“New World Dollar” Coming Oct. 20, 2015?

Monday, April 27, 2015 11:34

http://beforeitsnews.com/self-sufficiency/2015/04/new-world-dollar-coming-oct-20-2015-2489412.html

<a

href="http://ox-d.beforeitsnews.com/w/1.0/rc?cs=5125e7a33c8bf&cb=INSERT_RANDOM_NUMBER_HERE"

><img

src="http://ox-d.beforeitsnews.com/w/1.0/ai?auid=326914&cs=5125e7a33c8bf&cb=INSERT_RANDOM_NUMBER_HERE"

border="0" alt=""></a>

“New World Dollar” On October 20th , 2015

The International Monetary Fund is expected to a new reserve currency alternative to the US Dollar.

The dollar’s role as the world’s primary reserve currency helps all of us Americans by keeping interest rates low. Foreign countries buy United States Treasury debt not just as an investment, but because dollar-denominated assets are the best way to hold foreign exchange reserves.

The dollar’s role as the world’s primary reserve currency helps all of us Americans by keeping interest rates low. Foreign countries buy United States Treasury debt not just as an investment, but because dollar-denominated assets are the best way to hold foreign exchange reserves.

And on Oct 20th of this year, the IMF is

expected to announce a reserve currency alternative to the U.S. dollar,

which will send hundreds of billions of dollars moving around the

world, literally overnight.

As China moves up the economic pecking

order, it has been trying to promote the yuan as an alternative to the

U.S. dollar, which has been the dominant global reserve currency since

the 1944 Bretton Woods conference.

Currently, China represents around 11

percent of global gross domestic product, more than 10 percent of world

trade and nearly 9 percent of total foreign direct investment.

China may have prompted some interest in

the subject: “. . . it is perhaps a good time for the befuddled world

to start considering building a de-Americanized world,” wrote Liu Chang

for China’s official news agency Xinhua.

Robert Kiyosaki: Why An Economic Crash Is Coming

https://youtu.be/ASOfrk2df4g

https://youtu.be/ASOfrk2df4g

Look What Will Happen After The Dollar Collapse

Look What Will Happen After The Dollar Collapse

Monday, May 4, 2015 7:57

<a

href="http://ox-d.beforeitsnews.com/w/1.0/rc?cs=5125e7a33c8bf&cb=INSERT_RANDOM_NUMBER_HERE"

><img

src="http://ox-d.beforeitsnews.com/w/1.0/ai?auid=326914&cs=5125e7a33c8bf&cb=INSERT_RANDOM_NUMBER_HERE"

border="0" alt=""></a>

Look What Will Happen After The Dollar Collapse

What is dollar collapse?

The dollar collapse is no longer a

secret. Almost everyone seems to know of this. The collapse of any given

currency generally implies the absolute devaluation of a given currency

in relation to others in the world. The collapse of the

dollar, however, means this and much, much more. This is owed to the

fact of the US Dollar’s unofficial status as world currency, alongside

the Euro since the Bretton Woods agreement.

Numerous nations around the world have since pegged their currencies to the dollar as it has provided them with a hard currency they could base their reserves on. Most even use it to settle trade transactions internationally. This means that a greater percentage of the world’s commodities are priced and traded in US dollars, and thus, dollars must come in play at some point.

Numerous nations around the world have since pegged their currencies to the dollar as it has provided them with a hard currency they could base their reserves on. Most even use it to settle trade transactions internationally. This means that a greater percentage of the world’s commodities are priced and traded in US dollars, and thus, dollars must come in play at some point.

What The Dollar’s Collapse. Will Mean To The World

Over the last few days, there has been a

number of articles in the media about the steady decline of the $US

against the Euro. While many economists have forecasted the possiblity

of the dollar declining against the Euro for sometime, most do not

comprehend the significance of this. Some believe that the decline of

the dollar against the currencies of American’s trading partners will

help correct the USA’s trade deficit, and the dollar will stop falling

when the trade imbalance is corrected. However, the evidence is that the

opposite is happening – the $US has declined 40% against the Euro over

the last 2 years, and during this time America’s trade deficit has

continues to deteriorate.

There is now nothing the USA can do to

prevent the collapse of its currency, and its economy. It has no

reserves to support its value, and has the most indebted country in the

world, is dependant of the credit from America’s former enemies. Over

the last couple of days, both Russia and China have said they will be

switching their considerable dollar reserves into Euro. This will only

hasten the lack of confidence in the dollar, creating a global lack of

confidence in the currency, and setting into free-fall. It will soon

bring about the total collapse of the dollar, and the American economy.

The collapse of the dollar will throw

the world into a global depression. Those nations with large external

debts will not be able to trade sufficiently to earn the income to

service their debts, and will slide into bankruptcy. The economies of

New Zealand, Australia, Canada and the UK will also totally collapse, as

a result of their indebtedness and not being able to service their

borrowings. It will result in the Anglo-Saxon nations facing abject

poverty, our people facing starvation, and a total break-down in

society. Crime will become rampant. Law and order will cease to exist. Disease will become widespread.(rense)

We know a collapse is coming… If you’re

paying attention you probably have the distinct feeling that we are in

the middle of it right now. And guess what? The government and military

know it’s coming too, as evidenced by large-scale simulations of exactly

such an event and its fallout.

But the collapse of our financial

system, or hyperinflation of our currency, or a meltdown in US

Treasuries is only the beginning. We know some or all of these events

are all but a foregone conclusion.

What we don’t know is the timing of the

trigger event that causes the global panic to ensue and what will happen

after these primary events take hold.

According to Jeff Thomas, while we can’t

know for sure, the following “secondary events” are the most likely

outcomes when the system as we have come to know it destabilizes.(Mac Slavo SHTFplan.com)

An imminent $100 Trillion dollar collapse

What could happen after the dollar collapse. Look What Will Happen After The Dollar Collapse

Hope for the best, but prepare for the worst.

This is a good motto to live by, despite how you think about things.

Individuals can still hope for the best (that things can and will eventually work out), but what good is your prosperity going to do if you don’t have anything to eat or a safe place to hang out for an extended period of time?

Why not prepare while you still can — when things are readily available and can still be purchased at cheap prices? The coming hyper-inflation will make any such purchases beforehand look very intelligent…

intelligent…

To prepare for the worst, you need a plan. Why are most people so against doing basic preparations that could be the difference on how they survive — or whether they survive?

History shows time and again that those who prepare always fare better than those who did not.

Having a plan and being determined to act on that plan will always be the best way to handle any contingencies, should they occur.

After disaster strikes, your mind is going to be racing around like a car on a race track. Preplanning and having a written set of measures to take will make someone’s life go much smoother when the SHTF.

Your own personal plan is ONLY what best fits what you are going to do during and after a disaster.

Hope for the best, but prepare for the worst.

This is a good motto to live by, despite how you think about things.

Individuals can still hope for the best (that things can and will eventually work out), but what good is your prosperity going to do if you don’t have anything to eat or a safe place to hang out for an extended period of time?

Why not prepare while you still can — when things are readily available and can still be purchased at cheap prices? The coming hyper-inflation will make any such purchases beforehand look very

To prepare for the worst, you need a plan. Why are most people so against doing basic preparations that could be the difference on how they survive — or whether they survive?

History shows time and again that those who prepare always fare better than those who did not.

Having a plan and being determined to act on that plan will always be the best way to handle any contingencies, should they occur.

After disaster strikes, your mind is going to be racing around like a car on a race track. Preplanning and having a written set of measures to take will make someone’s life go much smoother when the SHTF.

Your own personal plan is ONLY what best fits what you are going to do during and after a disaster.

