Uranium - Is It A Dead Market?

Uranium - Is It A Dead Market?

About: Energy Fuels Inc (UUUU), Includes: URA

Summary

The price of uranium has been falling for a dozen years.

Kazakhstan is the top producer.

Australia holds the largest stockpile.

Energy Fuels, Inc. produces uranium and vanadium, and the stock has declined dramatically since 2007.

Uranium could make a significant comeback.

Kazakhstan is the top producer.

Australia holds the largest stockpile.

Energy Fuels, Inc. produces uranium and vanadium, and the stock has declined dramatically since 2007.

Uranium could make a significant comeback.

Looking for more? I update all of my investing ideas and strategies to members of Hecht Commodity Report. Get started today »

Uranium

is a chemical element with the symbol U and atomic number 92.

Uranium-238 is the most common isotope which means it has the same

chemical properties and atomic number but differs in mass. Isotopes have

the same number of protons and electrons, but a different number of

neutrons. Uranium-238 has 146 neutrons while Uranium-235 has 143

neutrons.

Uranium-238 can undergo a conversion into

plutonium-239, a fissionable material that is fuel in nuclear reactors.

One kilogram of uranium can produce as much energy as 1500 tons of coal.

It takes as little as 15 pounds of uranium-235 to make an atomic bomb.

Aside from the military use in nuclear weapons and civil applications in

nuclear power plants, uranium, and its various isotopes have a myriad

of industrial and medical applications.

Uranium is a

metal and a commodity. While it does not trade with the same volume and

interest as other metals like gold and copper, the NYMEX division of

the CME offers uranium futures that have limited liquidity. Energy

Fuels, Inc. (UUUU)

is a company that extracts, recovers, explores for and sells uranium in

the United States. The company also produces vanadium, another chemical

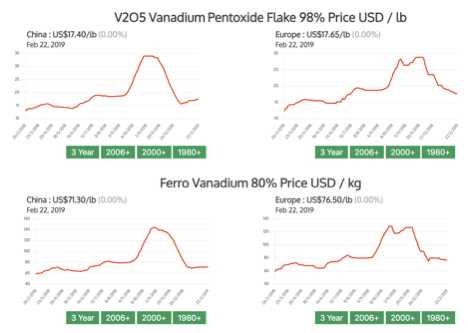

element that is an ingredient in alloy steels. Vanadium prices rose to

record highs in 2018 but have since come back down to earth.

The price of Uranium has been falling for a dozen years

The price path of uranium has been in a bear market since reaching a high at $148 per pound

in May 2007

page 1 / 5

|

Next »

About: Energy Fuels Inc (UUUU), Includes: URA

Source: CQG

As

the chart highlights, the price of uranium futures that trade on the

NYMEX division of the CME moved to a low at only $17.50 per pound in

late 2016. Since then, they recovered to a high at $29.80 last December

and were at the $28.80 level as of Monday, February 25. While uranium

futures are $11.30 or 64.6% above the low, they remain $119.20 or 75.8%

below the 2007 peak. The percentage losses and gains mask the price

destruction in the uranium market over the past dozen years.

Kazakhstan is the top producer

The

world's leading producer of uranium is Kazakhstan which is the home to

12% of all reserves on the earth. The country has 17 uranium mines and

50 deposits across six provinces. Recently, Kazakhstan produced 23,800

tons which is over 39% of the global output of the element.

Canada

is the world's second leading producer with around 13,000 tons of

output, followed by Australia which produces over 5,000 tons each year.

The African nations of Niger and Namibia together with the Russians all

produce between 3,000 and 4,000 tons of uranium each year. Uzbekistan's

output is over 2,000 tons while China, the US, Ukraine, and South Africa

all have production levels that exceed 1,000 tons per annum.

