s the biggest solar breakthrough in 60 years — one about to disrupt the industry. Plus, you’ll see the tiny company that owns 60 patents on it. And how you can buy into it now for under $1... before it becomes a billion-dollar giant. It doesn’t manufacture the solar cells. And it isn't a solar company. It simply owns the disruptive technology and processes that every solar maker will inevitably be forced to adopt. These are the kinds of game-changing plays that could help us see massive profits on the solar boom. But before I share more details on that, you should know that while everything I’ve said so far may seem a little too optimistic... It’s actually just a conservative estimate of solar’s growth potential. In fact, based on one leading economist’s projection of its current growth, it will inevitably overtake the entire global electricity market... in just 16 years. That would mean no more coal or gas — every home on the planet could be powered by solar... And you have the very brief opportunity to buy in while it’s still on the ground floor. Let me explain... "Why Solar Could Soon Cost NOTHING... And Power EVERYTHING"  It’s following a pattern you may have heard of before. One similar to the pattern followed by the processing chip — a key component of the personal computer revolution. Moore’s Law. And it says the size (and cost) of processor chip transistors halves every two years... doubling chip performance. For the last 50 years it’s held true... and led to the development of the PC, smartphones, and calculators. Incredibly enough, solar power has been following a similar trajectory. Just like Moore’s Law, the cost of solar cells dips 20% for every doubling of total volume shipped. And it's done that every two years... For the last 20 years.  Since then solar has remained on the same trajectory. And based on the conventional growth curve... It could continue falling 20% in price and doubling power output — every two years, for decades. Just like Moore’s Law for processor chips. How long would it take before solar became the world’s ONLY electricity source? It would just need eight more times to double. That’s 16 years. By then the price of solar would plunge to near zero. A development that would forever transform how we power everything in our lives — from our homes and cars... to schools and workplaces. This may seem a little "out there." But the price of solar is limited by technology — not scarcity. That brings me back to the technology I was just mentioning... The biggest solar breakthrough in 60 years... One that could kick "Swanson’s Law" into overdrive... pushing down the price of solar exponentially — even quicker. And... "The $1 Stock That Holds ALL Patents on THE Next Generation Solar Cell" The leading thinkers who are most capable of developing the best solar innovations. They created a brand-new solar cell that delivers 100% more power output — at half the manufacturing costs. A development that — writes economist Peter Arendas — "has the potential to bring revolutionary changes to the global energy market." Nothing else has singlehandedly revolutionized the solar cell design like it. And they own every step of the process for what will inevitably be the first-line solar technology. A must-have for every solar manufacturer. It’s three generations ahead of the ordinary solar panel — and it’s coming to market sooner than anyone can imagine. In 2016, I believe we’ll see the first of their solar cells go up on homes, businesses, and solar farms. Based on the deals they’re setting up, they’ll earn 20% of every solar panel sold — without touching the manufacturing. If this becomes industry standard in 2016 — and in a moment you’ll see why it could — we’re talking about capturing a fifth of the market... That’s a market now valued at $125 billion... and projected to reach $5 trillion over the next decades. One of these is a silicon technology I call "absolute black." "Absolute Black" Absorbs 99.7% of the Sun's Power This was the first step to engineering the solar cell of the future. According to a series of recent tests, in fact, it absorbs 99.7% of the sun’s energy — double that of existing solar cells. What’s more, tests found it shaves off 23% of the production cost — a savings of $0.04 per watt. Add to that its patented laser production process... which has led to even more exciting developments. 66% More Power — for Free The problem is, it’s expensive and complicated to produce using traditional methods. But this company’s low-temperature laser process streamlines the process — building the HIT for the same cost as typical solar cells. It essentially delivers 66% more power than typical solar cells for free. But a recent development may be the biggest. Something that could cut even more off the manufacturing cost. In 2015, the company announced it created a brand-new solar structure using its laser process. One that doesn’t use silver. Solar Panels Without Silver And while silver is sitting at 10-year lows, that probably won’t last forever. If silver reaches even just $25, it could seriously cripple solar panel production. So the company developed a way to replace silver with aluminum — without reducing power output. This alone directly shaves an extra one-third off the cost — and even more, if silver prices go higher. (Which I hope they do for other reasons) These designs have all proven commercially viable in production lines. Together they DOUBLE power output — at half the cost. And 2016 is the year they hit the market. Now here’s why this is REALLY a perfect storm of profits... Why 2016 is