That You Should Do To Get Prepared For The Coming Economic Collapse

EVERYONE NEEDS FOOD STORAGE FOR THE TIMES AHEADSOURCE

http://www.prepperfortress.com/look-what-will-happen-after-the-dollar-collapse/

SOURCE

http://www.prepperfortress.com/?p=5939&preview=true

FORGET IRAN, IRAQ, UKRAINE

This is where WWIII starts...

http://pro.moneymappress.com/MMRBSSH39PPM3/LMMRRA62/?h=true

STEVE MEYERS:

My name is Steve Meyers.

And I want to thank you for taking part in this exclusive Money Morning interview with Jim Rickards, the Financial Threat and Asymmetric Warfare Advisor for both the Pentagon and CIA.

Recently, all 16 branches of our Intelligence Community have come together to release a shocking report.

These agencies, that include the CIA, FBI, Army, and Navy, they've

already begun to estimate the impact of the fall of the dollar as the

global reserve currency.

And our reign as the world's leading super power being annihilated in

a way equivalent to the end of the British Empire, post-World War II.

And the end game could be a nightmarish scenario, where the world falls into an extended period of global anarchy.

Jim Rickards fears he and his colleagues' warnings are being ignored by our political leaders and the Federal Reserve, and we're on the verge of entering the darkest economic period in our nation's history.

One that will ignite a 25-year Great Depression.

Today, we're going to examine everything he's uncovered because the bedlam could begin within the next six months.

Which is why every American should hear his warnings before it's too late.

Jim Rickards, thank you for joining us.

JIM RICKARDS:

It's my pleasure, Steve. Glad to be with you.

STEVE MEYERS:

In the early '80s, you were a member of the team that helped negotiate an end to the Iran hostage crisis.

In the late '90s, when it was discovered that the Wall Street firm

Long-Term Capital Management was about to cause a total collapse of the

financial markets, the Federal Reserve had to turn to you in order to

stop this catastrophe from plunging America into a recession.

And then, after 9/11, you were tasked by the CIA with investigating

potential insider trading that took place prior to the terrorist

attacks.

JIM RICKARDS:

That's exactly right.

The problem was the CIA didn't have any capital markets expertise.

And why should they?

Prior to the beginning of globalization, capital markets weren't really part of the battle space.

So the CIA engaged in some outreach, they recruited certain people,

myself included, to bring the Wall Street expertise to the agency.

This Led to Project Prophecy

So, what the CIA said was, well, if there's going to be another spectacular attack…

Using price signals to determine the actions of participants in the

market, whether it be terrorists, or strategic rivals of the United

States…

Could you spot it?

Could you get the information, and actually break up the plot, and save American lives?

STEVE MEYERS:

This system you built with Project Prophecy actually predicted a terrorist attack that was thwarted in 2006.

JIM RICKARDS:

On August 7, 2006, I got an email from my partner.

She said, "Jim, we've got a bright signal on American Airlines.

It looks like a possible terrorist attack."

We documented that.

I was up at 2:00 in the morning in my study, watching CNN, and all of

a sudden MI-5 and New Scotland Yard emerged to break up this terrorist

attack.

They were arresting suspects and removing files.

So this showed that the system worked.

However, it's not just good for predicting terrorist attacks, but

also strategic attacks by rivals and enemies of the United States.

STEVE MEYERS:

For years now, you've been helping the Pentagon and CIA prepare for a

rise in asymmetric warfare and financial threats, because today there

are immense fears we'll be struck by – as you've described it before – a

financial Pearl Harbor.

JIM RICKARDS:

There's now concern in different branches of the U.S. government…

Historically in Washington, the Treasury and the Fed take care of the dollar.

The Pentagon and the Intelligence Community take care of other threats, but what happens when the dollar IS the threat?

Americans generally know that:

- The Fed has increased the money supply by $3.1 trillion.

- We have $17.5 trillion of debt.

- We have $127 trillion of unfunded liabilities.

Medicare, Medicaid, Social Security, student loans, Fannie Mae, Freddie Mac, FHA.

You go through the whole list and it goes on and on and on.

There's no way to pay it.

Debt can no longer be used to artificially grow our economy.

During the boom years of the 1950s and 1960s, every dollar of debt that was created, we got $2.41 worth of economic growth.

So that was pretty good bang for the buck.

But by the "stagflation" of the late 1970s that relationship had actually collapsed.

So now for a dollar of debt in the late 1970s, we were only getting $.41 in growth, so, obviously, that's a huge drop-off.

You know what that number is today? Today, we only get $.03 in growth for every $1 of debt.

So we're piling on the debt, but we're getting less and less growth.

As the trend goes from $2.41 to $.41 to $.03…

It's soon going to go negative.

This is a signal of a complex system about to collapse.

STEVE MEYERS:

This really speaks to what you wrote about in your new book, The Death of Money, the title strongly alludes to this, the hourglass is now empty.

You warn we're about to fall into a 25-year Great Depression…

That the stock market could plunge overnight 70%.

JIM RICKARDS:

(Interrupts)

You know, when I use the phrase 25-year depression, it sounds a little extreme, but historically it's not.

We had a 30-year depression in the United States from about 1870 to 1900. Economists actually call it the Long Depression.

That was before the Great Depression. The Great Depression lasted from 1929 to 1940, so that was quite long.

The U.S. is in a Depression Today

STEVE MEYERS:

A lot of folks might disagree with you that we're currently in a depression.

That word brings to mind images of the 1930s and soup kitchens.

JIM RICKARDS:

Well, we have soup kitchens today…

They're just at Whole Foods and your local supermarket, because 50 million Americans are on food stamps.

It's not that we don't have distress.

We have enormous distress, but it's being hidden in different ways.

The unemployment rate today is actually 23% when you calculate it the right way.

STEVE MEYERS:

And you point the finger right at the Fed, Congress, and the White House.

JIM RICKARDS:

(Interrupts)

I was in a meeting in the Treasury and I said:

"The Fed and the Treasury are the greatest threats to national security, not Al- Qaeda."

"The Fed and the Treasury are the greatest threats to national security, not Al- Qaeda."

Right here in this building with this group…

You people are destroying the dollar and it's just a matter of time before it collapses.

And I testified before the United States Senate about this.

I warned the Senate, maybe we can't stop earthquakes on the San Andreas Fault…

But nobody thinks it's a good idea to send the Army Corps of Engineers out there to make the San Andreas Fault bigger.

But by money printing, credit creation, and reckless monetary policy

by the Fed, we're making the San Andreas Fault bigger every day.

And when you make a complex system bigger - the risk doesn't go up a

little bit - it goes up exponentially. So the risk is unimaginable at

this time.

The collapse hasn't happened yet, but the forces are building up and it's just about to snap.

Editor's Note: Because the revelations in Jim Rickard's book are so important to the everyday lives of Americans, Money Morning is sending free copies of The Death of Money to people who want to get this intelligence in their hands.

Click here to have The Death of Money rushed to you.

Click here to have The Death of Money rushed to you.

STEVE MEYERS:

Jim, your take, and that of many in the Intelligence Community…

Is much different than what we're hearing out of Capitol Hill.

Which is why the allegations you make in this book are causing quite a controversy in Washington.

JIM RICKARDS:

I was at a recent conclave in the Rocky Mountains with a couple

central bankers, one from the Federal Reserve and one from the Bank of

England.

They'll say things privately that they won't say publicly.

And I was handed a copy of Janet Yellen's playbook.

They'll say things privately that they won't say publicly.

And I was handed a copy of Janet Yellen's playbook.

The Fed is trying to kind of use propaganda…

Lie to us about economic prospects, talk about green shoots, use happy talk to try to get us to spend our money.

The Fed doesn't know what they're doing.

Don't ever think that they know what they're doing.

You can print all the money you want, but if people are not borrowing

it, if they're not spending it, then your economy is collapsing, even

with money printing.

So you can understand it this way…

Let's say I go out to dinner and I tip the waiter.

And the waiter takes my tip and he takes a taxicab home.