Australia holds the largest stockpile

When

it comes to reserves of uranium, countries like China and Russia view

their strategic stockpiles and reserves as a state secret given the

sensitive nature of the data. According to published statistics,

Australia holds the world's leading uranium stockpiles with over 30% of

the world's recoverable reserves. Kazakhstan is second followed by

Russia, Canada, South Africa, Niger, Namibia, and Canada. While there

are reserves in the US, the country is not in the top ten when it comes

to the amount of uranium in the crust of the earth.

Energy Fuels produces uranium and vanadium, and the stock has declined dramatically since 2007

The corporate profile for Energy Fuels, Inc. states:

Energy Fuels, Inc., together with its subsidiaries, engages in the extraction, recovery, exploration, and sale of uranium in the United States. It operates in two segments, Conventional Uranium and ISR Uranium. The company owns and operates the Nichols Ranch uranium recovery facility located in Wyoming; the Alta Mesa project located in Texas; and the White Mesa Mill located in Utah. It also holds interests in uranium and uranium/vanadium properties and projects in various stages of exploration, permitting, and evaluation located in Utah, Wyoming, Arizona, New Mexico, and Colorado. The company was formerly known as Volcanic Metals Exploration Inc. and changed its name to Energy Fuels Inc. in May 2006. Energy Fuels Inc. was incorporated in 1987 and is headquartered in Lakewood, Colo.

About: Energy Fuels Inc (UUUU), Includes: URA

As a producer of both uranium and vanadium, the stock tanked since the price of uranium fell from its peak in 2007.

Source: Barchart

As

the chart illustrates, UUUU fell from a high at $240.22 per share in

2007 to a low at $1.29 in 2016 and 2017 where there is a double bottom

at over 99.4% below its peak. In December 2018 the stock made a bit of a

comeback, rising to a high at $4.09 per share. While the rally was

impressive given the low, it still only traded to a small fraction of

its price in 2007.

One of the primary factors that

lifted the price of UUUU stock at the end of last year was the price

action in the vanadium market.

Source: Vanadium Price

As

the charts show, the price of vanadium in many forms rose to what was

the highest price in decades in 2018 which likely supported gains in

UUUU shares.

UUUU was trading on February 25 at

$3.05 per share close to the middle of its trading range since 2017. The

company has a market cap of $273.516 million, trades just under 950,000

shares on average each day and pays no dividend. However, the company

is a significant uranium producer in the US and the only company with

vanadium output. Vanadium is used in steel, titanium and other alloys

and has a myriad of defense applications. At $3 per share, UUUU could be

a call option on the uranium and vanadium markets without an expiration

date.

Uranium could make a significant comeback

The

demand for uranium could grow over the coming years as demand for new

nuclear reactors in China, Russia, and India increases. At the last

party conference in Beijing, President Xi pledged policies that would

fight pollution in his nation. Nuclear power plants have a checkered

past after the tragedies in Japan, Chernobyl, and Three-mile Island.

However, the growing demand for clean power from the two most populous

nations in the world, China and India, means that demand for uranium is

likely to rise.

About: Energy Fuels Inc (UUUU), Includes: URA

In the United States, less

dependence on foreign energy supplies could lead to support for an

increase of US domestic production which would favor companies like

UUUU.

The price of uranium may be less than

one-fifth what it was in 2007, but that could be an opportunity given

the growing population in the world and the ever-rising demand for

energy and cleaner fuels. An increase in nuclear energy plants and a

world obsessed with weapons of mass destruction tell us that companies

like UUUU could see an increase in the demand and prices for their

production. The company has also increased its output of vanadium

pentoxide (V205) to 175,000 to 200,000 pound per month and plans to

reach full production of 200,000 to 225,000 pounds by the end of the

first quarter of this year. While UUUU grew their output, the purity

level of V205 has also increased.

The uranium market

is far from dead at the current price level, and vanadium demand is

growing around the globe. UUUU is an inexpensive stock that could have

lots of upside potential if the company continues to carve out its

franchise in US production of both elements over the coming months and

years. At $3.05 per share, UUUU has the potential to double in value

from its current price.