The Last Year This Tiny $1 Stock Trades UNDER $10 The new billionaire solar alliance will commit its first major investments, too. And if a Democrat wins the election — which looks likely — the U.S. will lead the race with unprecedented reforms like Hillary’s 100% solar power plan. Republicans are getting behind the boost for clean energy too... and just extended solar’s tax credit for five years — a major milestone for this energy shift. Solar stocks have already started moving on the tailwinds of all these trends... Even Fortune predicts, "solar panels will boom in the first half of 2016." My point is, 2016 is the "tipping point" for the solar market’s energy dominance. And that’s exactly when this company’s new technologies will hit the market... dropping the price of solar by 75%. Sure, tons of new solar technologies are being mentioned in the news. But few are even close to ready for market. Most have not even left the prototype stage. That’s not the case at all with this company’s third-generation solar cell — which is not only ready for production... But has proven commercially viable in assembly line tests. How much money are we talking about? In the United States alone, the market is $33 billion. So let’s be conservative and say this company’s solar technology captures just half of current U.S. sales... That’s nearly $16.5 billion in annual revenue. Twenty percent of that — this company’s share of royalties — is roughly $3 billion. Factoring in the average price-to-sales ratio for similar companies, the share price comes out to $67. That’s a 13,400% gain! Enough to turn every $10,000 invested into a staggering windfall of $1,340,000. And in case you think I’m stretching here... That’s just a fraction of the U.S. market... in a solar market that is growing rapidly here — and worldwide. Considering that nobody, anywhere, can manufacture a more efficient solar cell for such a low price. And that nothing like it has been developed in the last 60 years of the solar industry... One conclusion is unavoidable: There’s nothing stopping this new solar breakthrough from overtaking the entire industry worldwide. Which is why its upside truly has NO limits. It’s not even a question of IF solar makers will jump at the opportunity to cut costs by 75%. It’s a matter of WHEN. And that’s why 2016 is shaping up to be a game-changing year not just for the solar revolution... Or the future trillion-dollar industry behind it... But also for investors who buy in before the world’s biggest solar players are begging to GIVE AWAY 20% of their sales to this tiny $1 company.  So you can take action early while there’s still time, I include the name, ticker symbol, and profile of this play in my FREE report: "134-Times Your Money on the Trillion-Dollar Solar Boom." But before I show you how to get your hands on this groundbreaking research absolutely FREE... Allow me to share a few details on a few other plays I’ve identified — starting with another potential 100-bagger. Solar Boom Play #2: Bag 100-Fold Gains on Solar Picks & Shovels Instead it produces software that brings standardized quality to solar manufacturing. What I consider a "picks and shovels" play for the solar boom. The opportunity lies in the old, outdated, and inefficient production process for solar cells. The current lines produce a high rate of defective solar cells — as high as 25% in fact... A serious loss of time and money for solar makers. Imagine if one of every four cars that came off the line was completely useless. Nearly every car maker would go out of business tomorrow! Well, that’s where the solar industry is at right now. Solar companies are making cells at a 20% margin loss. And trying to make it up on volume. As global demand climbs to unprecedented levels every single quarter, this will cut even deeper into profit margins. And that’s why the industry is in desperate need of automated and standardized production. Every product you can imagine at some point or another has gone through something similar. Paper, steel, pharmaceuticals, semiconductors, petrochemicals, and so on — all have gone through a phase that resulted in streamlined finished products at extremely high standards. Like what Henry Ford did for automobile manufacturing. Now it’s solar’s turn, thanks to this company’s hardware and software. Tests show it can yield 99% quality control — an absolutely incredible boost. This will bring solar up to the standards of other industries — where the defective rate is 1% or less. It can singlehandedly flip a solar maker’s 20% loss to a 20% profit gain. So you can imagine why solar makers are lining up to get their hands on this tech. Now get this... This tiny company’s market cap is only $5 million... But it has $10.5 million worth of orders already locked. These are orders already set, with the shipments going out. That’s double its market cap! But the stock hasn’t even moved. The markets haven’t caught on yet. This is a huge under-the-radar opportunity... one that could instantly double your money — and that’s just for starters. In total, there are 625 solar production lines worldwide and growing. So this software (at $500,000 a pop) has a market opportunity of $312 million. When you add the service costs, it totals up to roughly $500 million. That’s 100 times its current market cap — and that’s just on the existing lines. All told, early investors could see 10,000% profits in the next few years as the orders roll in. You’ll get all the lucrative details on this groundbreaking solar play — and the one I already told you about — in my FREE report:

"134-Times Your Money on the Trillion-Dollar Solar Boom."

Each of the picks inside could hand you 100-fold gains starting in 2016.And let me be clear: While you’re virtually guaranteed to make money investing in solar stocks... If you know where to look and when to buy, it could mean the difference between just doubling your money... And retiring wealthier than you ever dreamed. I only know where to look because of my extensive "boots-on-the-ground" investigations. I go out to the operations... and see the technology firsthand. I meet with the management, which is a crucial (yet overlooked) asset for any solar company... And I get a peek "behind the scenes," pulling up the curtain on the quarterly earnings report. While traveling the world, I’ve combed the entire solar sector from top to bottom. And these two picks — the ones I just described — are the cream of the crop when it comes to tiny solar stocks with explosive potential. Hands down.  Again, I’ve included full details on these potential 100-baggers in my FREE report: "134-Times Your Money on the Trillion-Dollar Solar Boom." Here’s a quick preview of what you’ll get:

All I ask is that you give my advisory research service, Early Advantage, an absolutely free test drive. Join the Club  I'm an investment analyst here at Angel Publishing in Baltimore, Maryland. I'm also editor of Early Advantage, the resource for big profits from little-known breakthroughs and disruptive technologies in energy, electronics, technology, agriculture, and more. No sector is off limits. In just the past few years, I've brought investors massive, rapid-fire gains from companies in multiple sectors... Including several big winners from the solar boom, such as:

But know this: Off of just one of my recommendations, you could make the type of money that could change your portfolio... or even your life. How do I know? It’s already happened. One guy by the name of Dan Leopold wrote to me about one of my recent recommendations...

I made over $100,000 with you on the first run a year or so ago...

I’ve had to redact the stock name there because it’s an active play

that’s still making people money, and it wouldn’t be fair to those

currently holding positions.Donald McMillan shared his story, too:

I did very well on two picks. Pretty lucky with a profit of $27,649!

And Anthony Reymond recently wrote me to say:

This is the most profitable service in almost 10 years of trading.

Pure and simple. [Three picks] have been triple-digit winners for me. As

a friend of mine who speaks broken English would say, 'THANK YOU VERY

BIG'

But my favorite is from Tom Donaldson, who made nearly half a million dollars on a single trade:

Nick - My account is now over $450,000. Happy with the gains so far! Thanks!

So as you can see, I continually provide the potential for huge gains.And I can tell you this... It takes a lot of hard work and boots-on-the-ground research to maintain the success I’ve experienced. Whether it’s flying out to California and speaking with an aquaculture expert to get the inside details on a world-changing medical discovery...  Or taking a tour with Canadian CEOs to uncover the newest intelligence in the world of energy...  Or even interviewing Montel Williams in the hopes of discovering the next 1,000% gainer in the market...  There’s not a stone I won’t turn over if I think there’s money to be made on the other side. I Spend Millions on My Research I’ll go to any extent I feel necessary to make sure things are on the up-and-up before I recommend something other folks might put their money into. I don’t simply sit behind a desk, stare at a computer screen, and pick a stock based on some arcane information from an annual report. That’s for the no-talent hacks that think they know what they’re doing. Not me. I do the real research most analysts don’t feel like doing — or can’t afford to do. I’ve been in a three-man helicopter over the Canadian wilderness... stood on the edge of 500-foot-deep mines... and attended $5,000/seat conferences across the country... all in the name of securing the full stories behind the biggest wealth-creating opportunities in the world. You can even say I’ve hobnobbed with the financial elite...  If you didn’t already know, the "other guy" in that snapshot is John Paulson, American hedge fund guru and billionaire. We were both invited to a closed-door investment summit in Puerto Rico recently, and we had a nice little chat. It’s pretty obvious these things don’t happen for analysts who refuse to leave the office — or get out of bed. But I do it because it’s what I love to do. It’s what I’ve always loved to do. Giving readers like YOU the early advantage on any moneymaking or money-saving opportunity available long before the rest of the market catches on. That's what Early Advantage is all about. I've been on the cutting edge for years, discovering major life-changing, moneymaking opportunities that other financial institutions don't cover. Just to give you a better idea:

For 30 days, you'll have the chance to profit from every single one of the winning investments I’ve shared exclusively with my followers... without risking a single dime. I want you to see for yourself how potentially profitable Early Advantage really could be for you. Simply put, the minute you claim your copy of "134-Times Your Money on the Trillion-Dollar Solar Boom," you'll immediately receive 30 full days of unrestricted access to the following:

Unbelievable Value! The short answer is: nothing. I’ve convinced my publisher to give you a special deal... one that we’ve never offered before. Now, I've seen research services like Early Advantage sell for $10,000 or more. There are also "analysts" on Wall Street who pay thousands for these small-audience subscriptions. Some of these analysts work in hidden niches of the market, making millions per year to research new ways to play upcoming trends. To them, services like mine are a leg up on the competition, and they would happily pay $10,000 or more per year, since it’s really a fraction of the cost some "professionals" shell out for research like this. But even though I could see this service going for that much, I know it would be difficult for everyday investors to participate at such high a price... So I asked myself, What’s the absolute minimum I could ask people to pay for this service? What's reasonable? What's fair, considering the fundamental value? After all, Angel Publishing and Outsider Club are in the publishing biz, and we have to keep the lights on here. That, and many of the companies I recommend with this predictive investment strategy require deep investigation. That last part means I have to travel out to worksites... talk to the geologists and engineers... rub elbows with the people on drill decks and in core shacks... and meet with the CEOs and other executives. So after crunching the numbers, I finally settled on a price of $1,599 per year for this service. At least, that will be the regular price of this service moving forward. It’s easy to understand why: One single recommendation could easily pay for your entire subscription. For example, one of my followers, Chris G., recently sent me this note:

Thanks Nick, I grabbed a quick 36% gain today. That'll take care of this year's subscription price!

Another of my followers, who wishes to remain anonymous, chimed in,

I just renewed Early Advantage. Made $6,000 on one play, so my membership has more than paid for itself. Keep 'em coming!

Another one of my followers, Donald M., said he made a profit of $27,649 last year.That’s enough to pay for 17 years of my research! Todd S. is up a bit more, saying...

Thanks to Early Advantage, I'm planning to retire a multi-millionaire!

Given these kinds of gains, I'm sure you'll agree $1,599 is a bargain.But you won’t have to pay that. Reply Immediately and Receive My "Charter Member" Pricing In fact, you’ll pay 50% less than others pay for 12 months of my profit alerts. That’s a HUGE discount off the normal price! Simply click the "Subscribe Now" button below to see your final pricing. I truly believe the $5 trillion solar boom is the single best opportunity I’ve ever discovered. I want to make absolutely sure you don't miss out on your chance to profit from it. But there’s no telling how long this offer will be open, especially considering that many of the companies are small now but could be hitting the mainstream soon. Even if we can at some point reopen this offer, it will likely only be to a handful of people and will probably come with the full price tag. It’s a truly unique opportunity. Because when I release my next alert, you could be up and running on your own path to becoming... well, much better off financially! Subscribe at the end of this presentation to start receiving your profit alerts each month! You're Minutes Away From Starting Click the "Subscribe Now" button below to receive my latest alert, and you could be on your way to riding the biggest gains of your life. And if you're still not convinced, you have 30 days to decide if my brand-new strategy is really right for you! You have my personal guarantee... My "Keep Everything & Risk Nothing" DOUBLE GUARANTEE So I want you to go ahead and take a FULL 30 DAYS to have a good look at every breakout company I've uncovered. And then, if for any reason you're not totally thrilled... Just tell us to send your money back, and we'll promptly refund every penny, NO QUESTIONS ASKED. You’ll get all the details about the solar boom and the 100-baggers primed to soar... all the exclusive information on the members-only Early Advantage website... all the reports and investment guides... all the recommendations... all the articles and investing tips. And if you join me today, I will give you access to three bonus reports — ABSOLUTELY FREE:

All three bonus reports are yours FREE when you agree to test-drive Early Advantage for 30 full days starting right now. The intel in just one of these special briefings could easily pay for your membership many times over... And they're yours to keep — no matter what your final decision is. But you must act fast... As you’ve seen, the solar boom is heating up right now. The opportunity is hot. The tiny $1 company behind it is on the cusp of explosive profits that can change your life. Its breakthrough technology is about to disrupt the market NOW. It’s rolling off the production lines as we speak. Solar makers are lining up to get their hands on the first shipments of orders. When just a fraction of the billions flowing through the energy markets hit its balance sheets, the company will surge to $10... $30... and as high as $67. And it all begins in 2016. You’ve seen the charts. You’ve seen the proof. You’ve seen the wealth and money. Here’s what I suggest you do right now... Click the link below to get started right away. You’ll be able to review everything on the next page before your order is final. And remember, this offer is risk-free for 30 days. If you don’t like what you see, call me and cancel. But if you’re still reading, I don’t think you'll need to worry, because I seriously doubt you'll be canceling... Especially when you see what I’ve prepared for you. Remember... your opportunity for incredible wealth could start immediately with my next alert. I urge you not to delay. I likely won't be able to offer this amazing deal to anyone else after this initial offer expires. Just click here or the "Subscribe Now" below to get started... or call our customer service team at 855-877-8623. I look forward to the wealth we'll make together. Call it like you see it, Nick Hodge Editor and Creator, Early Advantage |

Permian Basin (North America)

From Wikipedia, the free encyclopedia

The West Texas Permian Basin

state of Texas and the southeastern part of the state of New Mexico. It reaches from just south of Lubbock, to just south of Midland and Odessa, extending westward into the southeastern part of the adjacent state of New Mexico. It is so named because it has one of the world's thickest deposits of rocks from the Permian geologic period. The greater Permian Basin comprises several component basins: of these, Midland Basin is the largest, Delaware Basin is the second largest, and Marfa Basin is the smallest. The Permian Basin extends beneath an area approximately 250 miles (400 km) wide and 300 miles (480 km) long.[1] The Permian Basin gives its name to a large oil and natural gas producing area, part of the Mid-Continent Oil Producing Area. Total production for that region up to the beginning of 1993 was over 14.9 billion barrels (2.37×109 m3). The towns of Midland and Odessa serve as the headquarters for oil production activities in the basin. The Permian Basin is also a major source of potassium salts (potash), which are mined from bedded deposits of sylvite and langbeinite in the Salado Formation of Permian age. Sylvite was discovered in drill cores in 1925, and production began in 1931. The mines are located in Lea and Eddy counties, New Mexico, and are operated by the room and pillar method. Halite (rock salt) is produced as a byproduct of potash mining.[2][3][4][5] Contents