And the taxi driver takes the fare and puts some gas in her taxicab.

Well, in that example, my dollar had the velocity of three.

$1 supported $3 of goods and services: the tip, the taxi ride, and the gasoline.

But, what if I don't feel great? I stay home, and watch television.

I don't spend any money.

Well, that money now has a velocity of zero.

I leave my money in the bank, but I don't spend it.

Let's look at what's actually happening with the velocity of money.

It's plunging… It's going down very rapidly.

But compare this decline of velocity today to what we saw leading up the Great Depression.

Now, in the depths of the Great Depression velocity was even lower…

But…

If you compare what's going on today to what happened in the late 1920s just prior to the Great Depression, there's a very striking resemblance.

So, it doesn't matter how much money the Fed prints.

Think of it as an airplane that's coming in for a nosedive.

It's crashing… crashing… getting closer to the ground.

The Fed is trying to grab the joystick and pull the plane up out of the nosedive and get it back in the air...

But, unfortunately, it's not working, we're heading for a crash.

It's crashing… crashing… getting closer to the ground.

The Fed is trying to grab the joystick and pull the plane up out of the nosedive and get it back in the air...

But, unfortunately, it's not working, we're heading for a crash.

STEVE MEYERS:

We've just covered a lot of these startling numbers, these signals of this coming Great Depression.

Let me see if I can quickly put it all together.

Nobody denies that we have a debt crisis in this country, but you're

saying we can no longer grow our debt without causing our economy to

aggressively slow down.

We're barely above water now.

So that's signal number one.

Signal number two is this dangerous slowdown in our velocity of money.

It's already plummeting to levels not witnessed since the Great Depression in the 1930s.

Are there any other signals the Intelligence Community is monitoring that suggest this collapse is right around the corner?

Editor's Note:

Jim Rickards reveals the early warning signs the U.S. Intelligence

Community is tracking in advance of this coming 25-year Great Depression

in his book, The Death of Money.

Money Morning believes this is a must-read for every American. So you can have a copy rushed to you for free.

Click here to claim your free copy of The Death of Money.

Money Morning believes this is a must-read for every American. So you can have a copy rushed to you for free.

Click here to claim your free copy of The Death of Money.

JIM RICKARDS:

There are, Steve.

There are a lot of signals out there and they're very, very troubling.

One of the ones I'm watching closely, and I know people in the

Intelligence Community focus on also, because it covers so much ground,

is called the Misery Index.

The Misery Index = Real Inflation Rate + Real Unemployment Rate

If you look at the Misery Index today compared to the period of

stagflation in the late 1970s and early '80s that Americans remember so

well…

It's actually worse.

This can lead to social instability…

Take this back to the Great Depression... The Misery Index in the Great Depression was 27.

Today it's 32.89.

Believe it or not, it's worse today than it was during the Great Depression.

What happens as a depression worsens?

Businesses can't pay their debts. The bad losses fall on the banks. The banks ultimately fail.

That's happened before.

The Fed has had to bail out the banks.

But what happens when the Fed, itself, is in jeopardy?

STEVE MEYERS:

Based on these signals you've been tracking, the Federal Reserve is going to fail?

JIM RICKARDS:

The Federal Reserve actually, in some ways, already has failed.

I spoke to a member of the Board of Governors of the Federal Reserve and I said, "I think the Fed is insolvent."

This Governor first resisted and said, "No, we're not."

But, I pressed her a little bit harder and she said, "Well, maybe."

And, then, I just looked at her and she said, "Well, we are, but it doesn't matter."

This Governor first resisted and said, "No, we're not."

But, I pressed her a little bit harder and she said, "Well, maybe."

And, then, I just looked at her and she said, "Well, we are, but it doesn't matter."

In other words, here's a Governor of the Federal Reserve admitting to

me, privately, that the Federal Reserve is insolvent, but said, it

doesn't matter, because central banks don't need capital.

Well, I'm going to suggest that central banks do need capital.

Look at this chart.

What it shows you is that the Fed has increased its capital they currently have about $56 billion.

That sounds good.

You say, "gee, $56 billion is a lot of money, that's a pretty good capital base."

But That's Not the Whole Story

You have to compare the capital to the balance sheet.

How much in the way of assets and liabilities is that amount of capital supporting.

When you look at that it's a much scarier picture, because the actual

liabilities, or debt, if you will, on the Fed's books is $4.3 trillion.

So you've got $4.3 trillion sitting on this little skinny capital base of $56 billion…

That's very unstable.

Prior to 2008, the Fed's leverage was about 22 to 1.

Meaning they had $22 in debt on their books for every $1 of capital.

Today, that leverage is 77 to 1.

So, yes, the capital has increased, but the debt and the liability has increased much more.

STEVE MEYERS:

Your warnings haven't gone completely ignored.

In the budget he presented this year, Senator Rand Paul cited your

work and how we've driven our economy to the edge of a Roman Empire-like

collapse.

In fact, we have footage of Senator Paul instructing Americans to listen to your warnings.

SENATOR RAND PAUL:

Jim Rickards notes the Fed is insolvent on a mark-to-market basis.

The Fed has wiped out its capital on a mark-to-market basis.

Of course, the Fed carries these notes on its balance sheet at cost and does not mark them down to market.

But if they did, they would be broke.

JIM RICKARDS:

First of all, I give Senator Rand Paul credit.

He's one of the few people who understand the dangers here.

But, the problem is not limited to the Fed.

It's infecting the private banking system as well.

It's infecting the private banking system as well.

There's about $60 trillion of debt on the balance sheets of our banking system.

For a long time, debt and the banks grew at about two times the rate of growth in the economy.

But lately, this has exploded.

Today it's up to 30 to 1.

In other words, for every dollar of economic growth, there's $30 of credit being created by the banking system.

The Whole Thing is Unstable

I can give you a very good example of this and this actually comes from physics.

If you had, let's say, a 35-pound block of uranium shaped like a cube, it would actually be fairly harmless.

It's what we call sub-critical. It's radioactive, but it's kind of tame.

But now imagine you engineer it.

You take that 35-pound block.

You take one piece and shape it into something about the size of a grapefruit.

Take another piece, shape it into something like a bat.

Put the ball and the bat in a tube and fire them together with high explosives.

That sets off a nuclear detonation.

That destroys a city.

The way it's been shaped and configured is what takes it from what we call sub-critical to super-critical.

STEVE MEYERS:

Jim, are you seeing any signs that our stock market has reached a super-critical state?

JIM RICKARDS:

Well, unfortunately, yes.

We're seeing a lot of signs of this.

One of the signs that's really fundamental, and really important, is the ratio of stock market capitalization to GDP.

Because, remember, the value of all the stocks in the stock market, that's supposed to represent the fundamental economy.

It's not supposed to be off in a world of its own.

But if you look at what's been happening to that ratio recently, it's going sky-high.

It's 203%.

Just prior to the recession…

That number was 183%.

Go back to the famous tech bubble, the dot com implosion of 2000.

At that time, it was 204%.

Just prior to the Great Depression that number was 87%.

The stock market capitalization, as a percentage of GDP, is twice as high as it was just prior to the Great Depression.

So, that's a really good metric for saying, "Hey, is the stock market heading for a crash?"

All the data says, "Yes, we are."

But there's another metric, another warning sign, if you will, that's

even more frightening, which is the Gross Notional Value of

Derivatives.

There are a certain number of shares of IBM that are outstanding, but we know what that number is.

But there's no limit on the derivatives.

I can write options and futures on IBM stock all day long and all the other stocks on the stock market.

And that's what's been going on.

Now, the Gross Notional Value of Derivatives in the world today is over $700 trillion. Not billion.

$700 trillion.

That's ten times the global GDP.

This collapse is unavoidable.

So, we ask ourselves, how bad can this be?