The Hecht Commodity Report

is one of the most comprehensive commodities reports available today

from the #2 ranked author in both commodities and precious metals. My

weekly report covers the market movements of 20 different commodities

and provides bullish, bearish and neutral calls, directional trading

recommendations, and actionable ideas for traders. I just reworked the

report to make it very actionable!

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I

wrote this article myself, and it expresses my own opinions. I am not

receiving compensation for it (other than from Seeking Alpha). I have no

business relationship with any company whose stock is mentioned in this

article.

About: Energy Fuels Inc (UUUU), Includes: URA

Additional disclosure: The

author always has positions in commodities markets in futures, options,

ETF/ETN products, and commodity equities. These long and short

positions tend to change on an intraday basis.

page 5 / 5

The Reason Ammo Prices Are Falling – And What You Should Do

http://www.offthegridnews.com/self-defense/the-reason-ammo-prices-are-falling-and-what-you-should-do/

Old

gun owners and new gun owners alike looked on as ammo and gun prices

increased dramatically in recent years, and millions of Americans

swarmed sporting goods stores to stock up.

Due to the threat of

new gun control measures such as bans on semi-automatic rifles,

high-capacity magazines, and a closing of the background check loophole,

people weren’t just buying guns for themselves. They were buying guns

for their children and grandchildren, too.

Pretty soon, .22 LR

vanquished completely from the shelves, and other ammo, handguns, rifles

and shotguns increased to the point where some people couldn’t afford

them. In some cases, ammunition had tripled in price. AR-15s and AK-47s disappeared from gun racks.

But

in recent months, people have been breathing a sigh of relief as the

price of ammunition has fallen back to its normal levels. ARs and AKs

are now in abundance at Walmarts and sporting goods stores alike. And

.22s are still more expensive than they were, but at least they’re

re-appearing on the shelves.

All

in all, almost all ammunition has decreased in price by about 15

percent, and in some areas, it’s continuing to drop. This is certainly

good news … at least for now.

There are two questions we need to

examine: One, what has caused the price of ammo to rise and fall so

drastically, and two, will the now low price of ammunition remain that

way?

The reason why ammunition prices increased so much is because

of the government’s actions. As we have discussed, people were scared

that some guns would be banned and/or required to be registered and that

other strict gun laws would be put in action. But that’s not all.

Federal

agencies bought ammunition en masse: .22, 9mm, .40, .45 ACP, 5.56x45mm,

and .308 were the primary calibers bought in bulk by the government.

Ammunition manufacturers now had two problems: They had to cope with

increasing demand from both the government and from the people.

Ammunition

companies have never produced as much ammo as we saw during the

ammunition bubble, but despite them turning out more rounds from the

factories, ammo was still expensive and scarce. Previously, American

ammo manufacturers had taken up the biggest market share among gun

buyers, but now foreign manufacturers were pumping off rounds

themselves.

Suddenly, ammo was a rare commodity. A bulk of 500

rounds of .22 LR that would have cost $10 to $15 previously now cost up

to $100 in some states. Even so, more .22 LR was produced from 2012 to

2014 than another time in history.

Fortunately, people are now

rejoicing that ammo prices have fallen back to where they should be.

Will it stay that way? It looks like it will — at least for a while.

But

when all is said and done, it’s likely that we could have yet another

ammunition bubble. All it takes is a government threat of new strict gun

control measures. Another ammunition bubble could be as far away as 50

years or as close as 50 days.

So what should you do? Some may criticize this suggestion, but … STOCK UP NOW.

Ammo

prices have fallen to where they should be, and in the areas where they

haven’t, they will soon. ARs and high-capacity magazines are once again

commonplace. You need to buy your guns and ammo now, while they are

affordable. If you wait too long, another ammo bubble will hit before

you know it.