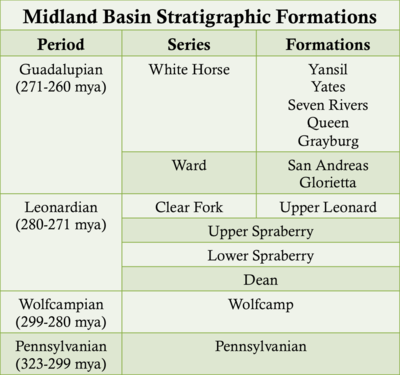

Depositional historyThe Permian Basin is the thickest deposit of Permian aged rocks on Earth whichwere rapidly deposited during the collision of North America and Gondwana (South America and Africa) between the late Mississippian through the Permian. Lower Paleozoic (Upper Cambrian to Mississippian)Prior to the breakup of the Precambrian supercontinent and the formation of themodern Permian Basin geometry, shallow marine sedimentation onto to the ancestral Tobosa Basin characterized the passive margin, shallow marine environment. Upper Mississippian-Lower PermianThe collision of North America and Gondwana Land (South America and Africa) duringthe Hercynian Orogeny created the Ouachita-Marathon thrust belt and the associated foreland basins, the Delaware and Midland Basins, separated by the Central Basin Platform. The tectonic activity resulted in the distribution of voluminous siliciclastic sediments into the basins during the Early Pennsylvanian. Siliciclastic sedimentation was followed by the formation of carbonate shelves and margins at the basin flanks in the Early Permian. Upper PermianAfter the Hercynian Orogeny, 4 km of sediment filled the rapidly subsiding Delawareand Midland basins. The Midland basin was filled by about 270 mya, as it received the majority of clastic sediment from the Hercynian Orogeny via a subaqueous delta, while the Delaware Basin continued to fill until the late Permian. Sandstones and some deep water, organic rich shales were deposited within the basins while reef carbonates were deposited on the Central Basin Platform and on the shelves of the basins. The extensive reef deposits fringing the Delaware Basin became known as the Capitan limestone. In the later Guadalupian, the Permian sea retreated, and the basins were capped with evaporite deposits, including salts and gypsum. The deep water shales and carbonate reefs of the Delaware and Midland Basins and the Central Basin Platform would be become lucrative hydrocarbon reservoirs.[4][12] Generalized facies tracts of the Permian BasinThe Permian basin is divided into generalized facies belts differentiated by thedepositional environment in which they formed, influenced by sea level, climate, salinity, and access to the sea. Lowstand systems tractLowering sea level exposes the peritidal and potentially, the shelf margin regions,allowing linear channel sandstones to cut into the shelf, extending beyond the shelf margin atop the slope carbonates, fanning outward toward the basin. The tidal flats during a lowstand contain aeolian sandstones and siltstones atop supratidal lithofacies of the transgressive systems tract. The basin fill during a lowstand is composed of thin carbonate beds intermingled with sandstone and siltstone at the shelf and sandstone beds within the basin. Transgressive systems tractThese facies results from the abrupt deepening of the basin and the reestablishmentof carbonate production. Carbonates such as bioturbated wackstone and oxygen poor lime mud accumulate atop the underlying lowstand systems tract sandstones in the basin and on the slope. The tidal flats are characterized by supratidal faces of hot and arid climate such as dolomudstones and dolopackstones. The basin is characterized by thick carbonate beds on or close to the shelf with the shelf margin becoming progressively steeper and the basin sandstones becoming thinner. Highstand systems tractHighstand systems tract facies results from the slowing down in the rise of sea level. It ischaracterized by carbonate production on the shelf margin and dominant carbonate deposition throughout the basin. The Lithofacies is of thick beds of carbonates on the shelf and shelf margin and thin sandstone beds on the slope. The basin becomes restricted by the formation of red beds on the shelf, creating evaporites in the basin. [13] [12] [14] Tectonic historyDuring the Cambrian-Mississippian, the ancestral Permian Basin was the broadmarine passive margin Tobosa Basin containing deposits of carbonates and clastics. In the early Pennsylvanian-early Permian the collision of North American and Gondwana Land (South America and Africa) caused the Hercynian Orogeny. The Hercynian Orogeny resulted in the Tobosa basin being differentiated into two deep basins (the Delaware and the Midland Basins) surrounded by shallow shelves. During the Permian, the basin became structurally stable and filled with clastics in the basin and carbonates on the shelves.[15] Lower Paleozoic passive margin phase (late Precambrian-Mississippian, 850-310 Mya)This passive margin succession is present throughout the southwestern US and is up to1.5 km thick. The ancestral Permian basin is characterized by weak crustal extension and low subsidence in which the Tobosa basin developed. The Tobosa basin contained shelf carbonates and shales.[16] Collision phase (late Mississippian-Pennsylvanian, 310-265 Mya)The two lobed geometry of the Permian basin separated by a platform was the result ofthe Hercynian collisional orogeny during the collision of North America and Gondwana Land (South America and Africa). This collision uplifted the Ouachita-Marathon fold belt and deformed the Tobosa Basin. The Delaware Basin resulted from tilting along areas of Proterozoic weakness in Tobosa basin. Southwestern compression reactivated steeply dipping thrust faults and uplifted the Central Basin ridge. Folding of the basement terrane split the basin into the Delaware basin to the west and the Midland Basin to the east.[15] [17] Permian Basin phase (Permian, 265-230 Mya)Rapid sedimentation of clastics, carbonate platforms and shelves, and evaporitesproceeded synorogenically. Bursts of orogenic activity are divided by three angular unconformities in basin strata. Evaporite deposits in the small remnant basin mark the final stage of sedimentation as the basin became restricted from the sea during sea level fall.[16][18] Hydrocarbon plays