Well, what happened in 2007, 2008 when the markets collapsed…

We all remember the value of stocks going down…

Real estate going down, housing going down…

All that lost wealth was $60 trillion.

The problem is now the system is bigger, so I would expect the lost wealth this time to be $100 Trillion – possibly a lot more.

We're in this critical state, getting close to the super-critical state where the system implodes.

But it takes a catalyst, it takes a flashpoint.

There are a number of potential flashpoints I've investigated.

Editor's Note: Jim Rickards' book, The Death of Money, provides specific guidance that can protect your wealth from this coming collapse.

Click here to claim your free copy of The Death of Money.

STEVE MEYERS:

Jim, in a few moments I want to discuss the steps Americans need to

take with their investments and personal finances to prepare for

everything you and your colleagues are predicting.

But now let's quickly focus on some of these major flashpoints.

JIM RICKARDS:

One of the key flashpoints we're looking at is foreign ownership of U.S. government debt.

Now, this is a very important thing to understand.

We all know that the Treasury has issued over $17 trillion worth of debt, the question is who buys it?

A lot of U.S. debt is owned by foreigners. Who owns it?

China, Russia, other countries…

Countries that are not necessarily our friends.

But they can dump it when they want to.

Well, guess what, that's actually what's been going on.

Recently, foreign holdings of U.S. government debt have been plummeting.

But it gets even more interesting than that.

We talked earlier about the project I did for the CIA…

Project Prophecy.

And we said, you can see not only market action, but rivals, enemies, terrorists and others, operating in financial markets.

So, we all know that Russia invaded Crimea in the spring of 2014.

Let's say you're Putin. You know you're going to invade Crimea. You can expect U.S. financial sanctions.

So what do you do?

Let's say you're Putin. You know you're going to invade Crimea. You can expect U.S. financial sanctions.

So what do you do?

You basically mitigate the impact of the sanctions, start dumping

treasuries in advance so that when you make your move and the Treasury

tries to come against you, you've insulated yourself.

So go back and look at October 2013, here's Russia dumping Treasuries month after month.

That was a clear signal that they were getting ready to do something…

To engage in financial warfare against the United States.

But guess what? It's worse than that.

We know the Russians and Chinese are working together.

So is it any surprise that when the Russians started dumping…

The Chinese started dumping also?

STEVE MEYERS:

Does the Intelligence Community have the ability to defend our country in the event that this escalates even further?

JIM RICKARDS:

Believe it or not, there's an intelligence unit inside the Treasury.

And they actually have a war room.

That tells you that financial warfare is here and it's real.

So if the Russians are dumping…

The Chinese are dumping…

Who is going to buy all this debt?

Well, a mystery buyer has shown up.

Recently, Belgium has bought enormous amounts…

In the hundreds of billions of dollars of U.S. government securities.

STEVE MEYERS:

So Belgium started loading up on treasuries, coincidentally at the exact same time Russia and China began dumping theirs?

JIM RICKARDS:(Interrupts)

It's not the Belgians.

These amounts are bigger than the Belgian current account surplus.

These are not Belgian dentists who are buying these things.

Belgium is a Front

You know, could it be the Fed itself?That's the point.

Maybe the public doesn't know who the mystery buyer is, but the national security community does.

Now, the Treasury, operating through this war room, and the Fed – the mystery buyer in Belgium…

For now, they have managed to prop up the treasury market.

It hasn't collapsed yet.

But they're not going to be able to keep pulling these rabbits out of a hat, there's a limit.

This should be very scary, because if the Fed is tapped out – we talked earlier about how the Fed is leveraged 77 to 1.

So the Fed is at the limit of what they can do.

The foreigners are now dumping treasuries and if no one buys it, guess what, interest rates go up.

That'll sink the stock market, that'll sink the housing market.

Higher interest rates mean the debt gets higher, so interest rates go up some more.

So you start a death spiral and there's no way out of it.

STEVE MEYERS:

An attack on our treasury market is obviously a very serious

flashpoint that could ignite this Great Depression you predict in your

book.

Let's talk about another flashpoint.

JIM RICKARDS:

What I call flashpoint number two has to do with the petrodollar.

STEVE MEYERS:

Can you explain what you mean by the petrodollar?

JIM RICKARDS:

It's basically a system whereby oil exports are priced in dollars.

Oil doesn't have to be priced in dollars.

It could be priced in euros, Japanese yen, Swiss francs, gold.

It could be priced in a lot of things.

But, in fact, the whole global oil market is priced in dollars.

I was actually very close to the birth of the petrodollar system.

My first visit to the White House on official business was in 1974, with a small group, about five of us.

We met with Helmut Sonnenfeldt, who was the Deputy National Security Advisor at the time.

He was the number two to Henry Kissinger.

And, this was at a time you have to remember…

At the beginning of the '70s oil was $2 a barrel.

At the end of the '70s, oil was $12 a barrel.

This Was an Oil Shock

The price of oil was skyrocketing.

Inflation was getting out of control.

There were gas lines.

You know, a certain generation of Americans remembers this very well.

We were in the White House talking about what to do about this.

One of the scenarios we discussed was the U.S. military would invade Saudi Arabia.

We would secure the oil fields and create a military perimeter around them.

One of the scenarios we discussed was the U.S. military would invade Saudi Arabia.

We would secure the oil fields and create a military perimeter around them.

We would pump the oil and set it at a price that was favorable to us.

Now, we would give the money to the Saudis.

We didn't want to steal their money.

We didn't want to steal their oil.

We just wanted to set the price.

Now, fortunately, that plan was not carried out.

But it shows you how desperate things were at the time.

But it shows you how desperate things were at the time.

But what did happen?

Why did we not invade Saudi Arabia?

Well, the answer is Kissinger and the Saudis worked out a deal.

And the Saudis said, "Okay, we'll price oil in dollars, so that secures the role of the dollar as the global reserve currency."

But there was a quid pro quo.

We agreed to guarantee the continuation of the House of Saud, the royal family of Saudi Arabia.

And by extension, the national security of Saudi Arabia.

Because they're a relatively weak military power.

And it's a bad neighborhood - a lot of enemies in the region starting with Iran and others.

So the question would be, obviously, did this petrodollar deal work?

And it ABSOLUTELY did work.

Once it kicked in, the dollar roared.

This was the period – sometimes people call it the king dollar period, the strong dollar period.

This was after Volcker and Reagan in the 1980s.

But this only continued up to a certain period of time…

Up until around 2000.

And since then, the dollar has been in a decline.

STEVE MEYERS:

So what could cause the fall of the petrodollar?

JIM RICKARDS:

Well, we're seeing it in real time.

Think of the petrodollar, or the dollar as the global reserve currency…

Think of it as a three-legged stool.

So, here's the stool and it's got three legs.

As long as the legs are standing, the foundation is firm and the dollar will remain as a global reserve currency.

But, one by one, those legs are being pulled out.

What are the legs?

Well, the first one is Saudi Arabia.

That was where the petrodollar deal began.

Our side of the deal was we would guarantee the national security of Saudi Arabia.

But lately – going back to December of 2013…

President Obama stabbed the Saudis in the back by anointing Iran as the regional-hegemonic power.

You know, the President has been withdrawing American power from

around the world and his view is, well, we'll leave a friendly cop on

the beat.

Every sort of bad neighborhood around the world will have a cop on the beat.

The President has decided that Iran is going to be the cop on the beat in the Middle East.

They're going to be the heavyweight regional power.

Where does that leave Saudi Arabia? Out in the cold.

So now Saudi Arabia is saying…

"Wait a second, you've undermined our national security, you've

reneged on your side of the petrodollar deal, why should we hold up our

end?

Maybe we'll start pricing oil in gold or euros or maybe Chinese yuan."

Because now, increasingly, Saudi Arabia is selling more and more oil to China.

So, the first leg of the stool has been pulled out.