Do you agree that gunowners should stock up on ammo while it’s affordable? Share your thoughts in the section below:

Get $600 Worth Of Survival Blueprints … Absolutely Free!

to Invest

What Happened to the Stock Market Today?

https://trendshare.org/how-to-invest/what-happened-in-the-stock-market-today

last updated

What happened to the stock market today? Interest rates

rose in 2018 and will rise in 2019. Tariffs and trade wars are here. Why

is the market up or down?

The stock market is a collection of

countless transactions. It doesn't have an opinion; it has millions. It

doesn't have feelings. It's not a single thing and it's not a single stock and

it doesn't speak with one voice. Sometimes stocks go up. Sometimes stocks go

down.

Unless you're an active day trader flipping penny stocks (and if you are, please

understand the risks of penny stock

trading), what happens in the stock market on one day or another probably

isn't as big a deal as the financial news

wants you to believe.

Yet as you can learn from One Up On Wall Street or The Little Book of Common Sense Investing, this doesn't have

to affect your returns in the long term. It can even be a great

opportunity for you to find bargains in the stock market!

Before you panic and sell everything (or rush out and buy everything, hoping

for a bounce), take a minute to catch your breath. Close your eyes. Go make

yourself a smoothie. There's no rush; the market will be there when you get

back. Ready?

Apple Revised Its Financial Outlook

On January 2, 2019 Apple CEO Tim Cook

published a

letter to Apple investors revising revenue estimates for Q1 2019 lower by

$9 billion dollars. Apple stock dropped around 10% on the news.

Apple joined the Dow Jones Industrial Average in March 2015. Since then,

it's contributed to a lot of the growth in the Dow. As Boeing and Apple have ups and downs in late 2018 and

early 2019, the Dow has reflected that volatility.

By the close of trading on January 3, 2019, the Dow looked to be down about 2.5%.

Apple's revised guidance reflects a couple of important things:

- It's not selling as many iPhones as before

- The US dollar is strong against foreign currencies (meaning that selling in foreign countries is less and less profitable)

- China's economy slowed in 2018, producing fewer iPhone sales

While the first point may be specific to Apple, the latter two may reflect

macroeconomic woes that could affect many other global

businesses—especially those that rely on markets outside the USA for

significant revenue.

Donald Trump's Presidential Administration

On November 8, 2016, Donald Trump was declared to have been elected as the

45th president of the United States. During the evening and night of the 8th

and through the morning of the 9th, global financial markets lost a tremendous

amount of value—at one point, US markets had lost a trillion dollars in

one of the biggest crashes ever. While the overnight US markets showed big

losses, even hitting the circuit breakers, the day of November 9 closed with

the three major stock indexes up over a point each. It's too early to tell what

this means in the long term.

Some of this volatility reflects the uncertainty that switching the White

House between two major parties always provides, but it also demonstrates how

global markets see a Trump administration as unpredictable, unmoored, and even

dangerous. Investors seeking safer investments turned to the stability of

bonds, precious metals, and even cash while they wait to see what will

come.

By the time of Trump's inauguration and into the first months of his

presidency, broad market indexes climbed to new heights. Early conventional

wisdom suggests that all of his signals on reducing regulation and corporate

taxes would improve profits. Financial services, petroleum, private prisons,

and other market sectors saw even larger gains as the administration made

specific gestures to shuffle more money their way.

Throughout his presidency, questions arose from his handling of various

events, including one self-inflicted crisis after another. Tensions rose as he

fired Michael Flynn and then FBI director James Comey. The selloff on the

morning of May 17, 2017 occurred after reports that Comey was asked to drop the

formal investigation into Flynn. If these allegations are true, this could

represent the same sort of obstruction of justice which lead to the impeachment

calls and, ultimately, resignation of President Richard Nixon.

On 1 March 2018, the president seemingly spontaneously announced tariffs

on steel and aluminum imports. This has at least two implications.

First, the cost of materials for large companies such as Boeing and Ford are

likely to rise. This will increase their costs overall and could reduce their

profits. With that said, companies such as US

Steel rose on the news, as their products could become cheaper in

comparison. (It's important to note that Boeing has buoyed the Dow Jones

throughout 2018, so any fluctuations in its price affect that market index more

than any other company.)