Figure 8: Active oil (green) and gas (red) wells on the Permian Basin, Texas

Figure 9: Significant hydrocarbon plays within the Permian Basin

The Permian Basin is the largest petroleum-producing basin in the United States and has produced a cumulative 28.9 billion barrels of oil and 75 trillion cu ft. of gas. Currently, nearly 2 million barrels of oil a day are being pumped from the basin, which still contains an estimated 43 billion barrels of oil and 18 trillion cu ft. of gas. 80% of estimated reserves are located at less than 10,000 ft. depth. Ten percent of the oil recovered from the Permian basin has come from Pennsylvanian carbonates. The largest reservoirs are within the Central Basin Platform, the Northwestern and Eastern shelves, and within Delaware Basin sandstones. The Primary lithologies of the major hydrocarbon reservoirs are limestone, dolomite, and sandstone due to their high porosities. However, advances in hydrocarbon recovery such as horizontal drilling and hydraulic fracturing have expanded production into unconventional, tight oil shales such as those found in the Wolfcamp formation.[5][19] Counties of the Permian BasinDue to its economic significance, the Permian Basin has also given its name to thegeographic region in which it lies. The counties of this region include:[citation needed]

Other counties sometimes considered part of the Permian Basin are:[citation needed]

to 577,667.[citation needed]

External links

| |||||||||||||||||||||||||||||||||||||||||||||||||||

6,189 viewsThe Permian Basin: America's Most ImportantOil And Gas Resourcehttp://www.forbes.com/sites/drillinginfo/2015/11/02/the-permian-basin-the-countrys-most-important-resource/2/#648c6a5c6d31

Opinions expressed by Forbes Contributors are their own.

Continued from page 1

New Production CapacityDI’s New Production Capacity (or NPC) takes active rigs, corroborates them with permits, and then compares those new wells with recent near-neighbor production to determine the potential capacity of each new well drilled. We can then add those figures up into a national figure (The DI Index) or break the analysis down even further. It is a more precise leading indicator of production that will likely come online in the next few months than rig count alone. When we look at New Production Capacity by basin across the US for the month of September, again we see the clear dominance of Permian Basin operations.  Image Source: Drillinginfo New Production Capacity National Report Focusing back into the Permian and further breaking down into Operator and County NPC, we see Occidental and Concho are leading the pack of operators, and that Midland and Reeves Counties have the current geographic pole positions.  Image Source: Drillinginfo Permian Basin NPC report Let’s take a closer look at operations within those two top counties. In the following image, on the left we have Reeves county (in the heart of the horizontally focused Delaware Basin) and on the right, Midland County (in the more diverse trajectory-wise Midland Basin).

Recommended by Forbes

Image Source: Drillinginfo New Production Capacity County reports The Permian Basin: America's Most ImportantOil And Gas Resource

Opinions expressed by Forbes Contributors are their own.

Continued from page 2

Concho

drilled one well in Reeves, but boy is it positioned to be a boomer! Occidental drilled 7 new wells, and on average their wells are poised to perform quite well. Over in Midland County we see a wider variety in NPC, likely as a result of the heavier vertical/conventional activity in that part of the Permian. ConclusionThe Permian enjoys not only favorable geology but also one of thehighest concentrations of onshore oil & gas professionals and already built infrastructure in the world. Because of its favorable economics and no political risk, the Permian Basin will likely play a dominant role as a global crude oil supply buffer for the foreseeable future. |

|||||||||||||||||||||||||||||||||||||||||||||||||||

(Click to Enlarge)

(Click to Enlarge)