The Saudis are going to back away from the petrodollar, because we

are no longer guaranteeing their security - we're playing footsie with

Iran.

The second leg of the stool is Russia.

Now, Russia is not a member of OPEC, but they are the world's largest

oil exporter, one of the world's largest energy exporters, actually

bigger than Saudi Arabia.

So even though they're not a member of OPEC, they also price oil in dollars.

So, they've signed onto the petrodollar deal in their own way.

But, we're now engaged in financial warfare, Russia is ready to fight back.

And this is not classified information.

This is being said publicly.

Andrei Kostin, President and Chairman of Russia's VTB Bank, it's one of the largest banks in Russia, he recently said…

"It's time to change the entire international financial system that

considers the dollar the key reserve currency. The world has changed."

A member of the Russian Parliament, he said…

"The dollar is evil.

We will sell rubles to consumers that rely on gas and later we'll exchange the rubles for gold.

If they don't like this, let them not do it.

Let them freeze to death."

So, two of the legs of the stool, Saudi Arabia and Russia, have already been pulled out.

The third leg is China.

And that is coming out too.

STEVE MEYERS:

As far as Russia and China's role in taking down the petrodollar…

This recent $400 billion energy alliance they signed, is that the purpose of it?

JIM RICKARDS:

Sure.

Russia is the world's largest energy exporter, China is the fastest growing economy in the world, they need energy.

So this is a natural partnership between the two. But the dollar is out in the cold.

And, China is actually putting these yuan bilateral trade agreements in place all over the world.

They're doing them one-by-one.

But once there's enough trade and enough volume in a certain currency, it can become a reserve currency.

These are all straws in the wind, leading to the collapse of the dollar as the global reserve currency.

STEVE MEYERS:

Jim, in your book, you investigate how nations are now using gold as a financial weapon.

Is this one of the most dangerous flashpoints?

JIM RICKARDS:

It's absolutely one of the most dangerous flashpoints and, here's why…

A lot of people look at the dollar and say, "Look, you may not like

the dollar, you may worry about the dollar, but you've got nowhere else

to go."

But there is another place to go, which is gold.

You don't have to buy treasuries, you can buy gold.

And countries are actually doing that.

So this is basically a global rebalancing of gold reserves.

This is one of the things that the Intelligence Community is watching most closely.

And China is our number one case.

And China is our number one case.

Here's why: China has acquired more than 3,000 tons in the past four years.

Now they lie about this.

They officially say they have 1,054 tons.

The reason is, China is using their own military and their own intelligence assets to acquire some of this gold in stealth.

I recently ran into a senior officer of one of the major secure logistics firms in the world.

Secure logistics that means these are people who operate vaults and armored cars.

So they handle the physical metal.

They're not central banks.

They're not government agencies.

These are Brinks and G4S and ViaMat.

These are the big players in this field.

One of these officials said he recently brought gold into China at

the head of an armored column of the People's Liberation Army.

In other words, he was in an armored car and they had Armored personnel vehicles bringing gold into China.

I guarantee that did not show up in the official Hong Kong import figures.

In other words, he was in an armored car and they had Armored personnel vehicles bringing gold into China.

I guarantee that did not show up in the official Hong Kong import figures.

Now, why is China doing this?

A lot of people speculate that they want to launch their own

gold-backed reserve currency, to take the Chinese yuan, back it with

gold, make it a global reserve currency.

That's extremely unlikely.

That's not what China is doing.

What they are trying to do is hedge against the collapse of the dollar.

China can't prevent that from happening.

What they can do is build up the gold reserves.

This is known to the Intelligence Community.

This is NOT publicly revealed.

What if it were publicly revealed?

This is NOT publicly revealed.

What if it were publicly revealed?

Here's what global gold reserves would look like if the amount that China owns were actually suddenly revealed.

This is a dagger aimed at the heart of the dollar.

Editor's Note:

Jim Rickards' book, The Death of Money, will help you prepare for the

frightening American economic collapse many in the U.S. Intelligence

Community fear is at our doorstep.

Click here to claim your free copy of The Death of Money.

Click here to claim your free copy of The Death of Money.

STEVE MEYERS:

Jim, so far all of these flashpoints have involved China.

Isn't this an economic suicide mission to attack America?

JIM RICKARDS:

There's something else here, another flashpoint that could meltdown the global financial system.

What if the U.S. doesn't bring the entire pyramid crashing down, what if it's China?

Well, it could very well be.

They have a highly leveraged banking system.

But the banking system is just the beginning.

There's also something called a shadow banking system.

This is now a $7.5 trillion industry and it's up 4,067% since 2005.

STEVE MEYERS:

This term shadow banking, it's starting to get play in the press.

How would you explain it?

JIM RICKARDS:

If you put your money in the bank in China, they – it's just like the United States.

They pay you nothing, zero maybe, one quarter of one percent, something pathetically small.

But, they're offering these wealth management products that pay five, six, seven percent.

Well, what are they?

Well, they're actually – they take the money and they buy mortgages

on worthless assets, inflated assets and bubble assets that are going to

crash.

Before the crash in the United States, before 2008, new construction, as a percentage of GDP growth, that was about 16%.

16% is a pretty big slice.

But, look at China.

In each of the last three years, construction has been 50% of GDP growth.

They're building white elephants, they're building trophy projects, they're building ghost cities.

I've been to China - I was with the Communist Party officials and

provincial officials, they were trying to get me to bring some

businesses there.

I went to one place near Nanjing.

They weren't building seven buildings, they were building seven cities.

Every city had a whole cluster of skyscrapers, luxury hotels,

athletic facilities, housing facilities, high-end shopping, metro stops,

highway access…

And an airport to service all seven of these cities.

This construction was going on as far as the eye can see.

It was all empty.

All of it.

Now, here's the point.

In the U.S. before the crash, it took about 4.3 years of income to buy the typical house .

In China, it takes 18 years of income.

If they're building apartments, co-ops and condos, and people can't afford them, you know their prices are going to collapse.

One of the senior banking officials in China said, "This is a Ponzi scheme."

Those are his words, not my words.

I happen to agree.

But, we all know what happens to Ponzi schemes, eventually you run out of suckers and they collapse.

Once you have enough collapses, there's going to be a run on the banks.

The bankers are going to say sorry, we can't pay you, it's not our problem.

Well, that's not going to be good enough.

Riots are going to break out.

What does it mean when the world's second largest economy hits the brakes?

That's going to be disastrous to global growth; it's going to pull

the rug out from under the sky-high valuations we're seeing in the U.S.

stock market.

This is a set-up for an entire collapse of the global economy.

STEVE MEYERS:

Jim, there's one more flashpoint I'd like to talk about.

It has to do with a premeditated plan you believe exists inside the IMF, and it involves high-ranking U.S. officials…

To replace the dollar as the world's reserve currency.

JIM RICKARDS:

It's not just my belief.

This is actually documented.

It's a ten-year plan to replace the dollar as the global reserve currency.

The IMF released a report this year, it was called – and get this title – "The Dollar Reigns Supreme By Default."

And here's a direct quote…

"The aggressive use of unconventional monetary policies by the

Federal Reserve, the U.S. central bank, has increased the supply of

dollars and created rifts in the financial system. The dollar status

should be in peril."

Reserves are nothing more than a savings account for a country.

That's the amount of money they've saved.

But, the problem is, when you have it you have to decide what to do with it.

You can't just stick it under a mattress, so to speak.

A lot of people think that the dollar will prevail because there are no good alternatives.

That's not true.

The dollar is declining sharply, as a percentage of total global currency reserves.

Imagine if that continued.

The euro comes up.

Swiss franc comes up.

Some of the other currencies come up.

That's one outcome.

But, there's another outcome, that's probably coming a lot sooner.

We have a financial panic in the world.

If a central bank has to re-liquefy the world, where is that money going to come from?

It can't come from the Fed, they're leveraged 77-to-1.