Second, given that the effect of tariffs is to make imported goods more

expensive so as to reduce the amount of goods imported, China may retaliate by

imposing its own tariffs. Who knows what those will be? Whatever the case, this

will make US goods less attractive in Chinese markets, and US companies relying

on sales in China will end up making less money.

By the 25th of June, 2018 the Dow Jones Industrial Average had posted losses

in 9 of the previous 10 days. With companies such as Boeing and Harley-Davidson expecting fewer orders or even

moving more operations out of the United States, the fears of a trade war

dragged the market down.

In short, the possibility of making less money (whether by selling fewer

things or paying more for materials) makes stocks less attractive, so their

prices tend to go down.

Political turmoil of this sort makes markets nervous. On 4 December,

President Trump tweeted about being "A Tariff Man". Unfortunately, this was

during a trade negotiation with China about removing tariffs. The

market sank because of the uncertainty about whether tariffs would go away or

increase. Given the vigor of his rhetoric, markets question whether his

administration can negotiate successfully with China.

For more details, see What Does a

Trump Administration Mean for the Stock Market?.

Interest Rates Returning to Normal

The last week of January 2018 and the first week of February 2018, the Dow

Jones dropped several hundred points. It looks to close out February 2 down

hundreds of points, with other indexes (S&P 500, NASDAQ) to follow. While

this may seem like a crisis, it is more than likely to reflect

short-term investors taking their profits (in the long run up to this point)

and shuffling them to other types of investments to prepare for improved bond

yields.

One of the big drivers of the stock market since 2008 has been monetary

policy: in specific, the Quantitative

Easing program of the Federal Reserve and the low interest rates. While the

former put a lot of new money into bonds (keeping those interest rates low),

the latter kept the world's least risky investment paying out very little. As a

result, a lot of money chased better returns in the stock market.

With every indication that the Federal Reserve may raise interest rates,

savvy investors believe that stocks are a little less attractive. Why? Because

other, less risky investments, will start returning a little more.

This is a tricky and unpredictable line of thinking; you can easily get

yourself tied up in knots trying to predict what other investors will think

about the vague policy pronouncements some member of the Fed has made in a

speech here or there. The important takeaway is simple, though: money will flow

quickly to where people think they can get the biggest, least risky return. If

that's not Treasury bills (and it hasn't been for a long time), it'll go

somewhere else. As happened in early September 2016, the suggestion of an

interest rate hike by December 2016 led to a selloff on Wall Street.

Throughout 2017 and 2018, the Federal Reserve discussed a policy of raising

interest rates, as they'd been at historically low levels for a historically

unprecedented amount of time. Remember the correlation between interest rates

for US Treasury securities and stock prices—the more you can make with

safer investments (T-bills, bonds), the less attractive the risks of stocks

are.

In the long term, this may reflect that the Great Recession of 2008 is

finally over—especially given that the US economy has been at full

employment for a while. Time will tell what a new Federal Reserve chairman will

implement in terms of policy, but giving the Fed options to reduce rates again

as necessary is a positive sign for global economic outlook.

The UK Voted to Leave the European Union (#Brexit)

Of course, sometimes something happens. On June 23, 2016, voters in the United

Kingdom voted for their country to leave the European Union. Membership in

the EU means improved trade policies, less friction around goods and services

and people moving across borders, and (despite the economic kerfuffle around

different economic strengths and weaknesses between member countries) a general

sharing of wealth from multiple countries all working more or less

together.

Despite the UK's one-toe-in-the-water approach to the European Union, as

evidenced by keeping the British Pound instead of the Euro as prime currency,

the current state of the country is still tied to its membership. Trade deals

will have to be renegotiated. Tarrifs may be in play. The two year

process of political and economic disentangling is unprecedented, and that

creates uncertainty.