It can't come from the Fed, they're leveraged 77-to-1.

There's only one clean balance sheet left in the world… the IMF's.

The IMF, believe it or not, is only leveraged 3-to-1.

When the next crisis comes, it's going to be bigger than the Fed.

The only source of liquidity in the world is going to be the IMF.

Think of it this way.

The Federal Reserve has a printing press, they can print dollars.

The European central bank has a printing press, they can print euros.

The IMF, the International Monetary Fund, has a printing press too.

They can print something called the Special Drawing Right, or the SDR for short.

These SDRs can come along as a new reserve currency.

They can print something called the Special Drawing Right, or the SDR for short.

These SDRs can come along as a new reserve currency.

The reason they came up with the name Special Drawing Right is

because if they called it "world money" that would sound a little spooky

and scary.

But that's exactly what it is.

Here's the point.

This may be a ten-year plan.

We're not going to make it ten years.

This collapse will happen a lot sooner than that.

So they're going to have to dust off this playbook and run out these SDRs and print trillions of them to prop up the system.

Now, if the Fed bailed out private credit in 2008…

And the IMF now bails out the Fed in the next financial panic…

Who runs the IMF? Who's really in charge?

Well, it's a nice crowd.

We've got kings, dictators, communists…

They're unelected, unaccountable.

Well, it's a nice crowd.

We've got kings, dictators, communists…

They're unelected, unaccountable.

And this is the next flashpoint, really, the IMF taking over the

world monetary system and becoming the central bank of the world…

Printing "world money" called the SDR.

STEVE MEYERS:

Jim, these flashpoints…

The attacks on our treasury market and petrodollar…

China's stealth gold run…

China's inevitable collapse…

Even this alarming inside job to take down our dollar that's escalating at the IMF…

You've only scratched the surface of what you reveal in your book.

However, the most important message I took away from The Death Of Money is:

Regardless of which flashpoint unleashes the 25-year Great Depression, folks need to understand it's coming, and coming quick.

JIM RICKARDS:

Steve, that's exactly right.

There is a mission in this book and it's urgent and it's important.

We're talking about:

A prolonged depression…

- Massive deflation

- Massive unemployment

- Rampant bank collapses

- A 70% best case scenario stock market drop

This could all start within the next six months.

Look at it this way.

Americans right now are standing at the very bottom of a tall mountain… Mt. Everest, Mt. Kilimanjaro.

About halfway up the mountain, there's a catastrophic avalanche barreling down towards us.

About halfway up the mountain, there's a catastrophic avalanche barreling down towards us.

Determining the one snowflake…

The one flashpoint that's going to speed this chaos up shouldn't be our focus.

Recognizing the severity of the situation and moving to safety should be.

So, mission one is helping people hold on to what they've got.

That's going to be more than half the battle ahead.

STEVE MEYERS:As well as your mission to warn the public…

That we'd like to send free copies of The Death of Money: The Coming Collapse of the International Monetary System, to everyone who is watching this interview.

Now, it's on bookshelves, it's being sold for about $28.

But, I want to point this out.

The version we're sending folks is different than the one being sold in stores.

JIM RICKARDS:

(Interrupts)

And the reason why is simple.

What we're talking about today is not light reading material.

The book investigates everything thoroughly, except for one part.

It's what our government calls – and to be clear, this is what they call it – "the Day After Plan".

This describes what America and our government will be like when our economy collapses.

It's what our government calls – and to be clear, this is what they call it – "the Day After Plan".

This describes what America and our government will be like when our economy collapses.

Now, I have an unpublished chapter that does outline this situation, it's called The Day After Plan Declassified.

I didn't put it in the book that was originally released, because it is controversial.

The picture I paint is far from pretty.

But I am going to include this chapter here…

Because folks watching this interview are more prepared to see this intelligence and these scenarios.

STEVE MEYERS:

You also took another step with this version of the book…

You created a six-part video series you're calling, The Death of Money Digital Debriefing.

JIM RICKARDS:

Here's why I put that together.

It's impossible for anyone, me or anyone else in my line of work, to give you an exact day and time this collapse will begin.

We just know it's coming and coming soon.

However, there are crystal clear warning signs that will appear in our economy and in our markets.

This is certain.

So, across this video series I walk folks through the seven major signs.

I give you the exact signals to watch for.

I share the charts.

The announcements you'll hear from certain world governments and the Federal Reserve.

I examine, even further, the flashpoints that could ignite this nuclear meltdown in our economy.

I explore the secret bubbles nobody is talking about.

I share more findings from the Intelligence Community about Russian, Chinese, and Iranian activities against America.

This is very important…

Across this video series I help folks analyze their investment portfolios.

I show them how to adjust their allocations accordingly for numerous scenarios that could unfold, because this is a fluid situation – it's volatile.

Across this video series I help folks analyze their investment portfolios.

I show them how to adjust their allocations accordingly for numerous scenarios that could unfold, because this is a fluid situation – it's volatile.

So, I review how much of your portfolio should be in certain sectors of the stock market, precious metals, income opportunities…

Where folks should be looking overseas to invest. It's a point-by-point examination of each of these areas.

STEVE MEYERS:

Jim, we'd like to rush copies of your book, the unpublished chapter,

and this six -art digital debriefing out to everyone watching.

It's part of a bold initiative you're taking on, what you're calling:

You helped lead a CIA mission called "Project Prophecy."

The goal was to identify the signals in the financial markets and economy that threatened our country.

With this re-launch of Project Prophecy here, you're applying this

same methodology to helping everyday folks build this unbreakable wall

around their wealth.

Let's talk about what you've created.

Editor's Note:

Jim Rickards has prepared a comprehensive package that will give you the

real story and real solutions for these troubling times ahead.

Click here to claim your free copy of The Project Prophecy 2.0 Action Plan.

Click here to claim your free copy of The Project Prophecy 2.0 Action Plan.

JIM RICKARDS:

Steve, I realize much of what I've revealed today is a shock to the system.

America is facing one of its darkest periods.

There's no escaping that.

And some of the measures folks are going to need to take to protect themselves may be outside of their comfort zones.

So, I'm going to take a hands-on approach here.

My book, the unpublished chapter, and digital debriefing will give them the big picture.

But, folks also need to know the exact investments to target and the ones to avoid.

They need to rethink how they handle their personal finances.

To help them I've prepared a set of intelligence briefings.

The first is called, The Project Prophecy Wealth Defense Blueprint: The Four Directives.

And, with each directive, I have specific investments targeted.

STEVE MEYERS:

Let's examine each of them.

JIM RICKARDS:

Directive #1:

Seek Shelter From the Dollar's Fall

The next time the dollar falls – it won't be the first time.

The dollar almost collapsed completely in the late 1970s.

Between 1977 and 1981, a five-year period, cumulative inflation was 50%.

If you had insurance, annuities, any kind of fixed income, retirement

income, savings in the bank, you lost half your wealth in a very short

period of time.

What we're talking about now could be a 70 or 80% collapse, maybe even more.

The best way to handle the dollar's fall – and this is what I focus on in the briefing – is to invest in the euro.

What people have to understand is the euro is not an economic project.

It's a political project.

And if the political will is there, directed from Germany, the euro is going to hang together.

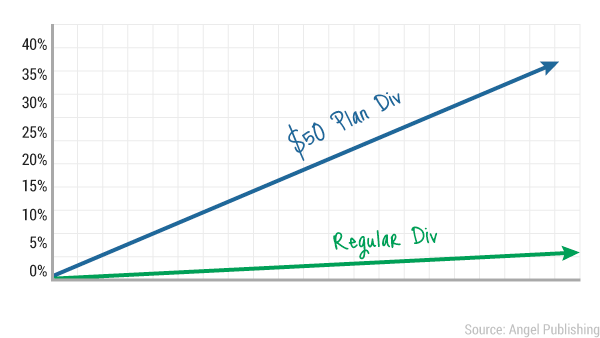

We have a chart actually showing the euro's rise against the dollar.

So just imagine all the talk about the collapse of the euro and yet the euro is actually getting stronger.

And, by the way, everyone knows that the United States has 8,000 tons of gold.

Well, Europe has 10,000 tons of gold.

Europe is the largest gold holder in the world.

So, they actually have the gold to back up the euro.

Now, you don't have to open a foreign bank account to invest in the euro.

In this Project Prophecy Wealth Defense Blueprint, I'm recommending a specific fund that rises twofold as the dollar falls against the euro.

This is a very strong defense play because you are getting twice the return from both the dollar's fall and the euro's rise.

STEVE MEYERS:

So walk us through this second directive in this briefing.

JIM RICKARDS:

Directive #2:

Always Have an Insurance Plan For a Market Collapse

The stock market is going to fall 70%.

Now, does that mean you shouldn't hold stocks?

Folks should make that decision for themselves.

But, there are ways to use the market itself as a safety net.

I'm recommending we target the sector that will experience the most severe consequences of this collapse, the financial sector.

The companies that are holding all these stock derivatives.

These are going to fall harder and faster than anything else.

So, I examine a specific fund in this briefing that is heavily weighted against the financial sector.

It rises 3% for every 1% the financial sector pulls back.

So, a 25% pull back, that's a 75% return from this fund.

If it falls 70%, now you're looking at a 210% return.

What this fund allows you to do is use a small amount of capital to multiply your protection against a market crash.

It's excellent insurance.

STEVE MEYERS:

So, take us through the third directive.

JIM RICKARDS:

Directive #3:

Invest in What People Can't Live Without

Invest in What People Can't Live Without

When America experiences this worst case scenario we are predicting

in the Intelligence Community, people won't stop needing food.

They won't stop using energy.

They won't stop using essential goods and services.

This is where folks should be looking now.

So in the briefing I'm recommending water investments, because you can't live without water.

And we're already seeing water investments begin to take off.

This sector has been surging since 2009. It's up about 200%.

I'm targeting a water processing company that operates 47,000 miles of water pipelines across 16 states and 1500 communities.

Now, this is a sleeping giant income play.

This water processor's dividend has grown every year.

It's up 55% already.

And, income is something we can't live without either.

And, besides water, the briefing also focuses on a company that

provides emergency medical supplies, because that's also a necessity.

STEVE MEYERS:

Jim, you have one more directive in this briefing.

JIM RICKARDS:

Yes, Warren Buffet's secret weapon.

Directive #4:

Target Companies Who Control Hard Assets

You know Warren Buffet has this reputation as the avuncular oracle of Omaha, the stock market investor's best friend.

But, I say when it comes to billionaires, don't listen to what they say, watch what they do.

Warren Buffet's recent acquisitions have been very revealing.

A few years ago he bought the Burlington Northern Santa Fe Railroad.

He bought the whole railroad.

He actually took it private.

But what is a railroad?

A railroad is nothing but hard assets.

They have right-of-ways, mining rights adjacent to the right-of-ways, rail rolling stock, yards, switches, signals; it's all hard assets.

How does a railroad make money?

It moves hard assets in the form of freight, coal, wheat, corn, steel, cattle, etc.

So a railroad is the ultimate hard asset play. It's hard assets making money moving hard assets.

What was Warren Buffet's next big acquisition? He bought oil and natural gas resources, another hard asset.

And by the way, he can move his oil on his own railroad.

He doesn't need the Keystone Pipeline.

When you line up 100 tanker cars on a railroad, that's a pipeline on wheels.

So Warren Buffet is a guy who's dumping paper money, getting hard assets in the form of railroads, oil, natural gas.

If it's good enough for Warren Buffet, it's good enough for everyday Americans.

This is the most important of the directives, so I have the top six companies who have built these hard asset escape plans into their business models.

STEVE MEYERS:

The second intelligence briefing you've created is called: The Project Prophecy Watch List: 30 Stocks That Will Soon Collapse.

Take us through this.

JIM RICKARDS:

Steve, during the original Project Prophecy for the CIA we built a

tracking system, a watch list of the 400 stocks most likely to signal a

coming attack on America.

But, in the years that followed, we kept modifying its capabilities

so it could identify the companies that were in danger of collapsing.

This intelligence briefing reveals the 30 stocks that are now at the top of that list.

Now, when folks see these stocks, it may shock them.

These aren't micro caps or small caps, because they don't have the capability to do widespread damage.

These are 30 of the most widely held stocks in the retirement accounts and 401ks of everyday Americans.

Most are large blue chip.

That means everybody watching today is probably holding one, two, or more of them.

And they are vulnerable to complete annihilation.

Now, inside this list of 30 I've singled out the 10 that are currently at a red alert status.

This means if you were holding them today you need to not be holding them tomorrow, because the clock is running out on them.

They're already at risk of failure before the worst of what's coming appears.

STEVE MEYERS:

Now, let's talk about the final intelligence you've created: The Project Prophecy Hard Assets and Personal Finance Playbook.

JIM RICKARDS:

I'm advocating people – if they aren't already and they have the

means to do so – to start exploring adding hard assets to their overall

portfolio.

This intelligence briefing covers them all, from land, including

farmland, to certain antiquities and art that holds value, as well as

physical currencies and precious metals.

STEVE MEYERS:

I'd like to focus on one precious metal in particular, gold.

Now, in the book, you reveal how China has successfully manipulated

gold's price to keep it low, while they stockpile it in their reserves.

But you're bullish on it moving forward.

However, you do write that people may be taking a dangerous approach to gold investing.

JIM RICKARDS:

It has become fashionable in recent years to invest in gold ETFs.

The GLD ticker is the headliner.

The logic on the surface makes sense, you can secure gold without having to acquire it physically and store it.

You can even, theoretically – at least, they tell you – you can cash

in your ETF shares for physical gold if you so choose in the future.

This is the problem – that's not true.

The everyday American does not have that ability.

Here's how to think about the gold market.

Imagine it's a pyramid, but it's inverted.

Imagine it's a pyramid, but it's inverted.

The point is down at the bottom and wide base is at the top.

There's a little tiny bit of physical gold at the bottom.

On top you have all these forms of paper gold.

What are they?

- Gold leasing

- Unallocated gold forwards

- Gold futures

- Gold options

- Gold ETFs

These are all what I call paper gold. They give you contractual

rights but there's no assurance you'll ever get your hands on physical

gold.

Now, what's happening is this whole pyramid is getting larger and

larger, but the amount of physical gold, the floating supply, is

disappearing.

When gold moves from the GLD warehouse to the Chinese warehouses in Shanghai, which it is…

It's been moving from west to east in very large quantities…

Once it goes to Shanghai it's no longer a part of the floating

supply. That gold is never going to see the light of day, at least not

for several hundred years.

So, the total supply may be unchanged, but the floating supply is dropping.

That means this little brick at the bottom of the pyramid is getting smaller and smaller.

One of two things has to happen: either that paper pyramid has to shrink, or the whole thing is going to become wobbly and tip over.

So, if you have GLD, you only have shares and you will only ever have shares.

You cannot get your hands on the gold.

So, with this intelligence briefing, I tell folks to stay away from gold ETFs.

Instead, I talk about three specific precious metal coins they'll want to look into immediately.

STEVE MEYERS:

Now, let's examine how folks can fortify their personal finances from these dangerous times that are fast approaching.

JIM RICKARDS:

This is very important, because if you protect yourself with your

investments, yet don't take the same measures with your personal

finances, you'll experience the same outcome and it won't be a good one.

The bank you choose to keep your money in is now a critical decision,

because that bank may not be around next year or the year after, as

everything escalates.

So, I talk about the safest banks and credit unions, these will not collapse.