Whereas London was once the financial capital of western Europe, it remains

to be seen if it will continue to be the financial capital of the European

Union. Hence the drop in the value of the pound. Hence economic uncertainty for

all companies which do business in the UK or the rest of the Continent. Will

the UK fall into a recession? How will that affect global demand?

Even a good US stock with solely US customers may feel the ripple effects of

this uncertainty; our global economy means we're all connected.

Of course, stocks going on sale can be a

good thing, if you're ready for it.

China's 2016 Stock Market Crash

As another example, China's

currency devaluation in January 2016 made the renminbi less valuable

compared to the US dollar—and made Chinese stocks look less worth owning.

This triggered a selloff in Chinese markets, and the volume of sales triggered

a circuit breaker which suspended trading.

That's a short term shock which makes a lot of people catch their breath.

When a country as big as China has a short term shock (even in stocks), a lot

of people in other countries get nervous. It's not just stocks, either; the

price of oil has dropped dramatically in recent months—good for a lot of

people who consume oil (airlines, transportation, individuals), but

bad for people who produce oil (oil-rich countries, petrochemical

refineries).

China's a particularly pernicious example, as it's still destroying

its stock market in order to save it. If the economic powerhouse that is

China suffers from economic turmoil, that'll affect global demand. The world's

just digging itself out of an economic crisis from 2007, so investors are

rightly concerned about global stagnation.

What Happened to the Stock Market Today

What the market did today is a combination of the decisions of hundreds of

thousands of people.

Everyone seems to have an explanation for why stock prices rise and fall.

People are happy about the economy. People are worried about the economy.

People want interest rates to rise. People want interest rates to fall. Europe

looks good. Europe looks bad. Canada's raising tariffs. Canada reported

extraordinary growth. Company A met its earnings goals. Company B didn't.

Inflation numbers looked bad. Inflation numbers looked good. Gold is hot.

Silver prices fell. Oil supplies are running low—or high. Unemployment

numbers changed too much or too little. Euros went up against the dollar. Who

knows?

These contradictions suggest that post-hoc explanations are

guesses.

Any of the measurements people quote—any of the stock market indexes which go up and down—are

just measurements. They're averages. They're big bundles of numbers all mixed

together. In all truth, they only reflect a snapshot of a point in time.

They're numbers that stocks happened to end on when trading stopped for the day

(or, at least, paused until after hours

trading took over).

Maybe Coca-Cola announced record earnings.

Maybe it's the middle of the month, and your 401(k) contribution has just come

out of your paycheck, so you

automatically bought a fund or individual stocks. Maybe you've just

retired, and you'd like to take 40 years of profits to pay off your mortgage,

so you're selling some stocks. Maybe a stock hasn't gone anywhere for you, and

you don't mind taking a little loss for the tax break. Maybe you found a

bargain and you just can't wait to snap up a few shares. Maybe it's a stock

bubble or stock valuations are running high.

Some of these motivations come from people all following each other, trying

to predict the exact economic actions of other people all engaged in the same

activity. (People who bought a stock at too high a price are looking for

greater fools to unload it on.) While the market's open, everyone's trying to

figure out the optimal value for the price of every stock everywhere. It's

exhausting to think about the trillion or so variables that go into that

immense labor of capitalism. It's crazy to consider how complicated the chains

of cause and effect and overthinking are.

Why Does the Market Go Down?

Remember that the market as a whole is a complicated system; a huge

collection of thousands of stocks and funds and futures and derivatives. You

might look at an index like the Dow Jones, S&P

500, or the NASDAQ and it will move in a direction opposite of another

index.

If the market went down, is it because one company changed its business

model or its forecasts? Because a mutual fund changed its strategy? Because a

glitch triggered a wave of selling? Because yesterday it went up a lot and

people decided to take their profits and invest elsewhere? Because one large

investor decided to cash out on high valuations? Because another round of stock

options for Facebook employees matured, and they

sold? On the whole, we can't say why the market went down today is due to a

single reason.