You should make sure your money is in one of them.

I show folks which CDs and conservative income opportunities are most shielded from risk.

I talk about the ten safest cities for the future.

These are the ones with the strongest local economies.

They have industries that will continue providing jobs, their crime

rates are low now, and they have the best chance of staying that way,

even in the darkest times.

Retirees should be looking near these areas.

Plus, I also examine which careers will be the safest, because real

unemployment and underemployment is already an epidemic, but it's going

to get much worse.

STEVE MEYERS:

Jim Rickards, what you revealed today in this interview is nothing short of a wake-up call. Thank you for joining us.

JIM RICKARDS:

It's my pleasure, Steve.

STEVE MEYERS:

Today, Jim Rickards stepped forward to warn you about a coming catastrophe the Intelligence Community fears is at our doorstep.

But, as you saw, he's also working to help everyday folks across the country prepare for it.

And we at Money Morning want to do our part as well.

That's why we'd like to send you a free copy of everything Jim has prepared.

What he's calling the Project Prophecy 2.0 Action Plan.

It includes:

- The New York Times best-selling book, The Death of Money: The Collapse of the International Monetary System

- The controversial unpublished chapter, The Day After Plan Declassified

- The six-part video series, The Death of Money Digital Debriefing

- The Project Prophecy Wealth Defense Blueprint

- The Project Prophecy Watch List

- The Project Prophecy Hard Assets and Personal Finance Playbook

You can click here to claim this Project Prophecy 2.0 Action Plan for free.

And I strongly suggest you do so.

Because if Jim and his colleagues at the Pentagon, the CIA, and across the entire Intelligence Community are right…

There isn't much time left to protect yourself.

If you'd prefer to claim your copy by phone...

Simply call 1.866.460.9039 or 1.443.353.4384 (for international

callers) from 9 am to 5 pm (Eastern Time) – and be sure to mention

Priority Code LMMRRA62.

I want to thank you for joining us today.

I'm Steve Meyers.

Stay safe.

August 2014

Copyright - 2014 Money Map Press, LLC. The Money Map Press is a publishing company that does not act as a personal investment advisor for any specific individual. Nor do we advocate the purchase or sale of any security or investment for any specific individual. The proprietary recommendations and analysis we present to readers is for the exclusive use of subscribers. Readers should be aware that although our track record is highly rated, and has been legally reviewed for presentation in this invitation, investment markets have inherent risks and there can be no guarantee of future profits. Likewise, our past performance does not assure the same future results. Warning: The past performance of any trade whether actual or hypothetical is not necessarily an indication of future results. Stocks, futures, currencies, commodities, CFDs, options and all types of investment trading can have large potential rewards, but also carry large potential risks. We make absolutely no representation that gains or losses demonstrated in services published by Money Map Press LLC are likely or achievable. Hypothetical trading examples also cannot possibly take into account the impact of liquidity or buyer and seller demand, and do not allow for slippage and associated trading costs and concerns. One must be aware of the risks and be willing to accept them in order to invest in the markets. One should never trade with money that one cannot afford to lose, and one must accept that there will be losses, and one must be able to sustain these losses, both from a financial as well as an emotional perspective. Recommendations are for the exclusive use of subscribers and can change at any time. This work is based on SEC filings, current events, interviews, corporate press releases, and what we've learned as financial journalists. It may contain errors and you shouldn't make any investment decision based solely on what you read here. It's your money and your responsibility.

Is James Rickards Right About A Coming Monetary Apocalypse?

http://www.forbes.com/sites/ralphbenko/2014/04/28/is-james-rickards-right-about-a-coming-monetary-apocalypse/

Opinions expressed by Forbes Contributors are their own.

Is a monetary apocalypse imminent?

James Rickards, bestselling author of Currency Wars, has a new New York Times bestseller out, about the possible imminent collapse of the dollar: The Death of Money: The Coming Collapse of the International Monetary System (Portfolio/Penguin). More interestingly, he writes about what could come next: a golden age.

Advance praise (“A terrifically interesting and useful book….”) from Brookings’s senior fellow Kenneth W. Dam, former Deputy Secretary of the Treasury and author of The Rules of the Game: Reform and Evolution in the International Monetary System, is an attention getter. Rickard’s Currency Wars was a hot best seller on the New York Times list, and also, more significantly, in the United States Senate.

The Death of Money is getting the attention of reviewers, James Mackintosh, investments editor of the FT, John Aziz at The Week, David Merkel at The Aleph Blog, as well as Kirkus, among

the more prominent. Reviewers are respectful… but not persuaded of his

claim of “Nighness of the End.” As David Merkel says, “extraordinary

claims require extraordinary proof. There is evidence here, but not

extraordinary proof.”

This columnist, too, is not persuaded that death of money is imminent. Reuters recently reported that a senior official of the Bank for International Settlements — sometimes referred to as the central banks’ central bank — states that “The dollar’s share of central bank reserves may fall by as much as 10-15 percentage points in coming years without threatening its role as the world’s main reserve currency….”

James Rickards, bestselling author of Currency Wars, has a new New York Times bestseller out, about the possible imminent collapse of the dollar: The Death of Money: The Coming Collapse of the International Monetary System (Portfolio/Penguin). More interestingly, he writes about what could come next: a golden age.

Advance praise (“A terrifically interesting and useful book….”) from Brookings’s senior fellow Kenneth W. Dam, former Deputy Secretary of the Treasury and author of The Rules of the Game: Reform and Evolution in the International Monetary System, is an attention getter. Rickard’s Currency Wars was a hot best seller on the New York Times list, and also, more significantly, in the United States Senate.

James Rickards

This columnist, too, is not persuaded that death of money is imminent. Reuters recently reported that a senior official of the Bank for International Settlements — sometimes referred to as the central banks’ central bank — states that “The dollar’s share of central bank reserves may fall by as much as 10-15 percentage points in coming years without threatening its role as the world’s main reserve currency….”

Recommended by Forbes

a lot of people are running around talking doom and gloom, the end of the dollar and all that. I might even agree with that, but I don’t think it has a lot of content.And “what that reformation will look like” really does constitute the most interesting part of The Death of Money.

What I try to do is provide a more in-depth analysis describing what will come next, what the future international monetary system will look like.

I point out that the international monetary system has already collapsed three times within the last 100 years—1914, 1939, and 1971—and that another collapse would not be at all unusual. But it’s not the end of the world. It’s just that the major powers sit down and reform the system. I talk about what that reformation will look like.

Sen. Nelson Aldrich (chairman of the National Monetary Commission, and called in his day America’s “general manager”) stated, before the New York Economics Club in 1909, that “[T]he study of monetary questions is one of the great causes of insanity.” Rickards provides a wonderful antidote to some of the insanity too often evident around the study of monetary questions.

Rickards critiques hysterics, apparently Nouriel Roubini (who he does not name and shame but with whom he engaged in a spirited 16 hour Twitter war some time ago) for an indictment of gold investors as “paranoid, fear-based, far-right fringe and fanatics.” Then Rickards berates reactionary hysterics for claims such as that Fort Knox surreptitiously has been emptied of gold.

Rickards observes that

Understanding gold’s real role in the monetary system requires reliance on history, not histrionics; analysis should be based on demonstrable data and reasonable inference rather than accusation and speculation. When a refined view is taken on the subject of gold, the truth turns out to be more interesting than either the gold haters or the gold bugs might lead one to believe.He goes on to strip the bark off of some of the criticisms of, and polemics surrounding, the gold standard. First he disposes of the myth that “there’s not enough gold.” (This myth is even more persuasively demolished by George Mason Professor Lawrence White, elsewhere. Further refutations are welcome until the culture fully assimilates just how asinine is the myth of “not enough gold.”)

Rickards then disposes of the even more pernicious myth that the true gold standard caused and perpetuated the Great Depression.