Why Does the Stock Market Crash?

This guideline has one exception: a stock market crash. If the market as a

whole, measured by all three major indexes, loses hundreds of points (multiple

percentage points), there's generally been a shock to the system, such as 9/11

or an unexpected political development or absolutely terrible economic news,

such as the collapse of a major currency. In recent memory, bugs in automated,

algorithmic trading have caused smaller crashes.

These events happen, but they're inherently unpredictable. That's

why they happen. Recovery happens too.

In recent years, the SEC has approved automated mechanisms to halt trading

in event of wild swings in stock prices. These mechanisms are known as circuit

breakers, curbs, or collars.

Since February 2013, the broad market has three circuit breakers tied to the

performance of the S&P 500 index. If it loses 7%, 13%, or 20% of its value

compared to the previous days close, trading halts for a period of time. If

anything can be considered a stock market crash, it's hitting these circuit

breakers.Remember, Black Monday (October 19, 1987) saw the DJIA lose 22.6% in a

single day.

Why Does the Market Go Up?

It's impossible to point to a single reason why any of myriad measurements

of the stock market increase or decrease in a day. A company releasing great

news about its business might draw more investors to buy its stock and push up

the price, but you can't tell if they're speculating or if they've analyzed the

stock and its financial basics and really believe it's a good price now.

If you have to ask "What do other people see in this stock?", they're

probably hoping they can sell it to you later by making it look more attractive

than it is. Tread carefully.

Stock Prices are Irrational and Unpredictable in the Short Term

Over time, we can correlate historical trends in the stock market

to the global business cycle. When times are good, stocks as a whole tend to go

up—bull

markets. When times are bad, stocks as a whole tend to go down—bear

markets. This doesn't predict the behavior of any individual company's stock

over time, however, nor does it suggest what any stock will do on any given

day.

Predicting a stock's daily changes is a guess. Some people will justify it

with formulas and predictions and complicated examples, but they're looking for

patterns in random fluctuations. Yes, if good news comes out, a stock price

might rise the same way that if bad news comes out, the stock price might

fall.

This can be tough to watch. You hate to see a

stock you spent time choosing and researching lose value, but keep the end

goal in mind. Buy great companies. Stick by the simple rule that, in the long

run, great companies thrive.

A Single Day in the Market Doesn't Matter

Does it matter what the market did today? Not really—not compared to

what the companies we own will do in the coming years. Why did the

stock market go up today? Who knows. Why did the stock market go down today?

Who can say?

Leave questions about

money supply and the Federal Reserve and unemployment rate and all of those

airy factors to economists. Let other people second guess everyone else. We

prefer a measured approach, one which gives our portfolios more stability

against the daily (hourly) rise and fall of trader sentiment.

Benjamin Graham once observed

that in the short term, the stock market is a voting machine. That's what it

did today. It went up or went down based mostly on popular opinion, blown by

the wind. In the long term, it's a weighing machine, which reflects the true

value of businesses in their stock prices. That's why it's so important to

think like an owner, and not just a trader.

To become a good investor, you must look beyond the irrationalities of the

stock market day by day. Instead you seek to understand the real value a stock

represents: ownership of a company with a solid plan to build lasting

wealth.

Don't try to predict the market's gyrations from day to day. Invest for the long term. Pick good stocks by looking for good companies with plenty of room

to grow. When stocks go up, celebrate. When stocks go down, watch and

wait.

Remember: the so-called stock market is one of many, many measurements of

dozens or hundreds or thousands of companies in countless industries. Some

businesses are great. Some businesses are poor. Some are growing. Some are

shrinking. Some of their markets are disappearing. Others are expanding. We can

examine history to explain what the market does over time, but we cannot

predict a single day.

With a little bit of discipline and hard work and knowledge, you found a

great company at a good bargain worth your time investing in. It's a boring

strategy, but it's a great way to find a good yield while keeping your money

safe.